Mortgage Life Insurance Premiums

| Age |

|---|

| National Bank Life Insurance Company | $150,000 |

Similar to mortgage life insurance, your cost of critical illness insurance is based on the insured mortgage balance. For example, if your premium rate is $0.45 per $1,000 of mortgage balance, and your mortgage balance is $500,000, then your cost of disability insurance will be $225.00 per month.

If your maximum coverage amount is less than your mortgage balance, then your mortgage balance is only partially covered. Once your mortgage balance falls below the maximum coverage amount, then your mortgage balance will begin to be fully covered.

For example, National Banks critical illness insurance has a maximum coverage of $150,000. If you have a mortgage balance of $500,000, your insured amount is $150,000. You are only charged insurance premiums on the insured amount of $150,000, not your full mortgage balance of $500,000. Your insured amount will decrease as your mortgage balance decreases.

Insurance benefits and payouts are not taxable. This means that if you are eligible for a critical illness claim and your insured amount was $150,000, then a maximum of $150,000 will go towards paying down your mortgage balance.

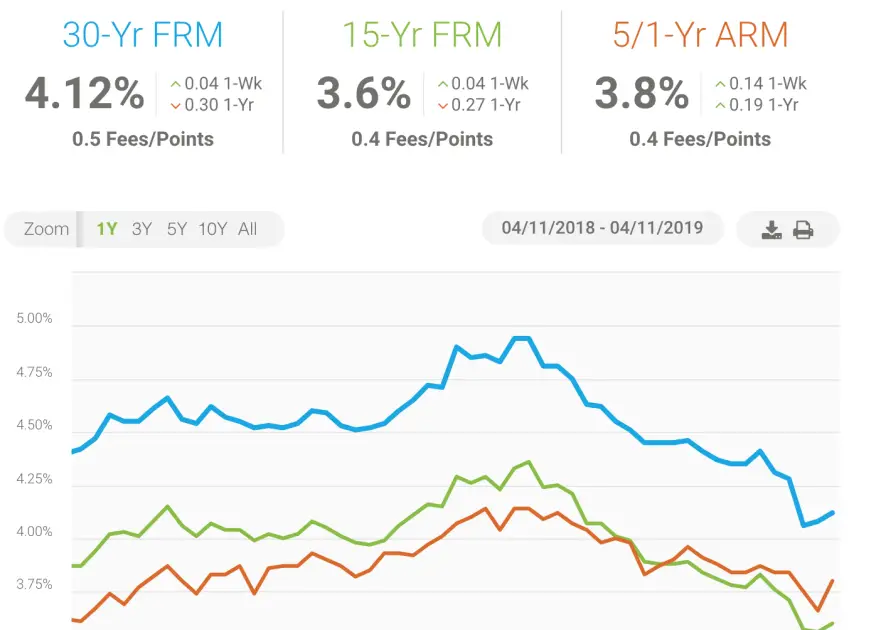

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Amerisave Mortgage Corporation Best Non

AmeriSave Mortgage Corporation is an online mortgage lender available in every state and Washington, D.C. Its one of Bankrates top lenders overall and best FHA lenders.

Strengths: Similar to competitors, AmeriSave Mortgage Corporation provides rate quotes quickly, and aims to close loans in days, not weeks, according to its website. Like other lenders, it offers 20-year loans, including rate-and-term and cash-out refinancing.

Weaknesses: Youll have to pay a $500 application fee.

Don’t Miss: What Were Mortgage Interest Rates In 2006

How Reliable Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Trustworthy average mortgage rates and mortgage refinancing rates are calculated based on information provided by partner lenders who pay a credible compensation.

Rates assume that the borrower has a credit score of 740 and is borrowing a traditional loan for a single-family home that is their primary residence. Rates also assume no discount points and a 20% down payment.

Reliable mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Mcglone Mortgage Group Best Overall

McGlone Mortgage Group, owned by Homestead Funding Corp., is available in 45 states and Washington, D.C.

Strengths: McGlone Mortgage Groups convenient mobile app allows you to prequalify for a loan, begin your application, scan and upload documents and calculate estimated mortgage payments.

Weaknesses: The rates on 20-year mortgages and other types of loans arent displayed on McGlone Mortgage Groups website. Youll have to fill out a short questionnaire to get in touch with the lender and learn what you might qualify for.

Don’t Miss: Is A Reverse Mortgage Good Or Bad

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Should I Choose A Fixed Or Variable Rate

Variable rates allow you to take advantage of future decreases in interest rate. On the other hand, fixed rates are preferable if interest rates rise in the future. Unfortunately, long-term fluctuations in the prime rate are difficult if not impossible to predict.

However, a2001 studyfound that between 19502000, choosing a variable interest rate resulted in lower lifetime mortgage cost than a fixed rate up to 90% of the time. According to the study, if you are comfortable with the risks involved, a variable rate may reduce your long-term mortgage cost.

Also Check: How Much Is Mortgage Insurance In Michigan

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

More Financial Flexibility Than A 15

With a 20-year mortgage, it may take longer to build up equity in your home and pay off your loan, but your monthly payments are significantly lower than theyd be with a 15-year term. While some people like the idea of getting rid of debt faster, others believe its better to have more financial flexibility.

How much lower would your monthly payments be with a 20-year term compared to a 15-year term? Suppose youre looking for a $350,000 loan to purchase a home, and your lender tells you they can offer you a 20-year mortgage with an interest rate of 4.38% or a 15-year mortgage with an interest rate of 4.25%.

If you choose the 20-year term, your monthly payments would be $2,190.73, but if you select the 15-year term, your payments would jump to $2,632.97 each month. By getting a 20-year mortgage, you save $442.25 each month and have the flexibility to choose how to use the funds.

Choosing the 15-year mortgage may ultimately put you at risk of defaulting. If your financial circumstances change due to job loss or unexpected medical bills, you may find that you cant pay the full amount.

However, with a 20-year mortgage, you can use the savings from your lower monthly payments to build up an emergency fund, invest or pay for daily expenditures. Furthermore, even if you choose a 20-year term, you can still make larger payments than youre required and pay off your mortgage early.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Read Also: Can You Get A 30 Year Mortgage On Land

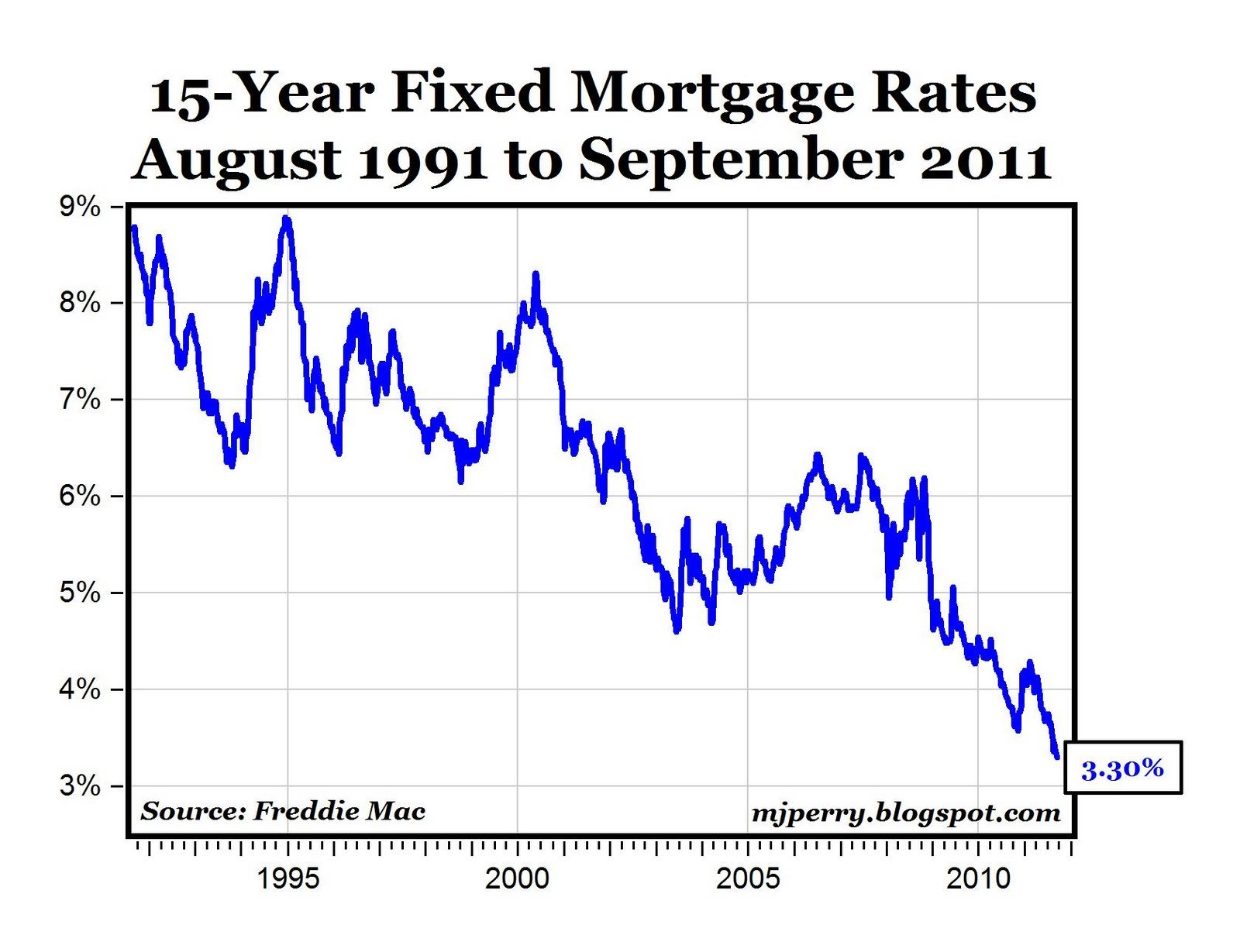

How Historical Mortgage Rates Affect Homebuying

When mortgage rates are lower, buying a home is more affordable. A lower payment may also help you qualify for a more expensive home. The Consumer Financial Protection Bureau recommends keeping your total debt, including your mortgage, to 43% of what you earn before taxes .

When rates are higher, an ARM may give you temporary payment relief if you plan to sell or refinance before the loan resets. Ask your lender about convertible-ARM options that allow you to convert your loan to a fixed-rate mortgage without having to refinance before the fixed-rate period expires.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

Recommended Reading: How To Lock Mortgage Rate For 6 Months

How Does The Federal Reserve Affect Mortgage Rates

The Federal Reserve System â or âThe Fed,â as itâs commonly called â is the United Statesâ central bank. Itâs tasked with taking steps to keep the economy safe, stable, and flexible. Consequently, the Fed controls the U.S. money supply and short-term interest rates, and sets the Fed funds rate, which is the rate that banks apply when borrowing from each other overnight.

But the Fed doesnât actually set mortgage rates. Rather, multiple things the Fed does influence mortgage rates. For example, while mortgage rates donât mirror the Fed funds rate, they do tend to follow it. If that rate rises, mortgage rates typically rise in tandem.

The Fed also buys and sells mortgage-backed securities, or MBS â a package of similar loans that a major mortgage investor buys and then resells to investors in the bond market. When the Fed buys a lot of mortgage-backed securities, it creates demand in the market, and lenders can make money even if they offer lower mortgage rates. So rates tend to be lower when the Fed is doing a lot of buying.

When the Fed buys fewer MBS, demand falls and rates will likely rise. Similarly, when the Fed raises the Fed fund rate, mortgage rates will also increase.

What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of CMHC insurance, since they generally carry a higher risk of default.

Read Also: How 10 Year Treasury Affect Mortgage Rates

Lower Interest Payments Than A 30

The most obvious benefit of 20-year mortgages is that they enable borrowers to make lower interest payments than they would with a 30-year mortgage. Yet, its not just the shorter term that enables borrowers to save on interest. Twenty-year mortgage rates are typically lower than 30-year rates.

To see just how much borrowers can save with a 20-year mortgage, lets take a look at an example. You want a $350,000 loan to purchase a home, your lender tells you that they can offer you a 30-year mortgage with an interest rate of 4.99% or a 20-year mortgage with an interest rate of 4.38%.

If you choose the 30-year term, youll pay $325,625.40 in interest over the life of the loan. However, if you choose the 20-year term, youll only pay $175,774.41 in interest over the life of the loan. Therefore, the 20-year mortgage is ultimately more affordable. By choosing a 20-year over a 30-year term, you save $149,851 in interest.

Securing A 20 Year Fixed Mortgage

The continually changing mortgage market often creates a confusing spectrum of choices for borrowers. By acquiring a general understanding of the types of mortgage products available and the advantages found in each, the consumer gains the ability to choose the best option. The 20 year fixed mortgage is available from a wide variety of financial institutions, though it is not marketed anywhere near as aggressively as 30-year fixed-rate mortgages.. The 20-year loan option provides distinct advantages over other products.

Recommended Reading: How To Pay Off A 200 000 Mortgage

Today’s National Mortgage Rate Averages

It’s been just over two weeks since mortgage rates spiked to almost their highest levels of the year. Since then the trend has been markedly downward, lowering the 30-year average two-tenths of a percentage point in that time, with Monday’s average dropping three basis points to 3.13%. That brings it to the lowest level since September 23.

Still, yesterday’s average is about a quarter of a percentage point higher than in early August, when a major rate drop brought the 30-year average down to 2.89%.

The 15-year and Jumbo 30-year rate averages also dipped further Monday. The 15-year average shed four basis points to 2.41%, which is 19 basis points below its YTD high, and the Jumbo 30-year average moved two points lower, to 3.31%, or 14 points lower than its highest rate of the year. Similar to the 30-year average, these rates sit two-tenths to a quarter of a percentage point above their early-August valley.

Refinance rates showed similar downward pressure Friday, with the major fixed-rate refinance averages losing two to four basis points. Rates to refinance 30-year and 15-year loans are currently priced 8 to 16 basis points higher than new purchase rates.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

You May Like: How To Determine My Mortgage Payment

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Are Interest Rate And Apr The Same

The interest rate and annual percentage rate are not the same. Lenders include charges such as origination fees along with the interest in the APR. Thats why the APR is higher than the interest rate. For APRs that are similar to the interest rate, it means the loan has fewer added costs rolled into the loan. Like interest rates, the lower the APR, the less borrowers will pay throughout the lifetime of the loan.

You May Like: Are Online Mortgage Calculators Accurate

How To Compare 20

When comparing mortgages, make sure they all have the same loan term so you can see which one truly offers the best mortgage rates. Also consider a variety of mortgage lenders. These include both local and national banks and credit unions, as well as online lenders. In some cases, seeking the help of a mortgage broker could pay off. Some may offer very competitive rates.

Since applying for a loan might result in a ding to your credit score, find lenders that offer mortgage prequalification. This only involves a “soft” credit inquiry. It won’t affect your credit score. When you receive a few quotes, take a look at items such as any loan origination fees, interest rates, closing costs, and mortgage points. Don’t forget to look at what you may need to qualify for the best rates. These include a high FICO® Score, a minimum income amount, and a history of on-time payments.

Current Mortgage Rates Tick Lower

The 30-year fixed-rate loan is averaging 2.86% for the week ending September 16, down just 0.02 percentage points from last week, according to Freddie Mac’s benchmark survey.

Rates have been hovering between 2.86% and 2.88% since August 12. Earlier this year, there was more weekly movement, with the 30-year rate reaching a high of 3.18% on April 1. Since then, rates have been trending lower with occasional bumps.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months. The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases,” said Sam Kahet, Freddie Mac’s chief economist. “While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy-efficient and resilient economy. These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

The direction of rates for various types of loans continues to be mixed this week:

Don’t Miss: What You Need For A Mortgage