Whats The Difference Between Base Fico Scores And Industry

Base FICO® Scores, such as FICO® Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether its a mortgage, credit card, student loan or other credit product.

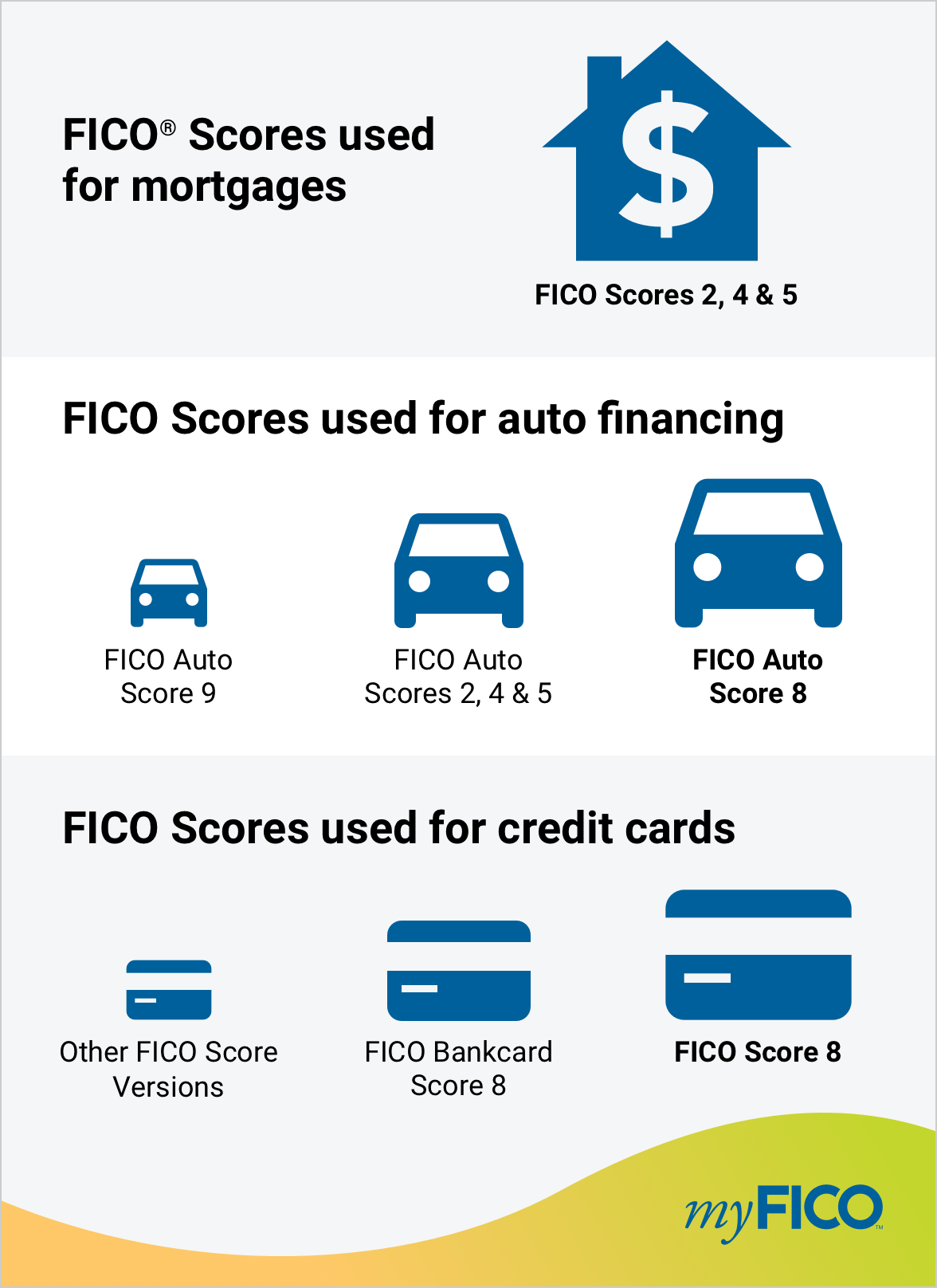

Industry-specific FICO® Scores are designed to assess the likelihood of not paying as agreed on a specific type of credit obligationcar loans or credit cards, for example.

Industry-specific FICO® Scores incorporate the predictive power of base FICO®Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use FICO® Auto Score or a FICO® Bankcard Score, respectively, instead of base FICO® Scores.

FICO® Auto Scores and FICO® Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO® Score

- It is up to each lender to determine which score they will use and what other financial information they will consider in their credit review process

- The versions range from 250-900 and higher scores continue to equate to lower risk

How Can I Access My Credit Score

Per the Federal Trade Commission, you can pull one free copy of your credit report from each of the three main agencies per year.

You also may have frequent access to your score for free through your bank or credit card issuer.

Keep in mind that the free score you have access to through your bank or credit card company is not your comprehensive report, but it will give you a snapshot of where you are to help you get where you want to go.

Fico 8 Mortgage Score

In October 2010, the Fair Isaac Company revealed its new Mortgage Score, based on the FICO 8 credit scoring formula. It is worth noting that FICO is always tinkering with its credit scoring formula, adding more factors, and increasing the sophistication of the measure. While we have a general idea of what is included in a FICO score, the truth is that the actual formula is a closely guarded secret. And, in addition to the more generic FICO score that we are all used to hearing about, FICO offers a number of different scoring products. These scoring products include those that rate depositor behavior for banks, as well as the FICO 8 Mortgage Score.

There are also many other types of credit scores, such as the VantageScore, and those provided by other fintech companies, such as and Credit Sesame.

As you might gather from the name of this score, the Fico 8 Mortgage Score is meant to help lenders figure out what sort of default risk you pose to them. On its web site, FICO describes the power of the FICO Mortgage Score:

The score includes 17 distinct scoring models, increased from the 12 included in the base FICO® 8 Score. This allows for more refined risk assessment of mortgage consumers thats better tuned to reflect mortgage-specific risk performance. Five segments evaluate the future risk among mortgage consumers, including first mortgages.

Recommended Reading: Is Quicken Loans A Mortgage Company

Which Fico Scores Do Mortgage Lenders Use

Modified date: Apr. 22, 2021

Editor’s note –

As Ive mentioned before, Ive been on a refinancing binge. My wife and I have refinanced our home twice in the last 12 months, and my business partner and I are doing the same with three rental properties. With mortgage rates at an all time low, these deals were just too good to pass up. And this got me to thinkingwhich credit scores do mortgage lenders use to qualify people for a mortgage?

Its an important question, as your or if you even qualify for a loan. While its common knowledge that mortgage lenders use FICO scores, most people with a credit history have three FICO scores, one from each of the three national credit bureaus . Do lenders average the three scores, or take some other approach? And what happens when two people buy a home together? Do lenders average their scores together?

So I did some research on the following questions:

- Which FICO formula do mortgage companies use?

- For a single applicant, which of up to three FICO scores will be considered?

- For spouses, significant others, or business partners, how do lenders evaluate credit worthiness?

- And finally, what if an applicant doesnt have FICO scores from all three credit bureaus?

Since most loans are sold to either Freddie Mac or Fannie Mae, I focused on the requirements for these types of loans.

How Can My Fico Scores Affect My Mortgage Interest Rate

When a loan officer gets your mortgage application, they may use a pricing grid to figure out how your credit scores affect your interest rate, says Yves-Marc Courtines, a chartered financial analyst with Boundless Advice. Generally, higher scores can mean a lower interest rate, and vice versa.

From there, a mortgage loan officer will likely look at the rest of your loan application to decide whether your base interest rate needs any adjustments. For example, if youre making a smaller down payment, you may be given a higher interest rate, says Courtines.

A banks pricing grid may change on a daily basis depending on market conditions. However, heres an example of what you might expect your base interest rate to be, based on your credit score, on a $216,000, 30-year, fixed-rate mortgage.

| FICO® score range |

|---|

Source: myFICO, November 2020.

You May Like: Which Credit Reporting Agency Do Mortgage Lenders Use

Fico 8 Mortgage Score Now Available From Top Three Us Credit Reporting Agencies

MINNEAPOLISOctober 26, 2010FICO , the leading provider of analytics and decision management technology, today announced that its latest credit scoring product, the FICO® 8 Mortgage Score, is now available from all three major U.S. credit reporting agencies. Mortgage lenders now have access to more precise risk assessment tailored for the real estate market, which can help support market stability and reduce borrower, lender and investor risk.

The FICO® 8 Mortgage Score was built specifically to help mortgage lenders better predict mortgage performance and improve credit decisions for both current and prospective homeowners. The score analyzes the full credit history on file to deliver significantly sharper assessment of mortgage repayment risk, and aids servicers in earlier identification of borrowers at risk so they can mitigate the incidence and high cost of foreclosure. Validation results have demonstrated an additional predictive value of up to 15 percent for mortgage servicing over the broad-based, all-industry FICO® Score used most widely today.

The Basics: What Is A Fico Score

A FICO® Score is a credit score model from Fair Isaac Corporation that is used by thousands of lenders to help them assess the credit risk of individual consumers. Its a three-digit number ranging from 300 to 850, where higher is better , and has been the industry standard since the products founding in 1989.

Tom Quinn, vice president of Scores at FICO, says that there are numerous versions of FICO credit scores because they are periodically redeveloped to incorporate new analytic tools. Through the updating process, FICO releases new FICO Score versions to the market, at which point lenders determine if theyre going to migrate to a newer version of the FICO® Score or continue using the version they are currently using.

In addition, there are FICO® Score versions tailored to assess the credit risk for specific types of financial products. In addition to the base model, which is designed to predict the general risk of any credit obligation, Quinn points out that there are industry-specific versions focused on auto and bankcard risk.

According to myFICO.com, the industry-specific FICO credit scores leverage all the predictive power of the base FICO® Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking.

And then we have three bureaus, so you multiply everything by three, says Quinn.

Recommended Reading: What Is A Mortgage Deposit

Why Do Credit Scores Differ Between Online Sources And Mortgage Lenders

Heres a common story: You apply with a lender thinking that you know your credit scores. Then, the lender informs you that its credit scores were far lower than the free scores you got online. Theres good explanation. There are many different versions, models, and algorithms when it comes to credit scores dependent upon the purpose and type of industry.

The main goal of credit scoring is to predict the likelihood that a person will fall at least 90 days behind on a bill within the next 24 months.

Consider this: There is no default risk to allowing you to check your credit and credit scores online or through an app. However, the default risk to an auto lender for granting you a $40,000 loan is far greater than that of a credit card company that is considering a $2,000 credit limit.

In comparison, the risk associated with granting you a $200,000 mortgage loan is far greater than any of the prior examples. It makes sense that each type of creditor would use a different type of credit scoring.

Related: Raising Your Credit Score Can Save Thousands in Interest. Heres Why.

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Read Also: Is 720 A Good Credit Score For Mortgage

Free Credit Score Can Confuse Homebuyers

Free credit scores are everywhere. In this article, we explain what you need to know about free credit scores when buying a home.

Get your free credit score. No credit card required!Your credit scores should be free. And now they are.

Sounds great but, these free credit scores can cause quite a bit of confusion when youre buying a home when you realy need to know your credit score.

We began analyzing credit reports in 2004. We’ve worked with thousands of mortgage lenders and realtors. One story we hear far too often is: The borrower got a free credit score and was very upset when it wasnt the same as their mortgage score.

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Don’t Miss: What Is The Mortgage On 1.4 Million

How Do I Find Out My True Credit Score

With so many credit scoring models, you really dont have just one true score, but many. Your scoredepends on all of the factors mentioned above in addition to what type of lender you apply to for credit.

Its important to remember that everyones scores are different because they represent a snapshot in time of the particular individuals current and past credit habits. By following the tips mentioned above long term, you can definitely build and maintain scores to be proud of.

Predicting Consumer Credit Behaviors

This development is just one of a large number of efforts to further reduce consumer credit behaviors to numbers that can provide at-a-glance assessments for financial service providers. With technology in the digital age providing the ability to collect a great deal of information about you almost instantly, it is little surprise that more factors, from income estimates to deposit behaviors to what you say about money on social media to where you bought lunch yesterday, are being considered as part of yourconsumer credit risk profile. Indeed, we may be moving toward a system that can provide real-time updates to your credit score.

Also Check: Can You Get A Mortgage To Buy A Foreclosed Home

How To Find Out Your Classic Fico Score

Currently, the FICO website offers access to up to 28 of the most widely used FICO scores, including mortgage-lending , auto, and credit card versions, and access to a copy of credit scores based on your Equifax, Experian, or TransUnion file. But the downside is that you have to pay for credit monitoring to the tune of $29.95 per month, which will automatically renew unless you cancel, to get them. You may cancel at any time, but partial month refunds aren’t given. Also, FICO might change the terms of this program and the scores offered in the future.

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

Don’t Miss: What Do Mortgage Rates Follow

Don’t Put Your Eggs In One Basket

Before you go out, keep in mind that few lenders have abandoned FICO entirely. Most use a combination of bothparticularly for borrowers with credit issues. This is why it’s important for consumers to understand the scoring model used by a lender before signing a loan application and agreeing to credit being pulled. Submitting loan applications haphazardly as a way to land a hit can result in excessive , which can further depress a credit score.

Few lenders have abandoned the FICO scoring model completely.

Part of a loan officer’s job is to understand his employer’s criteria for approving applicants. This includes knowing which credit models are used and how they are weighted versus one another. Borrowers who want to be scored by VantageScore should glean this information from the loan officer up front.

Rmcrs Contain Additional Information

An RMCR usually contains information on both your employment and residence histories. A mortgage lender will use this information as additional verification of what you have included on your loan application. The report also includes legal records, such as bankruptcies, foreclosures, and judgments.

Another important aspect of RMCR credit scores is that theyre specifically tailored to mortgage lenders. That means that the primary focus is on the likelihood of repaying a mortgage, rather than necessarily on credit cards, auto loans, and other loan types. Since a report you will get from a third-party credit-monitoring service does not have a mortgage emphasis, the credit scores will be different from what an RMCR will provide.

Also Check: How 10 Year Treasury Affect Mortgage Rates

It Depends On The Type Of Credit For Which Youre Applying

If youve applied for a credit card, mortgage, or car loan, you probably know that you have a FICO score. However, what you may not realize is that you likely have more than one FICO scorepossibly dozens of them. Thats because lenders look at different versions and types of FICO scores depending on the type of credit youre seeking and other issues. Lets explore the range of FICO scores and which lenders use them.

Fico 8 Vs Fico : What Are The Differences

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your than a credit card bill in collections.

Additionally, FICO 9 ignores accounts in collections that have a zero dollar balance. If you had a credit card account go to collections but later paid it off, FICO 9 will no longer use said collections account against your score. This is different than FICO 8, which factors all collections amounts of $100 or more into your FICO scoreeven if theyre completely paid off.

Just because collections with a zero balance are ignored by FICO 9 does not mean that lenders will ignore them. Credit bureaus will still show these collections on your full credit report, and lenders will see them when they reviews your full credit history.

Finally, FICO 9 factors rental history into your credit score. This makes it easier for people with no credit to build a high credit score with their monthly on-time rent payments. Unfortunately, this is dependent on your landlord actually reporting rent payments to credit bureaussomething not yet seen on a large scale.

Also Check: Can Your Mortgage Go Up