Private Second Mortgage Vs Heloc: Which Should You Choose

When deciding which loan product to choose if you want to use your homes equity, consider the following.

When To Choose A Private Second Mortgage

- You know exactly how much you need to borrow

- You have a very specific one-time need for a large sum of money

- You prefer having a regular, fixed payment schedule

When To Choose A HELOC

- Youre not sure exactly how much money you need

- You want to access extra cash on a regular basis

- You dont want to have to apply for loan after loan when the need for extra cash arises

- You like the flexibility of having access to cash just in case

- You want a lower interest rate compared to a credit card

- Youre comfortable with budgeting

Calculate Your Homes Equity To Determine How Much You Can Borrow

Home equity is one of the primary factors a lender evaluates when reviewing a HELOC application. To calculate how much equity you have in your home, estimate the market value of your home using an online real estate marketplace like Zillow or Realtor.com. Keep in mind, however, that these websites only offer rough estimates and your lender will likely require a formal appraisal when you apply for a HELOC.

Once you determine the market value of your home, add up how much you owe on any mortgage or mortgages for that home. Then, subtract the total mortgage balance from the market value to obtain your equity in the home.

Homes Market Value Total Mortgages = Equity in Home

Finally, you can divide the equity in your home by its appraised value to obtain your equity percentage for purposes of a HELOC. Lenders typically look for equity between 15% and 20% of the homes value before theyll approve you for a line of credit.

Equity in Home / Homes Market Value = Equity Percentage in Home

For example, consider a home with a market value of $350,000 and $200,000 in outstanding mortgages. In this case, the homeowner has $150,000or almost 43%equity in the home and is likely to be approved for a HELOC. On the other hand, if the same homeowner has $315,000 in outstanding mortgages on the same house, she would only have 10% equity in the homeless than many lenders require for a HELOC.

Pros And Cons Of Signature Loans

Benefits

Drawbacks

Usually reduced rates of interest than credit cards. The common interest rate for charge cards is extremely higher, sitting at 19.94% as the ordinary interest on unsecured loans is closer to 10per cent.

Large rates. While rates of interest on signature loans are generally around those on charge cards, theyre nevertheless higher and it also can add up. If you decide to pull out an unsecured personal bank loan for $12,000 and spend this right back over a loan phrase of 5 years with an 11.99per cent rate of interest, youll wind up paying back $16,012 . Thats over $4,000 extra just in interest!

Mobility helpful. You can utilize personal loans to pay for many types of expenditures, from wedding events and getaways, to room remodeling, autos, wedding bands, health debts, debt consolidation reduction, etc.

Charges. Unsecured loans feature a myriad of fees, such as upfront and ongoing fees, escape fees/break costs for fixed debts, and early repayment fees. This might create signature loans expensive ultimately.

Effortless software procedure. Applying for an individual loan is very easy plus the affirmation techniques is fast when you have a great credit rating, see every qualification requirements and have now all encouraging documentation. The funds may be in your bank-account within 1-2 time or much less, and thats useful if you want immediate access to cash in a crisis.

Don’t Miss: Who Has The Best Reverse Mortgage Rates

Do You Want A Loan Or Line Of Credit

Let us walk you through each step in the calculator with helpful tips and definitions.

1 Displayed rate does not represent the actual rate you may receive.

* The calculation is based on the information you provide and is for illustrative and general information purposes only and should not be relied upon as specific financial or other advice. Actual results and loan or line of credit payment amounts and repayment schedules may vary. Calculator assumes a constant rate of interest.

** Creditor Insurance for CIBC Personal Lines of Credit, underwritten by The Canada Life Assurance Company , can help pay off or reduce your balance in the event of death or cover payments in the event of a disability. Choose insurance that meets your needs for your CIBC Personal Lines of Credit to help financially protect against disability or death.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Who Offers 20 Year Mortgages

Why Consolidate Debt Into A Mortgage

Refinancing your existing mortgage into a consolidation loan combines your debts into one payment. This is a great option if you have high-interest loans and you’re only paying the interest rather than the principal.

When you refinance, you can get up to a maximum of 80% of the appraised value of your home minus the remaining mortgage.

Interest rates on a debt consolidation mortgage might be different from your existing mortgage. If you change your mortgage, the terms of your original agreement will likely change.

Debt consolidation mortgages come with a structured payment plan and an assured pay-off date. Payment schedules vary: weekly, biweekly, semi-monthly or monthly over a negotiated term. Refinancing fees apply, such as appraisals, title search, title insurance and legal fees.

Access Funds Using The Equity In Your Home

Equity is the difference between the current market value of your home and the outstanding balance of your mortgage. By tapping into the equity you have built in your home, you may already have the financial resources needed to pursue such personal goals as:

-

Renovating or remodeling your home

-

Consolidating high-interest debt

Read Also: What Does A Commercial Mortgage Broker Do

How To Calculate Home Equity Line Of Credit

Wondering how to calculate how much you can obtain in funding through a HELOC? Heres how:

Step 1: Multiply your homes value times the percentage value that your lender allows you to borrow. This is the maximum equity that can be borrowed.

Step 2: Subtract the remaining mortgage balance from the maximum equity that can be borrowed This is the total amount you can borrow.

For example, say you get a HELOC with an 80% loan-to-value ratio. Your home is worth $300,000 and you currently owe $150,000. To figure out how much your credit limit would be on this HELOC, multiply your homes value by 80% and subtract your current balance.

$300,000 X .80 = $240,000

$240,000 $150,000 = $90,000

Under the terms of this scenario, you could potentially apply for a credit limit of up to $90,000.

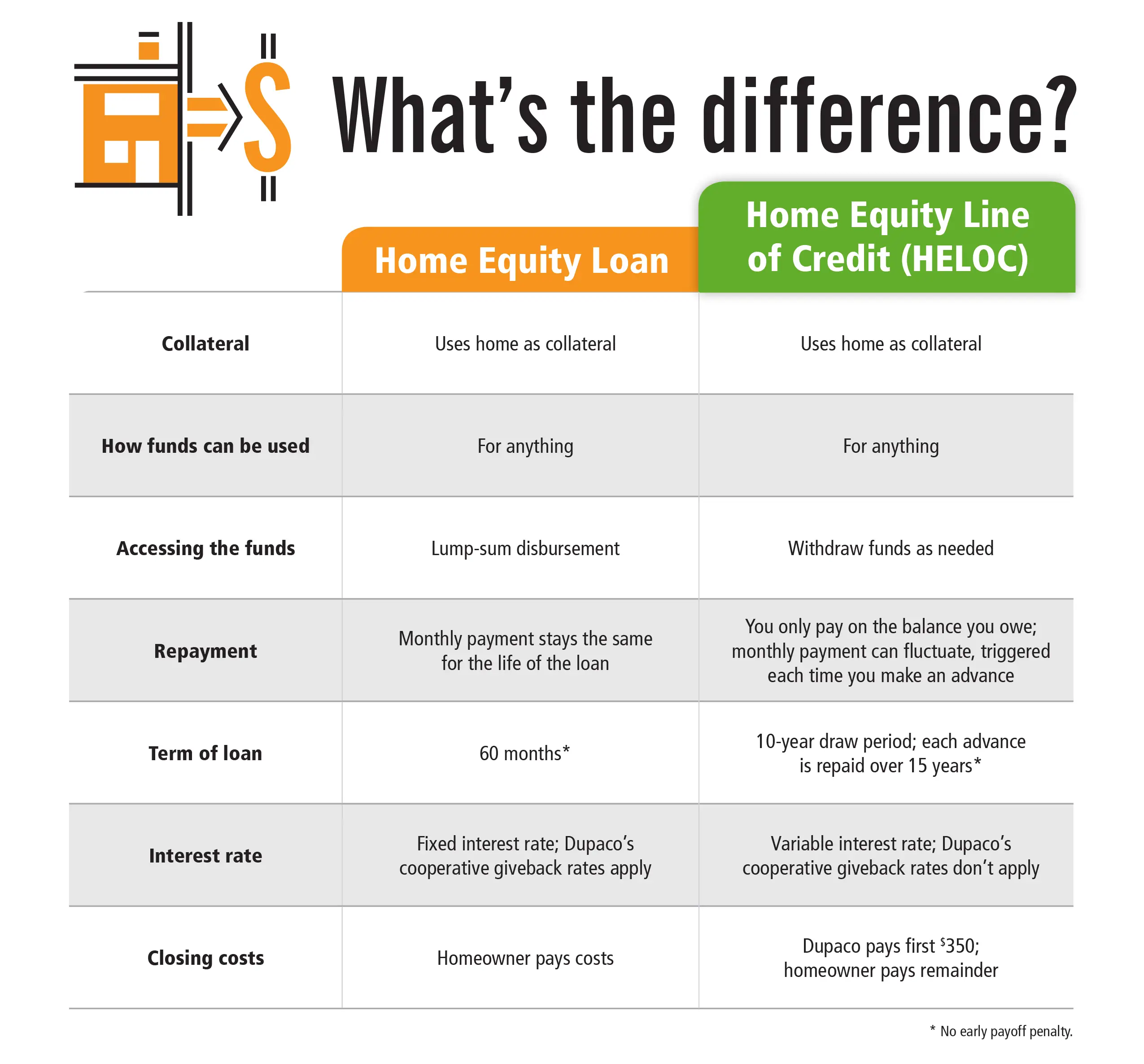

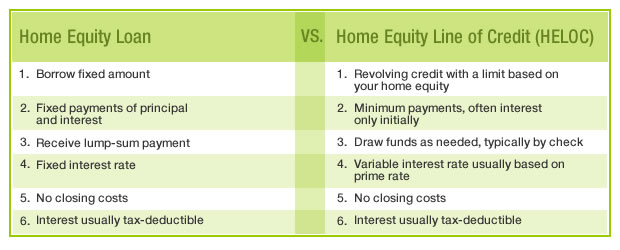

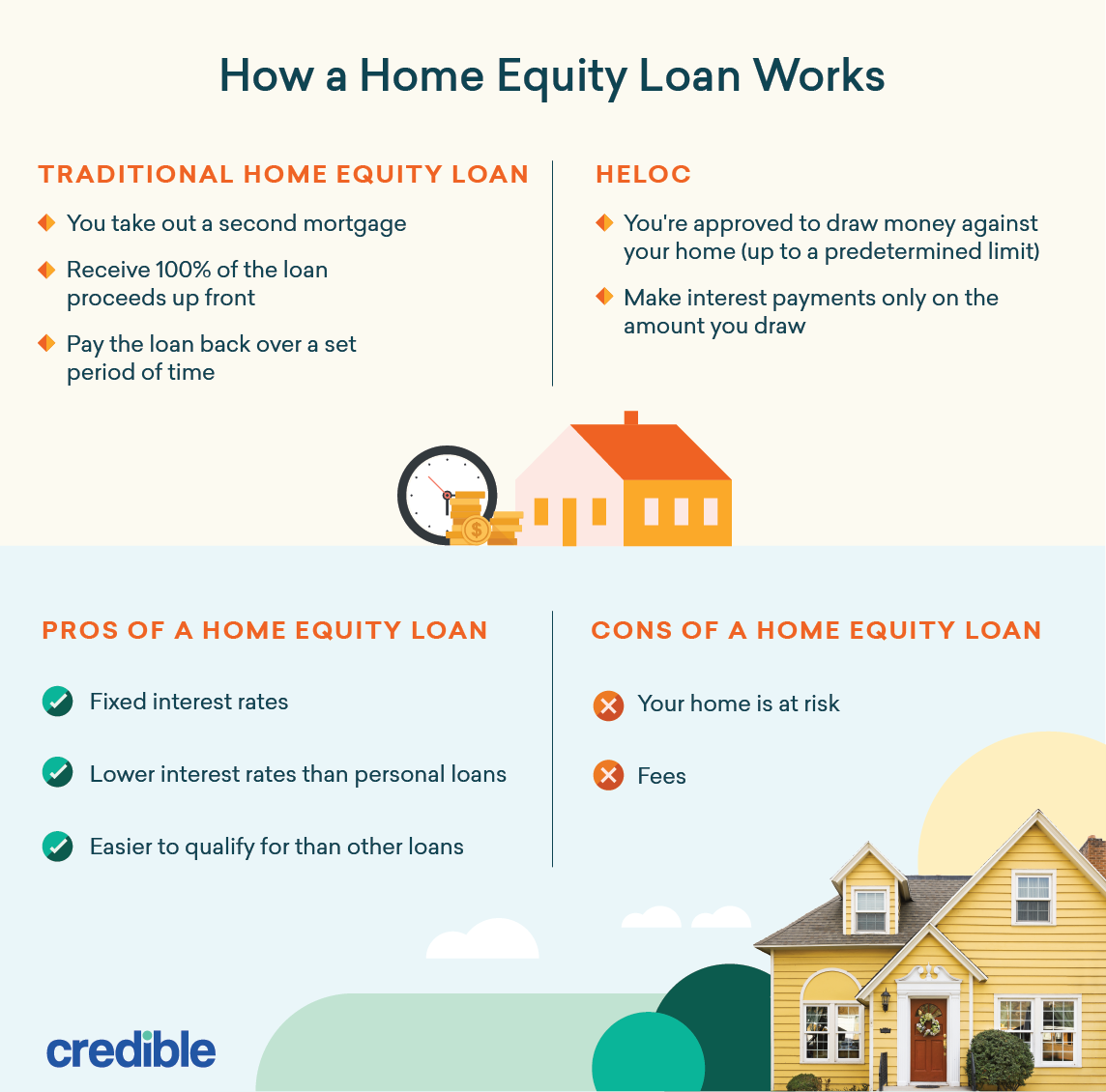

What Is The Difference Between A Heloc And A Mortgage

A mortgage is a one-time loan where the entire amount is loaned upfront and then repaid over a period, with payments going to both the principal and interest.

In the case of a TD Home Equity FlexLine, you get a revolving credit amount which lets you make withdrawals as needed and then pay it back at your own pace with a minimum monthly interest payment. You can also add an optional Term Portion which acts more like a traditional mortgage loan.

You May Like: Which Mortgage Lenders Use Transunion

Is Getting A Heloc A Good Idea

Whether a home equity line of credit is a good idea really comes down to your goals and financial situation. A HELOC is often used for home repairs and renovations, which can increase your home’s value. Another bonus: The interest on your HELOC may be tax-deductible if you use the money to buy, build or substantially improve your home, according to the IRS.

Some use home equity lines of credit to pay for education, but you may get better rates using federal student loans. Financial advisors generally dont recommend using a HELOC to pay for vacations and cars because those expenditures dont build wealth, and may put you at risk of losing the home if you default on the loan.

» MORE:5 good reasons to tap your home equity

What’s The Difference Between A Heloc And A Home Improvement Loan

The biggest difference between a HELOC and a home improvement loan is that a HELOC borrows against the existing equity in your home, while the latter does not. Because of this, home improvement loans have a lower limit that you can borrow. These loans can also carry higher interest rates than HELOCs.

The money from HELOCs also doesnt have to be used for home improvement. It can be used in other ways, from debt consolidation to making major purchases.

Recommended Reading: How Do Mortgage Lenders Make Money

Home Equity Line Of Credit

Home equity lines of credit are secured commonly backed by the market value of your home. A HELOC also factors in how much is owed on the borrower’s mortgage. The credit limit for most HELOCs can be as high as 80% of a home’s less the amount owing on your mortgage.

Most HELOCs come with a specific drawing periodusually up to 10 years. During this time, the borrower can use, pay, and reuse the funds over and over again. Because they’re secured, you can expect to pay lower interest for a HELOC than you would for a personal line of credit.

Whats The Difference Between A Loan And Line Of Credit

A loan and line of credit are both ways for people to borrow money and pay it back over time. But there are differences in how you receive funds and how you pay them back. A loan gives you a lump sum of money that you repay over a period of time. A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

Don’t Miss: How To Calculate Self Employed Income For Mortgage

First Lets Clarify What Is A Mortgage And What Is A Credit Line

What is a mortgage? The mortgage we will be referring to in this post is a standard long-term loan designed to help you buy or continue to own a house. The payments are blended, meaning each installment is composed of both the principal and the interest. An amortization period is the period of time needed to pay off the debt. Options for this currently go as high as 30 years and rates are based on prescribed terms . Standard mortgages are either fixed or variable/floating. A Fixed mortgage is when the interest rate is constant for the term. A Variable/floating mortgage is when the interest rate fluctuates throughout the term.

What is a credit line? On the other hand, when we refer to a credit line we are specifically talking about a HELOC . A HELOC is a revolving credit loan against your property where installments consist of interest only. Contrary to a standard mortgage, HELOCs are interest-only, are not amortized, do not consist of terms and finally, rates fluctuate according to the prevailing prime rate.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Don’t Miss: Does Bank Of America Do Mortgage Loans

Ways To Access Your Home Equity

A second mortgage refers to a home loan that is taken out on a home that already has a mortgage on it. Its called a second mortgage because it comes second in line to a first mortgage in terms of loan repayment.

The most common way for a homeowner with good credit to tap into their equity is via a home equity line of credit.

But for those who have struggled financially in the past or who are looking for an alternative option, a second mortgage from a private lender is something to consider.

Learn About Accessing Home Equity With Mortgage Broker Dave Johnson

Is A Home Equity Line Or Loan Right For You

A HELOC gives you the flexibility of a financial backstop thats there when you need it. If your roof needs repair or a tuition bill comes due when youre short of cash, drawing on a home equity line of credit can be a convenient solution. You decide when to use the funds, and you pay interest only on the money you actually use. On the flip side, with a HELOAN, you get a lump sum of cash at loan closing, and know how much your monthly payments will be and how long it will take to pay off the loan.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, its important to remember that youre using your home as collateraland it could be at risk if its value drops or theres an interruption in your income.

But if you qualify and your financial situation is stable, a home equity line or a home equity loan could be a helpful, cost-effective tool for making the most of your homes value.

Ready to apply? Apply online now

You May Like: What Day Of The Week Are Mortgage Rates Lowest

How A Line Of Credit Affects Your Credit Score

Typically when you borrow money in your name, even if your home or business is collateral, the impact to your credit score hinges partly on your repayment of that money.

Missed payments are among the biggest factors in a drop in your credit score, so no matter the kind of credit line youre considering, borrow only if you have a plan to pay it back.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Annie Millerbernd is a personal loans writer. Her work has appeared in The Associated Press and USA Today.Read more

How Do You Spend Heloc Funds

If youre approved for a HELOC, lenders may allow you to withdraw money during a fixed time known as a draw period.

Once your draw period has ended, your lender may let you renew the credit line. If not, you may need to repay the outstanding amount all at once or over a period of time, which is called a repayment period.

Read Also: Is Citizens Bank Good For Mortgages

Secured Line Of Credit

With a secured line of credit, you use an asset as collateral for the line of credit. For example, the asset could be your car or your home. If you don’t pay back what you owe, the lender can take possession of that asset. The advantage is that you can get a lower interest rate than with an unsecured line of credit.

Tap Into Your Homes Capital

- First Position uninsured HELOCs up to 80% of your Home Value

- Second Position Equity Lines of Credit up to 80% on Home Value

- Debt consolidation can turn high-interest payments into one affordable amount

- Small business owners facing slow growth or a transitional period have better management options

- Homeowners can renovate for investment purposes and receive a return on their investment

Recommended Reading: How Do I Find A Good Mortgage Broker

Frequently Asked Questions About Heloc

How is the HELOC interest rate determined?

The Annual Percentage Rate for a HELOC is calculated based on a variety of factors, including credit score, loan-to-value, line amount, and location of the property securing the line of credit. With a home equity line from Truist, you can choose between a fixed or variable interest rate on each draw you take.

How are the payments determined?

Variable-rate repayment: Your minimum required monthly payment is based on your current outstanding balance and includes both interest and a percentage of your principal balance. Each payment helps to reduce your principal balance. Drawing additional funds or paying more than the minimum required payment amount will affect your future monthly payments. For draws on a home equity line from Truist taken under the variable rate repayment option, the minimum monthly payment is equal to 1.5% of the total outstanding balance.

Interest-only repayment: For draws taken under the interest-only repayment option, your minimum monthly payment is equal to the finance charges accrued on the outstanding balance during the preceding month. The minimum payment will not reduce the principal outstanding under this option. The interest rate is variable.1

Do I need to have great credit?

Your credit score is only one of the factors considered in the underwriting process, so having good credit, along with the other qualifications increases your likelihood for equity line approval.

Will I have to pay closing costs?