How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

How Good Is A 640 Credit Score

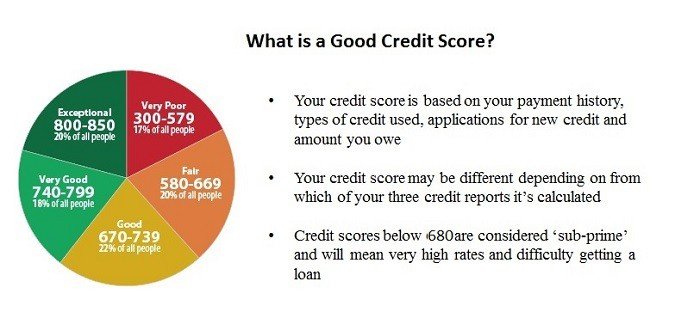

According to FICO, the average credit score in April 2016 was 699, so a FICO score of 640 is below average. Generally, fair credit scores range from 620 to 679. Applicants with a score below 620 are considered high-risk, and will have trouble qualifying for a home loan.

Many lenders set their minimum credit score at 640 or higher. Thats a minimum, which means applicants at the low end, credit-wise, may need to be strong in other aspects, like down payment size, income or assets.

Related

How To Request A Report

There are three major credit-reporting agencies: Equifax, TransUnion, and Experian. You can receive a free copy of your credit report once a year from AnnualCreditReport.com, which gets the reports from each of the three companies.

It is a good idea to get a copy annually so that you can check it for errors. Errors range anywhere from name misspellings and incorrect Social Security numbers to accounts being listed as still open when in fact they have been closed an error that can hurt you when you need to get a mortgage.

Your credit report also will show whether you have been the victim of identity theft. If your personal information, such as your Social Security number, has been changed, the report will reveal it.

You May Like: What To Know About Getting A Mortgage

Can I Get A Home Loan With A Credit Score Of 660

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

What If I Fall Short On Credit Requirements

Potential VA loan borrowers needn’t abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you’re considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If you’re ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

Don’t Miss: Do Multiple Mortgage Applications Hurt Credit

Credit Score: Is It Good Or Bad

A FICO® Score of 660 places you within a population of consumers whose credit may be seen as Fair. Your 660 FICO® Score is lower than the average U.S. credit score.

17% of all consumers have FICO® Scores in the Fair range

.

Statistically speaking, 28% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

Some lenders dislike those odds and choose not to work with individuals whose FICO® Scores fall within this range. Lenders focused on “subprime” borrowers, on the other hand, may seek out consumers with scores in the Fair range, but they typically charge high fees and steep interest rates. Consumers with FICO® Scores in the good range or higher are generally offered significantly better borrowing terms.

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 660 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 41% of Americans with a FICO® Score of 660 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Read Also: What’s The Monthly Payment On A 300 000 Mortgage

Conventional Loan With 660 Credit Score

The minimum credit score requirement to get a conventional loan is 660. In order to qualify for a conventional loan, you will need to meet all other loan requirements. This includes having at least 2 years of steady employment, a down payment of at least 3-5%, and no recent major credit events .

Would you like to find out if you qualify for a conventional loan? We can help match you with a mortgage lender that offers conventional loans in your location.

Fha Credit Score Requirements May Vary

The credit scores and qualifying ratios weve mentioned in this post so far are either the minimums required by Rocket Mortgage® or the FHA itself. Other lenders may have their own requirements including, but not limited to, higher FICO® Scores or a larger down payment.

In any case, we encourage you to shop around for the best loan terms and make sure youre comfortable before moving forward.

Read Also: How Much Do I Have Left On My Mortgage Calculator

Correct Errors On Your Credit Report

Correcting errors on your credit report is a relatively quick way to improve your credit score. If its a simple identity errorlike a credit card thats not yours showing upyou can get that corrected within one to two months. If its an error on one of your accounts, though, it could take longer, because you need to involve your creditor as well as the credit bureau.

The entire process typically takes 30 to 90 days. If theres a lot of back-and-forth between you, the credit bureau, and your creditor, it could take longer.

The first step to correcting errors is to get a copy of your free credit reports from TransUnion, Equifax, and Experian . You can do this at no cost once a year at annualcreditreport.com.

Next, review your credit report for errors. If its an error on one of your accounts, you must refute that error with the bureau by providing documentation arguing otherwise. For example, if you paid a credit card on time and the card issuer is reporting a late payment, find a bank statement showing that you paid on time.

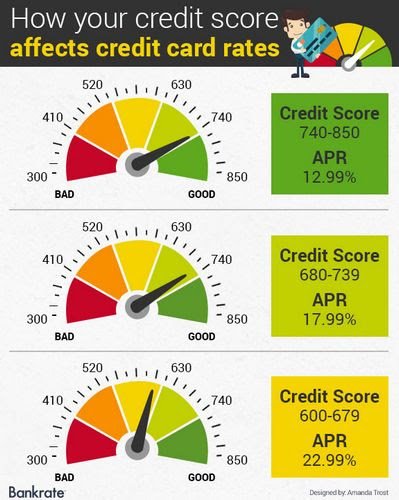

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Don’t Miss: Can My Wife Get A First Time Buyer Mortgage

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

Is 650 A Good Credit Score

On the FICO® Score scale range of 300 to 850, higher scores indicate greater creditworthiness, or stronger likelihood of repaying a loan. A FICO score of 650 is considered fairbetter than poor, but less than good. It falls below the national average FICO® Score of 710, and solidly within the fair score range of 580 to 669.

You May Like: How To Get The Best Interest Rate On A Mortgage

What Is A Good Mortgage Interest Rate

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

Va Credit Score Requirements 2021

While the VA itself doesnt set a required minimum credit score for a VA loan, most mortgage lenders will want to see a credit score above 620 FICO. Some lenders may go lower, but borrowers often incur additional scrutiny and lender requirements.

At Veterans United Home Loans, we typically look for a credit score of 640.

If your credit isn’t quite up to par, don’t worry. We’ve got a team of credit consultants to work to improve your credit score no strings attached.

Start your VA loan with Veterans United and see if your credit qualifies you for a VA loan.

Read Also: Can You Refinance Mortgage With Poor Credit

How Can I Check My Credit Score Before Applying For A Mortgage

Equifax and TransUnion are the two credit reporting bureaus in Canada. They both charge you to view your credit score. Free online alternatives are available, such as Credit Karma, Borrowell, and Mogo, as well as at some major banks. For example, RBC, CIBC, and BMO all allow you to view your credit score for free online.

Your credit report contains a list of inquiries made by lenders. TransUnion allows you to view your credit report for free once every month, whileEquifax Canadaalso allows you to request your credit report for free.

Is 680 A Good Credit Score

FICO puts a 680 credit score in the good range. That meansa 680 credit score is high enough to qualify you for most loans.

However, while 680 is a good credit score, its not themost competitive one.

What do we mean by that?

Well, in the second quarter of 2020, the median credit score for new mortgages was 784. And about 75% of mortgage borrowers had a credit score above 700.

So when mortgage lenders are looking at a 680 credit score,theyll typically see it as good enough to qualify you for a loan but nothigh enough to offer ultra-low rates.

That means its extra important to shop around with a fewdifferent lenders before deciding on a mortgage loan.

All lenders evaluate credit a little differently, and some arespecifically geared toward borrowers with moderate credit scores.

One of these companies will be able to offer you a lowerrate than a lender that prefers borrowers with scores in the mid- to high-700s.

Also Check: What Is The Mortgage On 1.4 Million

What Does A 660 Credit Score Get You

| Item |

|---|

| 88% |

As you can see, most people who are at least 35 years old have a credit score of 650 or higher. And even younger folks nearly have a majority. This just goes to show that people with 650 credit scores come in all shapes and sizes, with diverse backgrounds and differing financial obligations.

As a result, the grades for each component of your credit score, which you can find on the Credit Analysis page of your free WalletHub account, might not exactly match those of another individual with a 650 score. But the sample scorecard below will give you a pretty good idea of what a 650 score is made of.Sample Scorecard 660 Credit Score:

- Payment History: C = 98% on-time payments

- B = 10% – 29% utilization

- Debt Load: A = Debt-to-income ratio below 0.28

- Account Age: B = Average tradeline is 7 or 8 years old

- Account Diversity: C = 2 account types or 5 – 9 total accounts

- Hard Credit Inquiries: A = Fewer than 3 in past 24 months

- Collections Accounts & Public Records: A = 0 collections accounts and public records

These are by no means the only credit-score grades capable of producing a score of 650, nor will they necessarily result in that exact rating. However, this is representative of the type of scorecard someone with a 660 credit score can expect: plenty As and Bs, but no failing grades to be found.

Fha Lenders Dont Always Follow Fha Credit Score Minimums

Banks and mortgage companies that offer FHA loans are not required to follow FHA guidelines to the letter.

These are private, for-profit companies that simply approve loans based on guidelines provided by a government agency, namely the Federal Housing Administration, or FHA.

Most if not all lenders across the country impose tougher guidelines for FHA loans than does FHA itself. It doesnt seem to make a lot of sense until you realize that FHA penalizes lenders for approving too many bad FHA loans.

Yes, FHA actually penalizes lenders if they approve borrowers who default months and years later, even if the loan fits perfectly within FHAs published guidelines.

Heres an example.

A borrower applies for a loan and is approved based on FHAs guidelines. Six months later he loses his job and can no longer make his monthly payments. FHA records that bad loan on the lenders record.

Too many bad loans and FHA could revoke the lenders ability to offer FHA loans. That could put some mortgage companies out of business.

Statistically, borrowers with lower credit scores default more often. Thats why most lenders require a higher minimum credit score than does FHA.

Here are credit score minimums as stated by FHA:

Most lenders require a score of at least 620-640. But that number could drop closer to FHAs published minimums because of the new policy.

Don’t Miss: What Is The Mortgage On 800k

How To Fix A 660 Credit Score

If you can wait just three to six months for a loan, theres a good chance you can increase a 660 credit score into that prime lending range and get even lower rates. I realize this isnt always possible for most people but its something to consider.

One option would be to get a debt consolidation loan now to pay off your credit cards and immediately start saving on interest. This might be enough to hold you over until your credit score is higher and you can refinance your loan at a lower rate.

In fact, a debt consolidation loan alone can be enough to boost your credit score. Thats because you pay off credit card balances, which the credit score companies hate, and replace it with non-revolving debt with a fixed payment and payoff date.

A few other ways to boost your credit score that last mile include:

- Paying down your high rate debt with the debt snowball or avalanche method.

You wont be able to see your credit score when getting your free annual credit report but most credit cards offer free score monitoring as a bonus. Youll get monthly updates any time your FICO increases and will know exactly when to apply for a loan.

Having a 660 credit score isnt quite good credit but it isnt bad credit either. Youre so close to getting any loan approved and the best rates that it wont be more than a few months until youre there. Consider a small personal loan if you absolutely need the money now and then refinance it or pay it off when your credit score increases.