Will I Have Higher Mortgage Insurance Premiums With Bad Credit

Buying a house with bad credit doesnt automatically mean youll pay higher mortgage insurance premiums the type of loan you have and how much you put down will determine that. For example, all FHA loans come with two types of mortgage insurance premiums, upfront and annual. Conventional loan borrowers who put down less than 20% will pay a similar fee private mortgage insurance regardless of credit score.

Consider A Debt Consolidation Loan

A debt consolidation loan or balance transfer takes all of your outstanding debts on different accounts and combines them into a single monthly payment. Debt consolidation loans help improve your credit utilization rates, your credit mix and can help you avoid missed payments. A debt consolidation loan or balance transfer can be a great option for you if you have multiple lines of credit that you have trouble keeping up with.

You make a hard inquiry on your credit report when you apply for a debt consolidation loan. This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan.

Va Mortgage: Minimum Credit Score 580

VA loans are popular mortgage loans offered toveterans, service members, and some eligible spouses and military-affiliated borrowers.

Withbacking from the Department of Veterans Affairs, these loans do not require a down payment, nor any ongoing mortgageinsurance payments. They also typically have the lowest interest rateson the market.

Technically, theres no minimum credit score requirement for aVA loan. However, most lenders impose a minimum score of at least 580. And many startat 620.

Similar to FHA loans, VA loans dont have risk-basedpricing adjustments. Applicants with low scores can get rates similar to thosefor high-credit borrowers.

Recommended Reading: How Much A Month Is A 500k Mortgage

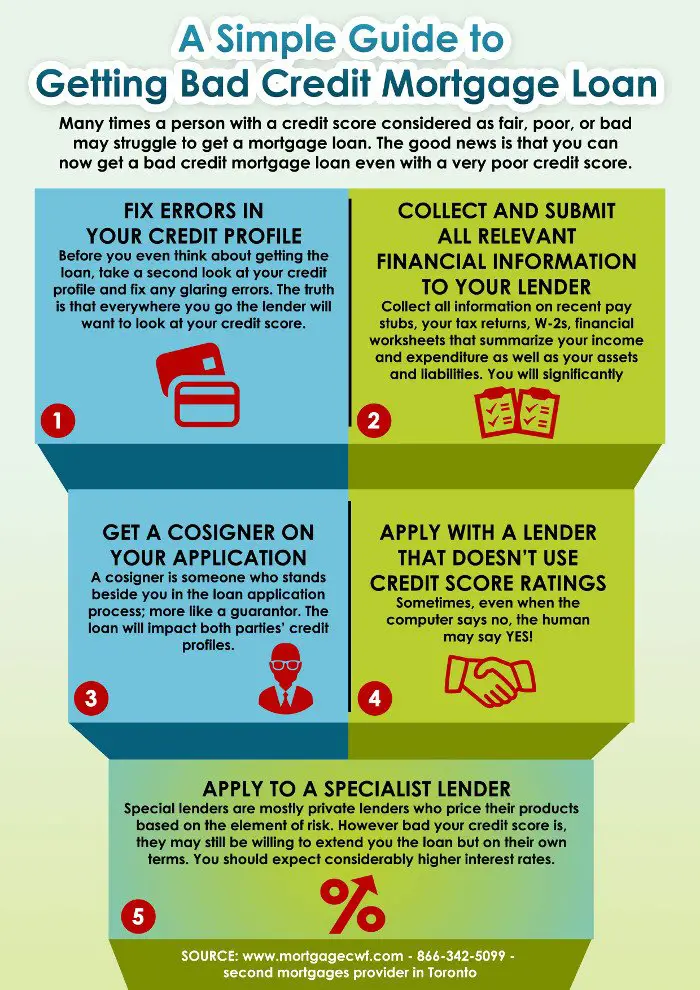

Have A Guarantor Or Co

Having the support of a co-signer or guarantor can help you get a mortgage with a poor credit history, as lenders see this as a way to reduce the risk of a mortgage default.

A co-signer signs all the mortgage documents and their name appears on title with the purchaser. They co-own the home with the person living in it and they are liable for the mortgage payments, even if the purchaser is the one making mortgage payments. In other words, if the person living in the home cant make payments, the co-signer will be held responsible for them.

A guarantor, as the name implies, guarantees that the mortgage payments will be made and becomes responsible for the payments the mortgage is unpaid. However, they will not own the property and their name doesnt appear on the title.

Bad Credit Good Mortgage

Whether you decide to hold off on buying a home until you improve your credit or move forward with a less-than-stellar credit score, you have options. There are loans available and designed to help people with imperfect credit histories purchase a home. If that sounds like you, we at Dash would love to talk through your options and help you decide if now is a good time to buy a home.

Opinions expressed are solely my own and do not express the views of my employer.

Read Also: How Often Do You Pay Your Mortgage

Check Your Credit Reports For Errors

It can feel overwhelming to even consider the details of your credit report, but its worth checking. Look for anything that doesnt seem accuratethat could be a payment that hasnt been updated, an outstanding loan that you dont know about, or an incorrect balance. If anything seems off, contact the credit bureau or creditor to dispute it. Your diligence could immediately remove the error and improve your score.

Can You Get A Mortgage Pre

Yes. Even though many lenders require good credit for mortgage approval, there are some options available even if you have bad credit.

The biggest questions that need to be answered when getting a mortgage pre-approval with bad credit:

- What is hurting your credit specifically?

- Has the issue been resolved, or will it be ongoing?

- How much do you have set aside for down payment?

- What is your income or employment situation?

The answers to those questions will be things that will be carefully considered when getting a home loan pre-approval with bad credit.

Recommended Reading: What Is A Va Mortgage Rate

Mortgage Underwriting: Manual Or Automatic

Mortgage underwriting is the process a lender uses to determine whether a borrower is qualified for a loan. It usually follows the three Cs of underwriting credit, capacity and collateral.

There are two paths manual and automatic.

Under manual underwriting, you are assigned a person to review your application. They will review documents such as credit score, debt-to-income ratio, bank statements and pay stubs, then make a decision on your ability to repay. If the underwriter is satisfied, your loan application will be approved.

Under automatic underwriting, its a computer-generated decision based on logic and algorithms, thus eliminating human bias. With systems that retrieve relevant data, such as the borrowers credit history, it gives a near-instantaneous loan approval or denial. Some factors, such as income and assets, must be verified. Occasionally, applications might be referred to manual underwriting, which can require up to 60 days.

Manual or automatic: which is the better choice?

Renew Or Switch Mortgages With Bad Credit

Back to Blog

Learn how its possible to renew or switch mortgages with bad credit or a less than perfect credit score. In Canada, 2.85% of the population has a credit score of less than 520 and 15 % have a bad credit rating of 520-680 and a low income. Imagine a person owning a home and getting ready to switch mortgages. With credit scores that are lower than the required minimum, a bank will not be in a position to help.

Fortunately, there are various strategies to get around a bad credit score. For example, refinancing and using a non-occupying co-applicant can help with this situation. Continue reading below to learn some tips and tricks in mortgage renewal with a low credit score.

You May Like: What Is Typical Debt To Income Ratio For Mortgage

Consider Adding A Letter Of Explanation For Past Financial Difficulties

It is a red flag for underwriters to see negative items on your credit report, but writing a good letter of explanation can help your case.

You may need to provide a letter of explanation for any negative items on your credit report, including missed payments, defaulted loans, or repossessions, says Quicken Loans. The letter should include an explanation regarding the negative event, the date it happened, the name of the creditor, and your account number.

You should let the lender know that you can manage your finances well and wrinkles on your credit history were due to difficult and reasonable situations.

Read more: Why black homeownership rates are 35% behind whites’

How Much Extra Will A Low Credit Score Cost You

Interest rates for new and refinanced mortgages hit record lows over the course of 2020. The average 30-year fixed mortgage rate was 4.87 percent in November 2019, according to Freddie Mac, but by the start of 2021, interest rates were hovering around 3 percent.

Those record-low rates might not be available to borrowers with bad credit, however. While rates are lower across the board than they were a year ago, applicants with low credit scores should expect to pay more than borrowers with stronger credit.

The table below shows that home loans for bad credit borrowers are significantly more expensive than mortgages for borrowers with good credit. Examples are based on national averages for a 30-year fixed loan in the amount of $248,640 the national median home price, less 20 percent, according to the National Association of Realtors using myFICO.coms loan savings calculator.

Heres how much youd pay at rates available at the time of publication, depending on your credit score range:

| $176,532 |

Don’t Miss: How Do I Apply For A Usda Mortgage

How To Get A Mortgage With Bad Credit

By Renee Sylvestre-Williams on September 28, 2021

Can you get a mortgage with bad credit? Yes, but there are some things to know before you apply or call your broker.

Bad credit and a bad credit history happen for a number of reasons: You lost a job, you forgot to pay your bills, youre new to a country. Weve been warned about what can happen because of bad credityou wont qualify for the best interest rates for mortgages or other types of loans, and, as a result, end up paying more to borrow and, in some cases, you may not qualify for a mortgage at all. Dont be discouraged. Even if your credit history and credit score arent the best right now, you can still qualify for a mortgage. If you have bad credit, your mortgage contract may come with more terms and more paperwork. But know that bad credit isnt forever. And, for that matter, neither is a mortgage.

Freddie Mac Home Possible: Minimum Credit Score 620

Released in March 2015, Freddie Macs first-time homebuyer program, Home Possible, is helping buyers get into homes with avery low down payment and moderate credit.

Home Possible is available for low and moderate-income borrowers and allows for a down payment of just 3%.

To qualify for the Home Possible loan with reduced private mortgage insurance rates, most lenders will require a 620 or better credit score.

Also Check: What Is A Mortgage Holder

Can I Buy A House With Bad Credit

When you apply for a mortgage, lenders will check your credit scores. While you have many credit scores from different credit-reporting agencies, many lenders use FICO® scores, which can range from 300 to 850 for base scores and 250 to 900 for industry-specific scores. These may not be the scores your lender uses when reviewing your credit, but they can give you a better idea of where you stand.

Most people who take out mortgages have strong credit. The median credit score was 788 for new mortgage originations in the first quarter of 2021, according to a Federal Reserve report. Only a small percentage of new mortgages were taken out by people with scores below 620.

While getting a home loan with scores in the low 600s is possible, the Consumer Financial Protection Bureau warns that these loans often come with very high interest rates and could put borrowers at risk of default. Because applying for a mortgage with bad credit could mean you only qualify for a loan that may be difficult to pay back, it might be smart to wait to buy a home until your credit scores improve.

How Do I Know If I Have Bad Or Adverse Credit

There are lots of ways you can unintentionally damage your credit score. Thats why its always a good idea to have a look at your credit report before you apply for any kind of mortgage bad credit or not.

But there are also some clear reasons why you might have a bad credit rating. These include:

-

Having been declared bankrupt, or having had a debt management plan, IVA etc.

-

Missing credit card, loan or mortgage payments

-

Having County Court Judgements against your name

The good news is there are also lots of ways to improve your credit rating – check out our tips below.

Also Check: What Is Llpa In Mortgage

A Down Payment Makes You Less Risky To Lend To

Putting money down helps mitigate risk for the lender in a couple of ways:

Its important to note that the down payment requirement isnt set by the lender alone. In many cases, the down payment requirement comes from the investor of the loan .

Absolutely Incredible 110% Effort Throughout

I used the services of Dominion Mortgage Brokers to help me find the best mortgage company for a house I planned to purchase. These people gave me 110% effort throughout the entire process. They found me the best interest rate, and the actual mortgage company seems to be a quality firm. I am very happy with them so far. Dominion took care of all communications between me and the mortgage company, and if some extra documentation was required, they worked with me to get it and pass it along. I was very impressed by how hard the people at Dominion worked. The man I worked with worked all hours of the day, and was available at 9:00 at night on occasion. I hate to spend money, but Dominion Mortgage Brokers made it easy for me! An absolutely incredible experience!

Justin H. –

Recommended Reading: Can You Get A Mortgage On A Condo

Can I Get Approved For A Mortgage Loan With A Bad Credit Score

If you’re wondering, “What credit score do I need to qualify for a mortgage?” you generally need a score of 620 or higher for a conventional mortgage. This is a type of mortgage not backed by a government agency. If your score is lower, your options may be limited — but they still exist. Keep in mind that 620 is smack in the middle of the “fair” range. So you may be thinking: “Why wouldn’t I manage to snag a conventional mortgage with a credit score of 600 or 590?”

The reason is that a home loan is a major undertaking and usually not a small amount of money. As such, lenders may be more careful about extending credit to you in mortgage form.

Below 600 Credit Score

FHA loans are your best bet. They were created by the Federal Housing Administration in 1934 to increase home ownership during the Great Depression. They have been utilized by more than 40 million families to purchase or refinance homes. The loans are insured, so lenders have greatly reduced risk. In 2019, FHA loans made up 15.8% of the market.

For FHA loans, a credit score as low as 580 can be accepted, with just 3.5% in equity. Scores dipping to 550 have been accepted, but a 10% equity position is required . Down payment assistance is non-existent and you will have a difficult time getting approved if your debt-to-income ratio exceeds 45%.

You might be required to show that a financial hardship was the reason you fell behind on your monthly bills, while displaying evidence that you have recovered.

Hopeful note: Nearly 20% of all homebuyers have credit scores below 600.

You May Like: How To Get Rid Of Escrow On Mortgage

Great Work Very Reliable

My wife and i went with Dominion Mortgage Pro’s off of an add we saw on the internet, and we are very happy we did. From day one, Narish Maharaj and Lisa Vetsby have been amazing and answered all our questions and provided us with the correct guidance we needed. They were extremely prompt with getting back to emails and even calling me on the phone when we needed that little bit more of an explanation. Narish and Lisa took the stress out of this part of the buying process and i would recommend Dominion to anyone looking for a personable and caring experience.

Yung L. –

Find The Right Professional

We are not afraid of hard work. Most Alberta mortgage brokers only focus on good credit files, whereas we have experience and success helping people with bad credit. The work involved on bad credit mortgage applications is often more time consuming because there are more lending variables to consider. You need to find a mortgage broker that has experience helping people with bad credit, poor credit or low credit scores, and will take the time help you learn the options available to you now and in the future. As long as you have a large down-payment we can likely help. When trying to get a bad credit mortgage approved, a Bad Credit Mortgage Broker with Dominion Lending makes sure to put the whole story together. Your story and circumstances are just as important as your credit score and how much you make. An experienced mortgage broker will take this all into account.

Recommended Reading: How Much Is A 180k Mortgage Per Month

The Bad Mortgage Approval Process

To get started any lender considering a bad credit mortgage application will assess the applicant to determine the level of risk.Every bank or lending agency has its own set of criteria to determine if an application should be approved. Some of the most common requirements for approval are listed here:

If you have bad credit, or no credit, you chances of securing a mortgage for a new home are still good, if you apply in the right places and take the right steps. A mortgage broker can help walk you through the process, and can improve your chances of obtaining the mortgage you need to secure a new future for you and your family.

Contact FamilLending.ca to learn more. We will assign an experienced mortgage broker to review your situation and provide a personal, no obligation consultation. You have nothing to lose and a whole new life to gain. Let us work for you by calling 1-866-941-6678

FamilyLending.ca is near you.

FamilyLending.ca is expanding in order to serve you better! At FamilyLending.ca, we are committed to providing you with the knowledge and understanding of financial products that are right for your particular situation. FamilyLending.ca has access to best rate mortgages from coast to coast. Why pay more when you can have the lowest mortgage rate out there? So what are you waiting for – how can FamilyLending.ca help you?