Can The Fha Up Front Mortgage Insurance Fee Be Financed

The upfront FHA mortgage insurance fee can be financed or rolled into the loan. This a huge benefit for those who dont have very much saved for closing costs. Here are some of the features or rules around financing the FHA up front mortgage insurance fee:

- The fee must be paid in cash or financed

- The fee cannot be split by financing some of it and paying cash for the rest. It is one or the other

- Financing the fee does not impact your DTI or reduce the loan amount that you qualify for.

- The upfront fee is not considered to be part of the minimum down payment amount

Financing the FHA up front mortgage insurance fee means you will be paying interest on it for the life of the loan.

Tip negotiate with the sellers of the home to have them cover this cost at closing.

Consider A 10 Percent Down Payment

If you can afford it, consider putting 10% down. Although the minimum down payment for an FHA loan is 3.5%, a larger one could mean youll only pay MIP for 11 years and significantly reduce the overall cost of your home loan.

However, most people refinance out of FHA MIP into a conventional loan after a few years anyway. Few keep paying MIP until it drops off after year 11. So from a mortgage insurance perspective, it often doesnt make sense to make a large down payment on FHA.

If you cant afford a 10% down payment, dont let MIP put you off FHA loans. Its better to take the 3.5% down option and pay MIP while building equity than to delay homeownership and the associated wealth-building opportunities for several years. A smaller down payment can keep your emergency fund intact, too.

How To Get Rid Of Fha Mortgage Insurance

Paying for FHA mortgage insurance for 11 years or longer might sound like a drag, but the expense doesnt have to last forever.

Many borrowers use FHA loans as a stepping stone that can help them reach the dream of homeownership, says Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals. From there, they take steps to improve their credit scores and acquire more equity in their homes so they can refinance out of their FHA loan into a conventional loan with better terms.

The FHA is a wonderful starter loan but, at some point, it can also be beneficial to refinance out of it for lower monthly payments, including no or PMI, Acosta says.

Its also possible to get out of FHA mortgage insurance by paying down your mortgage, but that can take a significant amount of resources to do. Before paying off your loan, make sure to weigh the financial pros and cons.

Recommended Reading: What Is Excellent Credit Score For Mortgage

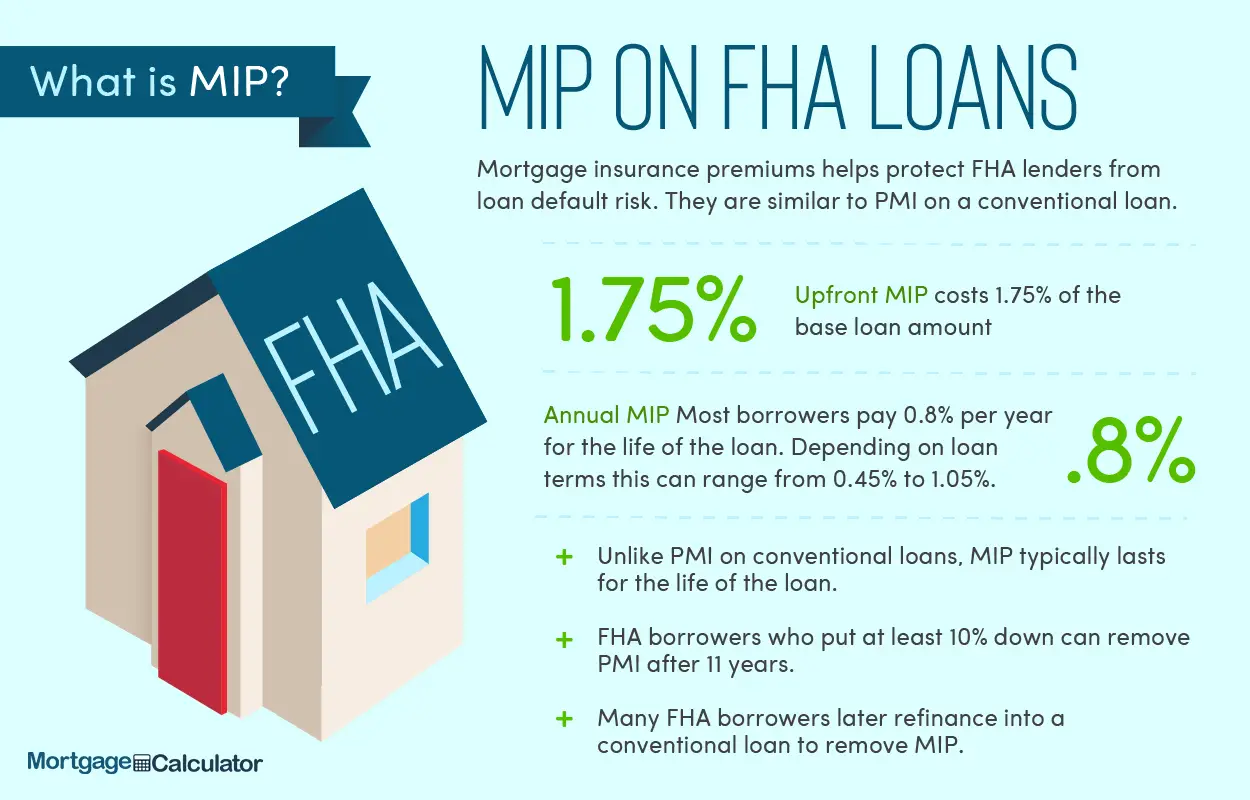

What Does Fha Loan Mortgage Insurance Cost

The upfront mortgage insurance premium is 1.75% of the loan amount, or $1,750 for every $100,000 borrowed.

The annual premium rate is based on your loan amount and down payment. Those factors also determine how long youll owe MIP.

Most FHA borrowers put down less than 10% and will pay annual MIP between 0.80% and 0.85%. But those who put down 10% or more will only pay annual MIP for 11 years, after which the MIP requirement ends.

Annual MIP is divided into 1/12th payments that are included in your monthly mortgage installments.

MIP rates for a 30-year FHA loan

| Loan amount |

|---|

| Annual MIP | $1,668 |

FHA guidelines allow you to roll the upfront MIP into your loan. If you choose this option, your total loan amount would be $196,378.

Upfront MIP can also be included in your closing costs. You can pay those from your savings, or from closing cost assistance funds if you qualify for a state or local assistance program.

You can look up homebuying assistance programs through the U.S. Department of Housing and Urban Affairs website, and by Googling closing cost assistance programs in .

What Is The Fha Loan And How Does It Work

FHA mortgage home loan thats backed by the government and insured by the Federal Housing Administration Although FHA loans require monthly mortgage insurance premiums, loan requirements are generally more flexible than traditional loans and the eligibility process. home loan thats backed by the government and insured by the Federal Housing Administration .

Recommended Reading: What Credit Agency Do Mortgage Lenders Use

What Is Mortgage Insurance

Mortgage insurance exists to protect lenders against losses they suffer when borrowers default. If a borrower defaults, the lender can foreclose on the loan and sell the home. The insurance covers all or part of the shortfall between the lenders proceeds from the sale and the borrowers unpaid loan amount.

Small down payment borrowers are perceived as being more likely to default since they have less equity at stake. Thats why lenders typically require mortgage insurance when a borrower makes a down payment thats less than 20 percent of a homes purchase price or appraised value.

Mortgage insurance is different from mortgage life insurance. Mortgage insurance, sometimes called mortgage default insurance, pays all or part of a lenders loss when the borrower defaults. Mortgage life insurance pays off a loan when a borrower dies.

Although mortgage insurance protects the lender, the borrower pays for it. The benefit for the borrower is that mortgage insurance acts as an incentive for lenders to make loans to borrowers whose down payment is smaller than 20 percent sometimes a lot smaller. The minimum down payment for a loan with FHA mortgage insurance is just 3.5 percent.

This example illustrates the benefit:

Home price: $200,000

Minimum 20 percent down payment without mortgage insurance: $40,000

Minimum 3.5 percent down payment with FHA mortgage insurance: $7,000

Us Department Of Agriculture Loans

The USDA offers several attractive loan programs. Most are limited to rural areas, and to people who have average or below-average income. If you live outside of an urban or suburban area, it pays to learn if you qualify for a USDA loan.

USDA Loan Insurer

Guaranteed by the U.S. Department of Agriculture, USDA loans do not require a down payment. USDA loans are designed to encourage rural development.

USDA Loan Insurance Cost

USDA loans have an upfront fee and annual fee. The upfront fee is 2 percent of the loan amount. The annual fee, paid monthly, is 0.4 percent of the loan amount. USDA fees are lower than FHA fees.

You May Like: How To Know If I Should Refinance My Mortgage

What Counts As A Net Tangible Benefit

The FHA will not allow a Streamline Refinance unless it produces a Net Tangible Benefit. This is to protect borrowers against unscrupulous loan offers.

Such benefits can include a rate drop of at least 0.5%, a switch from adjustable to fixedrate financing, or a shorter loan term.

However, FHA guidelines can be complicated. For example, if you switch from an adjustablerate mortgage to a fixedrate loan, a higher mortgage rate is allowed.

For details and specifics, speak with loan officers and compare FHA Streamline refinance offerings.

What Is Your Fha Mortgage

What is FHA loan? FHA loan a mortgage thats insured by the Federal Housing Administration . They are particularly popular with first-time home buyers, because they lower their payments with more than 580 credit cards. However, the borrower must pay the mortgage insurance premiums to protect the borrower if the borrower defaults.

Don’t Miss: What Do I Need To Become A Mortgage Broker

Refinance To A Conventional Loan

Many homeowners refinance to a conventional loan when they reach 20% equity. When you have a conventional loan, you dont pay MIP. Instead, your lender might require you to pay PMI but only if you have less than 20% down. You can stop paying MIP without switching to PMI by refinancing to a conventional loan once youve reached 20% equity.

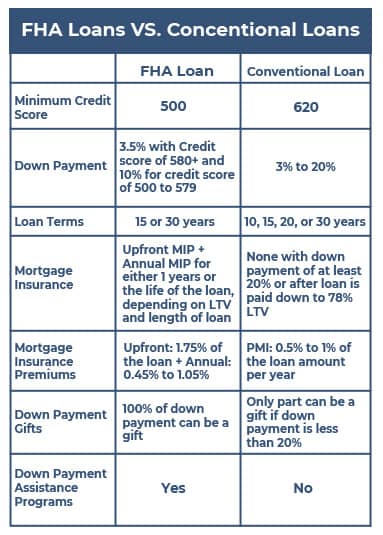

To refinance to a conventional loan, you must meet your lenders minimum requirements. Conventional loan requirements are stricter than FHA loan requirements, so you might need to take some time to build a better borrower profile before you refinance. To qualify for a conventional loan, youll need at least the following:

- A higher credit score: You must have a median FICO® Score of at least 620 points. Making your credit card and loan payments on time and limiting your spending can help you increase your score while you build equity.

- Debt-to-income ratio: You must have a DTI ratio of 50% or less to qualify for a conventional loan. You can decrease your DTI ratio by increasing your household income or paying down your debts.

- Home equity: You should have at least 20% equity in your home before you refinance. If you refinance before you have 20% equity, youll need to pay for PMI instead of MIP. PMI is more expensive than MIP, so be sure you have the right amount of equity before you refinance. If you arent sure how much equity you currently have, contact your lender.

What Are The Property Requirements For An Fha Loan

Popular among first-time homebuyers but available to other consumers are home loans backed by the Federal Housing Administration . FHA loans are mortgages insured by the FHA and subsequently issued by an approved lender. These loans are geared toward low-to-moderate income borrowers.

An FHA loan requires a significantly lower down payment than a traditional mortgage and comes with lower credit score requirements. In 2020, you were able to borrow up to 96.5% of the value of a home with one of these loans, and you needed a credit score of just 580 to make a down payment of 3.5%. With a 10% down payment, you might get approved with a credit score between 500 and 579.

If youre financing a home purchase with an FHA loan, you might not be able to buy a particular property if it doesnt meet the requirements. The FHA has minimum property standards as a way to protect lenders.

Recommended Reading: How To Know How Much Mortgage I Can Afford

Can I Get Rid Of Pmi On An Fha Loan

FHA PMI cancellation is commonly misunderstood. As many borrowers and even real estate professionals believe the monthly mortgage insurance cancels once the loan is paid under 80% of the value. Regretfully, only conventional loans offer this feature.

FHA loans are different. If a buyer puts down less than 10% down towards the purchase price, the mortgage insurance continues for the life of the loan. Although, dont forget it does reduce each year.

Conversely, if a buyer puts down 10% or more towards the purchase price at closing, the monthly MIP may cancel after 11 years. With how often borrowers sell or refinance, chances are not great of reaching 11 years with the same mortgage.

On a refinance, the same rules apply except it goes by the appraised value. If a homeowner borrows 90% or less of the FHA appraised value, then the 11-year cancellation applies. If borrowing more than 90%, FHA MIP continues for the life of the loan.

Who Needs An Fha Loan To Buy Another Home

FHA single-family loan program loan rules stipulate FHA mortgage loan requirements owner-occupiers However, regardless of the circumstances, the borrower can receive the approval of the participating lender so that it is likely to purchase another home to meet its actual needs, such as a larger family or working outside a reasonable distance.

Recommended Reading: Can I Get A Mortgage With A Fair Credit Score

How Long Do Guarantee Fees Last

The downside here is that guarantee fees live for the life of the loan. The only way to get rid of them is by refinancing into a conventional loan and requesting PMI removal after you reach 20% equity.

This isnt common, but there are cases in which you can receive your loan directly from the USDA. In these instances, there are no guarantee fees.

How Long Do You Have To Pay For Fha Insurance

Before 2013, MIP worked similarly to the private mortgage insurance that you pay on conventional loans. Once you reach 22% equity in your home, a conventional mortgage lender automatically cancels your PMI.

Todays FHA lenders no longer cancel your MIP once you reach a certain home equity percentage. The amount of time youll need to pay MIP depends on your down payment. If you have at least 10% down at the time of your purchase, youll pay MIP for 11 years. If you have less than 10% down at the closing table, youll pay MIP for the entire term length.

Recommended Reading: When To Refinance Your Mortgage Rule Of Thumb

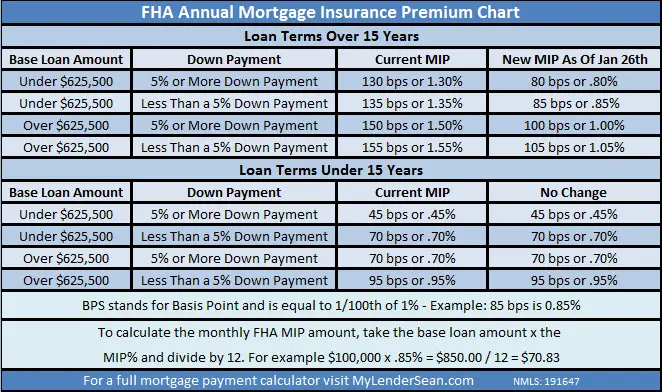

Two Ways To Reduce Fha Mip

- More down payment

- Shorter loan term

Remember the 2 charts above showing how much the monthly FHA mortgage insurance costs? Did you notice that higher down payments reduce the PMI? On the 20 30 year terms, putting down 5% or more reduces the PMI rate by .05%. Its not a lot, but it is a saving. On a 10 15 year term, a 10% down payment reduces the PMI by .25%.

The next option is shortening the loan term to 15 years or less. Also, notice in the second chart that the PMI rates decrease dramatically for these shorter terms. Although, to reach these lower mortgage insurance rates, a higher down payment and shorter-term may make the loan less affordable for many borrowers. Thats why most FHA buyers choose the lower 3.5% down payment and a 30-year term.

Upfront Mortgage Insurance Premiums Explained

Jamie Johnson is a sought-after personal finance writer with bylines on prestigious personal finance sites such as Quicken Loans, Credit Karma, and The Balance. Over the past five years, shes devoted more than 10,000 hours of research and writing to topics like mortgages, loans, and small business lending.

An upfront mortgage insurance premium is a one-time fee collected when you close on your Federal Housing Administration loan. The UFMIP is 1.75% of the base loan amount, and it helps protect your lender if you default on your mortgage.

FHA loans are a great option for many homebuyers since they require down payments as low as 3.5% of the purchase price. But its important to know what the UFMIP is and how much it costs so you understand what you will actually pay for your mortgage before you lock it in.

Recommended Reading: Are Mortgage Rates Going To Rise

Federal Home Loan Mortgage Protection

There is an additional type of mortgage insurance. However, it is only used with loans underwritten by the Federal Housing Administration. These loans are better known as FHA loans or FHA mortgages. PMI through the FHA is known as MIP. It is a requirement for all FHA loans and with down payments of 10% or less.

Furthermore, it cannot be removed without refinancing the home. MIP requires an upfront payment and monthly premiums . The buyer is still required to wait 11 years before they can remove the MIP from the loan if they had a down payment of more than 10%.

Who Can Fha Refinance Loans

You can refinance an FHA loan Back to the traditional loan If the minimum requirements are different from traditional mortgages FHA Require. If your credit score improves to the least 620 in the time after you apply for the loan FHA loan You may be eligible for delivery loan It’s time to advocate for the price tag.

Recommended Reading: What Percent Down Payment To Avoid Mortgage Insurance

How To Calculate Your Fha Mip Refund

To calculate your MIP amount for your new FHA refinance loan, youll need to determine the following figures:

Next, multiple your original upfront MIP amount by the eligible refund percentage to determine your total refund amount. For example, if your original MIP amount was $2,500 on a loan that closed 10 months ago, then your eligible refund percentage is 62%. Your MIP refund amount is $1,550 .

x = FHA MIP refund amount

FHA MIP Refund Calculation

Your refund amount is only part of the story, though. When you refinance your current FHA loan to a new mortgage and there is a refund due, the refund amount is applied to the new upfront mortgage insurance premium for your new FHA refinance loan.

Do You Qualify To Eliminate Mortgage Insurance

You probably never wanted to pay mortgage insurance , but when you had dreams of buying a home, that added cost made it possible at the time. If youve been making your on-time mortgage payments for a while, though, you may be wondering when you can stop paying mortgage insurance or at least reduce your payments.

Has your home increased quite a bit in value since you got your original Conventional loan? The value might be high enough to allow you to have a new appraisal completed and then contact your lender to eliminate private mortgage insurance . Have your financial circumstances improved since you were approved for your FHA loan? You may be able to refinance into another loan product, like a Conventional loan, that doesnt come with lifetime mortgage insurance premium .

The bottom line? You have options. But first, its important to understand the differences between types of mortgage insurance and how they affect you. Whether you have PMI or MIP depends on what kind of mortgage you have. Read below to learn the differences between these two types of mortgage insurance.

Also Check: Is Total Mortgage A Good Company