Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

When To Get A Pre

Pre-approval letters are valid for 60-90 days. They have an expiration date because a buyers finances and credit profile may change over a longer period. If your pre-approval expires, you will need to fill out a new mortgage application with updated paperwork. You may not be able to get the same loan that you were offered previously.

It is advisable that you seek pre-approval six months to one year before a serious home search. This gives you time to address any credit issues identified and improve your financial standing if necessary. You will also have more time to save for a down payment and closing costs.

What Is A Mortgage Pre

A mortgage pre-approval is where a lender like a bank or credit union conditionally approves you for a maximum loan amount before you make a final offer to buy a home. The process involves a lender looking at your finances to determine the maximum amount they can offer, and the interest rate they are prepared to give you. A successful pre-approval will tell you the maximum amount you can work with, and will allow you to house hunt more productively .

Its worth keeping in mind, however, that pre-approval does not guarantee a final mortgage approval. Its also not quite the same as pre-qualification, either.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

How Much Mortgage Can I Afford On My Salary Calculator

The only way to know for sure how much mortgage you can afford on your salary is by talking to a lender. Theyll look at every piece of your financial picture to calculate the exact amount you can borrow.

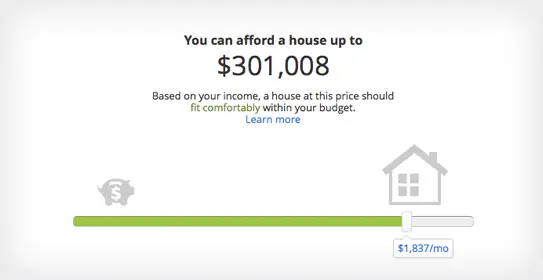

But if youre still in the researching phase, you can skip the phone call and get a good estimate of your budget by using a mortgage calculator.

This ‘by income’ mortgage calculator will estimate what you can afford based on your salary, down payment, existing debts.

If you want to better understand how each of those factors affects your max mortgage amount, read on.

Mortgage Approval Process Canada

The actual mortgage approval process starts when your offer has been accepted by the seller because your lender will need to know what the value of the property is based on current market conditions, as well as the amount of your down payment. In order for the approval process to be completed, your lender will require the purchase agreement as well as the MLS listing. The value of the property youve agreed to purchase will be assessed by an appraiser appointed by the lender to make sure that the price you agreed to pay is on par with what the home is actually worth.

The property will also need to be approved by the mortgage insurer if you are putting less than a 20% down payment. Your income, credit score, and debt, and any other financial information will be re-verified, and the specific type of mortgage product that youve decided on will be factored into the equation.

Take a look at this infographic to learn all about the true cost of borrowing.

You May Like: Chase Recast

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Why Should You Get A Pre

A mortgage pre-approval is not compulsory. However, getting pre-approved makes the home-buying process more efficient and provides an opportunity for you to compare loan options and solidify your budget.

It is important to be clear on your budget and the monthly repayments you can comfortably afford. This saves you time as you can eliminate homes that are out of your budget. It also prevents you from committing to a home that will stress your finances for years to come.

On top of this, pre-approval shows sellers and real estate agents that you are a serious buyer and can afford a home. Sellers want to know that a buyer can follow through with the financing. So being pre-approved gives you a much higher chance of having your offer accepted and securing your dream home.

You May Like: Can You Do A Reverse Mortgage On A Condo

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting.Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

Income Requirements To Buy A Home

Lenders consider much more than just your paycheck when you buy a home. Your debt-to-income ratio and your ability to make mortgage payments are more heavily considered than how much you make. Theyll also consider your credit score and how much you have for a down payment.

A great place to start is to get a preapproval, especially if you arent sure whether you can get a mortgage on your current income. A preapproval is a letter from a mortgage lender that tells you how much money you can borrow. When you get a preapproval, lenders look at your income, credit report and assets. This allows the lender to give you a very accurate estimate of how much home you can afford.

A preapproval will give you a reasonable budget to use when you start shopping for a home. Once you know your target budget, you can browse homes for sale to see what general prices are. Its a good sign that youre ready to buy if you find appealing options at your price range.

So what do lenders look for when you want to borrow? For starters, theyll take a look at your monthly income and your debt-to-income ratio.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

Do You Have Enough Income

To afford a home, you must have enough income to cover your mortgage payments as well as your usual expenses and other debt obligations. This is a big deal because it reveals how predictable your finances are, which is crucial in making monthly payments. You have increased chances of securing approval if you have a stable long-term job with high income, which is why lenders verify your employment status.

Apart from evaluating your income, you may also submit any additional proof of income. Note that extra income is only accepted by lenders if it can get funds from those sources for at least three years. Heres a list of eligible sources of additional income:

- Payment from part-time work

- Stocks, bonds, and mutual funds

- Certificates of Deposit

How Much Mortgage Can I Qualify For +

The mortgage you qualify for varies according to your present circumstances. The two main factors that are typically considered in determining how much mortgage you qualify for are your monthly income and your monthly expenses. The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford.

Read Also: 10 Year Treasury Vs Mortgage Rates

My Monthly Rbc Mortgage Payment Will Be

$0*/month

The mortgage amount is based on the qualifying rate of%.* The payment amount is calculated based on an interest rate of %.

View Legal DisclaimersHide Legal Disclaimers

Enter your annual household salary. This includes your spouse/partner.

Consider car payments, credit cards, lines of credit and loan payments. This should not include your rent.

Enter the amount of money you plan to use as a down payment. Donât forget you can also leverage your RRSPs.

The Home Buyers’ Plan allows you to borrow funds from your RRSP to purchase your first home. Here are some of the key facts:

- You and your spouse can each withdraw up to $35,000 from your RRSP.

- The funds must have been on deposit at least 90 days before you withdrew them.

- At least 1/15 of the funds must be repaid each year, beginning two years after the funds were withdrawn.

- A signed agreement to buy or build a qualifying home is required.

- You can only participate in the program once.

For details,watch this video or seeCanada Revenue Agency

Default insurance covers the lender in case of a failure to pay off the full mortgage amount. If your down payment is from 5-19%, a default insurance premium will automatically be applied to your mortgage.

Other monthly expenses you may want to consider include such items as alimony and condo fees .

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

If I Make $50k A Year How Much House Can I Afford

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000.

Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Just to show you how much these different variables can affect your home buying power, take a look at a few examples below.

Great To Hear Because I Found My Dream Home It Costs Way More Than I Make In A Year Though

Well, how much more exactly? Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross annual salary. And some say even higher. There are a ton of variables, and these are just loose guidelines. That said, if you make $200,000 a year, it means you can likely afford a home between $400,000 and $500,000.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

How The Mortgage Pre

This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for. But please understand its a calculator only, and the official number will be determined by a mortgage lender.

In addition, the validity of the results youll get from this mortgage prequalification calculator will only be as good as the information you input. For that reason, be as accurate as you can be. If you inflate any information, like your annual income or your credit score range, you may get a higher loan amount, only to get a smaller pre-approval amount from an actual mortgage lender.

The mortgage pre-approval calculator is self-explanatory, but heres a general overview.

Recommended Reading: Reverse Mortgage On Condo

Calculate How Much Home You Can Afford

Before applying for a mortgage, you can use our calculator above. This provides a ballpark estimate of the required minimum income to afford a home. To understand how this works, lets take the example below.

Suppose the house youre buying is priced at $325,000. The loan is a 30-year fixed-rate mortgage at 3.5% APR. To get rid of PMI, you decided to make a 20% down payment, which is $65,000. With a 20% down, this reduces your principal loan amount to $260,000.

To qualify for the loan, your front-end and back-end DTI ratios must be within the 28/36 DTI limit calculator factors in homeownership costs together with your other debts. See the results below.

- 30-Year Fixed-Rate Loan

| Minimum Required Income Based on 36 Back-end DTI | $98,083.87 |

*When you use the calculator, you can adjust the DTI limits as needed for when a lender accepts higher DTI ratios.

Based on the results, the minimum required annual salary based on the 28% front-end DTI limit for a $260,000 mortgage is $66,107.84. But note that this does not factor in your other debt obligations. Other debts are included when you calculate based on the 36% back-end DTI limit. This results in a minimum required salary of $98,083.87.

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

Don’t Miss: Recasting Mortgage Chase

Factors That Determine If You’ll Be Approved For A Mortgage

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If you think now is a good time to buy a home, chances are good you’ll need a mortgage. Mortgages can come from banks, credit unions, or other financial institutions — but any lender is going to want to make sure you meet some basic qualifying criteria before they give money to buy a house.

There’s variation in specific requirements from one lender to another, and also variation based on the type of mortgage you get. For example, the Veterans Administration and the Federal Housing Administration guarantee loans for eligible borrowers. This means the government insures the loan, so a lender won’t face financial loss and is more willing to lend to risky borrowers.

In general, however, you’ll typically have to meet certain criteria for any mortgage lender before you can get approved for a loan. Here are some of the key factors that determine whether a lender will give you a mortgage.

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

You May Like: Rocket Mortgage Vs Bank

How Much Do I Need For A Down Payment

It looks like you may be able to afford a home worth about 386,405 for a payment of about1,300per month/mo.

$376,405 loan amount

10,000 |2.6%

Down payment

Information and interactive calculators are made available as self-help tools for your independent use and are intended for educational purposes only. Any results are estimates and we do not guarantee their applicability or accuracy to your specific circumstances

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Recommended Reading: Rocket Mortgage Requirements