If I Have A Low Credit Score Do I Need A Large Income To Get A Mortgage

When a mortgage lender is deciding whether you meet their criteria for a loan, they will look at the factors that affect affordability. Your income certainly impacts your ability to repay your mortgage and having a sufficient income is important.

Lenders will look at the amount you earn against your outgoings which may include debt repayments, bills, car insurance or other travel expenses. If your current income could comfortably cover your current outgoings as well as your new mortgage repayments and any associated costs, a lender may decide to approve you.

Having a lower income that may not stretch to cover the above, may cause concern for some lenders, especially if you already have a low credit score. Your broker can take the time to listen to what you need from mortgage and can calculate the most affordable and viable route.

A Review Of Credit Karma Members Shows The Average Vantagescore 30 Credit Score Across The Us For Those Who Opened Any Type Of Mortgage Tradeline In The Past Two Years Is 717

Looking at VantageScore 3.0 credit scores from TransUnion for tens of millions of Credit Karma members who had a mortgage tradeline open on their credit report in the past two years, we also studied the average VantageScore 3.0 credit score among homebuyers state by state.

Our findings: Average credit scores ranged from 683 to 739 . The range of scores was even wider when broken down by city.

What Is The Minimum Credit Score For An Fha Loan

Loans backed by the Federal Housing Administration are designed to help Americans get into their first homes. They are issued by the same kinds of lenders that provide conventional loans, including banks, credit unions and mortgage brokers, but must adhere to strict FHA guidelines. FHA loans are well-suited to applicants with limited or less-than-perfect credit histories who may not qualify for conventional mortgages.

You can get an FHA mortgage with a FICO® Score as low as 500, but applicants with scores ranging from 500 to 579 must make a down payment of at least 10% to qualify. Applicants with credit scores of 580 or greater can qualify with a down payment as low as 3.5%.

Don’t Miss: Does Chase Allow Mortgage Recast

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, it’s always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less you’ll pay in interest and fees over the life of the loan.

If you’re planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

How Much Do I Need To Make For A 250k Mortgage

How much income do I need for a mortgage of 250 thousand? You have to earn $ 76,906 a year to afford a $ 250,000 mortgage. The income you need is based on a mortgage of 250 thousand on a payment that is 24% of your monthly income. In your case, your monthly income should be around $ 6,409.

How much house can I afford if I make $50000 a year?

A person earning $ 50,000 a year can afford a house worth $ 180,000 to almost $ 300,000. This is because salary is not the only variable that determines the budget for buying a house. You also need to consider your credit score, current debts, mortgage rates and many other factors.

How much income do I need for a 250k mortgage?

A $ 250,000 mortgage with an interest rate of 4.5% for 30 years and a repayment of $ 10,000 will require an annual income of $ 63,868 to qualify for the loan. You can calculate for even more variations in these parameters using our Mortgage Revenue Calculator.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Can I Buy A Home With Bad Credit

Having a bad credit score when you want to buy a house can limit mortgage options. While there are still lenders who will approve a mortgage for a lender with bad credit, it will come with high interest to pay. For those that are eager to buy their home right away, there are some fast ways to improve your credit score. For people with less time restraints, it would be to their benefit to take steps to work on increasing their credit score, so that a cheaper mortgage agreement can be made. If you have a bad credit score for a mortgage in Canada, the following steps can be taken if you still want to buy a home.

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

Read Also: 10 Year Treasury Yield And Mortgage Rates

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

Read Also: How Does Rocket Mortgage Work

What Is An Insured Mortgage Anyway

You may be wondering what an insured mortgage is in the first place. Often referred to as a CMHC mortgage, it applies to any mortgage where the borrower contributes a downpayment of less than 20%, down to the minimum downpayment of 5% of a home’s purchase price.

The ‘insurance’ refers to mortgage default insurance, which protects the lender against default should the mortgagor fail to pay the mortgage as agreed. CMHC is the leading provider of mortgage default insurance in Canada, alongside two other providers: Genworth Financial and Canada Guaranty. For more information, check out our guide to mortgage default insurance.

What Credit Score Is Needed For A $250000 House

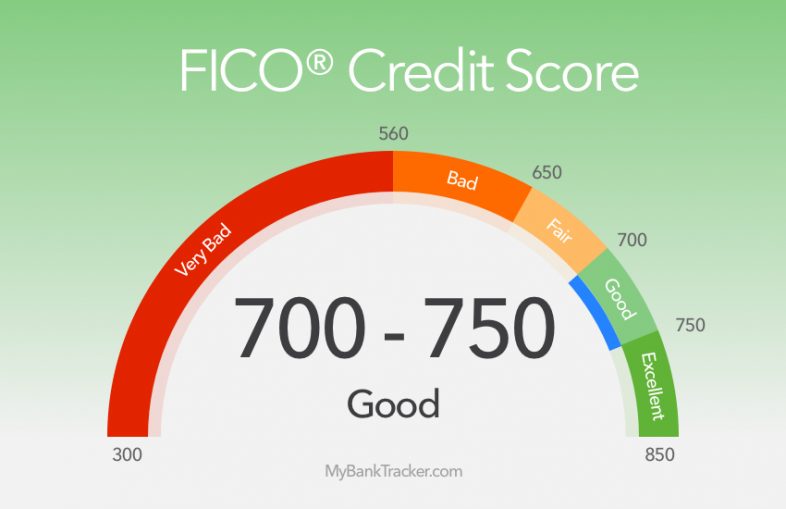

Conventional loans: Minimum from 620 to 640, depending on the type of loan. USDA loans: Minimum 580, and preferably 640. VA loans: No credit score requirements.

Can I get a mortgage of 250 thousand with a credit score of 650? However, minimum credit score requirements vary. Credit scores typically range from 300 to 850, and borrowers within a certain range can qualify for mortgage loans. Potential home buyers should aim to have credit scores of 760 or higher to qualify for the best mortgage interest rates.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

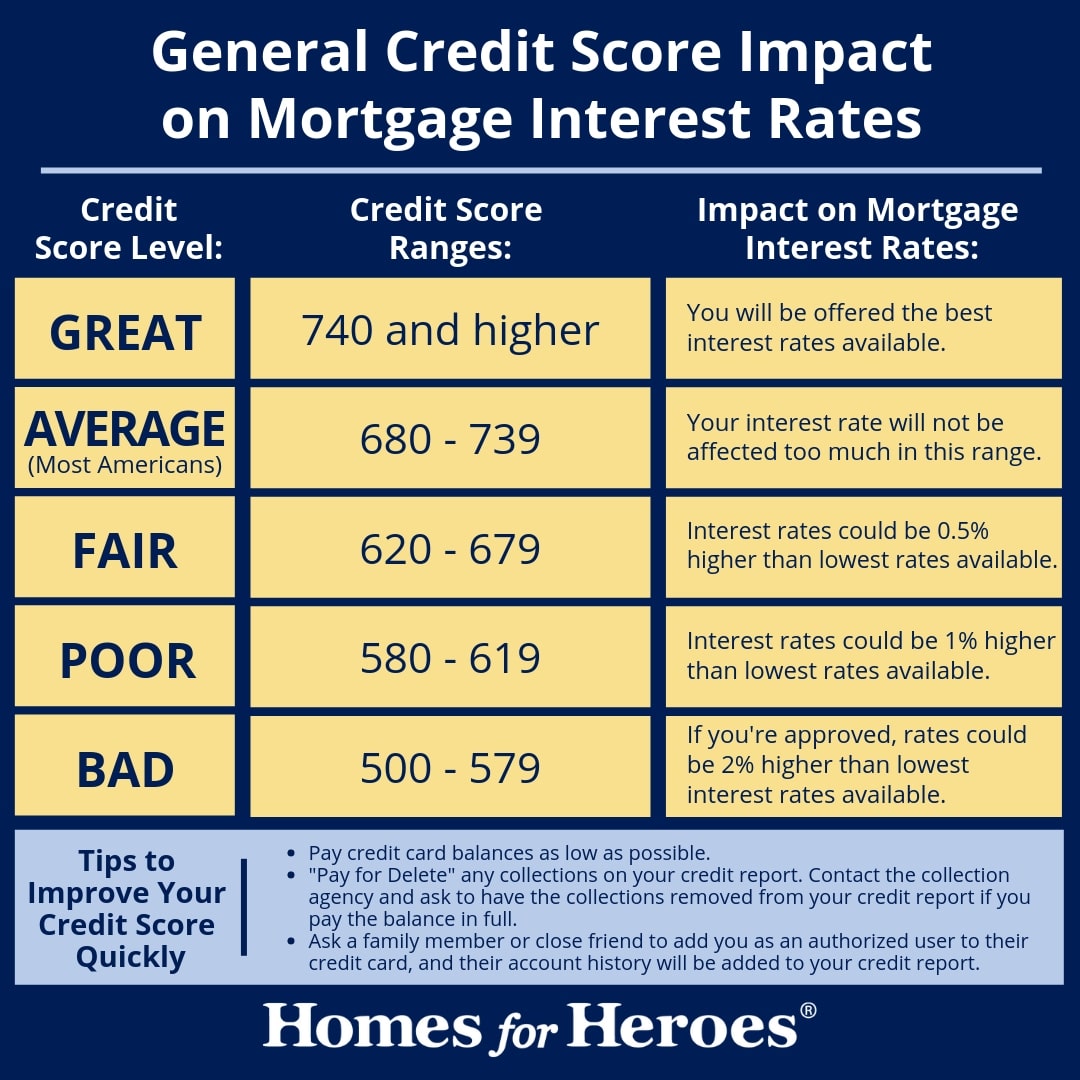

How Your Credit Score Affects Your Mortgage Rate

Although its up to specific lenders to determine what score borrowers must have to be offered the lowest interest rates, sometimes even the difference of a few points on your credit score can affect your monthly payments substantially. For example, the difference between a 3.5 percent interest rate and a 4 percent rate on a $200,000 mortgage is $56 per month. Thats a difference of $20,427 over a 30-year mortgage term.

A low credit score can make it less likely that you would qualify for the most affordable rates and could even lead to rejection of your mortgage application, says Bruce McClary, spokesman for the National Foundation for Credit Counseling. Its still possible to be approved with a low credit score, but you may have to add a co-signer or reduce the overall amount you plan to borrow.

You can use Bankrates loan comparison calculator to help you see interest rates for credit scores.

Using myFICO.coms loan savings calculator, heres how much youd pay at the current rates for each credit score range. These examples are based on national averages for a 30-year fixed loan of $300,000.

| Source: myFico. APR rates as of Nov. 5, 2021. Assumes a $300,000 loan principal amount. |

| How your credit score affects your mortgage rate |

|---|

| FICO score |

| If your score changes to 640-659, you could save an extra $34,017. |

Read Also: Mortgage Recast Calculator Chase

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

Getting A Mortgage With A Thin Credit History

One option to boost yourcredit score is to become a credit card authorized user on someone elsesaccount. You can be added tohealthy credit card accounts, and that can boost your score.

This strategy can help you if youre new to managing credit and dont have many open lines of credit or tradelines.

Tradelines arecredit-lingo for accounts with creditors. When youre short on tradelines, itcan be hard for the credit bureaus to assign to you a credit score and hardfor lenders to know whether youre a good borrower.

Getting yourselfauthorized to use a family members credit card can be a terrific way toboost your own credit rating andqualify to buy a house sooner.

Read Also: Reverse Mortgage Manufactured Home

Besides Credit Scores What Else Do Mortgage Lenders Look At

Your credit score is a main factor that lenders look at when qualifying you for a mortgage, but itâs not the only one. Other factors mortgage lenders consider when approving you for a mortgage include:

-

Your income

-

Your employment

-

Your payment history

Your current sources of debt include:

-

Student loan payments

-

Open lines of credit

Youâll also need to pass the mortgage stress test. The mortgage stress test proves to the lender that you can afford higher mortgage payments if and when higher mortgage rates arrive.

A mortgage lender will take all of these factors into account when deciding whether to approve your mortgage application. You donât have to be perfect, although if youâre strong in all or most of these areas, it can help make the mortgage approval process go much smoother.

Itâs a good idea to get pre-approved with a mortgage broker before looking at properties. If youâre not qualifying for the purchase price that you want, the mortgage broker can make suggestions to help you qualify, such paying down debt or bringing on additional income via a co-signer.

How Do I Improve My Credit Score

Hereâs a more detailed breakdown of steps you can take to improve your credit score and qualify for better mortgage rates in the future.

1. Check your credit score and regularly monitor it

Checking your credit score is the first step to improving your financial well-being. You can use Borrowell to check your credit score for free. Getting a handle on your credit score will help you access better products and get the best interest rates possible. Also, data says that checking your score can actually help you improve your credit!

2. Watch Your credit utilization

The amount of credit you have available is more important than you might think. Oftentimes, we run up balances on our cards and are unaware of the damages it can cause. Credit utilization is the ratio of your credit card balance to your credit limit as listed on your credit report. You should never use more than 30% of your available credit limit. For example, if you have a combined credit limit of $10,000, keep your total balance under $3,000.

3. Pay your bills on time

Paying your bills on time accounts for 35% of your credit score. Itâs the largest factor that impacts your credit score, so itâs important that you stay on top of your regular bill payments. Late or missed bill payments will have a negative impact on your credit score even one missed bill payment can decrease your score by up to 150 points.

Also Check: Reverse Mortgage Mobile Home

Minimum Credit Score Required For Mortgage Approval In 2022

Home \ Mortgage \ Minimum Credit Score Required For Mortgage Approval in 2022

Join millions of Canadians who have already trusted Loans Canada

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.