Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

What Does This Possibly Mean For Me

Based on your income, expenses, and the loan you selected, the amount above represents the most you will likely be comfortably able to pay for a home. This assumes that your total costs for your loan payments , taxes, and insurance should not be higher than 45% of your monthly income. Also, remember that you’ll have additional homeownership costs that you may need to factor into your monthly budget, including insurance, association fees, and maintenance expenses.Mortgage insurance expenseswhich you may have to pay if your down payment is less than 20%are not included in this calculation. We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search.

You selected an adjustable rate mortgage or ARM. Based on your income, expenses, and the loan you selected, the amount above represents the most you can comfortably afford to pay for a home*. This assumes that your total costs for your loan payments , taxes, and insurance should not be higher than 45%. Also, remember that you’ll have additional homeownership costs that you may need to factor into your monthly budget, including insurance, association fees, and maintenance expenses. Mortgage insurance expenseswhich you may have to pay if your downpayment is less than 20%are not included in this calculation. We suggest that for all buyers to get pre-qualified prior to starting their new home search.

Documentation Required To Get Pre

To get a full pre-approval, youll need to be prepared to provide the following documentation:

- Pay stubs Youll need to provide your most recent pay stub, which must show your year-to-date earnings. Youll need a pay stub for each job you have, and for each person applying for the pre-approval.

- W2s Many mortgage lenders will require your W-2 for at least the most recent calendar year. However, some lenders may require them for the past two years.

- Completed, signed income tax returns Youll need to provide these if youre self-employed, or have substantial real estate, investment, or partnership income. They should include all pages of IRS Form 1040, including schedules.

- Asset statements For bank accounts or taxable investment accounts, youll need to provide statements covering the most recent two months, or the most recent quarter. For retirement accounts, youll need to provide something similar.

- Gift information If some or all your down payment will come from a gift, youll need to provide the amount of the gift, when it will be available, who the donor will be, and what their source of funds for the gift will be. The lender will likely request that the donor complete a formal mortgage gift letter, that will request specific details.

- This can usually be satisfied by providing your drivers license. In some cases, the lender may request a copy of your Social Security card. These documents will be requested to verify your identity for federal compliance purposes.

You May Like: Are Discount Points Worth It

How The Mortgage Pre

This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for. But please understand its a calculator only, and the official number will be determined by a mortgage lender.

In addition, the validity of the results youll get from this mortgage prequalification calculator will only be as good as the information you input. For that reason, be as accurate as you can be. If you inflate any information, like your annual income or your credit score range, you may get a higher loan amount, only to get a smaller pre-approval amount from an actual mortgage lender.

The mortgage pre-approval calculator is self-explanatory, but heres a general overview.

How Do I Pre

You will need to gather some important basic financial information before you can complete the mortgage affordability and pre-qualification calculator. This includes your total monthly income before taxes plus your total monthly debt payments .

Once you have your most current information gathered, enter your income and debt totals in our mortgage affordability and pre-qualification calculator. You will also need to have a basic idea of what type of mortgage financing you would like to have. Start by choosing your preferred mortgage loan term and the associated interest rate that you expect to obtain. Then enter the state in which you are looking to purchase. Finally, you will need to enter the percentage that you plan to put as a down payment. Remember, the down payment is an up-front payment, so you need to have that cash readily available.

You May Like: Rocket Mortgage Launchpad

Stay In Touch With Your Broker

Stay reachable, in case your mortgage broker has any questions about your documentation. This means avoiding vacations or business trips where you wonât have access to email or phone. If you arenât available, they may make assumptions about your intent, and reject your mortgage pre-approval. If you absolutely must leave town, make sure to inform your mortgage broker in advance.

Use The Mortgage Affordability Calculator To Help Determine What You Could Pre

Getting pre-qualified for a mortgage is an informal way for you to get an idea of how much you can afford to spend on a home purchase. Mortgage pre-qualification is an important first step for anyone who is considering buying a home and is unsure if they are financially ready. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan as well as tell you the maximum amount you can afford and how much you can be pre-qualified to borrow.

Results

Recommended Reading: Rocket Mortgage Loan Requirements

My Monthly Rbc Mortgage Payment Will Be

$0*/month

The mortgage amount is based on the qualifying rate of%.* The payment amount is calculated based on an interest rate of %.

View Legal DisclaimersHide Legal Disclaimers

Enter your annual household salary. This includes your spouse/partner.

Consider car payments, credit cards, lines of credit and loan payments. This should not include your rent.

Enter the amount of money you plan to use as a down payment. Donât forget you can also leverage your RRSPs.

The Home Buyers’ Plan allows you to borrow funds from your RRSP to purchase your first home. Here are some of the key facts:

- You and your spouse can each withdraw up to $35,000 from your RRSP.

- The funds must have been on deposit at least 90 days before you withdrew them.

- At least 1/15 of the funds must be repaid each year, beginning two years after the funds were withdrawn.

- A signed agreement to buy or build a qualifying home is required.

- You can only participate in the program once.

For details,watch this video or seeCanada Revenue Agency

Default insurance covers the lender in case of a failure to pay off the full mortgage amount. If your down payment is from 5-19%, a default insurance premium will automatically be applied to your mortgage.

Other monthly expenses you may want to consider include such items as alimony and condo fees .

How To Determine How Much House You Can Afford

- Make basic calculations.

Fha loan income requirementsCan you make too much for a FHA loan? There are no minimum or maximum income requirements for an FHA home loan the rules don’t say you can make too much money to qualify for an FHA loan. In terms of minimum amounts, the rules place more emphasis on the borrower’s ability to pay the mortgage.Is FHA a good loan?An FHA loan is an excellent option for buyers who do not qualify for a regular mortgag

Don’t Miss: Rocket Mortgage Loan Types

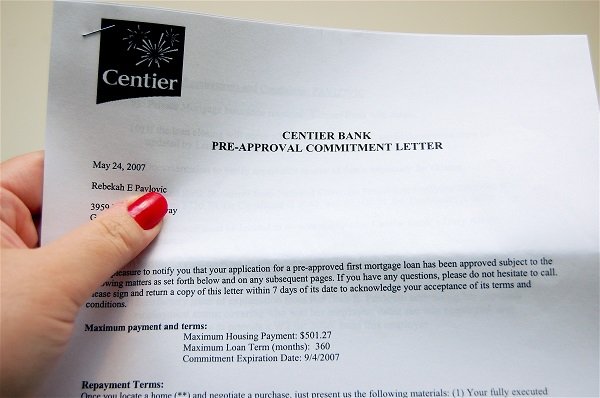

How A Mortgage Pre

When youre looking for a home, particularly in todays competitive market, having a mortgage pre-approval letter in hand can give you an edge over the competition because:

- It shows youre serious about buying a home

- It demonstrates that youre prepared to move fast

- It proves you can afford the offer you made

- It means you can close on the property soon

Pre-approval letters are good for a limited time just 60 days but you can get a subsequent pre-approval if yours expires while youre still shopping.

You can also get an amended pre-approval letter for a lower amount to match an offer if you dont want the seller to know what your loan limits are.

When youre ready to secure a mortgage pre-approval letter to get serious about buying a home, come to Get A Rate for a rapid pre-approval in about ten minutes or call 562-2611.

Overcoming Common Challenges To Qualify For A Mortgage

The three most common barriers to homeownership are:

If you get rejected for a mortgage based on any of these three factors, it may feel like all is lost. However, it may be possible to overcome these challenges, often in less time than you might think.

You May Like: Can You Refinance A Mortgage Without A Job

Do You Have To Be Debt

You don’t need to be in debt to buy a home, but getting a loan can be difficult if you have too much debt. Calculate your DTI and compare your monthly debt to your gross income. Pay off more of your debt before buying a home if your DTI is over 50%.

Mortgage stimulus program 2021How much does a mortgage stimulus program cost? With this new service, homeowners can earn $271 per month* or $3,252* per year! Banks don’t want homeowners to know about these programs because this simple, government-sponsored solution can dramatically lower mortgage payments.When does The homeowner relief stimulus program end?INCENTIVE PROPERTY SECURITY: New 2021 mortgage recover

Required Documents For Mortgage Preapproval

When preparing for a meeting with a loan officer or mortgage broker, there are a number of important documents to bring with you to make the pre-approval application process go smoothly. The fewer delays in the process the better, and the sooner you can turn your attention to shopping for the home of your dreams.

Getting Pre-approved & Receiving Your Good Faith Estimate

Ultimately, if you qualify for pre-approval, you will be receive a letter from the lender an/or underwriter which confirms your eligibility for a home loan with details concerning the loan program for which you have qualified, the loan amount, the terms of the mortgage, and the qualifying rate. Keep in mind that this is only a good faith estimate, and much can change between the receipt of a pre-approval confirmation and your application for a proper mortgage. A mortgage or home loan pre-approval typically has a shelf life of no more than 90 days, after which sellers will expect more current confirmation and you will have to go through the process again.

Don’t Miss: Rocket Mortgage Payment Options

How To Evaluate A Fha Mortgage Loan

- FHA mortgage. Instead, they are assigned by private lenders and then guaranteed by the FHA.

- Cheap loans. The main advantage of these loans is the lower interest rate.

- Low down payment loans. For qualified applicants, the down payment on these loans can be up to

- Less flexible

- Long application procedure.

How To Get A Mortgage Pre

You can get a mortgage pre-approval from amortgage brokeror directly from most lenders. You will likely have to provide detailed information about your financial situation and verify your income. Documents needed could include bank statements, a verification of employment, your credit report, and your previous tax assessment. Think of it like applying for a mortgage – in order for your lender to give you an accurate estimate, they will need to know whether you can handle the expenses of a mortgage.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Understanding What A Prequalification Is

A mortgage prequalification is something you work through with a lender or bank. Going through the process will help the lender determine if you have the necessary criteria in terms of income, credit, and debt. It can be an eye-opening step to not only deem if you are ready to buy, but how much you can actually spend.

How To Get Pre

To get pre-approved, youll need to apply directly through a mortgage lender. Most likely, youll need to be in contact with a live mortgage representative. But, the application process is increasingly taking place online.

If youre looking for an online mortgage experience that can do a lot of the work for you, check out Reali Loans. They guarantee a quick process, and theyll tell you what youre missing for documents on day one, so you only have to gather documents once .

In general, once you submit your application and required documentation, your application will go through the loan approval process. Youll make the process easier by having all your information and documentation gathered before making an application.

Once you submit, youll be halfway through the home buying process before you even put an offer in on a home.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

How Long Does Preapproval Last

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Dont Trust Just Any Mortgage Affordability Calculator

There are lots of home affordability calculators online that look at your income, debt, and down payment to tell you what you can afford.

These are over-simplified and rarely reflect what you can afford and what you would be approved for by a mortgage lender.

Pre-approval letters are much more accurate, and you can get one fast if you know the best solution.

With Get A Rate, you can get started in less than eight minutes and be ready to shop for your home with no delays.

Recommended Reading: What Does Rocket Mortgage Do

What Amortization Should I Input Into The Calculator

The calculator allows you to choose an amortization from 5 years to 25 years. Lenders will qualify you for a mortgage based on 25 years unless you have 20% down or more.

For the purposes of this calculator, the maximum amortization you can choose is 25 years.

If you have 20% down or more and want to know how much you qualify for based on a 30 year amortization, then complete the contact details in the middle of the calculator. We can connect and review your numbers.

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

Read Also: Rocket Mortgage Qualifications

What Is The Difference Between A Pre

You may wait with bated breath to receive word from your lender that youve been pre-approved for a mortgage. And even though your pre-approval isnt a guarantee you’ll receive a loan, its a firm step toward that goal. If you want to estimate your approval for a mortgage, you can walk yourself through some of the same preliminary steps that your lender will take. Your estimate may differ from your mortgage lenders pre-approval, but it could offer you insight into the mortgage loan amount you may be eligible to receive.

How Is My Credit Score Determined

Your credit score demonstrates to lenders how risky of a borrower you are. Your score will gradually rise over time if you pay your bills and debts on time. However, it will drop significantly if you miss a payment.

Other factors that harm your credit score include:

- Applying for too many loans and receiving multiple âhard credit checksâ

- Not having a credit history

In Canada, there are multiplefree services to check your credit score.

Also Check: What Does Gmfs Mortgage Stand For

What Should I Input For The Credit Card & Loc Balances Section Of The Mortgage Pre

For this section of the calculator add up all outstanding balances that you keep on your credit cards or lines of credit each month.

If you use your credit cards and pay them off to zero each month, then type in “0”. If you pay off your credit cards but keep a balance on your line of credit of $5,000 then add “5000” to this section.

The calculator will determine the minimum payment that you are required to make based on the balance that you input. The qualifying mortgage amount is then calculated based on all the input including your credit card and line of credit debt.

You will noticed that you can have a credit card balance without any effect on the approved mortgage amount. Once you increase the balance over a certain number, then qualifying mortgage amount decreases.

Play around with the numbers, it’s fun to see how different revolving balances will change the results.