What Happens When Siblings Inherit A House

Unless the will explicitly states otherwise, inheriting a house with siblings means that ownership of the property is distributed equally. The siblings can negotiate whether the house will be sold and the profits divided, whether one will buy out the others shares, or whether ownership will continue to be shared.

What Happens After Death

After the passing of the last surviving borrower, the reverse mortgage loan balance becomes due and payable. Many believe that the home reverts to the bank upon the death of the last borrower, but that is not the case.

Your heirs will have the option to decide whether they want to repay the loan balance and keep the home, sell the home and keep the equity or simply walk away and let the lender dispose of the property.

If they choose to keep the home, they will need to repay the loan and that means either refinancing the loan with new financing or with other money available to them. They can pay off the loan at the lower of the amount owed or 95% of the current market value.

If they wish to sell the home, they need to make sure that they take whatever steps are required to change the title so that they can sell the home and we encourage borrowers to contact an estate attorney to be sure they are taking the property steps for their circumstances.

The lender will work with heirs and if they are refinancing into a loan of their own they will typically give them up to 6 months to close that loan, or up to 12 months if they are selling the home.

Every 3-month extension may require evidence the home is listed for sale on the MLS. During this time, the lender or the lenders servicer will want to see the efforts of the family to sell and this is where the communication is important.

If Your Spouse Or Partner Is A Co

When you and your spouse are co-borrowers on a reverse mortgage, neither of you have to pay back the mortgage until you both move out or both die. Even if one spouse moves to a long-term care facility, the reverse mortgage doesnt have to be repaid until the second spouse moves out or dies.

Because HECMs and other reverse mortgages dont require repayment until both borrowers die or move out, the Consumer Financial Protection Bureau recommends that both spouses and long-term partners be co-borrowers on reverse mortgages.

Read Also: 10 Year Treasury Yield Mortgage Rates

What Happens If You Dont Pay Back A Reverse Mortgage

A reverse mortgage loan is only due and payable when there are no original borrowers or eligible spouses living in the home or if you fail to pay your property charges in a timely manner.

If the balance is not paid off through either a sale, refinance, or other acceptable funds the loan would go into foreclosure just like any other loan, but the loan is a non-recourse loan which means that the only security the lender has is the property.

How To Get An Extension

Staying in constant communication with the reverse mortgage servicer can help extend the amount of time heirs have to repay the loan.

When requesting an extension, heirs must contact the servicer and provide documentation, such as a letter of hardship that details their intentions to repay the loan, a real estate listing, proof that theyre trying to obtain financing to keep the house, or probate documents.

The servicer will then take those documents to HUD, which can grant the servicer an extension.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

When The Loan Repayment Is Due

When your loan reaches maturity, its time to pay off the balance. You can trigger maturity with a reverse mortgage through selling the home or the death of the borrower.

This situation is why heirs must be aware of any reverse mortgages. As soon as the maturity event occurs, the repayment time will come due.

Heirs should get in touch with the loan provider as soon as possible to discuss payment options. Communication is vital for paying off a loan like this tied to a house. A provider can foreclose within thirty days to six months from the date of the loan.

Extensions can be possible. However, these will not be on the table unless the heir communicates with the service provider. These extensions may also require the correct documentation. Such situations would apply if you were arranging the sale of the house or the financials of paying the balance.

How To Pay Back A Reverse Mortgage After Death

A reverse mortgage must be paid off when the borrowers move out or die. A Home Equity Conversion Mortgage is the most common type of reverse mortgage because it is backed by the Federal Housing Administration . Here are the options for paying off a reverse mortgage before or after the borrowers death.

Sell the house and pay off the mortgage balance. Usually, borrowers or their heirs pay off the loan by selling the house securing the reverse mortgage. The proceeds from the sale of the house are used to pay off the mortgage. Borrowers keep the remaining proceeds after the loan is paid off.

Sell the house for less than the mortgage balance. HECM borrowers who are underwater on their house can satisfy their loan by selling the house for 95% of its appraised value and using the difference to pay the HECM. Even though the sale may not cover the balance due on the loan, the Federal Housing Administration doesnt allow lenders to come after borrowers or their heirs for the difference. Borrowers with jumbo reverse mortgages need to check with their lender to see if they are liable to repay any difference after the home is sold.

Have a child take out a new mortgage on the house after your death. An heir who wants to keep a house can either pay off the HECM or take out a new mortgage to cover the balance of the reverse mortgage. If the balance on the reverse mortgage is higher than the value of the home, heirs can buy the house for 95% of its appraised value.

Also Check: Rocket Mortgage Loan Requirements

What Do Lenders Usually Do About Reverse Mortgages After The Borrower Dies

When you take out a reverse mortgage, youre borrowing a certain amount of money against your homes equity. While your loan may only be for a percentage of your homes value, your property is still used as security for the loan. This means that the lender can repossess and sell your home if the loan is not repaid. Since you have to be over 60 years old to take out a reverse mortgage, your death is often the trigger for lenders to seek repayment for the loan. Lenders need to ensure that youre fully aware of the conditions of your reverse mortgage before you sign the contract.

Unless youve made arrangements through your will or estate planning, anyone living with you at the time of your death could need to vacate the house before its sold. Dealing with a reverse mortgage when the homeowner dies can add to your familys pain and grief, which is why you should discuss it with your lender before borrowing the money. For instance, you could check if the lender accepts other forms of security, such as an investment property, instead of your residence. You should also consider the total repayment due on the reverse mortgage, which includes the compounded interest over various periods.

Types Of Reverse Mortgages

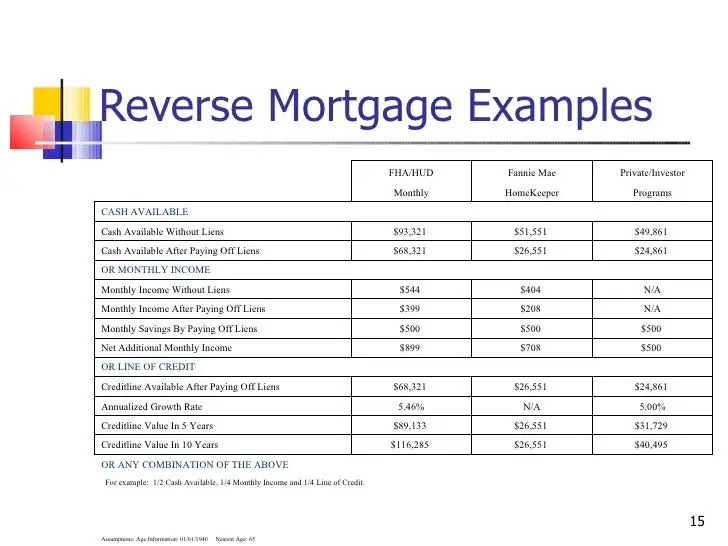

There are three types of reverse mortgages. The most common is the home equity conversion mortgage . The HECM represents almost all of the reverse mortgages that lenders offer on home values below $765,600 and is the type that youre most likely to get, so thats the type that this article will discuss. If your home is worth more, however, you can look into a jumbo reverse mortgage, also called a proprietary reverse mortgage.

When you take out a reverse mortgage, you can choose to receive the proceeds in one of six ways:

Recommended Reading: Recasting Mortgage Chase

Handing Over The Keys

While selling the house would settle a reverse mortgage, it may be an unnecessary hassle for the borrowers heir. It may just be easier to hand over the keys to the lender.

Consider this if:

- The house is worth less than the loan balance.

- The heir has no interest in keeping the house and paying the balance.

- There is no hope of recovering equity from the sale.

If this is your situation, you may not want to deal with the inconvenience of selling the house. With a deed in lieu of foreclosure, the lender will recover the house, and the debt will count as settled.

Make Sure Your Records Are Up To Date

Under current tax laws, borrowers who use a reverse mortgage to buy or substantially improve their home may be eligible for a home interest tax deduction when the reverse mortgage is paid off. But the only way to prove whether the interest is deductible is to keep records that show exactly how you used funds from a reverse mortgage.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Avoiding Reverse Mortgage Scams

With a product as potentially lucrative as a reverse mortgage and a vulnerable population of borrowers who may either have cognitive impairments or be desperately seeking financial salvation, scams abound. Unscrupulous vendors and home improvement contractors have targeted seniors to help them secure reverse mortgages to pay for home improvementsin other words, so they can get paid. The vendor or contractor may or may not actually deliver on promised, quality work they might just steal the homeowners money.

Relatives, caregivers, and financial advisors have also taken advantage of seniors either by using a power of attorney to reverse mortgage the home, then stealing the proceeds, or by convincing them to buy a financial product, such as an annuity or whole life insurance, that the senior can only afford by obtaining a reverse mortgage. This transaction is likely to be only in the so-called best interest of the financial advisor, relative, or caregiver. These are just a few of the reverse mortgage scams that can trip up unwitting homeowners.

How Does A Reverse Mortgage Loan Work When You Die

There are a lot of good reasons to consider a reverse mortgage. Improved cash flow, enhanced quality of life, more money available for healthcare and lifestyle expenses. But taking out a reverse mortgage, like any home loan, is a big decision. And it raises a lot of questions.

Among the biggest of those questions is, How does a reverse mortgage work when you die? And will a reverse mortgage cause problems for your heirs?

Well break down exactly what you, and your heirs, need to know about how a reverse mortgage works after you pass away and what their options may be at that time.

Also Check: Can You Get A Reverse Mortgage On A Condo

For Reverse Mortgage Loans With Case Numbers Assigned On Or After August 4 2014

Your lender or servicer will determine if your non-borrowing spouse qualifies to stay in the home after you, the borrower, die or move into a healthcare facility for more than 12 consecutive months . To qualify as an Eligible Non-Borrowing Spouse, your spouse must:

- Have been married to you at the time the loan documents were signed, and stay married to you up until your death. If you and your spouse were a same-sex couple and were unable to

- be legally married at the time the reverse mortgage loan was made, your spouse must show that you were legally married to each other at the time of your death.

- Have been identified in the loan documents as a non-borrowing spouse.

- Have lived, and continue to live, in the home as their principal residence after you die or move into a healthcare facility for more than 12 consecutive months.

- Continue to meet the loan requirements and make sure the loan does not become due and payable for any other reason.

You Must Pay Taxes And Insurance

While reverse mortgage holders dont have a monthly mortgage payment, its important to remember the loan also becomes due if you stop paying your property taxes or homeowners insurance, or if you fail to maintain the property in good repair. Failure to pay taxes and insurance is the number one reason behind most of the foreclosures, says Dan Larkin, divisional sales manager of Schaumburg, Illinois-based PERL Mortgage, Inc.

However, the most common reason a reverse mortgage becomes due is when the borrower has passed away, says Ryan LaRose, president and chief operating officer of Celink, a reverse mortgage servicer.

Once the reverse mortgage is due, it must be paid back in full in one lump sum, LaRose says.

Just as reverse mortgage borrowers are required to adhere to guidelines under the terms of their loans, heirs must also abide by certain requirements following the death of their borrowing parents.

Read Also: 10 Year Treasury Vs Mortgage Rates

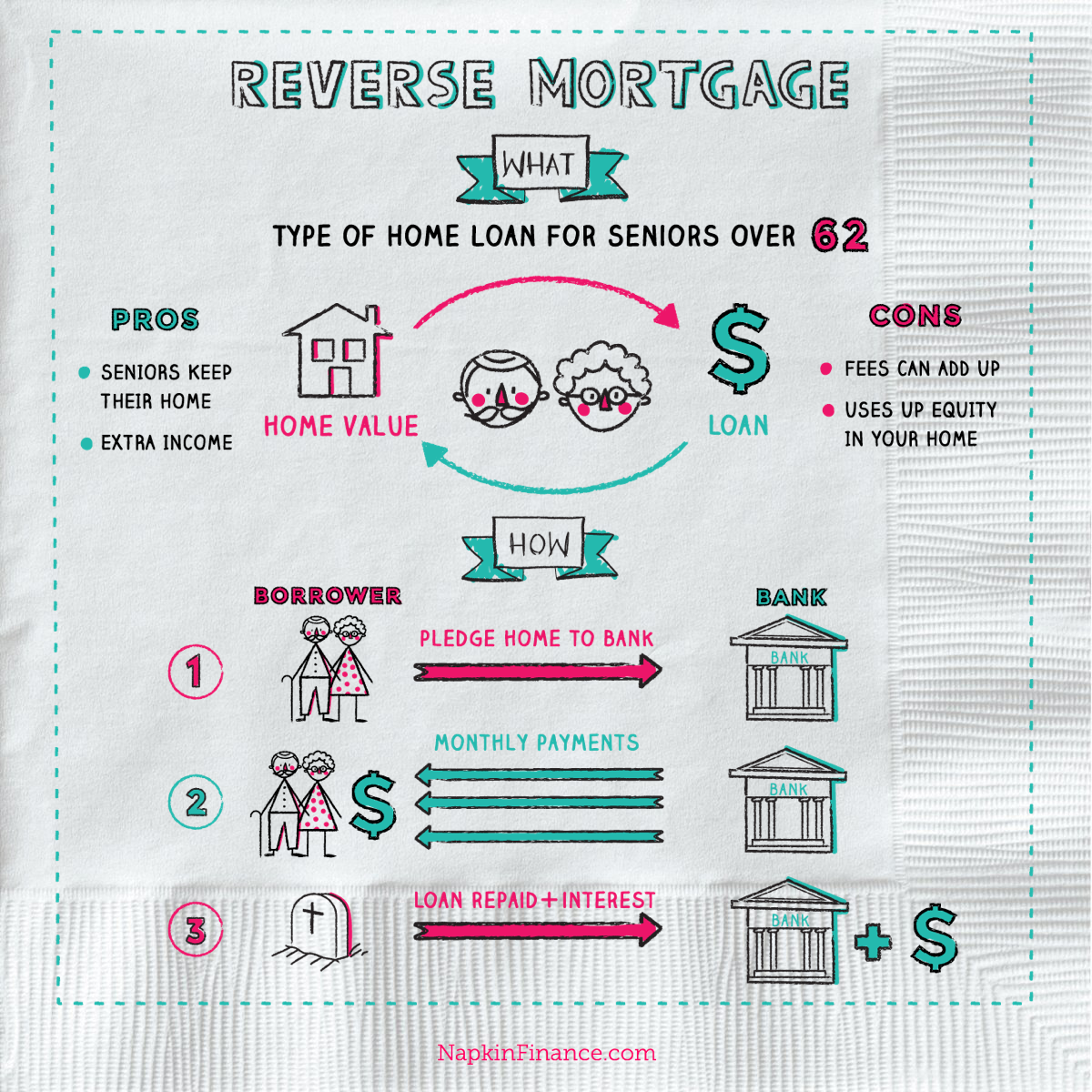

How A Reverse Mortgage Works

With a reverse mortgage, instead of the homeowner making payments to the lender, the lender makes payments to the homeowner. The homeowner gets to choose how to receive these payments and only pays interest on the proceeds received. The interest is rolled into the loan balance so that the homeowner doesnt pay anything up front. The homeowner also keeps the title to the home. Over the loans life, the homeowners debt increases and home equity decreases.

As with a forward mortgage, the home is the collateral for a reverse mortgage. When the homeowner moves or dies, the proceeds from the homes sale go to the lender to repay the reverse mortgages principal, interest, mortgage insurance, and fees. Any sale proceeds beyond what was borrowed go to the homeowner or the homeowners estate . In some cases, the heirs may choose to pay off the mortgage so that they can keep the home.

Reverse mortgage proceeds are not taxable. While they might feel like income to the homeowner, the Internal Revenue Service considers the money to be a loan advance.

Can The Mortgage Lender Demand Payment Of The Entire Mortgage Balance

Most mortgages contain a provision known as a due-on-sale clause , which says that if the property is sold or transferred, the loan servicer may call in the loan. In other words, when a bank enforces a due-on-sale clause, the entire mortgage balance becomes due immediately. If the bank doesnât receive payment in full, it can foreclose.

Due-on-sale clauses exist to protect mortgage lendersâ rights when a property is sold. These provisions ordinarily prevent anyone from assuming the mortgage. The Garn-St. Germain Act prevents mortgage companies from enforcing due-on-sale provisions in certain situations. Some of these situations include:

-

When, in cases where the house is owned jointly by two or more people, the borrower dies and ownership transfers to the surviving joint owner or owners. The borrower and the other co-owner must have owned the house as joint tenants or as tenants by the entirety.

-

When the borrowerâs surviving spouse, child, or relative inherits the house from the borrower. The relative must live in the house after inheriting it.

-

When the borrower transfers the house into a living trust. The borrower must continue to live in the house.

Recommended Reading: Rocket Mortgage Qualifications

Is It Hard To Sell A Home With A Reverse Mortgage

Yes, you can sell a house with a reverse mortgage. Your lender cannot force you to sell the home, but you are able to sell it at any time if you choose to do so. However, keep in mind that when you sell the home, your reverse mortgage comes due and you’ll need to pay off the loan balance, plus interest and fees.

Can You Sell Part Of Your Property If You Have A Reverse Mortgage

Can you sell a house with a reverse mortgage? Therefore, the answer is yes: a borrower can sell a home with a reverse mortgage at any time they choose, just like a traditional mortgage. When a borrower sells their home, they must repay the reverse mortgage loan balance and their lender will close their account.

Don’t Miss: Requirements For Mortgage Approval

Can You Inherit A House With A Reverse Mortgage

When a person with a reverse mortgage dies, the heirs can inherit the house. So, say the homeowner dies after receiving $150,000 of reverse mortgage funds. The heirs inherit the home subject to the $150,000 debt, plus any fees and interest that have accrued and will continue to accrue until the debt is paid off.

Pay Off The Reverse Mortgage

A special case that could result in far more mortgage debt than expected is the use of a reverse mortgage. When a person is 62 or older, they can borrow against a home if that homes mortgage has substantial equity.

This creates a periodic or lump-sum loan with the house as collateral. People may take out a reverse mortgage to pay expenses or to increase cash flow during retirement.

However, the total loan amount grows over time as you borrow more and interest grows. You arent allowed to borrow more than the equity you have in the home, as you might expect.

When a home has a reverse mortgage and the owner dies, you may need to sell it to repay the debt. Depending on the terms of the reverse mortgage, there may be little remaining equity in the home.

If you wish to keep the home in this case, it can be tricky. You can buy the home from the lender immediately . Or you can speak with an attorney or housing agency who could help find the time and financing for a new home loan.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home