What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

Real Estate Deal Volume & Appreciation

- Fannie Mae anticipates home sales which were at 6 million units in both 2018 and 2019 will end 2020 with 6.2 million transactions and will see 6.1 million transactions in 2021.

- Real estate appreciation in the United States during 2018 and 2019 ran at 5.1% and 4.2%. In 2020 Fannie Mae anticipates home prices to increase 5.5% and increase a further 2.6% in 2022.

How To Get A Good Mortgage Interest Rate

Rates vary by lender, so its always important to shop around for the mortgage lender that’s offering the best terms. Each lender has its own overhead and operating costs and has to charge differently in order to make a profit.

In addition to market and economic factors, the rate youre offered depends largely on your own financial situation. A lender will consider:

- Your repayment history and any collections, bankruptcies, or other financial events

- Your income and employment history

- Your level of existing debt

- Your cash reserves and assets

- The size of your down payment

- Property location

- Loan type, term, and amount

The riskier you are as a borrower and the more money you borrow, the higher your rate will be.

You can apply for a mortgage to several lenders at once, or you can go to a mortgage broker who will do the shopping for you to make sure you’re getting the best rate. Brokers can often find lower rates thanks to their industry connections and access to wholesale pricing.

Regardless of which route you choose, make sure youre comparing the full loan estimateclosing costs includedto accurately see whose pricing is more affordable.

You May Like: Is 720 A Good Credit Score For Mortgage

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Also Check: What Does A Mortgage Consist Of

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, a borrower with a good credit score and a 20 percent down payment who takes out a 30-year fixed-rate loan for $200,000 with an interest rate of 4.25% instead of 4.75% translates to almost $60 per month in savings in the first five years, thats a savings of $3,500. Just as important is looking at the total interest costs too. In the same scenario, a half percent decrease in interest rate means a savings of almost $21,400 in total interest owed over the life of the loan.

What Is The Best Mortgage Rate In New Brunswick

The best mortgage for you is the one that best suits your needs, and offers a great rate. It’s important to remember that the best mortgage is not always the mortgage with the lowest rate. While a low rate is important and can save you thousands of dollars, you also need to make sure that the term, conditions, and features of your mortgage suit your needs.

Don’t Miss: Who Is Rocket Mortgage Owned By

Whats The Difference Between Variable Vs Fixed Mortgage Rates

A fixed-rate mortgage will have the same rate locked in for your entire contract, while variable-rate mortgages can change over the course of your term. Variable rates will change alongside your lenderâs prime rate.

To account for the risk of a rate rise, variable mortgages normally have lower rates than fixed mortgages at the start of a mortgage term. Fixed rates, though higher at the start of a term, are a great option if you want predictable mortgage payments.

In Alberta, fixed rates are more popular, used on the overwhelming majority of mortgages. In Calgary and Edmonton in particular, around 80% of mortgages use fixed rates. .

Learn more by reading our guide to fixed and variable mortgages.

Mortgage Rates Are Stuck In A Holding Pattern

As the summer wound down, mortgage rates stagnated. The 30-year fixed mortgage rate the most popular home loan product has barely budged for more than a month.

According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average crept up to 2.88 percent with an average 0.7 point. It was 2.87 percent a week ago and 2.86 percent a year ago. Since the 30-year fixed average jumped from 2.77 percent to 2.87 percent in early August, it has essentially held steady the past five weeks.

Freddie Mac, the federally chartered mortgage investor, aggregates rates from around 80 lenders across the country to come up with weekly national averages. The survey is based on home purchase mortgages. Rates for refinances may be different. It uses rates for high-quality borrowers with strong credit scores and large down payments. Because of the criteria, these rates are not available to every borrower.

The 15-year fixed-rate average ticked up to 2.19 percent with an average 0.6 point. It was 2.18 percent a week ago and 2.37 percent a year ago. The five-year adjustable rate average edged up to 2.42 percent with an average 0.3 point. It was 2.43 percent a week ago and 3.11 percent a year ago.

Last weeks disappointing employment report had little effect on mortgage rates. The U.S. economy added a lackluster 235,000 jobs in August, falling well below what was forecast and a steep drop-off from June and July .

More Real Estate:

You May Like: Is 3.99 A Good Mortgage Rate

Why Are Rates Lower For A 15

Rates for mortgages are set based on bond prices in the mortgage-backed securities market. Investors of bonds want to park their cash in a more low-risk investment, one that offers a decent rate of return that will keep up with the rate of inflation.

Since inflation rates tend to go up over time, longer-term loans will have higher interest rates compared to short-term ones. Thats because investors can’t accurately project inflation rates farther in advance.

Freddie Mac and Fannie Mae, both government-supported agencies, also impose price adjustments for loan levels, driving up costs of 30-year mortgages. Many 15-year mortgages dont have these additional fees, which is reflected in a lower rate.

How We Chose The Best 15

In order to assess the best 15-year mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

Recommended Reading: How Much Interest Do I Pay On A Mortgage

What Is A Good 30

A 30-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over the 30-year loan period. With a rate that lasts the length of the loan, youll want the best rate you can get. Since your rate is most directly impacted by your credit score and down payment, youll want to make sure your credit file is accurate and make a down payment thats as much as you can easily afford.

Getting a good deal on a mortgage is like getting a good deal on a car. You do online research, you talk with friends and family, and then you comparison-shop. That last step, which involves applying with multiple lenders, is the most important step.

When you compare loan offers using theLoan Estimates, youll feel confident when you identify the offer that has the best combination of rate and fees.

A Freddie Mac report concluded that a typical borrower can expect to save $400 in interest in just the first year by comparison-shopping five lenders instead of applying with just one lender. Over several years, comparison-shopping for a mortgage can save thousands of dollars. Thatll give you something you can brag about.

The 30-year fixed isnt your only option. The 15-year fixed loan is common among refinancers.Adjustable-rate mortgageshave low monthly payments during the first few years of the loan, making them popular for high-dollar loans.

What Is The Best Credit Score To Get A Mortgage

Lenders reserve their most competitive rates to borrowers with excellent credit scores usually 740 or higher. However, you dont need spotless credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580, although youll probably need a score of 620 or higher to qualify.

To score the best deal, work to boost your credit score above 740. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

Don’t Miss: How To Apply For A House Mortgage

When Should I Lock My Mortgage Rate

Right now mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, you can ask your lender if it offers the option to change your rate if it drops, this is also called a float down. With this option, youll need to pay attention to the fine print. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Impact Of Mortgage Interest Rates On The Market

Mortgage rates dont directly impact home prices, but they do influence housing supplywhich plays a big role in pricing. As mortgage rates rise, existing homeowners are less likely to list their properties and enter the market. This creates a dearth of for-sale properties, driving demand up and prices with them.

When rates are low, homeowners are more comfortable selling their properties. This sends inventory up and turns the market in the buyers favor, meaning more options and more negotiating power.

It depends on how much rates rise, however. It can stifle demand if rates rise for too long or get too higheven for the few properties that are out there. That would force sellers to lower their prices in order to stand out.

Don’t Miss: What’s The Average Mortgage Payment

How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

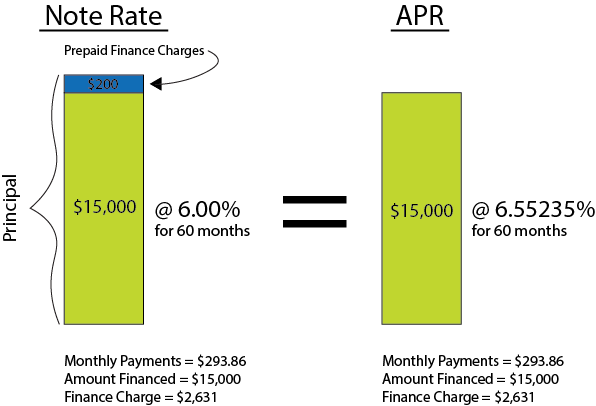

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

Also Check: Does Rocket Mortgage Affect Your Credit Score

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Throughout the first half of 2021, the best mortgage rates have been in the high-2% range. And a good mortgage rate has been around 3% to 3.25%.

Of course, these numbers vary a lot from one borrower to the next, as we explain below.

Top-tier borrowers could see mortgage rates in the 2.5-3% range at the same time lower-credit borrowers are seeing rates in the high-3% to 4% range.

In addition, looking forward in 2021, interest rates seem likely to increase. So a good mortgage rate later this year could be substantially higher than what it is today.

Average Mortgage Interest Rates

When it comes to mortgages, as with any loan, the interest rate is one of the most important factors. Unlike most other loans though, mortgages are very big often theyll be the biggest loan youll ever take out in your life.

There are also different types of mortgage, which makes getting the average mortgage interest rate a little tricky.

Statista has a useful graph showing the most up to date mortgage rates depending on if you are going for a fixed or variable mortgage.

Loan to value is the relationship between the current value of the property that the mortgage is paying for, and the actual amount the mortgage is. The mortgage value divided by the property value = LTV. Dont be scared of the maths, pull out your phone or use the Which? LTV calculator.

You also need to think about mortgage fees, which can be anything from £500 to £2,000 or more. Some mortgage providers will let you add the fees to the mortgage itself. This means you dont need to shell out the money when you first get the mortgage.

The con of doing this though is that the interest then applies to the fee, so you end up paying more overall, as well as more per month. Our advice: pay the fees upfront.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

Land Transfer Tax In New Brunswick

New Brunswick, along with most Canadian provinces, charges a land transfer tax on all property transfers . Unlike the marginal tax rates applied by other provinces, New Brunswick charges a simple, flat rate.

All property transfers in New Brunswick attract a 1% land transfer tax on either the property price or the assessed value, whichever is greater.

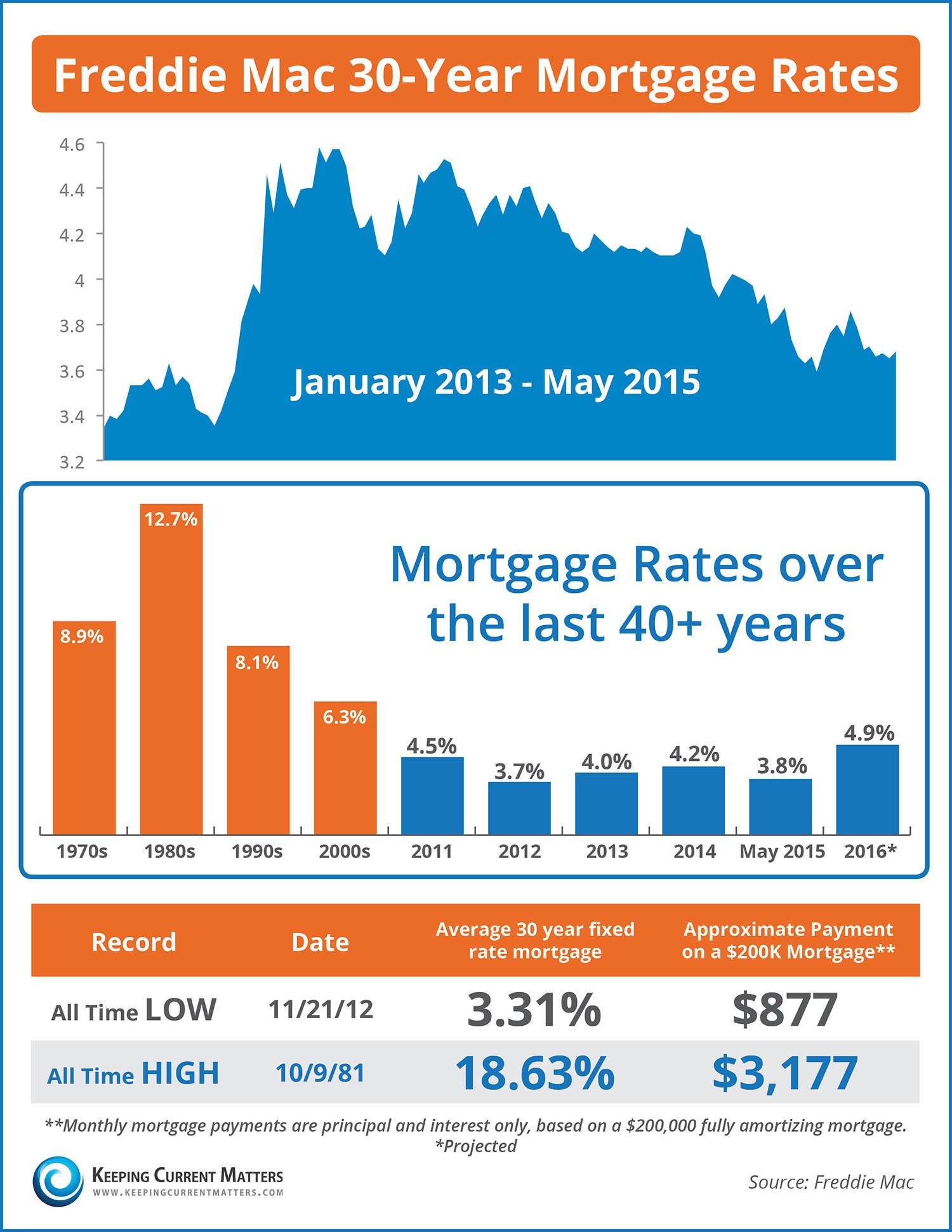

Are Mortgage Rates Impacting Home Sales

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-tami.png)

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

Read Also: What Do I Need To Become A Mortgage Broker