Here’s How To Save Up To $700/year Off Your Car Insurance In Minutes

When was the last time you compared car insurance rates? Chances are youre seriously overpaying with your current policy.

Its true. You could be paying way less for the same coverage. All you need to do is look for it.

And if you look through an online marketplace called SmartFinancial you could be getting rates as low as $22 a month and saving yourself more than $700 a year.

It takes one minute to get quotes from multiple insurers, so you can see all the best rates side-by-side.

So if you havent checked car insurance rates in a while, see how much you can save with a new policy.

Factors That Influence Your Mortgage Interest Rate

When searching for a lender to borrow a mortgage from, most borrowers will gravitate toward the lender that offers the lowest mortgage interest rate. A low-interest rate means a less-expensive monthly payment and the borrower will be saving money over the life of the loan. But understanding how mortgage rates are determined can help a borrower determine several aspects like if they have a good chance of being approved, or why they might have been denied. Lets take a look at several factors that help determine a mortgage rate.

Factors That Affect Home Loan Interest Rate

Posted on Friday, May 6th, 2022 | By IndusInd Bank

Buying your first home can mean different things to different people. On the one hand, it can be an emotional investment for some, and on the other, it may represent climbing the ladder of success for others. But one thing that remains constant is that it is a significant financial commitment. To make your job easier, you can apply for a home loan online by IndusInd Bank and unlock the door to your happiness.

However, if you are worried about high-interest rates on home loans, this article is for you. Keep reading to learn how to bring down your home loan rates and pay the loan easily.

Also Check: Can You Get A Mortgage On A Condo

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

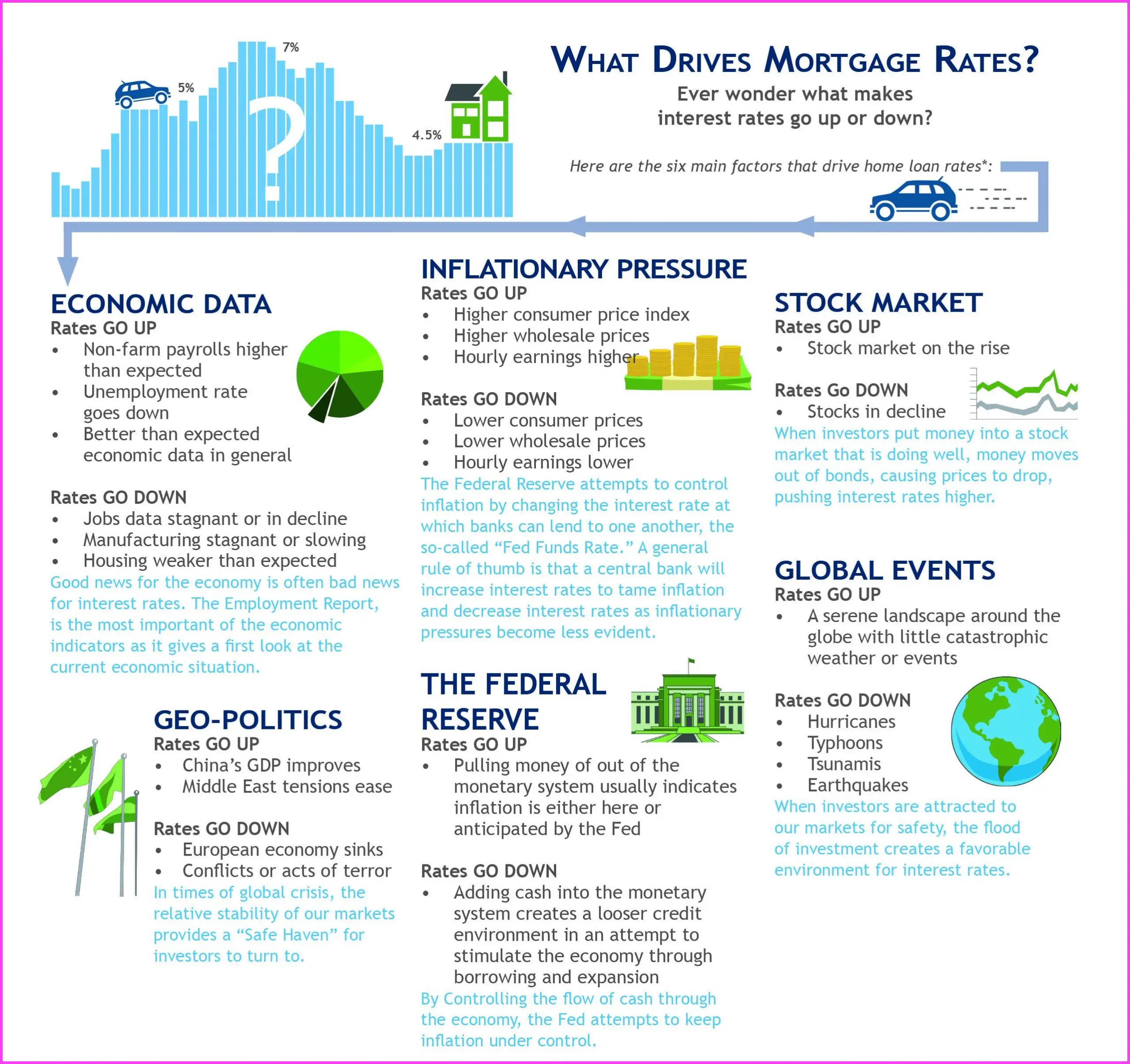

Factors In Mortgage Interest Rates

Factors in Mortgage Interest Rates

Article Excerpt

Your mortgages interest rate will affect how much you pay each month. Learn more about the factors that may affect your interest rate.

Mortgages have enabled countless people to buy their own homes. A mortgage is a type of loan specifically designed for the purchase of a home. The lender provides most of the money, typically minus the borrowers down payment. The borrower signs a promissory note. This document obligates the borrower to repay the loan according to certain terms, including the amount of time they have to pay the loan and the interest rate.

A mortgages interest rate significantly affects the amount that the borrower must pay each month, as well as the total cost of the mortgage over its lifetime. Homebuyers should choose carefully when seeking a mortgage loan. A mortgages interest rate is the result of many factors, only some of which might be within a borrowers control. Some of the factors involve large transactions between financial institutions that occur far away from the mortgage lending process.

Recommended Reading: How To Sell A Mobile Home With A Mortgage

Theres More To A Loan Than Just The Interest Rate

Yes, the interest rate is important and is probably one of the first questions you want to ask, however, dont forget to find out the following:

- Can you reset the loan at a lower rate if interest rates come down? How much will it cost you?

- Is there a prepayment penalty if you want to pay ahead or pay the loan in full?

- Does the lender give great service?

- Do they answer the phone or return calls promptly?

- Can the lender get the loan completed in a timely manner?

A few key things you should compare may include some or all of the following:

- Application fees

What Are Todays Investment Property Rates

Mortgage rates for investment properties are higher than those for primary residences because they are viewed as higher risk.

Still, rental properties are usually a great investment in the long run, and a slightly higher rate might not matter much when compared to the returns youll see on the property.

Every applicant is different. The best way to get your current investment property mortgage rate is to get quotes from multiple lenders and make them compete.

Rates change all the time, so contacting lenders online is the quickest way to get a fist full of rates to compare.

Read Also: Does Spouse Have To Be On Mortgage

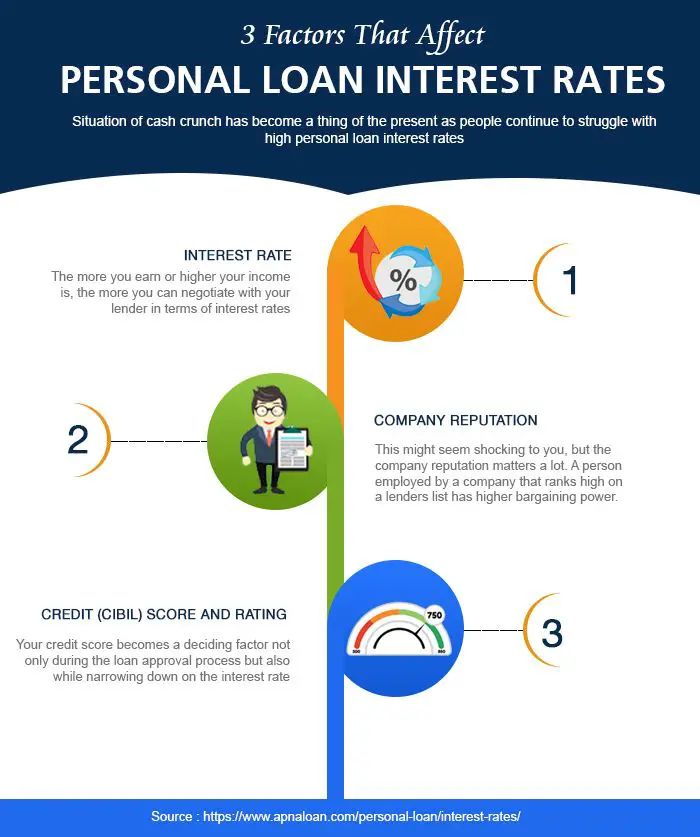

Employment Situation & Earnings

Banks and other financial institutions are more likely to lend to those who can demonstrate a history of consistent employment and high income. The actual minimum yearly income criteria are often about $20,000, but low-income borrowers rarely qualify for the greatest interest rates.

As a self-employed person with good credit, I can attest to the fact that self-employed borrowers are at a disadvantage the interest rate I pay on a personal loan is several percentage points higher than that charged to borrowers with traditional jobs and the same amount of income, and some lenders wont even consider my application.

Interest Rates On Primary Residences

Your primary residence is where you hang your hat at night. It can be a one-bedroom apartment in Tulsa, a midtown condominium in Houston, or a luxurious single-family residence in the foothills of the Santa Monica mountains. Since its the place you call home, youll typically get the best interest rate on a primary residence when borrowing money for a mortgage. Thats because lenders view loans for primary residences as less risky than other types of loans since homeowners are less likely to forgo making their loan payments if they happen to fall upon rocky financial times.

Your primary residence must be the place where you spend most of your nights. It also must be the address you use when filing your tax returns, or whats listed on your drivers license.

Last year was a good time for borrowing for primary residences interest rates for 30-year conventional loans hit an all-time low of 2.65 percent in early 2021. Rates have steadily begun creeping up, though, and as of mid-February, 2022, interest rates for 30-year conventional loans were nearing 4 percent.¹ Interest rates on 15-year loans, meanwhile, were just over 3 percent.

Note: The rates highlighted above are for prime creditworthy borrowers. Many different factors affect individual borrowing costs. Well cover those requirements a bit later.

Don’t Miss: What To Know Before Applying For A Mortgage

The Federal Reserve And The Prime Rate

This is the one youre probably hearing a lot about lately. Thats for two reasons: One, because the prime rate is going up. And two, because its one of the more important factors behind mortgage rates.

The federal reserve controls the prime rate, and the prime rate is basically the rate that banks borrow from one another. And as the cost of funds increases and they raise rates, rates that the consumer is going to get will be subsequently higher, said Mayer Dallal, managing director at digital mortgage lender MBANC.

In essence, theres a cost to the money that banks are borrowing in the first place, and they then need to make a profit when they lend the money to a homebuyer. So as the Fed raises the prime rate, the banks will raise the mortgage rates to keep their profit margin intact.

What Lenders Consider When Determining Your Interest Rate

Understanding what lenders look for is the first step in improving your chances of getting a lower rate.

When you visit a lender online or in person, youll see some advertised mortgage interest rates. But will you qualify for those rates? Why or why not?

It’s all about risk. The higher the repayment risk, the higher the interest rate the lender will charge.

Lenders will determine your loan interest rate based on several factors some of which you can influence and others you cant. So its important to understand why rates can vary, and by how much, because even a slight increase in your interest rate can cost you thousands of dollars over the loans term.

The good news for home shoppers is that interest rates can be negotiable. You should compare rates from several lenders, and see if one will sweeten its offer with a lower rate.

Also Check: Who Does Private Mortgage Insurance Protect

Job Security Of Applicant

Having a stable job and income can do wonders for your loan application. This is because having an unstable income makes you a high-risk loan candidate for the lender. So, if you are a doctor, chartered accountant, salaried professional, a government employee, etc., you can get lower home loan interest rates on the housing loan.

Economic Conditions Play A Role

What happens in the economy, and how those events affect investors confidence, influences mortgage pricing. Good and bad economic news have an inverse impact on the direction of mortgage rates.

Bad economic news is often good news for mortgage rates, McBride says. When concern about the economy is high, investors gravitate toward safe-haven investments like Treasury bonds and mortgage bonds, pushing bond prices higher but the yields on those bonds lower.

Good economic news increases in consumer confidence and spending, robust GDP growth and a solid stock market tend to push mortgage rates higher. Thats because the higher demand means more work for lenders who only have so much money to lend and manpower to originate loans, says Jerry Selitto, president of Better.com, an online mortgage lender. This effect was on full display in late 2021 and early 2022 with job growth strong and the economy in recovery, mortgage rates spiked.

Don’t Miss: What Is Considered A High Interest Rate On A Mortgage

Will Investment Property Interest Rates Drop In 2020

Average mortgage rates fluctuate daily and are influenced by economic trends including the inflation rate, the job market and the overall rate of economic growth. Unpredictable events, from natural disasters to election outcomes, can impact all of those factors. See NerdWallets mortgage interest rates forecast to get our current take.

Type Of Mortgage Loan Interest Rate

Mortgage loan interest rates can be fixed or adjustable. Fixed rates are consistent over the term of the loan, while adjustable rates fluctuate over time. An adjustable-rate mortgage typically charges a lower interest rate than a fixed rate to start, but that may change over the life of the loan. With a fixed-rate mortgage loan, you will have the same payment each month for the life of the loan.

Also Check: What Are Jumbo Mortgage Rates

How The Bond Market Affects Mortgage Rates

We dont tend to think of it this way because home is so personal for everyone, but at the end of the day, mortgages are just a big financial instrument. Like a lot of finance products, mortgages can be traded among investors. The particular mechanism for trading home loans is the mortgage bond.

Also called mortgage-backed securities , mortgage bonds are collections of loans with similar characteristics such as down payment amount, credit score and the original investor in the loan .

Based on your personal characteristics, you get bucketed into an MBS. Investors who are choosing bonds make decisions about which bonds to buy based on their risk tolerance and desire for a certain rate of return.

If you fall into a category with better financial characteristics, youre more likely to be able to make your payment than someone who has a riskier profile. The trade-off is that the interest rate is lower for you than it would be for the other borrower.

However, it goes beyond personal factors. One of the key things to understand is that the bond market in general is considered to be a safer place to put your money than the stock market. Although the stock market may offer a higher rate of return, its subject to a lot more volatility and could suffer more in a downturn. Bonds offer a guaranteed yield.

Factors That Affect Home Mortgage Rates

One of the most important factors to consider when applying for a mortgage is the interest rate that youll be charged. Your rate will have a direct impact on your monthly mortgage payments, as well as how much youll end up spending on your mortgage overall.

For this reason, its helpful to understand home mortgage rates and the factors that affect them, including the following.

Don’t Miss: Can I Apply For Mortgage With Multiple Lenders

Mortgage Points And Credits

You may have an opportunity to nab a lower interest rate by buying mortgage points, also called discount points. Each point costs about 1% of the loan amount, and the interest rate reduction can depend on the specific loan offer. Conversely, lenders may pay you lender credits that can offset your closing costs but increase your interest rate.

Federal Reserve Monetary Policy

The monetary policy pursued by the Federal Reserve Bank is one of the most important factors influencing both the economy generally and interest rates specifically, including mortgage rates.

The Federal Reserve does not set the specific interest rates in the mortgage market. However, its actions in establishing the Fed Funds rate and adjusting the money supply upward or downward have a significant impact on the interest rates available to the borrowing public. Generally, increases in the money supply put downward pressure on rates while tightening the money supply pushes rates upward.

You May Like: How To File A Complaint Against A Mortgage Lender

What Affects Mortgage Interest Rates When Buying A Home

Once people decide they’d like to buy a home, they want to know what interest rate they can expect from a mortgage. After all, buying a home is an important decision and the interest rate is a big factor that determines what the payments will be.

It’s a good idea to understand what affects mortgage interest rates. That way you can do your best to secure the best interest rate for your home purchase. So, to help you out, here’s a list of things that affect mortgage interest rates.

What Kind Of Loan Can I Get On A Primary Property

You could be eligible for many types of mortgage loans on a primary property. This will depend on your individual needs and qualifications. Types of mortgage loans include:

- 30-year and 15-year fixed-rate loansThese are mortgages where the interest rate is fixed and the principal and interest payment stay the same over the life of the loan.

- Adjustable-Rate MortgageThis is a loan where the initial interest rate is fixed for a period of time, then adjusts at regular intervals.

- FHA loanFHA loans may be ideal for people with lower credit scores and who are looking for a loan with a lower down payment.

- VA loanVA loans offer low or no down payment options for active-duty service members and veterans.

Read Also: Can I Get Preapproved For A Mortgage More Than Once

What Factors Affect Mortgage Rates

A lender considers many factors when setting their mortgage interest rates, some of which you can control, like your credit score and your personal financial situation. But you can’t control most mortgage rate factors, such as how the overall economy is doing, the state of the job market, worker incomes, supply and demand for new houses, and actions by the federal government.

Who Sets Interest Rates

Individual mortgage lenders set their own rates and there is no single source that sets mortgage interest rates for the whole country. The rates that a lender offers you also depend on multiple factors, so if you went to two banks that are across the street from each other, it’s possible they would each offer you different rates.

Don’t Miss: What Are Prepaid Items On A Mortgage

How Reverse Mortgage Lenders Calculate Interest Rates

Like other forms of financing, reverse mortgage lenders charge interest on these loans, which is rolled into the cost of the loan and repaid with the principal loan balance. Your interest rate depends on a variety of factors, including the type of reverse mortgage, your age, your homes value, your life expectancy, and your disbursement option.

Each reverse mortgage has a principal limit, which is the total amount the borrower can receive with the loan. The principal limit is based on several factors, including the home value, the borrowers age, and the interest rate.

Whats Behind Your Mortgage Rate

Never miss an article from Bank of Canada when you sign up for email alerts.

Buying a home is probably the biggest purchase youll ever make. If youre like most people, you wont pay cashyoull borrow most of the money by taking out a mortgage. And over the life of the mortgage, youll pay a lot in interest.

Small changes in interest rates can make a big difference in how much youll pay. So its important that you understand what determines the interest rate on your mortgage, even if you already own a home.

Many factors go into the interest rate you pay.

Also Check: Can You Add A Person To A Mortgage