Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

Calculations For Different Loans

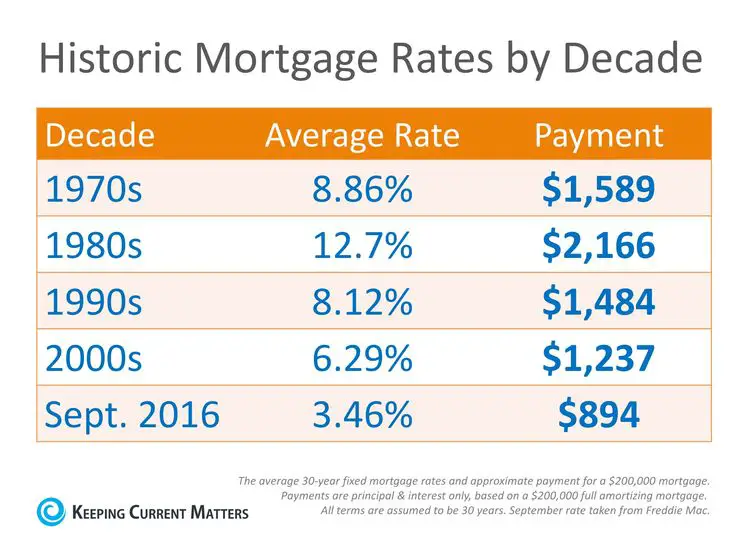

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Don’t Miss: What Type Of Mortgage For Rental Property

How Often Can I Skip Mortgage Payments

| Lender |

|---|

| – |

RBC lets you make a mortgage prepayment that is up to the amount of your regular mortgage payment during your regular payment date. The minimum amount for Double-Up payments is $100, and goes up to 100% of your regular payment amount. The Double-Up payment is used to pay your mortgage principal balance.

Scotiabanks Match-a-Payment allows you to double your regular mortgage payment for any payment. You’ll also be able to increase your mortgage payment by up to 15% once per year.

You can choose to increase your regular TD mortgage payments by up to 100% once every calendar year, up until the increase is equivalent to 100% of your regular mortgage payment. This allows you to double your regular payments.

BMO allows you to increase your regular mortgage payments by up to 20% once per calendar year, or up to 10% for BMO Smart Fixed Mortgages.

You can double your mortgage payments or increase it up to 100% at any time with CIBC.

National Bank lets you make an additional payment on top of your regular payment, which can be up to 100% of your regular payment amount, on each of your regular payment dates.

How To Lower Your Monthly Mortgage Payment

- Choose a long loan term

- Buy a less expensive house

- Pay a larger down payment

- Find the lowest interest rate available to you

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time.

An obvious but still important route to a lower monthly payment is to buy a more affordable home. The higher the home price, the higher your monthly payments. This ties into PMI. If you dont have enough saved for a 20% down payment, youre going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments.

Finally, your interest rate impacts your monthly payments. You dont have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible.

Don’t Miss: Does Charles Schwab Offer Mortgages

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums? Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

How Much Monthly Mortgage Payment Can You Afford

Weve looked at the median monthly mortgage payments, and youve even learned how one is calculated. But now the big question remains: How much mortgage can you afford?

Once youve set a ballpark housing budget, give Churchill Mortgage a call. Not only will they help you get a mortgage the smart way , but theyll also pay close attention to your budget and make sure you can actually afford it. Theyre real friendly folks. Get started with one of their loan specialists today! If youre wondering how much you can afford, dont sit around twiddling your thumbs. Get answers from a trustworthy lender now!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: How Much Usda Mortgage Can I Qualify For

What Is Mortgage Insurance

Mortgages with adown paymentof less than 20% are required to be insured due to the higher level of risk that they carry. This insurance protects the mortgage lender should you default on the mortgage. Mortgage default insurance does not protect you or help you cover mortgage payments.

The largest provider of mortgage loan insurance in Canada is the Canada Mortgage and Housing Corporation , which is owned by the Government of Canada. Some mortgage lenders allow you to go through a private mortgage insurer instead, such as Canada Guaranty or Sagen.

What Is An Accelerated Weekly Mortgage Payment

An accelerated weekly mortgage payment is when your monthly mortgage payment is divided by four and the amount is withdrawn from your bank account every week. With an accelerated weekly mortgage payment, you still make 52 payments per year but the payment amount is slightly more than a regular weekly mortgage payment.

Also Check: How Much Is An Application Fee For A Mortgage

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Read Also: What Is Mortgage Payment On 350 000

What Is An Accelerated Bi

An accelerated bi-weekly mortgage payment is when your monthly mortgage payment is divided by two and the amount is withdrawn from your bank account every two weeks. With an accelerated bi-weekly mortgage payment, you still make 26 payments per year but the payment amount is slightly more than a regular bi-weekly mortgage payment.

Which Payment Schedule Is Right For Me

While it will depend on your specific situation, here are some general guidelines:

- Most people choose to synchronize their mortgage payments with their monthly or bi-weekly paycheck. This will make it easier to budget.

- More frequent mortgage payments will slightly lower your term and lifetime mortgage cost. Accelerated payment frequencies are also available.

You May Like: Can I Get Preapproved For A Mortgage More Than Once

How A Mortgage Calculator Helps You

Determining what your monthly house payment will be is an important part of figuring out how much house you can afford. That monthly payment is likely to be the biggest part of your cost of living.

Using NerdWallets mortgage calculator lets you estimate your mortgage payment when you buy a home or refinance. You can change loan details in the calculator to run scenarios. The calculator can help you decide:

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Read Also: How Much Is Average Mortgage Insurance

Get A Home Mortgage You Can Afford

There are many types of mortgages and they all charge different monthly payment amounts. But dont make the mistake of choosing a mortgage just because it has the lowest monthly payment. If you want to build wealth that lasts, focus on total cost. Hint: The mortgage with the lowest total cost is a 15-year fixed-rate conventional loan. A good gauge to tell if you can afford a mortgage is if the monthly payments are no more than 25% of your monthly take-home pay.

If youre buying a house and need help finding a great home in your price range, be sure youre working with a top-notch real estate professional who can help you find the house of your dreams. Since you want to get a mortgage the smart way, connect with our friends at Churchill Mortgage. Theyll walk with you every step of the way to put you on the best path to homeownership.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Determining The Best Mortgage

Once you have a good idea of what your mortgage payments look like, try using the best Canadian mortgage rates to see how much you can save. Also explore our Mortgage Guides to learn more about mortgage payments and everything else you need to know when it comes to choosing the ultimate mortgage.

*Mortgage payment calculator disclaimer:

The mortgage payment calculator is intended to help you compare different mortgage options and understand your expected payment schedule. However, the mortgage payment calculation should not be used in isolation to influence your mortgage decision-making. Be sure to consult with a mortgage broker or lender about the various mortgage financing and payment options you can take advantage of. We’ll be happy to connect you with a licensed mortgage advisor. The best bet is to first start with analyzing different mortgages, which youcan do on RATESDOTCAhere.

Don’t Miss: Are Mortgage Rates Going Down Again

What’s Not Included In Your Monthly Mortgage Payment

Utilities, homeowners association fees, and condo association fees are not included in the mortgage payment that you pay to the lender.

Youre responsible for setting up your utility accounts and paying those separately. If your home is part of a homeowners association or condo association, you will receive paperwork from the association with payment information. If youre not in a flood zone that requires flood insurance, but you opt to have a policy, this will not be escrowed. If youre required to have flood insurance and your lender is escrowing the regular taxes and insurance, flood will be escrowed too.

How Do Mortgage Payments Work

When you take out a mortgage, youre borrowing money to buy or refinance a home. You make regular payments to repay this loan, usually monthly. The amount you borrow is the loan principal.

With each payment you make, you’ll be paying off part of the principal amount and part of the interest. The interest is what the lender charges for loaning you money to buy a house.

Depending on the type of mortgage you have, your payments are usually consistent in amount and made monthly. In the beginning, the majority of your payments will be used to pay off the interest on your loan. As this amount reduces, more and more of your payments will start applying to the principal the actual amount you borrowed. This means that for the first few years of your loan, your payments are focused on paying off interest rather than principal.

If you apply additional payments to your principal to bring the amount down, the interest paid on the balance goes down as well because interest is calculated based on the principal balance. The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible.

You May Like: Can I Get A Mortgage With A 660 Credit Score

Los Angeles Homebuyers Can Refinance At Historically Low Mortgage Rates Today

The spread of coronavirus caused financial market volatility, with the 10-Year Treasury Notes reaching all-time record lows. Mortgage rates tend to follow 10-Year Treasury movements. Savvy homeowners across the country are taking advantage of this opportunity to refinance their homes at today’s attractive rates.

As Seen In

How To Calculate Your Mortgage Payment

You can calculate your monthly payment manually excluding taxes and insurance by using a standard formula, where M equals your monthly payment, P equals your principal, r is your interest rate and n is the total number of payments:

M = P

With that said, a mortgage payment calculator is the best way to see what you’ll owe each month. It can also be a great way to assess how your down payment affects your monthly payments, which in turn might help you decide how much you’re going to put down.

Here’s what you’ll need to get started:

- Home price

Recommended Reading: How Much Mortgage And Taxes Can I Afford