Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

If You’re Thinking About Buying Start With This Home Affordability Calculator

Include pre-tax income from all applicants

Auto, credit card or student loans

Calculator results are estimates only based on the information you provide.

Home affordability estimate for a 30-year fixed rate loan

Need some more information? Now that you have your estimated home price, check out different loan options with our Mortgage Calculator.

Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence, with an interest rate of }% }% on }, for a borrower with excellent credit and user inputs. These home affordability calculator results are based on your debt-to-income ratio .

Determining How Much You Can Afford

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

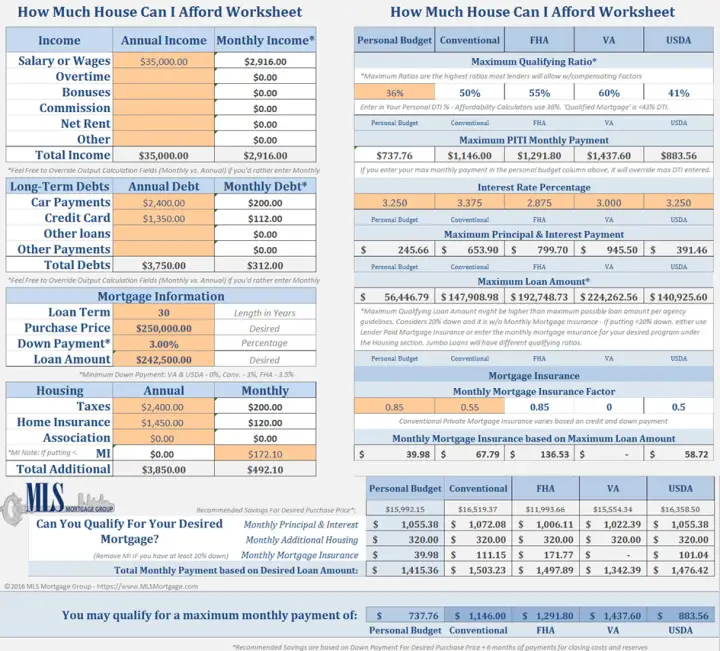

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner’s insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.4% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

You May Like: Can I Back Out Of A Mortgage Refinance

Help To Buy Equity Loan

The equity loan scheme finances the purchase of newly built houses. You can borrow a minimum of 5% and a maximum of 20% of the propertys full price. As a requirement, you must make a 5% deposit and obtain a mortgage to shoulder 75% of the loan. The house must also be bought from a builder recognized by the program. As an advantage, interest is not charged during the first 5 years of the equity loan. For more information on this government scheme, visit the Help to Buy equity loan page.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Read Also: Should I Pay Off My Mortgage Early

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

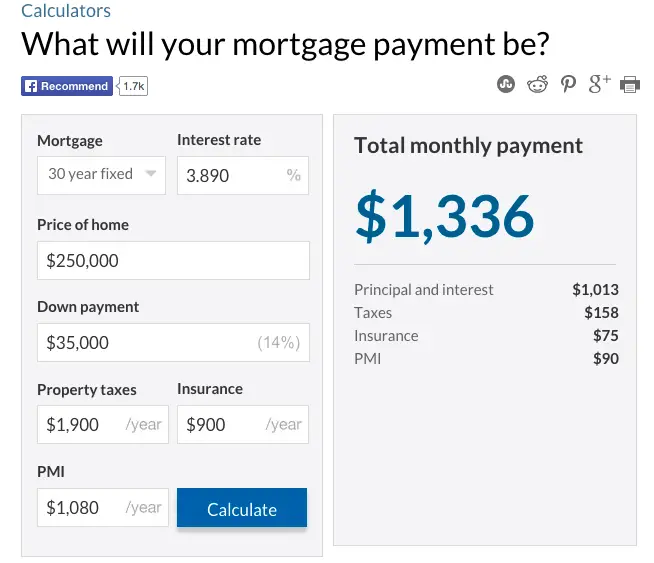

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Are Joint Applications Treated

For joint applicants the limit is typically slightly lower with them either offering a full multiple on the first income and then adding in the second income, or lowering the multiplier across all incomes down to 3. Examples are shown in the table below.

| Income 1 | |

|---|---|

| 3X 1st + 2nd | £110,000 |

The reason why limits are lower for joint incomes is it is more likely someone will either get laid off or want to voluntarily quit to start a family or go back to school.

Also Check: What Is The Monthly Payment On A 150 000 Mortgage

Estimate Your Monthly Mortgage Payments

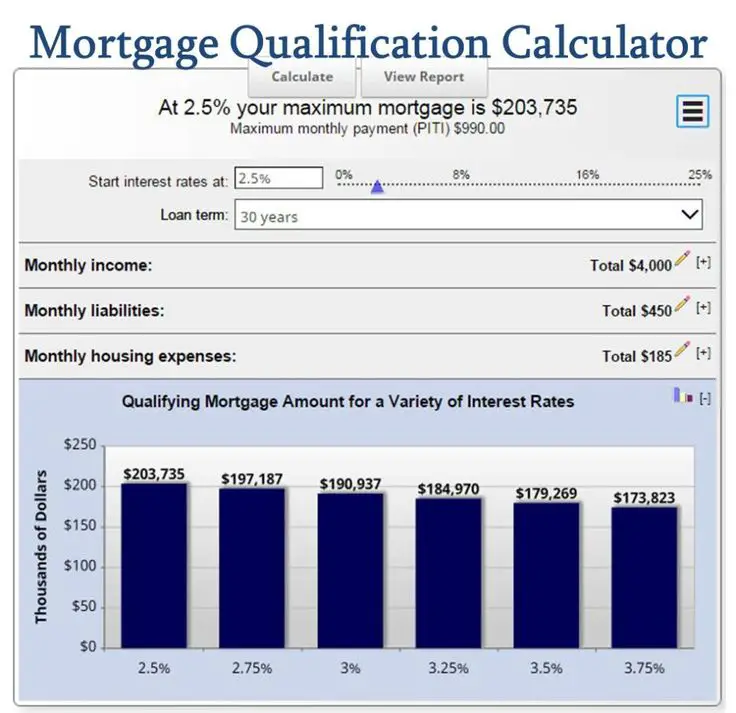

In addition to using the above affordability calculator, you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios.

The following calculator automatically updates payment amounts whenever you change any loan input, so if you adjust the interest rate, amount borrowed or loan term you will automatically see the new monthly fixed-rate and interest-only repayments.

Total Cost

We also offer a calculator with amortisation schedules for changing loan rates, so you can see your initial loan repayments and figure out how they might change if interest rates rise.

How Can I Determine My Mortgage Payment

The Mortgage Payment Calculator helps you generate mortgage payment scenarios to see how different homes impact your budget. Before estimating your affordability, compare mortgage rates and see how they affect your payment. Just remember, lenders, base your debt ratios on a stress-tested payment. That means they simulate a higher payment based on rates that are at least two percentage points above typical rates. They do this to ensure you can afford higher rates in the future. This simulated payment is then used as a key input in lenders debt-ratio formulas.

Check out our Mortgage Guide for more information on how to apply for a mortgage.

Also Check: What Is Current Rate For Mortgage

Use A Mortgage Affordability Calculator As A Starting Point

- Before you start perusing real estate listings

- Use an affordability calculator to determine if homeownership

- Makes sense financially and is within reach

- Then you can look into a pre-qual or pre-approval to fine-tune the numbers and make sure all red flags are addressed

The mortgage affordability calculator below can give you a head start in front of other prospective home buyers competing for the same property.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Don’t Miss: Is 3.75 A Good Interest Rate For Mortgage

Check Your Credit Score

Youll need good credit to qualify for a mortgage loan. And the better your score, the better your chances are for a lower interest rate. Its a good idea to establish your credit before talking to a lender so you can avoid surprises, or work to improve your credit score. You can check your credit for free once a year through AnnualCreditReport.com or by contacting one of the three national credit reporting agencies: Experian, Equifax and TransUnion. If youre not satisfied with your credit score, try to improve it by paying your bills on time and reducing your credit card balances.

Calculator: Start By Crunching The Numbers

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

You May Like: How To Become A Mortgage Broker In Massachusetts

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

How Does It Work

To use the mortgage affordability calculator, youll need to gather the following information:

- Your co-applicants income

- Your monthly debt payments, including credit cards, car payments and other loan expenses

- Your expected monthly living costs in your new home, including property tax, condo fees and heating costs, as applicable

These factors are used by lenders to calculate two ratios that serve as guidelines in determining how much you can afford. They are called the gross debt service ratio and the total debt service ratio.

Recommended Reading: Can You Lower Your Mortgage Payment

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loanâs price, as measured by comparing a loanâs annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumerâs ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

Canadian Home Mortgage Qualification Tips

If you are a first-time home buyer looking for the right price on a home in Canada, the real estate market in most metropolitan areas continues to be priced in such a way that it remains affordable to those making an average wage or above.

The resiliency of the market place over the past several years combined with a fairly good economy have created the type of environment that should encourage you to participate by buying.

Also Check: How Much Income For 500k Mortgage

What Is The Minimum Down Payment Required For A Mortgage

The minimum down payment required for a mortgage depends on the purchase price of your home. It is based on a tier system as follows:

- If the purchase price is $500,000 or less, the minimum down payment is 5%.

- If the purchase price is $500,000 to $999,999, the minimum down payment is 5% on the first $500,000 and 10% on the portion from $500,000 to $999,999.

- If the purchase price is $1 million or more, the minimum down payment is 20%.

For example, if the purchase price is $650,000. The minimum down payment would be $40,000 .

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

Recommended Reading: Are Mortgage Rates Higher For Townhomes

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Read Also: What An Average Monthly Mortgage Payment

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow based on your current income, debt and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrow, including the household income of the applicants purchasing the home, the personal monthly expenses of those applicants and the expenses associated with owning a home .

How Does The Type Of Home Loan Impact Affordability

While it’s true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all.

How much house can I afford with an FHA loan?

Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. If your credit score is below 580, you’ll need to put down 10 percent of the purchase price. If your score is 580 or higher, you could put down as little as 3.5 percent. There are limits on FHA loans, though. In most areas in 2022, an FHA loan cannot exceed $420,680 for a single-family home. In higher-priced areas, the number can go as high as $970,800. Youll also need to factor in how mortgage insurance premiums required on all FHA loans will impact your payments.

How much house can I afford with a VA loan?

How much house can I afford with a USDA loan?

USDA loans require no down payment, and there is no limit on the purchase price. However, these loans are geared toward buyers who fit the low- or moderate-income classification, so you will need to put a big emphasis on understanding how mortgage payments will impact your overall monthly budget.

You May Like: Why Are 15 Year Mortgage Rates Lower Than 30 Year