Thank You For Visiting Missionfedcom

Please note that you are about to leave our website for a website that Mission Fed does not control. When you access non-Mission Fed websites, including ones that contain the Mission Fed logo, we have no control over the website’s operations, content, links, privacy policy or security policy.

We wanted to let you know that we are not responsible for and assume no liability for any other company’s website. We will not represent you or another company as a result of any transactions you may perform.

Come back to MissionFed.com again soon. Your success is our bottom line, and we enjoy serving you.

Buy Down Break Even Point Calculator

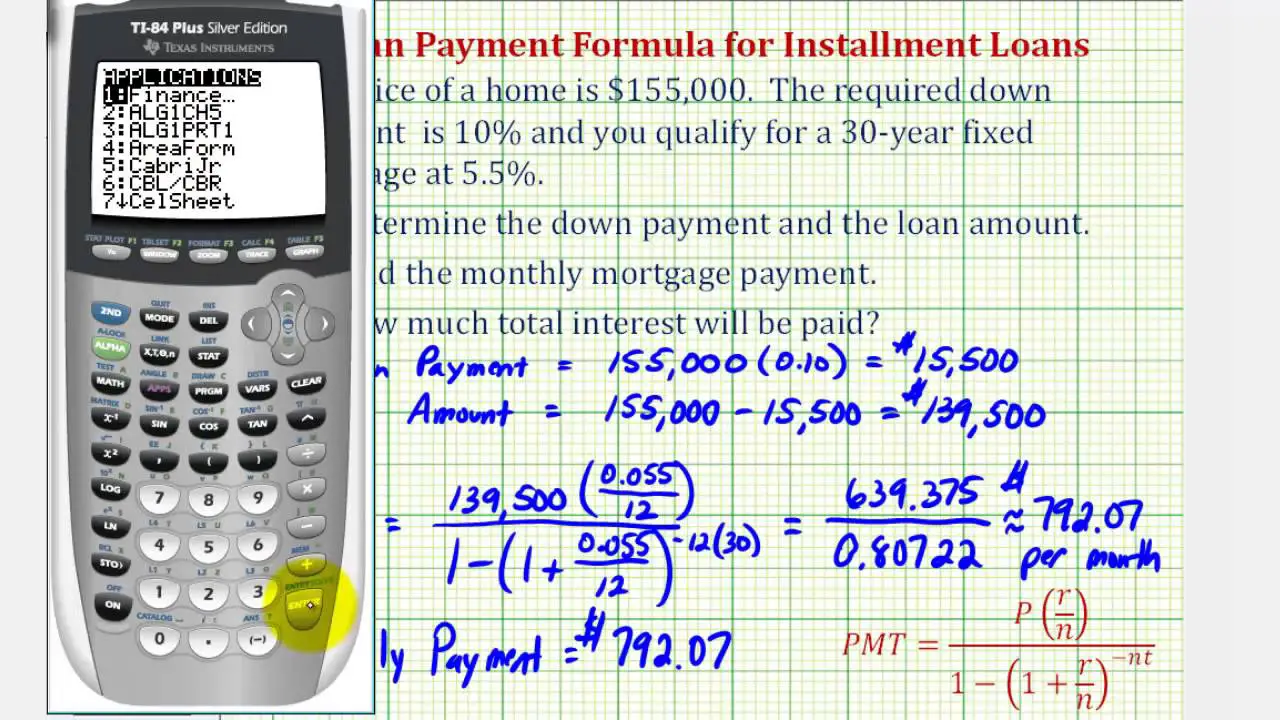

You dont need a special points calculator to determine the amount of mortgage points being charged. There are three steps to determine if is it worth paying points:

Using The Mortgage Points Break

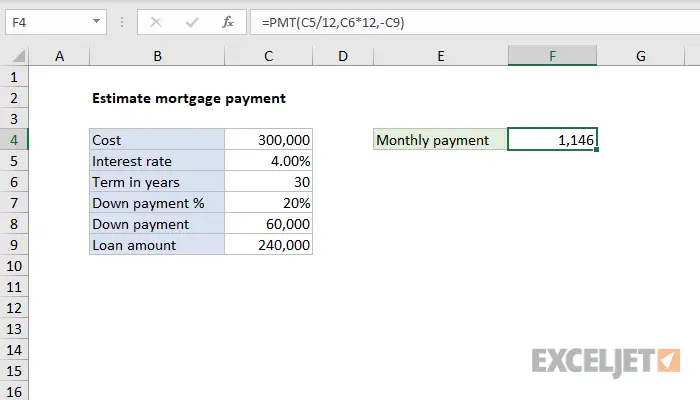

This mortgage points calculator assumes that you’ll roll the cost of your points into the mortgage. Enter the total cost of the mortgage with points in the box marked “Mortgage amount.” The calculator will determine the size of the loan without points for comparison.

- “Term in years” is the length of the mortgage.

- Enter the number of points under “Discount points” note that you can enter negative points as well, to reduce your closing costs in return for a higher rate. Fractional points can also be entered manually, though the slider will only reflect whole numbers.

- Under “Points rate” enter the reduced rate you will pay with discount points.

- Under “Interest rate” enter the standard rate you would pay with no points. .

- “Years in home” is how long you expect to stay in the home. Based on this figure, the calculator will determine how much your will save or it will cost you to pay for points.

- To find your break-even point, use the green triangle slider to adjust “years in home” to find the point you go from costs to savings.

- “View report” will provide you with an amortization schedule comparing the loan with and without points. This will allow you to compare interest savings over time as well as the rate at which you’re paying down loan principle, so you can project your home equity at any point in the loan.

Also Check: Can I Get A Mortgage With No Credit

How Do Discount Points Affect Yield

By charging a borrower points, a lender effectively increases the yield on the loan above the amount of the stated interest rate. … Borrowers can offer to pay a lender points as a method to reduce the interest rate on the loan, thus obtaining a lower monthly payment in exchange for this up-front payment.

Finding The Best Deal

Todays homebuyers have a plethora of mortgage options to sort and understand. Note that each lender will be different, and they will likely offer you multiple deals to consider. How you choose the right mortgage deal is determined by these common factors:

- Time: How long do you intend to own the property? Short-term plans are often bolstered by negative points, and potentially financing options. However, if you intend to keep your property for a long time, paying cash for discount points will help. Likewise, financing negative points would be costly.

- Cash: If you can pay for your discount points at closing, it has a direct and compounding impact to your loans value over time. This does not negate financing options. But rolling the costs of points into the loan is not as desirable as having cash to pay for them upfront. Your cash flow should guide you, both on-hand and to cover monthly premiums.

- Break-even: Will you have a decent break-even point to recoup your investment? If a benefit is countered by too much time to break even, it may be less valuable or not worth the investment. You can use our calculator on top to determine the break-event point on a prospective investment.

Taken together, these three factors should help guide you in choosing the best deal that suits your budget.

30-Year Fixed-Rate Mortgage

| $1,66,955.58 |

Read Also: What Percentage Of Your Income Should Be For Mortgage

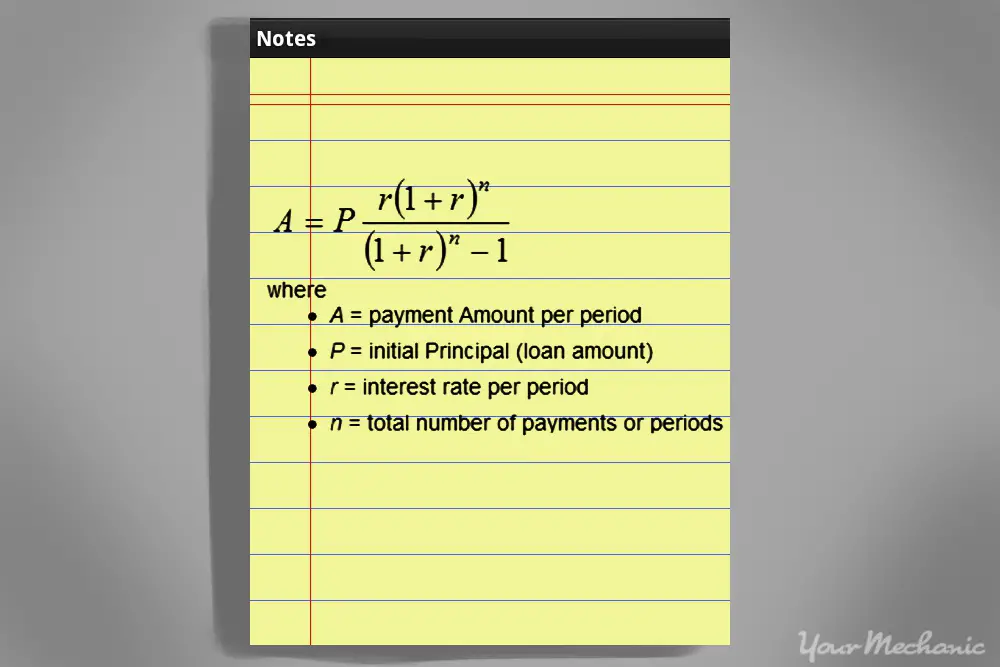

How To Calculate Mortgage Points

Before you buy mortgage points, calculate the break-even pointwhen your savings from receiving a lower interest rate equal the cost of the points.

For example, if you’re looking at a $300,000 mortgage, each point will cost $3,000. Say the mortgage has a fixed-rate, 30-year term and 4.5% interest rate, and the point you buy lowers the interest rate to 4.25%.

As a result of buying the point, your monthly payment will decrease from $1,520 to $1,476, a savings of $44 per month. Divide the $3,000 by $44 and you’ll find it takes 68 months to break even.

If you think you may move or refinance before 68 months, buying mortgage points won’t have much of a benefit. But if you expect to be making the mortgage payments past your break-even point, mortgage points could save you money.

Fortunately, you can search online and find calculators that can do the math for you. The hard part may be deciding how long you’re going to stay in the home.

Are Mortgage Points Tax

While mortgage interest in still tax deductible, the Tax Cuts and Jobs Act of 2017 puts a cap on the amount of mortgage interest that may be deducted. Because discount points are prepaid interest, they may be deducted as part of your home mortgage interest. See the details here.

Heres a tip: When youre loan shopping, ask each lender for two estimates: one for your mortgage closing costs if you buy points, another for the loan without points. Show the estimates to a tax preparer or tax accountant to find out how paying points could affect your taxes.

You May Like: How To Reduce My Monthly Mortgage Payment

Why Do We Use Basis Points

Basis points are used to remove any uncertainty when talking about percentage change. To say my commission is usually 10%, but it increased by 10% last quarter is needlessly ambiguous is your commission now 20%, or 11%? This is why we use basic points, so that we know when someone says a 100 basis point increase they mean an increase of 1%.

Should You Buy Mortgage Points

Whether you should buy points depends mostly on how long you plan to stay in the home.

Points can cost thousands of dollars upfront, adding to the cost of getting your mortgage. But because your interest rate is reduced, the money you save on monthly payments can eventually make up for the initial cost. After youve covered the cost of the points you paid at closing, all additional savings from the lower interest rate is extra cash in your pocket.

To figure out if buying points makes sense for you, calculate how long it will take you to cover the upfront cost based on how much you might save.

Say you want to borrow $200,000 for a house, with the upfront cost of a point at $2,000. Divide $2,000 by the amount you save each month thanks to reducing your interest rate to see how many monthly payments it will take for you to break even.

Since the specific amount you save varies based on your lender, youd need to calculate what your rate and monthly payment would be both with points and without. Lets look at an example.

Also Check: Why Do I Pay Escrow On My Mortgage

Straight To The Point Valuations

There are two types of points you can pay on your mortgage loan:

- Discount points – a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan

- Origination points – fees that are charged by a mortgage broker or lender for the origination of the loan

Determining whether you “should” pay points on your loan depends on what your financial goals are and how the points will affect the other terms of the loan, such as the interest rate or the other closing costs.

How Do Basis Points Work In Mortgages

Changes in basis points can impact your monthly mortgage payments, depending on what type of mortgage you have.

When the interest rate goes up, your monthly mortgage payment goes up. Your interest rate is the percentage you pay to borrow money from a lender for a specific period of time.

If your mortgage rate is variable, which is the case with adjustable-rate mortgages , this means your interest rate might change depending on market rates.

ARM payments may increase at adjustment dates and basis point hikes will affect your principal amount and your interest rate. Lets say, for example, that you have an ARM with an interest rate of 3.5%, then the interest rate changes to 3.75% at a later date. This means your interest rate rose by 25 basis points.

When youre searching for a home, its a good idea to lock your rate. If you dont, you could pay basis point hikes in the form of a higher interest rate.

Like this estimate?

Read Also: What’s A Conventional Mortgage

Current Local Mortgage Rates

Compare your potential loan rates for loans with various points options.

The following table shows current local 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

Are Mortgage Points Worth It

Some people argue that money paid on discount points could be invested in the stock market and used to generate a higher return than the amount saved by paying for the points. But for the average homeowner, the fear of getting into a mortgage they can’t afford outweighs the potential benefit that may be accrued if they managed to select the right investment. In many cases, being able to pay off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. While most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.

You May Like: Can You Get A 30 Year Mortgage On Land

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

How A Good Credit Score Can Lower Your Interest Rate

Buying mortgage points isn’t the only thing that can impact your loan’s interest rate. You may get offered different rates depending on the lender, type of loan and how much money you put down. Additionally, your credit can have a direct impact on your mortgage rate.

For example, using the FICO Loan Savings Calculator, you can see how increasing your FICO® Score can lead to lower interest rates. For a $300,000, 30-year fixed-rate mortgage, the national average rate is currently 4.378% for those with a FICO® Score in the 640 to 659 range. This translates to a monthly payment of $1,498.

However, increasing your credit scores to the 680 to 699 range would bring your rate down to 3.734% and monthly payment down to $1,387. To buy the same rate change, you’d have to purchase 2.576 mortgage points at a cost of $7,968.

Learn more about improving your credit, and ideally start working on your credit long before you buy a home.

Read Also: How Much Should Your Mortgage Be In Relation To Income

What Do Points Mean On A Mortgage

Points, also known as discount points, lower your interest rate in exchange paying for an upfront fee. Lender credits lower your closing costs in exchange for accepting a higher interest rate. These terms can sometimes be used to mean other things. Points is a term that mortgage lenders have used for many years.

Mortgage Points Explained: What They Are & How They Work

A common question for home buyers, especially first-time buyers, when they first see a loan estimate , is about mortgage points. Unless youre familiar with the mortgage industry, you probably arent aware of how mortgage points work or if they might make sense for your situation. Because your interest rate is impacted by the points included on your mortgage, its important to know the basics of what they are and how they work to fully understand the pros and cons.

Read Also: What Does A Co Signer Do For A Mortgage

What Mortgage Interest Is Deductible In 2020

Mortgage Interest Deduction Limit Today, the limit is $750,000. That means this tax year, single filers and married couples filing jointly can deduct the interest on up to $750,000 for a mortgage if single, a joint filer or head of household, while married taxpayers filing separately can deduct up to $375,000 each.

How To Calculate The Break

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Before you refinance your mortgage, figure out when you would break even. Your break-even point occurs when you begin saving money in other words, when your accumulated savings exceed the costs of the new loan.

Read Also: What’s The Average Mortgage Payment

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

How Negative Points Work

Negative points are also called rebate points, lender credits, or yield spread premiums. This basically works in reverse. While discount points lower your home loans interest rate, negative points are offered by lenders to incrementally increase your loan’s interest rate. In exchange, you receive a discount on your closing cost.

In the same way one discount point is roughly equal to a 0.25% APR reduction, a negative point will add this difference in exchange for one percent of the loans value. Its applied as a borrower credit to closing costs. Note that you cannot use negative points toward any part of your down payment or cash them out.

To give an example, lets say youre negotiating your $200,000 loan and your lender offered a deal structured with 1.5 negative points. This changes the rate from 5% to 5.4% APR. If you take this negative point, you obtain $3,000 toward your closing costs.

When to Take Negative Points

Beware When You Take Negative Points

Unfortunately, brokers are not always forthcoming about the availability of rebates or negative point loans. They may see it as an opportunity to collect more cash from a sale. To stay abreast of reasonable rates and parameters, rely on help from your own agent and keep yourself updated about current rates and trends.

Recommended Reading: What’s The Mortgage Rate

How Points Benefit Lenders

Points have an obvious financial benefit to the lender. They receive a lump sum payment upfront for interest that would otherwise trickle-in over time. For this reason, you can think of points offered as a reflection of the overall strength of current market conditions.

When the housing market is strong, lenders may be less willing to extend reduced interest rates. On the other hand, a softer trend might inspire them to try more competitive pricing on their offers. If interest rates are high or the buying market is sluggish, points can help lenders open the field to more qualified homebuyers.

Big Savings Beyond Breaking Even

If you want to pay off your home loan in fewer years by refinancing to a shorter term, then your savings can multiply beyond the break-even point. When you refinance to a shorter term, its not about having a lower monthly payment but about saving big money in total interest.

For example, if you’ve been paying a 30-year mortgage for five years, you have 25 years remaining on the loan. If you refinance to a lower rate, and your income has gone up since you got the mortgage five years before, you might be able to afford refinancing to a 15-year loan, or maybe a 20-year mortgage. The monthly payment might rise, but you could save thousands of dollars in interest in the long run.

Also Check: Are Mortgage Discount Points Worth It