Get Your Credit In Shape

A lower credit score can make it more difficult for you to get approved for a mortgage, and can also make your loan more expensive with a higher interest rate. If your credit score needs improvement, commit to paying down debt and try to keep your credit utilization ratio below 30 percent. With less debt, especially, your DTI ratio will be lower many lenders look for 36 percent or less.

In addition, check your credit report to ensure there are no errors that could be negatively impacting your score. You can get a copy from the three major credit bureaus. If you do find a mistake, contact the agency to dispute it as soon as possible.

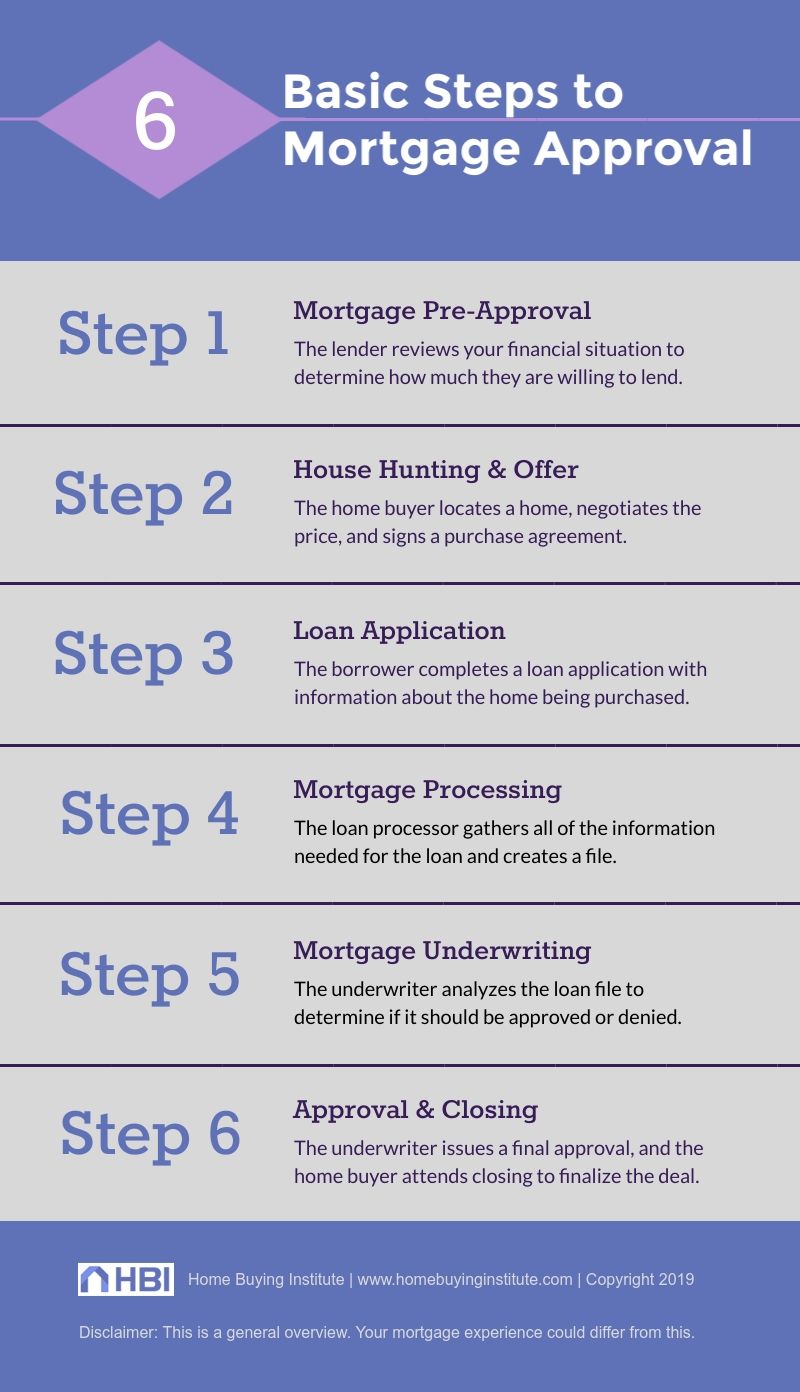

A Clear Understanding Of The Mortgage Application And Approval Process Can Help You Move Forward And Make Decisions With Confidence

The process of successfully obtaining mortgage financing can be broken down into 7 steps which we divide into 3 distinct stages. The first stage is to have an initial assessment discussion with a trusted mortgage broker to diagnose your situation and determine the best course of action. The second stage is the pre-approval in which a formal application with supporting documents is submitted and reviewed. Finally, in the approval stage, financing is formally requested and the details of the mortgage contract are finalized.

Each step is explained individually below.

Our mortgage application and approval process is an organized and sequential procedure that helps you progress towards your goals with confidence and clarity. A plan helps you define the scope of your objective and anticipate commonly encountered pitfalls. How long the mortgage approval process takes depends on how busy lenders are and how quickly you can provide the requested documents. We use checklists and diligent communication to keep things moving along. The approximate number of business days to complete each step are shown in brackets.

Stay Away From New Credit

Opening up new credit cards or accounts will raise your available credit. To a lender, this is potential debt that you could owe to someone else, increasing the likelihood that you will miss a payment to them.

Even if you find a great deal on a new credit card, wait until you have the keys before you open an account.

Don’t Miss: When Is A Reverse Mortgage Good

Not All Inquiries Are Alike

Soft inquiries just check to see what your number is. They dont have anything to do with a loan or line of credit. For example, you might look up your own number just out of curiosity, or someone whos considering hiring you might do so as part of a background check. Soft inquiries dont affect your credit score at all. In fact, we recommend checking your credit score now so you can see where you stand and have a chance to correct any errors you may find. You can check your score at www.annualcreditreport.com. Its fast, free, and easy.

- You check your own credit

- One of your current creditors checks your credit

- A company checks your credit to see if you qualify for preapproval offers

- You get a new job and your employer pulls your credit report as part of its screening process

Hard inquiries are different. With these, a lender is checking on your financial history to decide whether to give you a loan or line of credit and what kind of rates to charge you. If youre looking for loans or lines of credit, it tells a lender that youre thinking of taking on more debt, which can affect how much youll be able to pay back on your mortgage. Thats why these kinds of inquiries can subtract from your credit scoreespecially if youre applying for a lot of loans at once.

Hard inquiries:

How Does Getting Preapproved For A Car Or Mortgage Loan Work

A preapproved loan typically requires you to fill out a preapproval loan application with your financial information, and lenders will usually check your credit. You dont have to know which specific car or home youll end up buying when you apply for a preapproval.

After analyzing your preapproval application, credit and other information, the lender will let you know if youre preapproved for a loan. If you are, the lender will usually let you know the total amount youre preapproved for. Of course, you dont have to borrow the entire amount. In fact, it often makes sense to borrow less than what a lender is willing to let you borrow.

After you or home you want to buy, youll talk to the lender and finish your full loan application. Even though you were preapproved, your final loan application may still be denied if something in your financial situation or credit reports changed.

Getting preapproved for a loan helps sellers feel confident that they arent wasting their time with an insincere buyer looking at dream cars or homes they cant afford. Your preapproval shows sellers you have the income and credit to complete the sale.

Read Also: How To Calculate Self Employed Income For Mortgage

How Long To Close After Conditional Approval

Once you receive your conditional mortgage approval, you are quite close to an accepted loan and closing. However, you are not quite there. Many people want to know just how long it will take to close after receiving conditional approval.

Unfortunately, every situation is different and the time until closing will vary based on the conditions you must meet and your lenders timeline. The time it takes to go from conditionally loan approval to final approval can be a matter of days or weeks depending on your situation. However, there are some factors that will influence your time until closing after conditional approval.

For one, you should contact your lender to figure out their timeline. Some lenders have in-house underwriters that have a one-day turnaround time, while others may take up to 72 hours. The insurance portion of the process should be fairly quick as long as your insurance agent sends the insurance binder to the lender on time. Additionally, you need to meet the conditions specified in your conditional loan. The quicker you are able to provide the documentation to meet the conditions, the faster you can get to closing.

Once you submit the conditions back to the underwriter, they will review them for final approval. As long as you adequately met all of the conditions, you will receive final approval and clearance to close. To keep your closing time down, you should:

What Happens After Closing Disclosure

Federal law requires that mortgage lenders provide a Closing Disclosure at least three business days before your closing date.

When you get your CD form, you need to compare it against the Loan Estimate you received when you made your mortgage application.

Some charges on your Loan Estimate, such as the loan origination fee and appraisal fee, should never change on your Closing Disclosure.

If these fees have changed, contact your loan officer and ask for a cost correction. Even a 0.25% increase in your loan origination fee can have a huge impact on closing costs, since this fee is based on your loan amount.

Costs that can change from LE to CD

Lender fees shouldnt increase between your LE and CD, but other costs listed on your CD can increase.

Some can increase by up to 10% while others can increase by any amount.

- Can increase by up to 10%: These include survey fees, title search fees, and pest control fees. Since these services are provided by third parties, the costs arent controlled directly by the lender

- Can increase by any amount: Some costs depend on the final details of your loan, so they could increase significantly between your LE and CD. Your homeowners insurance provider, for example, may require an upfront payment. Or you may need to pay property taxes in advance. Delays in your closing day could increase some costs, too

Be sure to ask your loan officer or closing attorney about any cost increases you see on your CD.

What about the interest rate?

Don’t Miss: Do Any Mortgage Lenders Use Fico 8

When Does Underwriting Happen In The Mortgage Process

Underwriting happens at two stages in the mortgage process. The first is when you apply for preapproval. Your loan officer will collect information, such as your Social Security Number, current address, employment information, bank statements from the past two months, tax returns, and pay stubs.

Theyll also pull your credit to check your credit score, your payment history, and your debt-to-income ratio. Using that information, theyll calculate how much you can borrow. Before they can issue a preapproval letter, however, theyll send all of this information to underwriting.

The underwriting team will analyze your documents and if everything checks out, theyll issue a conditional approval.

The approval is conditional because you dont have a sale contract yet and the loan has not been processed.

After you find a home and get your offer accepted, your loan application will be processed and it will go back to underwriting.

At that point, an underwriter might ask for updated pay stubs and bank statements, especially if its been a few months since you were preapproved.

You can improve your chances of getting approved more quickly by having everything ready and in one place, being honest when filling out your application, responding quickly to requests for extra information, and being prepared to explain unfavorable items on your credit report,

Imani Francies

The four possible underwriting outcomes:

Gather All Of Your Documentation

Its essential to start collecting the papers needed for a mortgage pre-approval and application as soon as possible. Inquire with your mortgage broker about the paperwork needed to close your loan, and begin gathering them in one location.

To get you started, heres a typical list:

- Identification is required to verify that you are who you say you are.

- Statements from your bank account and investments to demonstrate your ability to make your monthly payments.

- Evidence of assets, such as a car, cottage, or boat.

- Pay stubs or a letter from your company will suffice as proof of income. If youre self-employed, youll require a notice of assessment.

- Your debt information, which includes student loans, car loans, and credit cards. Lenders have access to databases containing this information and hiding it will make you seem bad.

You May Like: How Long Does It Take To Get A Mortgage Commitment

How Long Will It Take To Get Your Mortgage Approved

You’ve sent in copies of your last two paycheck stubs. You’ve provided a letter from your employer verifying your job status. You’ve made copies of your tax returns from the last two years.

Now how long will you have to wait before earning approval on your mortgage loan?

The answer? It depends.

Weve all seen commercials from mortgage lenders who promise to make the application process easier. But just because you can submit a loan application with the press of your computers Return key doesnt mean that your approval will be coming in any faster.

Ellie Mae, in its latest report, said that it all mortgage loans an average of 49 days to close during November. Ellie Mae reported that it took mortgage refinances an average of 51 days to close and purchase loans an average of 47 days.

What causes loans to take so long to close? There are plenty of factors.

The underwriting process — the process by which mortgage lenders determine if you are a good risk for a mortgage loan — can be delayed if you don’t provide all the necessary documents that lenders need to verify your income and savings. Marks on your credit report such as late or missed payments can delay the process, too.

How Long Does The Underwriting Process Take

Underwriting a mortgage can take anywhere from a few days to several weeks, depending on your financial circumstances and the lenders resources. Initial underwriting approval typically happens within 72 hours of submitting your complete loan file, although the entire process could take up to one month in worst-case scenarios.

Remember that your loan is also contingent upon the appraisal, which itself can take three weeks to get scheduled, Boese says.

To speed up the underwriting process, have all your necessary documents and requested information ready for the lender when they ask for it. Also, be prepared to respond punctually to any phone calls or requests you get from the lender after submitting your loan application.

Related: How To Buy a House in 11 Steps

Also Check: Who Has The Best Mortgage Loan Rates

What Does An Underwriter Do

While your future home undergoes an appraisal, a financial expert called an underwriter takes a look at your finances and assesses how much of a risk a lender will take on if they decide to give you a loan.

The underwriter helps the lender decide whether or not youll see a loan approval and will work with you to make sure that you submit all your paperwork. Ultimately, the underwriter will ensure that you dont close on a mortgage that you cant afford. If you don’t qualify, the underwriter can deny your loan.

An underwriter can:

- Investigate your credit history. Underwriters look at your credit score and pull your credit report. They look at your overall credit score and search for things like late payments, bankruptcies, overuse of credit and more.

- Order an appraisal. Your underwriter will order an appraisal to make sure that the amount that the lender offers for the home matches up with the homes actual value.

- Verify your income and employment. Your underwriter will ask you to prove your income and employment situation.

- Look at your debt-to-income ratio . Your DTI is a percentage that tells lenders how much money you spend versus how much income you bring in. You can calculate DTI by adding up your monthly minimum debt payments and dividing it by your monthly pretax income. An underwriter examines your debts and compares them to your income to ensure you have more than enough cash flow to cover your monthly mortgage payments, taxes and insurance.

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Read Also: What To Watch For When Refinancing Mortgage

Conditional Loan Approval Vs Preapproval

Conditional loan approval and preapproval are both ways that a lender can give you some amount of assurance that youâll be able to borrow a given amount when it comes time to finalize your mortgage.

These two options are different in the lenders level of vetting. The major difference is that an underwriter must review some of your information for a lender to grant conditional approval. This means that conditional approval is more of a sure thing than preapproval, for which a lender simply verifies your credit history and credit score.

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

Don’t Miss: What Is The Formula For Calculating Monthly Mortgage Payments

Final Approval Vs Conditional Approval

Most borrowers get a conditional approval before the final approval, so dont be surprised if your mortgage underwriter has some questions about your financial situation.

Mortgage underwriters are people employed by the lender to review and analyze your ability to repay the loan.

The underwriting process will check your bank statements, credit history, and pay stubs for verification of employment. Self-employed borrowers may need to submit transcripts from their tax returns.

If anything looks amiss in these documents or raises questions for the lender, you may receive a conditional approval with a few extra steps before closing.

As part of your conditional approval, the underwriter will issue a list of requirements. These requirements are called conditions or prior-to-document conditions.

From conditional approval to clear to close

To meet these conditions, you may need to submit additional documentation, such as:

Theres no need to take these requests for additional information personally. Conditional approvals are a common part of the mortgage process.

Your loan officer will submit all your conditions back to the underwriter, who should then issue a clear to close, which means youre ready to sign loan documents. This last verification is your final approval.

How long does it take to get final approval?

Getting your loan from conditional approval to final approval could take about two weeks, but theres no guarantee about this timeframe.

What Is Underwriting Explaining The Underwriting Process

6-minute read

Did you know that your finances go through a process called underwriting before you can officially get a mortgage? Underwriting is a crucial component of the home loan process because you cant get to closing until your lender’s team completes the underwriting for your mortgage. Lets dive in and learn more about the underwriting process.

Don’t Miss: What Is Loan To Value Mortgage

Benefits Of A Mortgage Loan Approved With Conditions

You can only obtain a conditional mortgage loan after youve found a specific home. However, you should not wait until after your offer to apply for a mortgage loan with conditions. There are many important reasons to get a mortgage loan approved with conditions before making an offer on a home including:

- A mortgage loan approved with conditions is more attractive to sellers and can set you apart from other buyers that only have pre-approval.

- If you stick with only pre-approval, you are likely to lose to other buyers, especially for the most desirable properties.

- Conditional loan approval can greatly reduce the closing time since most of the loan process is already done.

- Eliminate many of the unknowns and uncertainties in the home buying process with your conditional loan approval.

- Builders for new construction often require conditional loan approval before beginning the process. Most likely, you cannot start building a new home without conditional loan approval.