Costs To Keep In Mind

Like everything else with buying a home, getting a mortgage credit certificate will cost you. The price tag varies based on your location and lender. In Michigan, for example, an MCC will run you $400, and a lender may tack on another $100 administration fee. In Texas, an MCC comes with a $500 issuance fee and a $200 compliance review fee.

While those additional fees might be frustrating, remember that you could wind up using the mortgage credit certificate for 30 years, so the annual savings might greatly exceed the one-time costs.

Save A Mortgage From Dying

The MCC tax certificate program can save a deal from dying. How so you say? Well that tax credit you will get? It can be applied towards your debt ratios as income. There are times for whichever reason that a persons debt ratios might be higher than what they or their lender was thinking. If they qualify for the program the underwriter can credit them the monthly income that they will be receiving. If they are poised to get a $2,000 a year credit, then that means the underwriter can apply about $166 a month towards their income. This can save a deal! Attentions real estate agents, be aware of this program! The lender you use might not be an approved provider of the MCC program. Training must be done by the loan originator to offer the program. Heres a link for more complete MCC First time home buyer guidelines.

What Is A Mortgage Credit Certificate

When you take out a mortgage, not only are you expected to pay off the principal of the loan, but you have to make interest payments. This interest is a fee charged by the bank for loaning you the money. An MCC is a way to get some of the money back that you paid in interest.

An MCC is a federal tax credit given by the IRS to low-income borrowers, and its typically reserved for first-time home buyers. When you receive an MCC, you can claim a deduction of up to $2,000 on the mortgage interest you paid on your home.

This credit will reduce the amount you owe in federal taxes for the year. However, an MCC only really helps you if you paid a substantial amount of money in interest. If your interest payments were relatively low, an MCC wouldnt help you as much.

Also Check: Can You Do A Reverse Mortgage On A Condo

How Mortgage Credit Certificates Work

Mortgage credit certificates are designed to help first-time homebuyers qualify for a home loan by reducing their tax liabilities below what they would otherwise have to pay. The term mortgage credit certificate is sometimes also used to refer to the tax credit it allows eligible borrowers to receive. Borrowers can receive a dollar-for-dollar tax credit for a portion of the mortgage interest they pay each year.

How Much Does An Mcc Tax Credit Cost

Wait, a fee? Yes, there is a one-time fee paid at closing for the ability to use the tax credit benefits. Again, this is an area where details depend on the state. For instance, $495 is the mortgage credit certificate NC Housing Finance Agency cost. Plus, lenders may charge up to an additional $300. Using $795 is a good rough figure to estimate other state costs until verified with a specific lender. Usually, the tax credit surpasses the cost during the first year. Since the MCC tax credit fee is considered a closing cost, it must by paid at closing. Also, an MCC fee may be paid by seller paid closing costs, lender credit, or even a real estate agent credit.

You May Like: Does Rocket Mortgage Service Their Own Loans

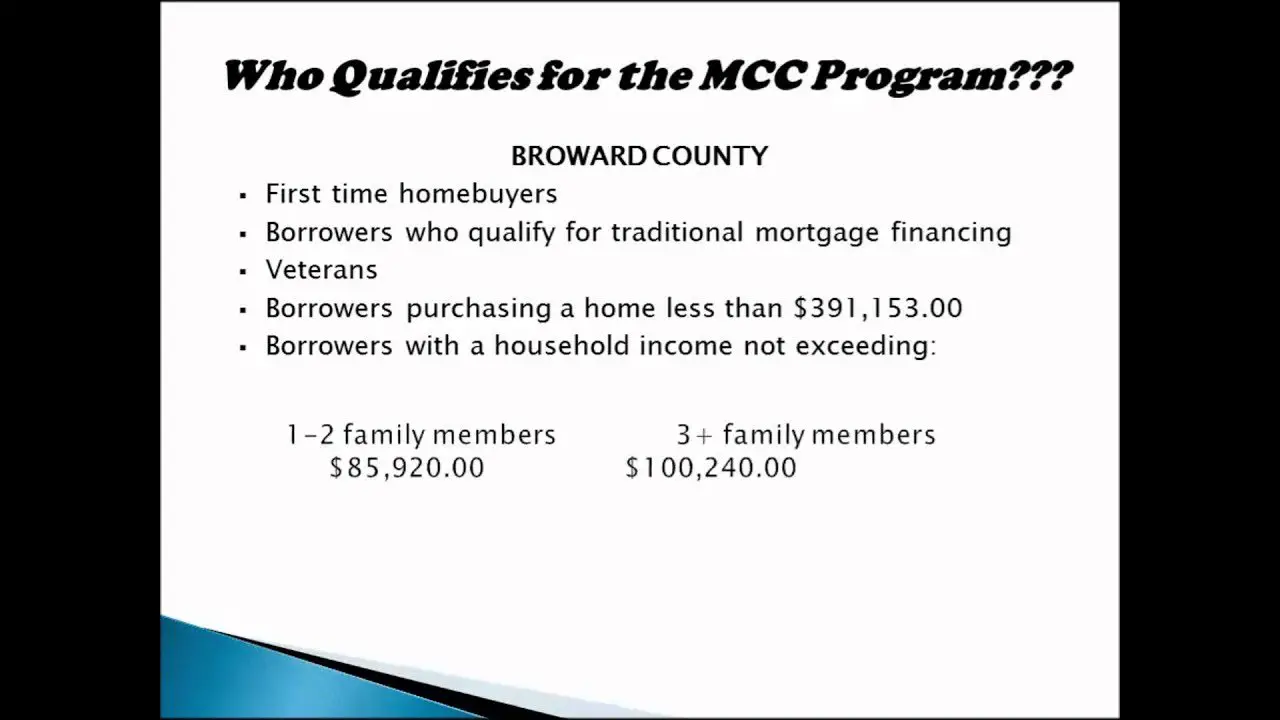

Who Qualifies For A Mortgage Credit Certificate

In order to qualify for a mortgage credit certificate, you must be a first-time homebuyer and meet the MCC program’s income and purchase limits, which vary by county and household size.

Anyone who has not owned a home in three years is considered a first-time homebuyer. Every state has their own requirements, which are designed to help low- and middle-income buyers, and a few states do not have a mortgage credit certificate program at all. The income limit may range from $60,000 to $90,000 for one to two person households, and the income of a spouse whose name isnât on the mortgage may still count towards the MCC limit. The purchase price of the house must also fall under a certain amount for the buyer to qualify for an MCC.

If you are interested in an MCC, but you earn more than the income limit and you are not a first-time buyer, then you might consider a home in a targeted area. These areas are designated by the state or Department of Housing and Urban Development and tend to have a more lenient income limit.

Since the MCC is not a loan, you do not need a certain to qualify.

Mortgage Credit Certificate Pitfalls

On the surface, an MCC credit sounds like a win-win. But here are some things you need to watch out for.

Tax credit payback. If you sell your home, or convert it to a rental or second home, within 9 years, you may have to pay back some or all of the MCC credit. That could be one big tax bill.

MCC credit is bigger than your tax owed. You cant claim a credit if its bigger than your overall tax bill. So if you owe $2,000 in income taxes, but your MCC credit is $3,000 for the year, you will lose $1,000 of your credit.

MCC fee. The fee, usually around $650, adds to your loan closing costs. If your savings with the program are small, it could take you a year or two to break even on the fee.

Read Also: Mortgage Rates Based On 10 Year Treasury

Tax Credits For First

The Mortgage Credit Certificate Program offers qualified first-time homebuyers a Federal income tax credit. The credit can reduce potential Federal income tax liability, creating additional net spendable income for qualified first-time homebuyers to possibly use toward their monthly mortgage payment. This MCC Program enables qualified first-time homebuyers to convert a portion of their annual mortgage interest into a direct dollar-for-dollar tax credit on their U.S. individual income tax returns. The qualified homebuyer is awarded a tax credit of up to 20% of the annual interest paid on the mortgage loan. The remaining 80% of the mortgage interest will continue to qualify as an itemized tax deduction.To become a participating lender, you must receive MCC training from our agency. Please to register for the next training.

GET STARTED

– Applicants must be a first-time homebuyer: no ownership interest in real estate at any time in the past three years- The first-time homebuyer’s household annual income cannot exceed program guidelines- Homebuyers must occupy the home as their principal residence

– The households annual income must be below the following limits: – For one to two persons, the maximum income limit is $135,120 – For three or more persons, the maximum income limit is $157,640- Annualized gross income is current gross monthly income multiplied by 12- Income includes the income of both spouses, whether or not both spouses will be on title

MCC Areas

How Do I Qualify To Receive A Reissued Mcc

Answer the following questions to see if you qualify:

a. Will this be first refinancing of your original loan?

b. If No, an additional fee may be charged for retrieving MCC/RMCC historical information.

c. Is the Funding Lender a Santa Cruz County Reissue MCC Program Participating Lender?

If you answered YES to c. then you may be qualified for a Reissued MCC.

Don’t Miss: Reverse Mortgage Mobile Home

How Much Time Do I Have To Apply

The application and all required documentation must be received in our Santa Cruz County office within 365 days of the closing date of the New Loan . Applications received after December 15th in any calendar year may not receive a Reissue MCC prior to April 15th of the following year. Exceptions to the 365 day limit must be granted before application is submitted.

Requesting A Duplicate Copy

If you do not receive a copy of your certificate, it is essential that you contact the relevant agency in order to receive a duplicate, as you cannot properly file your annual tax returns without the information presented on this form. If you lose your form, you can also request another, although you may incur a small fee for this service.

In order to request a new form, you will have to provide a variety of information, including your Social Security number, birth date, street address etc. As a general rule, make sure you have this form in your possession well in advance of the annual tax deadline!

References

Also Check: Rocket Mortgage Vs Bank

What Happens If I Sell My House Or Refinance

If you make a profit from selling an asset and it provides a tax benefit, you may have to pay something called a recapture tax to the IRS.

Homeowners may be subject to recapture tax, which is only a portion of the gain, in the following conditions:

-

They sell their home before nine years have passed

-

They earn a capital gain from the sale of the home

-

They earn significantly more income at the time of sale than they did at the time they bought the home

Because all three conditions must be met, the risk of having to pay the recapture tax is relatively low for most homeowners.

If you refinance your mortgage, you can still get a mortgage credit certificate. Youâll have to reapply for it again with an approved lender. Because refinancing means taking out a new mortgage to pay off the old one, the refinance may have to follow certain terms in order to be eligible, like not refinancing for a larger loan amount. Ask your loan officer for more information.

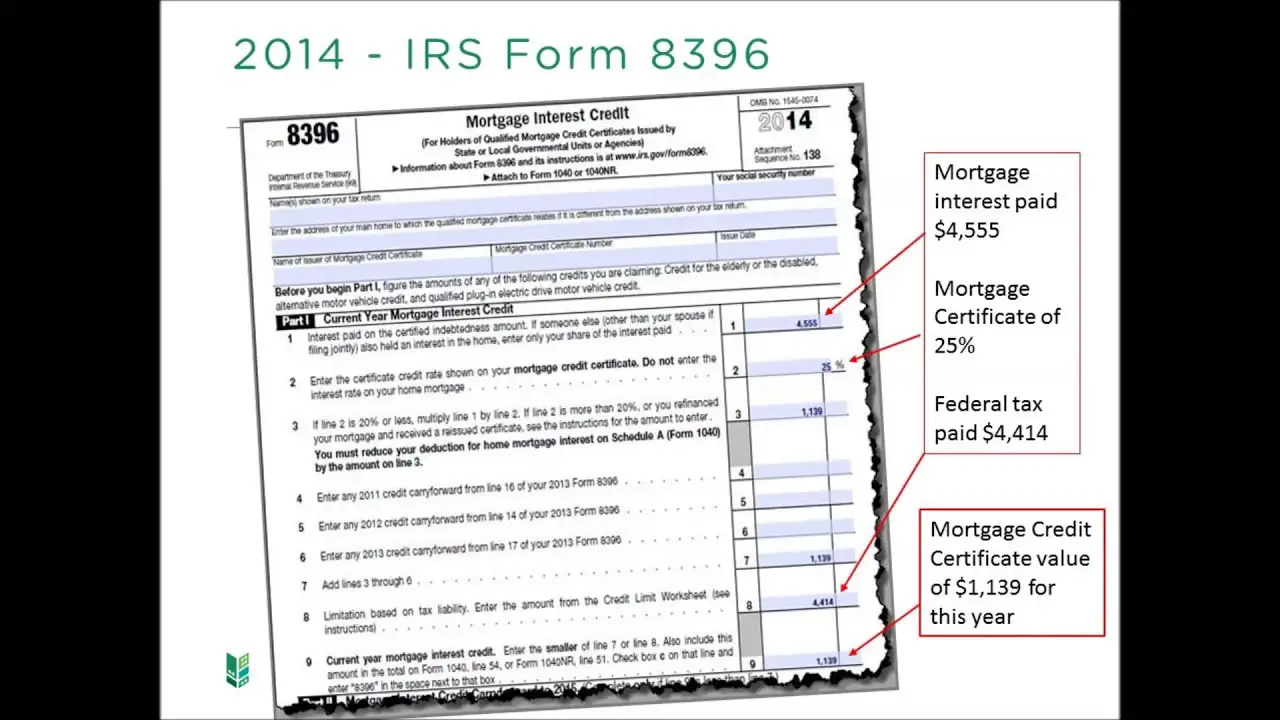

How To Claim The Mortgage Interest Credit On Your Taxes

You must claim the MCC tax credit every year on your federal tax return by completing IRS Form 8396, Mortgage Interest Credit and attaching it to your 2021 tax return.

You will need the following information from your certificate:

-

Mortgage credit certificate number

-

The date it was issued

-

Name of the issuer of the mortgage credit certificate

On Form 8396, you must enter the amount of interest you paid on the mortgage loan . You can find this number on Form 1098, Mortgage interest Statement, which you should have received in the mail from your lender. This is multiplied by your stateâs MCC rate to calculate the credit amount youâre eligible for. The maximum possible mortgage interest credit is $2,000.

Next, you will account for and add any credit carrying over from the past three years. The final credit amount should be entered on Schedule 3.

If you itemize your deductions, you will need to make adjustments to Schedule A to reduce the home mortgage interest deduction.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

You May Like: Chase Recast Mortgage

How Can A Mortgage Credit Certificate Benefit Me

You may use Mortgage Credit Certificates with most of LGFCU’s mortgage products. The tax liability reduction of an MCC makes it more affordable to buy your first home.

Youll benefit the most when using an MCC in combination with our First-Time Homebuyers Loan and our partnership with the Federal Home Loan Bank of Atlanta First-time Homebuyer Grant Program, which offers assistance with down payment and closing costs.

Are There Any Risks

Saving on your annual tax bill is worth celebrating, but getting a mortgage credit certificate can come with one potential downside. In rare cases, you might have to pay back the money you saved from the credit.

If you sell your home within the first nine years, you may, under limited circumstances, have to pay whats called a recapture tax to the federal government to cover some of the benefit you receive, says Rosemarie Sabatino, senior homeownership policy specialist at the National Council of State Housing Agencies.

Specifically, the tax applies if you sell the home within nine years, if your income during that time increased significantly and if you realize a gain on the sale, Sabatino says. How much of a tax you pay depends on how many years youve owned the home before the sale.

Depending on where you live, though, you might be able to avoid the recapture tax. For example, the Michigan State Housing Development Authority offers a reimbursement program that fully reimburses anyone subject to paying the recapture tax.

On the flip side, there is another risk: The credit might not add up to much if your income declines to such a low level that you dont owe taxes to the IRS.

Also Check: Chase Recast

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

First Time Home Buyer Education Class Required

Unless you are buying in a targeted area or have a veterans exceptions you must take a first time home buyers education class from a HUD approved counselor. The certification is good for 2 years from the time of completion, and it must be completed before your closing. Its easy to do online but face to face counseling can be done as well. Here is a link to the HUD website for Florida Counselors.

Also Check: Reverse Mortgage Manufactured Home

What Is A Mortgage Credit Certificate And Could I Benefit From It

A Mortgage Credit Certificate is a tax credit given by the IRS to low and moderate income homebuyers. Generally the program is only available to first time homebuyers. Terms differ by state. An MCC can be a great way to use your home to save money on your taxes, but there are some drawbacks as well as hidden costs, so use caution in deciding whether to use the program.

An MCC is not credited at the closing of the loan, but on the homeowners federal taxes in the future. The credit can be used for each future tax year in which the mortgage is held that the homeowner has a tax liability. The amount of the tax credit is equal to 20 percent of the mortgage interest paid for the tax year. The remaining 80 percent interest is still eligible to be used as a tax deduction. If the mortgage is ever refinanced, the MCC will be voided, even if the recipient still owns the home.

An MCC usually costs around $650 up front, and mortgage lenders may charge an additional $100 processing fee at their discretion.

Florida Housing Mortgage Credit Certificate

The Florida Housing Mortgage Credit Certificate Program is designed to help first time homebuyers save money each year that they live in their home.

Using the MCC Program a homeowner can claim up to 50 percent of their paid mortgage interest each year as a TAX CREDIT on their federal IRS tax return.The credit is capped at $2000* annually and any remaining mortgage interest not included as part of the TAX CREDITis still eligible for the home mortgage interest deduction on their federal tax return.

A little-known fact is that the MCC can also be used to help First Time Home Buyers use that $2000 annual tax credit and add $166.67 to their monthly incomeduring the mortgage qualification period to help qualify for a slightly higher priced house.

Each year, a homeowner may claim a dollar-for-dollar reduction of income tax liability on up to 50 percent of the mortgage intereston their first mortgage , reducing the amount of federal taxes owed.This amount is capped as a $2000 Federal tax credit

Florida Housings MCC Program is for first time homebuyers purchasing a home, non-first time homebuyers purchasing a home in targeted areas in Florida or for eligible veterans purchasing a home anywhere in Florida.

The MCC Program has income limits and purchase price limits.These limits differ from county to county as well as by household size.Please contact Florida Down Payment Assistance at for more information

Don’t Miss: Rocket Mortgage Qualifications

What Are Mortgage Credit Certificates

In North America, a mortgage credit certificate, also called an MCC, is a document provided by the originating mortgage lender to the borrower that directly converts a portion of the mortgage interest paid by the borrower into a non-refundable tax credit. Low- or moderate-income homebuyers can use a mortgage credit certificate program to help them purchase a home. Mortgage credit certificates can be issued by either loan brokers or the lenders themselves, however, they are not a loan product.