Current Mortgage Rate Trends

The mortgage or refinance rate you get depends a lot on your personal finances, and well explain why below. But overall mortgage rates provide the context for your personal rate.

Average mortgage rates have been low for months. This climate has allowed the most qualified borrowers to access historically low rates. But theres no guarantee rates will remain low in 2022 and beyond.

To see where 30year mortgage rates may be going, lets check where theyve been:

Average mortgage rates by loan type

| 3.13% |

Where will rates go from here? No one can predict the future, but most experts including Freddie Mac and Fannie Mae anticipate a gradual increase in rates going into 2022.

Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

The Ontario Housing Market

The Ontario housing market is greatly skewed by Toronto and Ottawa. The Greater Toronto Area is Canadaâs largest population centre, and Toronto is one of the most expensive cities in the world to buy a home. Ottawa, as Canada’s capital city, has more inflated prices than most comparable cities. Outside of these two cities, Ontarioâs housing market is more similar to the rest of Canada.

| 2016 |

Source: Canadian Real Estate Association

Within the Toronto census metropolitan area , only 59% of families owned their primary residence in 2016, slightly lower than the national average of 63% . Once you exclude Toronto and Ottawa, Ontario homeownership rises to 70%. This is probably due to the high cost of real estate in Toronto.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Factors That Affect Your Mortgage Interest Rate

For the average homebuyer, tracking mortgage rates helps reveal trends. But not every borrower will benefit equally from todays low mortgage rates.

Home loans are personalized to the borrower. Your credit score, down payment, loan type, loan term, and loan amount will affect your mortgage or refinance rate.

Its also possible to negotiate mortgage rates. Discount points can provide a lower interest rate in exchange for paying cash upfront.

Lets look at some of these factors individually:

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

Recommended Reading: How Does Rocket Mortgage Work

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

Read Also: Chase Recast Calculator

Are Mortgage Rates Impacting Home Sales

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

Should I Use An Ontario Mortgage Broker

Ontario mortgage brokers often have the lowest rates in the province, particularly for default-insured mortgages. And theyre generally free of charge for qualified borrowers. Ontario brokers also tend to provide better advice than many lender representatives since they specialize in mortgages and deal with multiple lenders. Note that all brokers must be licensed by the Financial Services Regulatory Authority of Ontario. Heres a link to see if your broker is licensed.

Don’t Miss: How Much Is Mortgage On 1 Million

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

Why Are Rates Lower For A 15

Rates for mortgages are set based on bond prices in the mortgage-backed securities market. Investors of bonds want to park their cash in a more low-risk investment, one that offers a decent rate of return that will keep up with the rate of inflation.

Since inflation rates tend to go up over time, longer-term loans will have higher interest rates compared to short-term ones. Thats because investors cant accurately project inflation rates farther in advance.

Freddie Mac and Fannie Mae, both government-supported agencies, also impose price adjustments for loan levels, driving up costs of 30-year mortgages. Many 15-year mortgages dont have these additional fees, which is reflected in a lower rate.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

Recommended Reading: Can You Refinance A Mortgage Without A Job

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Recommended Reading: Requirements For Mortgage Approval

Should I Get An Open Or Closed Mortgage In Ontario

With an open mortgage, you can pay down as much of your principal as you want in a given year without restriction. However, open mortgage rates are higher. So you are essentially paying more for flexibility.

With a closed mortgage, prepayments are restricted and interest penalties are enforced on any overpayment, but your rate will be lower than an open mortgage rate.

In Ontario, closed mortgages are the more popular option as most people donât expect to pay more than their monthly mortgage payment. However, an open mortgage could be a good choice if youâre planning to move soon or expect to receive a lump sum of money during your mortgage term.

Look At Interest Rate And Apr

Most borrowers tend to focus on mortgage rates. But the APR you pay on a loan is often just as or even more important than the basic interest rate.

Annual percentage rate looks at all your costs of borrowing and spreads them over the potential life of your loan. So APRs are higher than straight rates. And they can tell you about what youre actually going to pay.

Just note, APR assumes youll keep your loan its full term, which most borrowers dont. They either sell or refinance before the mortgage term ends.

So look at APR, but remember that its not always the last word on what youll pay. You can learn more about how to compare interest rates and APR effectively in this article.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

Why Mortgage Rates Change

Mortgage rates are influenced by a range of economic factors, from inflation to unemployment numbers. Typically, higher inflation means higher interest rates and vice versa. As inflation rises, the dollar loses value, which in turn drives off investors for mortgage-backed securities, causing the prices to fall and yields to climb. When yields climb, rates get more expensive for borrowers.

A strong economy usually means more people buying homes, which drives demand for mortgages. This increased demand can push rates higher. The opposite is also true less demand can trigger a drop in rates.

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Recommended Reading: Chase Recast Mortgage

How To Get The Best Mortgage Rate For Your Credit Score

Comparison shopping for your mortgage can make a huge difference. The CFPB said in 2018, Previous Bureau research suggests that failing to comparison shop for a mortgage costs the average homebuyer approximately $300 per year and many thousands of dollars over the life of the loan.

But before you even get to the mortgage shopping phase you can work on improving your odds for a lower rate.

For example, if you save enough for a down payment thats bigger than the minimum required, you might get a lower rate, even if your scores unimpressive.

And the same applies if you have few existing debts. People with low debttoincome ratios are more likely to be able to afford their new mortgage payments than those already struggling to stay afloat.

Lenders take both those factors into account, alongside your credit score, when deciding on the mortgage rate to charge you.

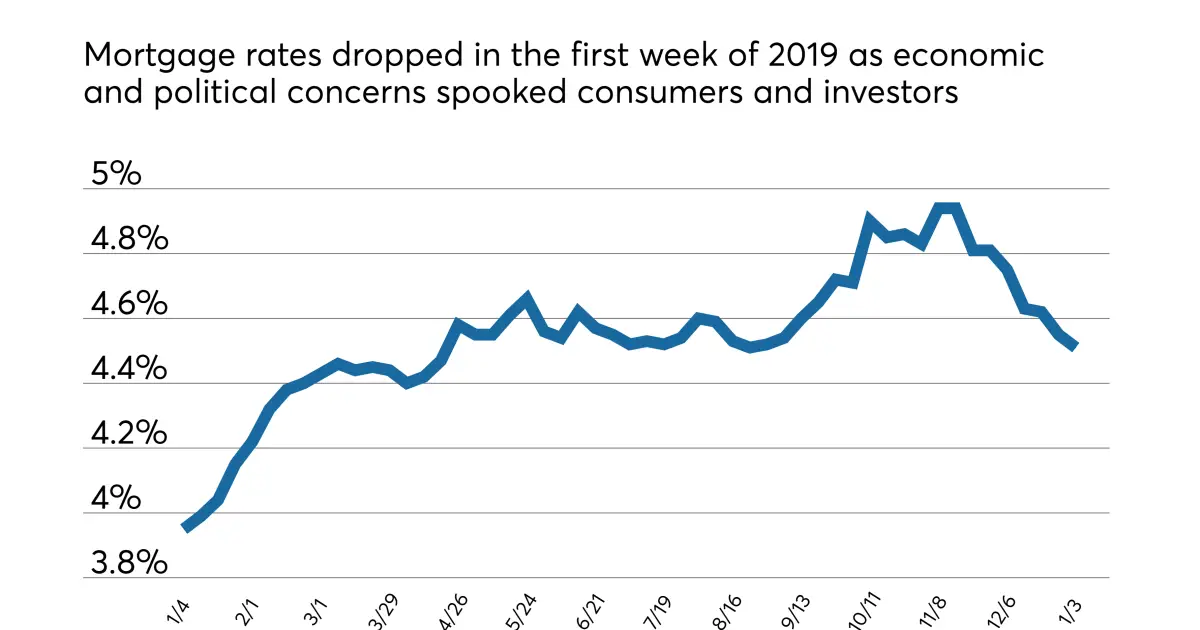

Average Mortgage Interest Rate By Year

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

Recommended Reading: Monthly Mortgage On 1 Million

When To Lock Your Mortgage Rate

Keep an eye on daily rate changes. But if you get a good mortgage rate quote today, dont hesitate to lock it in.

Remember, if you can secure a 30year mortgage rate below 3% or 4%, youre paying less than half as much as most American homebuyers in recent history. Thats not a bad deal.

*Average rates are for sample purposes only. Your own interest rate will be different. See our mortgage rate assumption here.

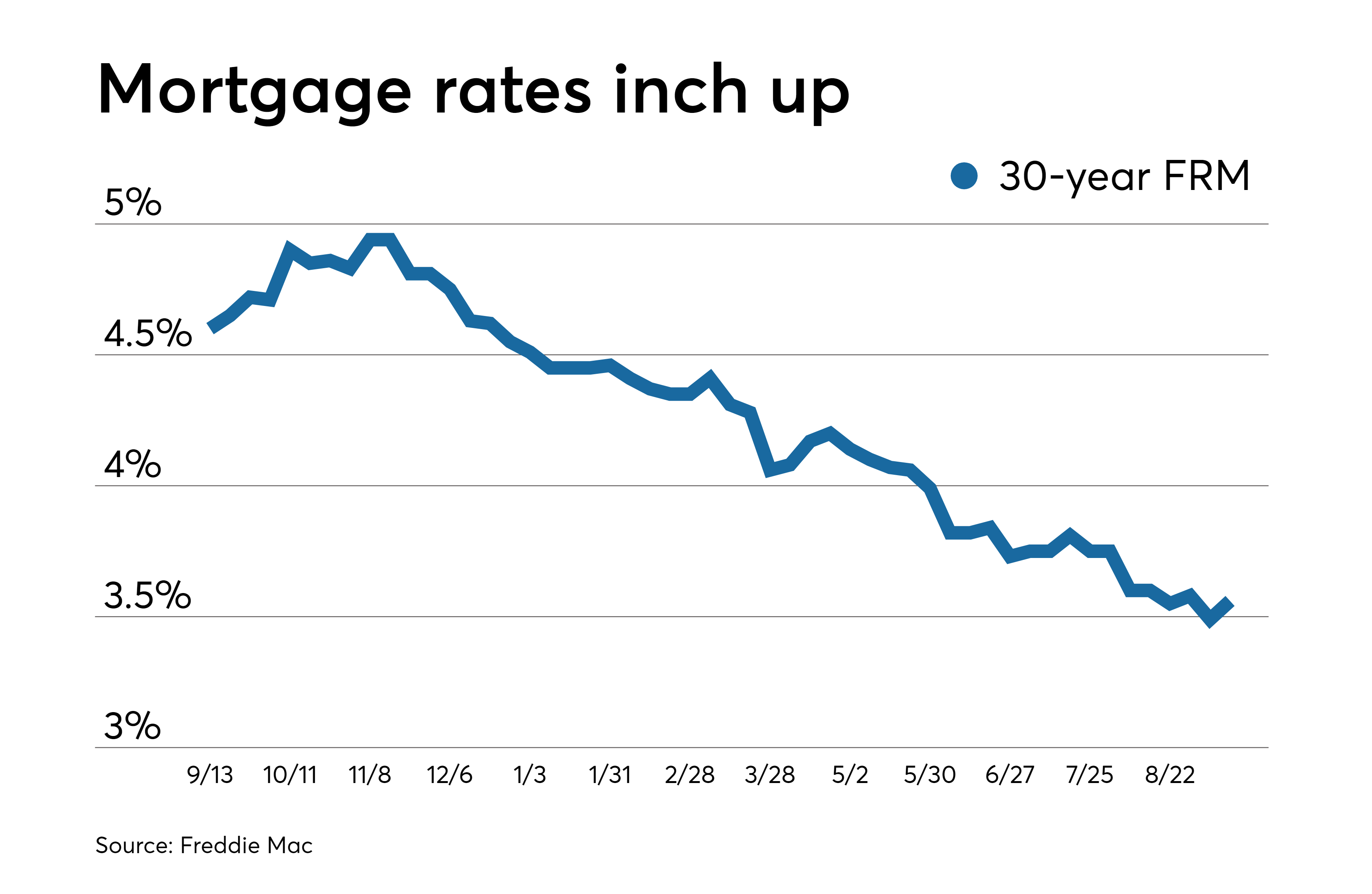

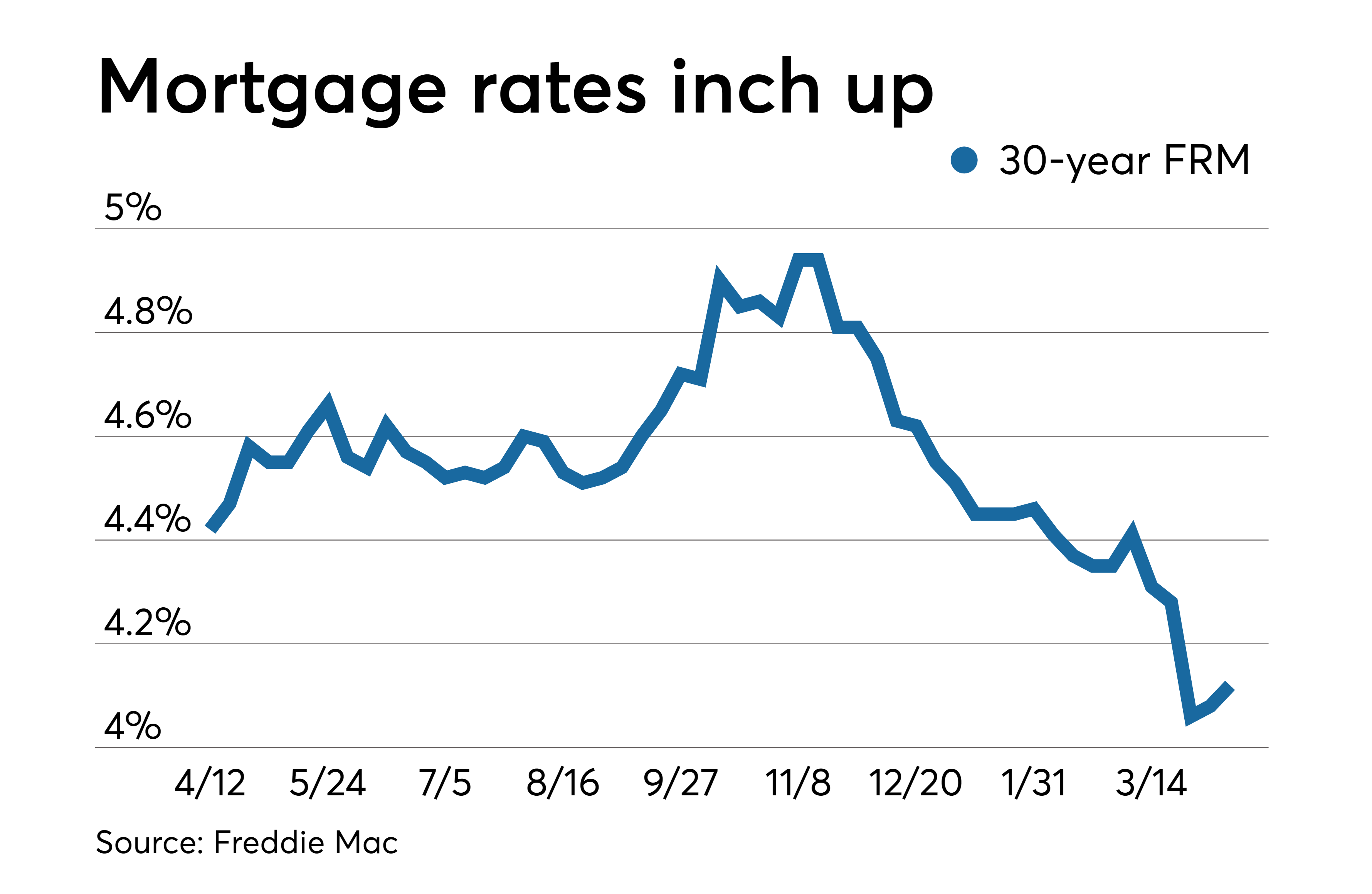

What Are The Mortgage Rate Trends For 2021

This year, rates have fluctuated but overall they have been low compared to rate history. But, many experts believe rates will rise in 2021.

As the economy recovers and the Federal Reserve announced its plan to scale back its low-rate policies the likely outcome will be rising mortgage rates. However, the expectation among experts isnt for skyrocketing rates overnight, but rather a gradual rise over time.

Recently, though, rates have been volatile. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years.

Long term, experts still expect rates to slowly increase as the economy recovers. The recent volatility could continue through the end of the year and into 2022.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

Current Mortgage Rates Can Be Deceptive

Its important to understand that shopping around means actually applying with multiple lenders and getting personalized quotes. It does not mean simply looking online and picking the lender with the lowest advertised rates.

Why? Because lenders tend to base their advertised rates on ideal borrowers. They often include discount points, too, which lower your mortgage interest rate but increase your upfront fees.

So unless you have great credit, a big down payment, and dont mind paying extra closing costs, you probably wont get those advertised rates.

The same applies to average rates. By definition, some borrowers will qualify for lower rates and some will get higher ones. What youll be offered will depend on your situation and personal finances.

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

Read Also: Rocket Mortgage Loan Requirements

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.