How Much Can I Save Comparing 5

Your mortgage is likely to be the largest financial commitment youâll ever make, and getting a better rate can save you thousands of dollars over a 5-year term. Even a slightly lower mortgage rate can result in big savings, especially early on in your mortgage.

For example, on a $500,000 mortgage with a 25 year amortization period, a rate of 3.00% would see you pay $69,347 interest over 5 years. With a 2.75% rate, youâd pay $63,454 interest over the term. So, a difference of just 0.25% can save you $â5,893⬠over your 5-year term.

Should You Lock A Mortgage Rate This Week

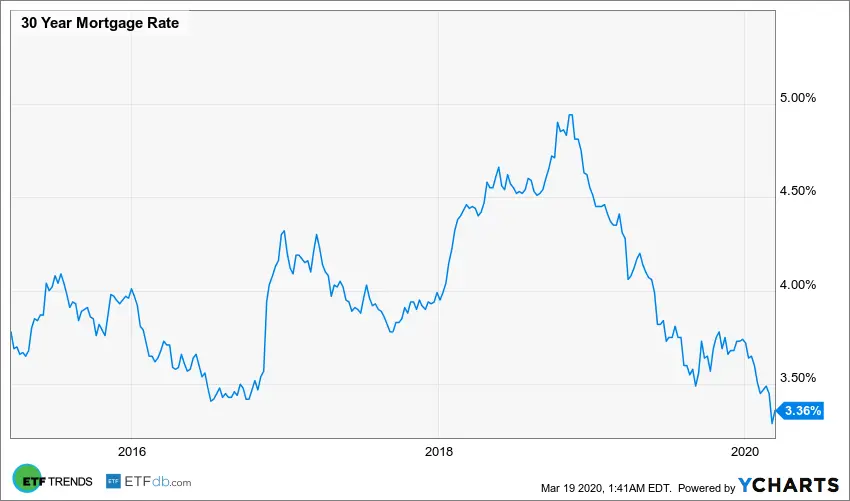

Some believe the coronavirus will continue to nudge mortgage rates downward.

If you agree, you might wait to see lower rates before locking one in.

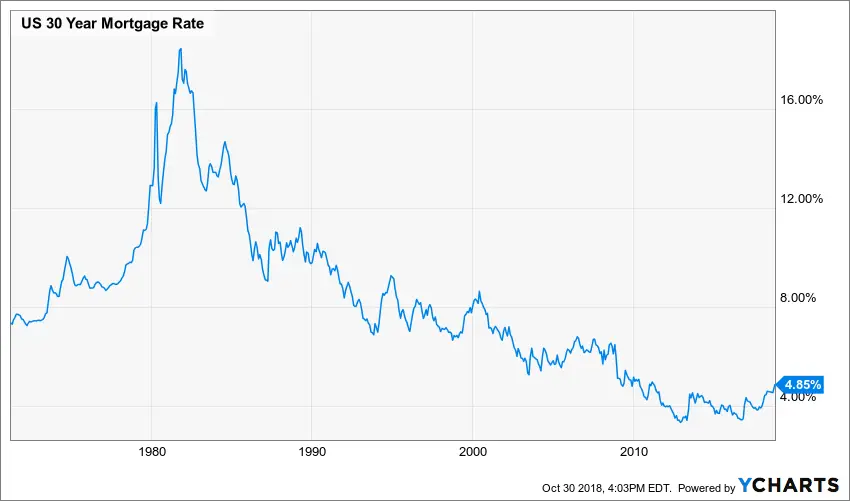

More conservative borrowers might decide that by locking now, they can secure a rate almost unheard of in US mortgage history.

Even if rates edge down a bit more, a mortgage rate on par with what weve seen this week puts you in a very good position.

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

You May Like: Are Mortgage Discount Points Worth It

Mortgage Life Insurance Premiums

| Age |

|---|

| National Bank Life Insurance Company | $150,000 |

Similar to mortgage life insurance, your cost of critical illness insurance is based on the insured mortgage balance. For example, if your premium rate is $0.45 per $1,000 of mortgage balance, and your mortgage balance is $500,000, then your cost of disability insurance will be $225.00 per month.

If your maximum coverage amount is less than your mortgage balance, then your mortgage balance is only partially covered. Once your mortgage balance falls below the maximum coverage amount, then your mortgage balance will begin to be fully covered.

For example, National Banks critical illness insurance has a maximum coverage of $150,000. If you have a mortgage balance of $500,000, your insured amount is $150,000. You are only charged insurance premiums on the insured amount of $150,000, not your full mortgage balance of $500,000. Your insured amount will decrease as your mortgage balance decreases.

Insurance benefits and payouts are not taxable. This means that if you are eligible for a critical illness claim and your insured amount was $150,000, then a maximum of $150,000 will go towards paying down your mortgage balance.

What Loans Do Home Buyers Choose

Across the United States 88% of home buyers finance their purchases with a mortgage. Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans, with 6% of borrowers choosing a 15-year loan term.

| Loan Type |

|---|

Source: Freddie Mac’s 2016 home buyer statistics, published on

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Can You Get A 30

While 30-year mortgages do exist in Canada, most mortgages are limited to a 25 year amortization period . This is because mortgages that require CMHC insurance coverage have a 25-year maximum.

Keep in mind that a longer amortization period is not always better. While taking a long time to pay off your mortgage will reduce your monthly payments, it will also increase the amount of overall interest you will pay. Its important to consider both your current situation as well as your long term finances.

In order to get a 30-year mortgage in Canada, youll need to have whats known as a low-ratio mortgage, which wont be subject to the CMHC rules.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: Who Is Rocket Mortgage Owned By

Fixed Versus Adjustable Rate Loans

On a fixed rate mortgage, the interest rate remains the same through the entire term of the loan, rather than the interest rate doing what is called float or adjust. What characterizes a fixed rate mortgage is the term of the loan and its interest rate. There are a number of popular fixed-rate mortgage loan terms: the 30-year fixed rate mortgage is the most popular, while the 15-year is next. Other loan terms tend to be quite rare in comparison. People paying off smaller loans may want to try to pay them in 10 years, while people with pristine credit who are afforded credit cheaply could choose to extend their credit out to a 40-year or 50-year term. Those who want to remain highly levered & have other financial assets to back their position may opt for interest-only or balloon mortgages.

In the United States fixed-rate mortgages are the most popular option. In many other countries like Canada, the United Kingdom & Australia adjustable rate loans are the standard. If a large portion of the economy is structured into variable rate loans or interest-only payments, then if the housing market gets soft it can create a self-reinforcing vicious cycle where rising interest rates spark further defaults, which then reduces home prices & home equity, driving further credit tightening & defaults..

Explore Your Options

Use our free calculators to compare loans with different lenghts or compare fixed, adjustable & interest-only mortgages side by side.

Calculating Your Actual Monthly Payment

Your monthly mortgage payment depends on your interest rate, loan amount, and loan term. Before going under contract on a home, spend some time with a mortgage calculator, experimenting with different mortgage terms.

If you cant afford the payment on a 10-year or 15-year mortgage, consider going with a 20-year or 30-year term which will offer lower monthly payments.

As you consider these estimates, remember that your actual monthly payment will likely be higher than the calculator shows because of extra charges such as:

- Homeowners insurance premiums: Most loan servicers let you pro-rate your annual homeowners insurance premiums into 12 installments added to your mortgage payment. This money goes into escrow and will be ready when your homeowners policy comes due.

- Local property taxes: Loan servicers will also collect your annual city or county property taxes as monthly installments paid into escrow.

- Mortgage insurance premiums: Depending on your loan type and down payment size, you may need to buy mortgage insurance which provides protection for your lender in case you default on the loan.

- Other fees: Its possible to add homeowners association dues or home warranty premiums onto your monthly mortgage payment.

Its common for homeowners to pay several hundred dollars in taxes, premiums, and fees each month in addition to the actual mortgage payment which goes onto the real estate debt.

Recommended Reading: Chase Mortgage Recast

The Chinese Real Estate Bubble

In China’s booming real estate market it is not uncommon to falsify income statements to qualify for unaffordable loans, hoping to gain from further property price appreciation.

Rapid urbanisation, combined with unprecedented monetary easing in the past decade, has resulted in runaway property inflation in cities like Shenzhen, where home prices in many projects have doubled or even tripled in the past two years. City residents in their 20s and 30s view property as a one-way bet because theyve never known prices to drop. At the same time, property inflation has seen the real purchasing power of their money rapidly diminish. … The lesson was that if you dont buy a flat today, you will never be able to afford it, Wang, 29, said.

Real estate fraud is so widespread in China it typically goes unpunished.

The motive for widespread mortgage fraud is simple: fear of missing out. Millions of homeowners are enjoying the sensation of ever-expanding wealth. The average value of residential housing in China more than tripled between 2000 and 2015 as a huge property market emerged from the early decades of economic reforms.

The boom in property prices across tier 1 Chinese cities has made much of the rest of the world look cheap to Chinese investors. Bond market manipulation by central banks have coupled with hot money from China promoting real estate bubbles in Hong Kong, Vancouver, Toronto,San Francisco, Melbourne, Sydney, London and other leading global cities.

Paying Down Loans: Amortization

When we talk about mortgages, such as 30-year mortgages or 50-year mortgages, were talking about how long it will take to pay them off. With each monthly payment, you pay some interest, and you repay part of the loan balance. With a 50-year mortgage, your final payment in year 50 will completely pay off the loan.

The process of paying down a loan is called “amortization.”

When you change some part of a loan , you change how quickly it will amortize. By lengthening the time frame, the loan amortizes more slowly.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

What Kind Of Mortgage Should You Really Get

First off, lets make something clearthe sooner you can pay off your mortgage, the sooner you can feel the weight of the loan lifted, free your budget, and officially own your home!

We believe everyone can have this kind of financial freedom, which is why we only recommend the best mortgage option out there: the 15-year conventional mortgage. Youll save thousands in interest and youll get out of debt faster.

You dont have to put yourself in debt for 50 years just to own a house! You can get a home the right wayby getting out of debt now, building an emergency fund of six months of expenses, and saving at least a 10% down payment . With this financial foundation in place, youll be ready to take out a mortgage with a monthly payment thats no more than 25% of your take-home pay.

If you want to get a mortgage the right way, talk to a mortgage professional you can trust. Check out Churchill Mortgage. Theyve helped thousands of people just like you finance their homes without using a 50-year mortgage. Churchill takes pride in educating first-time homebuyers and helps them make wise decisions about the biggest purchase theyll ever make.

About the author

Ramsey Solutions

Why Are Fixed Rates Different To Variable Rates

You can think of the difference between variable and fixed mortgage rates as the price of insurance that mortgage costs will not increase during your term. Fixed rates transfer the risk of a rate rise onto your lender. It makes up for this increased risk by setting different rates for fixed-rate mortgages, as well as by charging a larger prepayment penalty on fixed rates.

The advantage of fixed-rate mortgages is that you know exactly how much your mortgage payments will be regardless of whether rates rise or fall. You can, essentially, set it and forget it. This eases the budgeting anxiety that may accompany a variable-rate mortgage.

On the other hand, as is the case with all fixed mortgage rates, there is the potential to pay higher interest when variable rates are low. Examined historically, variable rates have proven to be less expensive over time.

You May Like: What Information Do You Need To Prequalify For A Mortgage

What Affects Your Mortgage Rate In Canada

There are a few different types of mortgage interest rates in Canada: Fixed interest rates, variable interest rates, or a hybrid combination of the two. These mortgage rate options will affect how your interest rate changes over time. Your mortgage rate will also be affected by certain factors that your mortgage lender will look at.

You Can Start Building Equity And Refinance Later

Some people want to buy a house, but they arent in good enough financial shape to qualify for a 15-year conventional loan. So they sign up for a 50-year mortgage and hope their circumstances will change.

Maybe they think theyll get a promotion and refinance the home later or theyll build equity and sell the house when the market is hotter. They plan to make small payments now, then one large payment later.

Folksthis is broke peoples logic!

If you cant afford a house now, you should rent. Period. Its not a waste of money. Its a chance for you to pay off your debt, save for a strong down payment, and get financially ready for a better mortgage. Read on to learn why a 50-year mortgage is such a bad investment.

Also Check: Who Is Rocket Mortgage Owned By

Using A Mortgage Broker

With many lenders to choose from, you may decide to get a mortgage broker to find loan options for you. See using a mortgage broker for tips on what to ask your lender or broker.

Mai and Michael get the best deal on a home loan

Mai and Michael are looking to buy a $600,000 apartment. They’ve saved a 20% deposit and want to borrow $480,000 over 25 years.

They check a comparison website to compare:

- interest rates â variable versus fixed

- fees â application fee, ongoing fees

- features â basic versus extra

Ticking different boxes on the website, they look at loan options to see how the cost varies. Given interest rates are low, they decide to go with a variable rate. Plus they want to be able to make additional repayments. Using these as filters, they review loan options.

They repeat the process with another comparison website.

Then, using the mortgage calculator, they compare the impact of different interest rates over 25 years.

Based on their research, they shortlist loans from two lenders. They approach each lender to get a written quote personalised for their situation, then choose the best loan.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Recommended Reading: Does Pre Approval For Mortgage Affect Credit

Have You Ever Heard Of A 60

Q: Have you ever heard of anyone financing a 60 year mortgage?

A: For a time during the great real estate boom, when home prices were skyrocketing and mortgage products designed to “improve affordability” were all the rage, we did see some unusually long terms for mortgages. However, the longest such offers were usually 40 years.

What Drives Mortgage Term Choices

When interest rates are low home buyers have a strong preference for fixed-rate mortgages. When interest rates rise consumers tend to shift more toward using adjustable-rate mortgages to purchase homes.

The advantage of a 50-year loan over a 30-year loan is a slightly lower monthly payment. The disadvantage is payments need to be made for another two decades & the monthly savings are not very high – slightly more than $100 a month on a typical home at current interest rates.

The cons of a loan that lasts decades longer & has over double the total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount.

The following table shows loan balances on a $200,000 home loan after 5, 10, 15, 20, 25, 30, 35, 40, 45 & 50 years for loans on the same home.

| Mortgage Type | |

|---|---|

| $262,451.12 | $126,334.03 |

Please note the above used interest rates were relevant on the day of publication, but interest rates change daily & depend both on the individual borrower as well as broader market conditions.

The above calculations presume a 20% down payment on a $250,000 home, any closing costs paid upfront, 1% homeowner’s insurance & an annual property tax of 1.42%.

50-year mortgages are available in the United States using both fixed & adjustable rates, although mortgages with a loan duration longer than 30-years are relatively uncommon.

Don’t Miss: Reverse Mortgage Mobile Home