Va 30 Year Fixed Mortgage Rates

Since VA loans are guaranteed by the government, VA loans provide access to special benefits, including:

What Are The Disadvantages Of 30

The biggest disadvantage of a 30-year fixed rate mortgage is that it’s more expensive over time than a shorter term loan. Let’s compare it to a 15-year fixed rate mortgage as an example. The 30-year fixed mortgage is more expensive not only because the interest rate on a 30-year fixed loan is higher than a 15-year fixed loan, but also because you’ll pay more interest over time since you’re borrowing the money for twice as long. Additionally, spreading the principal payments over 30 years means you’ll build equity at a slower pace than with a shorter term loan.

Renasant Bank Best Bank Lender

Renasant Bank is a bank and lender with branches in Alabama, Florida, Georgia, Mississippi and Tennessee.

Strengths: As with other mortgage lenders, Renasant Bank allows you to lock in a competitive rate for up to 60 days. Because its a regional bank, Renasant has more of a local feel, which can enhance the borrowers experience. The bank also offers Community Home Improvement loans, which could be useful if youre looking to make repairs to your home.

Weaknesses: Renasant Bank is only available in certain states, and doesnt offer interest rate information online.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

What Are Mortgage Points

Also known as discount points, this is a one-time fee or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Each discount point costs one percent of your mortgage amount, or $1,000 for every $100,000 and will lower the rate by a quarter of a percent, or 0.25. For example, if the interest rate is 4 percent, purchasing one mortgage point will reduce the rate to 3.75 percent.

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

You May Like: Bofa Home Loan Navigator

What Is A Good Fha Interest Rate

Many factors influence the mortgage rate youre offered, from forces that are pretty much out of your control to your personal financial details. The best way to find out if youre being offered a good FHA loan interest rate is to apply with multiple lenders. That way, you can compare loan offers and determine which has the best combination of rate and fees.

Get A Helping Hand In Homeownership

We are here to tailor a plan of action when considering whats best for your future, finances, and lifestyle. Getting an FHA 30-year fixed-rate mortgage1 is a great option for first-time homebuyers and those with little-to-no formal credit history, limited cash for down payments, or less-than-optimal credit. Lower credit scores may not prevent you from qualifying however, higher scores could net you lower interest rates. With a more flexible application process, we are ready to walk you through the steps in owning your home with a 30-year fixed FHA mortgage loan.

Don’t Miss: Rocket Mortgage Vs Bank

Why Are Aprs Higher Than Fha Interest Rates

An annual percentage rate reflects other costs related to getting a mortgage, such as origination fees and discount points. However, the APR on FHA loans is often much higher than FHA interest rates because of the higher cost of FHA mortgage insurance, which covers the lenders losses if a borrower cant repay the loan.

FHA loans require two types of mortgage insurance to protect lenders against default. The first is an upfront mortgage insurance premium of 1.75% paid in a one-time lump sum. The second is the mortgage insurance premium ranging from 0.45% to 1.05%, which is an ongoing annual charge that becomes part of your monthly payment.

THINGS TO KNOW

The Impact Of Prolonged Pmi Insurance

You must pay for both annual and upfront mortgage insurance, no matter your down payment, to meet the terms for an FHA loan. If you pursue a conventional loan and are unable to make a down payment of at least 20%, PMI will be required to protect the lender in case of homeowner default. Its essential to remember that this type of insurance does not protect you in the event that you fall behind on mortgage payments and you could still face foreclosure.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

What Do You Need To Know About Mortgage Insurance

All FHA loans must have mortgage insurance. This is regardless of the borrower’s credit score and down payment. The FHA uses these funds to cover the costs of defaults.

FHA mortgage insurance is usually more expensive than the private mortgage insurance required on a conventional loan. Additionally, you must maintain FHA loan insurance for a minimum of 11 years. By contrast, for applicable conventional loans, you must maintain private mortgage insurance only if your down payment is below 20% of the loan amount or until your home equity reaches 20%.

There are two types of FHA mortgage insurance:

- Upfront mortgage insurance premium This is a one-time upfront charge of 1.75% of your loan amount. You may pay it in full at closing or add it to your loan balance.

- Mortgage Insurance Premium This is an annual insurance premium that is required to be paid monthly. Your lender will incorporate it into your monthly mortgage payment. Amounts for this insurance range from 0.80% to 1.05% of the loan balance on a 30-year FHA.

Talk with a U.S. Bank mortgage loan officer to learn more about FHA mortgage insurance.

Bbva Best For Low Down Payment Options

BBVA was founded well over a century ago in 1899 in Spain and has been helping customers with personal finance ever since. The bank offers five separate low and no down payment home buying options for you to choose from, including an FHA mortgage. The minimum credit score the bank is willing to work with on an FHA loan is a bit higher than the rest of the industry at 640, which could be a deterrent for some.

Read Also: Reverse Mortgage Manufactured Home

Tips To Get The Lowest Mortgage Rate

To get the best rate possible, it helps to get your finances shipshape before applying for a mortgage.

For example, managing debts well and keeping your credit score up can help you qualify for a lower interest rate. As can savings for a bigger down payment.

Dont worry. Nobodys expecting miracles. But small improvements can make a worthwhile difference in the mortgage rate youre offered.

Here are some quick hits:

Few of us can afford to boost our savings and pay down our debts at the same time. So focus on areas where you think you can make the biggest difference. Youll see the biggest improvement in your credit scores by paying down highinterest, revolving credit accounts such as credit cards.

The other big way to lower your interest rate is by shopping around.

Mortgage lenders have flexibility with the rates they offer. Some will offer you lower rates than others because theyre more favorable toward your particular situation.

Cardinal Financial Company Best For Low

Cardinal Financial Company, which also runs Sebonic Financial, is a mortgage lender available across the U.S., offering an array of loan products including FHA loans.

Strengths: Like many mortgage lenders, Cardinal Financial Company offers FHA loans to borrowers with lower credit scores , as well as other types of loans with some credit flexibility . One key benefit: The lenders proprietary system, Octane, guides borrowers throughout the home loan process with a customized to-do list.

Weaknesses: While you can easily learn Cardinal Financials credit and down payment requirements for specific products online, you wont be able to find information regarding interest rates or fees. To receive a quote and cost details, youll need to contact a loan officer.

Don’t Miss: Rocket Mortgage Payment Options

Interest Rates And Apr Vary By Loan Type

30year mortgage rates also vary by loan program.

If you look at interest rate alone, VA loans typically have the lowest rates, followed by USDA loans.

FHA mortgages also have belowmarket rates. But they charge expensive mortgage insurance premiums which push up the overall cost of the loan.

Similarly, conventional loans with less than 20% down can have expensive private mortgage insurance . Thats especially true for borrowers with lower credit.

But for borrowers with great credit, PMI is less expensive and wont have as big of an impact on monthly mortgage payments.

Look At Apr As Well As Mortgage Rates

Its important to look at annual percentage rate as well as current mortgage rates.

So while an FHA loan might appear to have lower rates than a conventional loan, for example, it could have a higher APR and therefore be more expensive overall.

Jumbo mortgages are a bit of a special case. Jumbo loan rates can be near or even below conventional loans. But these mortgages are significantly tougher to qualify for.

You May Like: Rocket Mortgage Qualifications

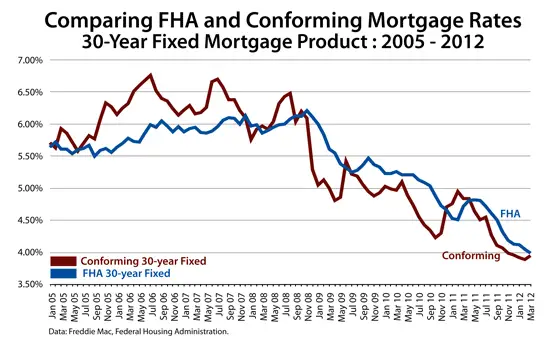

Fha Mortgagerates Vs Conventional Loan Rates

FHA mortgage rates are typically lower than conventionalloan rates, or at least very close to them. But its hard to compare conventionaland FHA interest rates on equal footing because of the difference in mortgage insurance.

FHA mortgage insurance premium costs the same amountfor every borrower: a 1.75% upfront fee and a 0.85% annual fee .

But conventional private mortgage insurance and the interest rate itself are charged on a sliding scale: the bigger your down payment and the higher your credit score, the less youre going to pay.

That means someone with a low down payment but very high credit could likely get a low PMI rate and save money compared to an FHA loan. But someone with the same down payment and bad credit could pay 1.25% of their loan balance per year for PMI more expensive than FHAs 0.85%.

| Loan |

| $1,350 |

Payment assumes $250,000 loan. Rates are for example purposes only. Your rate will be different.

Be sure to compare all your loan options. If your credit is high enough to qualify for a conventional mortgage , look at the total cost of interest and fees compared to an FHA loan, and choose the one with the best combination for you.

Your loan officer can help you compare loan types and findthe best option.

Do Fha Interest Rates Vary By Lender

Yes, FHA loan rates vary by lender, so it can pay to comparison shop. Once youve found a few lenders that seem right for you, compare each one.

If youre approved, each lender will provide you with a Loan Estimate form. This will let you compare not only FHA mortgage rates, but also origination fees, closing costs and everything else youll pay over the life of the loan. Comparing loan estimates from more than one lender will give you confidence that youre getting a good rate and that youre getting the right loan for your situation.

Don’t Miss: Reverse Mortgage For Condominiums

Can 30year Mortgage Rates Go Lower

The short answer is that mortgage rates could always go lower. But you shouldnt expect them to.

The recordlow rates seen in 2020 and 2021 were largely due to the Coronavirus pandemic.

When the economy crashed early on during Covid, the Federal Reserve forced interest rates down to keep money circulating.

In addition, investors tend to purchase mortgagebacked securities during tough economic times because they are a relatively safe investment. MBS prices control mortgage rates and the flood of capital into MBS during the pandemic helped keep rates low.

But those lowrate pressures were never meant to be permanent.

How A 30year Fixedrate Mortgage Works

As its name implies, a 30year fixedrate mortgage or FRM is repaid over a period of 30 years.

This is the most popular mortgage loan product in the U.S., thanks to a few key benefits:

- The interest rate and payment for a 30year FRM are fixed, meaning your rate and monthly payment will never change unless you decide to refinance the loan

- A 30year mortgage has lower monthly payments than a shorterterm loan because your loan amount is repaid over a longer time

- 30year fixedrate loans are available for all major loan types , and from all mainstream lenders

Most home buyers can get a 30year fixed home loan with a down payment of just 3% or 3.5%. And you dont need a perfect credit score to qualify.

Thanks to these perks and todays low interest rates 30year mortgages are an affordable path to homeownership for many.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.

What Are The Advantages Of 30

The 30-year fixed rate mortgage is by far the most popular loan type, and for good reason. The pros of a 30-year fixed mortgage include a predictable, steady monthly payment that never changes since the interest rate never changes. This loan type also has a relatively low monthly payment, compared to shorter term loans. For example, on a 30-year mortgage of $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payment would be about $1,111 . But for a 15-year fixed loan, the payment would be about $2,062. And because the 30-year fixed monthly payment amount is lower than a shorter term loan, it can also help home shoppers qualify for more home.

Recommended Reading: Rocket Mortgage Launchpad

Year Mortgage Rates Chart: Where Are Rates Now

Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic.

Emergency actions by the Federal Reserve helped to push mortgage rates below 3% and keep them low.

But, with the economy in recovery mode, mortgage interest rates have risen since their alltime low in January 2021. And theyre likely to keep rising in 2022.