Your Loan Terms May Change

When you get a cash-out refinance, you pay off your original mortgage and replace it with a new loan. This means your new loan may take longer to pay off, your monthly payments may be different or your interest rate may change. Be sure to look at the Closing Disclosure from your lender and analyze your new loan terms.

How Much Equity Do I Need To Get A Cash

The amount depends on the type of mortgage and the lenders refinance requirements. Heres a ballpark answer: Say closing costs are somewhere around 5%. That may be a little high in some cases, but it gives us a margin of error. With a lender that will write a cash-out refi up to 80% of your homes value, youre likely going to need a 75% loan-to-value ratio just to cover the costs. And thats before you pull any equity out.

What Are The Cons Of Cash

Risk of foreclosure. If you fail to repay the loan, your home is on the line and you could end up losing it. Dont increase your risk by taking out more cash than you need.

Private mortgage insurance . If you withdraw more than 80% of your homes equity, youll have to pay for PMI even if youve already canceled it.

Increased interest rate. When you do a cash-out refinance, your new mortgage will have different terms than your original loan. This means you could end up with a higher interest rate.

Closing costs. Like with a standard refinance, youll have to pay closing costs with a cash-out refinance.

Enables bad financial habits. Using a cash-out refinance to pay off credit cards or book lavish vacations can give you a false sense of security to live beyond your means. If youre struggling with debt or to control your spending habits, consider reaching out to a non-profit credit counseling agency.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

How Much Can You Get From A Cash

The best cash-out lenders typically offer these three common mortgage programs:

Conventional loans. With guidelines set by Fannie Mae and Freddie Mac, youll be able to borrow up to 80% of your homes value. A bonus: You wont pay mortgage insurance, which provides lenders with financial protection if you default on your home loan.

FHA loans. Backed by the Federal Housing Administration , FHA loans allow you to borrow up to 80% of your homes value with credit scores as low as 500. The catch: Youll pay expensive FHA mortgage insurance regardless of how much equity you have.

VA loans. Designed for eligible military borrowers, the U.S. Department of Veterans Affairs guarantees cash-out refinance loans up to 90% of the homes value.

What Higher Rates Mean For You

Fortunately, mortgage rates shouldnt get too out of hand in 2022 at least by historical standards.

Are suddenly going to get to a place where theyre going to start hurting affordability in the housing market or spike to uncontrollable levels? I dont think so, he says. As long as wages and salaries continue to go up, thats going to wash out any hit that we would take from an affordability standpoint.

Keep in mind: Economic conditions are always in flux, so these are just projections. Get in touch with a mortgage advisor in your area for the latest conditions and to stay on top of rates in your local market.

Recommended Reading: Rocket Mortgage Loan Requirements

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas mortgage rate marketplace and our latest state-specific guides.

About the author:

Read More

What That Forecast Got Correct

I look at that year-ago prediction in two ways. The forecasters were wrong in their aggregated prediction that mortgage rates would stay about the same. But they were right about something more important: that rates, when averaged for the year, wouldn’t be higher in 2021 than in 2020.

That prediction wasn’t exactly bold, but it wasn’t intuitive, either. Mortgage rates were low in 2020, with little room to go down and a lot of room to go up. The COVID-19 recession looked like it was ending, and vaccines were on the way. An economic recovery would tend to push mortgage rates higher.

But mortgage rates didn’t move much in 2021 until they turned upward in late September. The forecast is for them to assume an upward trend throughout 2022.

Also Check: Recast Mortgage Chase

Todays Conventional Loan Interest Rates

Mortgage rates are currently resting near record lows, and conventional loans are no exception. Heres how todays conventional loan rates compare to FHA and VA mortgages*:

| Loan Type | |

| % | % |

*Interest rate and APR represent the lowest rate from The Mortgage Reports’ lender network on December 23, 2021. Your own rate will vary. You can get a custom rate quote here.

What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

Pros And Cons Of A Cash

As with any decision, especially a major financial decision like a cash-out refinance, weighing the pros and cons helps you understand if its a good fit for you.

Pros to Consider

- Interest rates are typically lower than HELOCs and personal loans

- Theres a variety of loan types to choose from

- The mortgage interest may be tax-deductible

- The cash from your home equity can be used for nearly anything you want

- A cash-out refinance will likely extend the repayment time of your mortgage

- Closing costs and origination fees are expenses to consider

- If your interest rate on your current mortgage is lower than what you could qualify for with a cash-out refinance, you could have a higher interest rate loan, paying more every month

You Are Now Leaving The Cherry Creek Mortgage Website

Please be advised that you are leaving the Cherry Creek Mortgage, LLC NMLS #3001 website. This link is provided as a courtesy. Cherry Creek Mortgage, LLC NMLS #3001 does not manage or control the content of third party websites.

If you are planning to use a credit card to make your payment, please check with your credit card company to find out if any fees will apply to your transaction.

Don’t Miss: Rocket Mortgage Payment Options

Nerdwallets Mortgage Rate Insight

On Tuesday, December 21st, 2021, the average APR on a 30-year fixed-rate mortgagerose 5 basis points to 3.073%. The average APR on a 15-year fixed-rate mortgagerose 1 basis point to 2.283% and the average APR for a 5/1 adjustable-rate mortgage fell 2 basis points to 2.786%, according to rates provided to NerdWallet by Zillow. The 30-year fixed-rate mortgage is5 basis points higher than one week ago and28 basis points higher than one year ago.

A basis point is one one-hundredth of one percent. Rates are expressed as annual percentage rate, or APR.

What Are The Fees For A Cash

Expect to pay about 3 to 5 percent of the new loan amount for closing costs to do a cash-out refinance. These closing costs can include lender origination fees and an appraisal fee to assess the homes current value. Shop around with multiple lenders to ensure youre getting the most competitive rates and terms.

You might be able to roll the loan costs into your new mortgage to avoid upfront closing costs, but youll likely pay a higher interest rate. Plus, taking out another 30-year loan or refinancing at a higher interest rate might mean you pay more in total interest. Crunch the numbers with Bankrates refinance calculator to gauge whether the math works in your favor.

Also Check: Can I Get A Reverse Mortgage On A Condo

Why Are Refinance Rates Higher It All Has To Do With Risk

Mortgage Q& A: Why are refinance rates higher?

If youve been comparing mortgage rates lately in an effort to save some money on your home loan, you may have noticed that refinance rates are higher than purchase loan rates.

This seems to be the case for a lot of big banks out there, including Chase, Citi, and Wells Fargo, which while enormous institutions arent necessarily the leaders in the mortgage biz anymore.

In fact, today Quicken Loans is #1, followed by United Wholesale Mortgage in the #2 spot, then a mix of these big banks and nonbanks, including loanDepot, Caliber Home Loans, and others.

So why is that some of the big guys list purchase rates and refinance rates separately, with different pricing, points, and APRs?

Well, for starters a home purchase is not the same as a mortgage refinance, though both processes are very similar, and the underlying loans themselves arent much different.

Ultimately, a home purchase loan is for someone who has yet to buy a property, whereas a mortgage refinance is for an existing homeowner who wants to redo their home loan.

We know they are different objectives, but if the underlying loans are both 30-year fixed mortgages with the same loan amounts, the same borrower credit scores, and the same property types, why should rates be any different?

Youll Pay Closing Costs

Just like when you buy a home, youll pay closing costs when you refinance. Some common costs to refinance for closing include credit report fees, appraisal fees and attorney fees, depending on your state. If you only need to take out a very small loan, you should take a look at whether the closing costs would negate anything you save with a lower interest rate. In cases like this, resources like Rocket Loans® can help you explore your options for personal loans.

You May Like: Rocket Mortgage Conventional Loan

How Does A Conventional Loan Work

A classic conventional loan is simple. In the most basic example, you put down 20% and the lender puts up the remaining 80% to purchase a home.

If a home costs $400,000, youd have an $80,000 down payment while the lender finances $320,000. This means the lender ideally wants an 80% loantovalue ratio.

20% down is no longer required. These days, borrowers can get a conventional loan with as little as 3% down.

20% down used to be the norm for conventional mortgages. But 20% down is no longer required. These days, borrowers can get a conventional loan with as little as 3% down.

Of course, all mortgage programs have requirements in addition to the down payment. A few major requirements to keep in mind are:

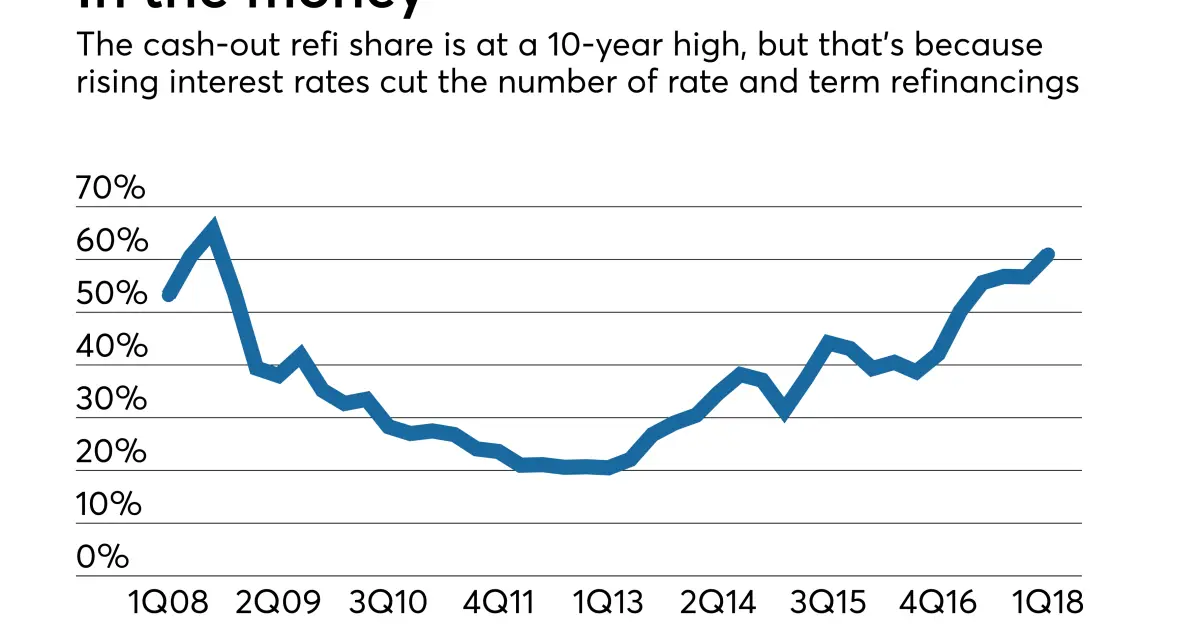

Untitled How To Take Cash Out Of Your Home When Mortgage

How to take cash out of your home when mortgage rates are rising #Home

The Feds latest move will send borrowing costs higher #Home

Mortgage refinances fizzle as interest rates resume their climb #Home

What Everyone Wants To Know: Will Home Prices Decline in 2022? #Home

Homebuilder confidence ends the year on a high even as costs rise and labor is in short supply #Home

Read Also: Mortgage Recast Calculator Chase

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

How Do You Get Started On A Cash Out Refinance

There are several ways to get the ball rolling on a cash out refinance. You can contact your current lender, other lenders or a mortgage broker. But one of the easiest ways can be to use an online lending marketplace.

An online marketplace like LendingTree lets you compare cash out refinance options without having to reach out to individual banks, credit unions and other lenders one at a time. Best of all, you only have to submit your information and requirements once, and theres no cost to seeing the offers, so you can get an idea of your options without having to pay anything.

So if youre tight on cash right now, take a look at all of the possibilities for extra funds, your ability to repay money in the future and your personal situation. Then, consider reaching out to lenders to explore whether a cash out refinance makes sense for you.

You May Like: How Does The 10 Year Treasury Affect Mortgage Rates

How Much Of A Down Payment Is Needed For A Conventional Loan

Lenders have long wanted mortgage borrowers to purchase with 20% down. The reason is that a big equity cushion was thought to reduce lender risk. But the oldtime benchmark has changed.

The 20% standard for conventional financing has long been a problem. Many borrowers simply dont have such cash.

In 2019, the median down payment was 12 percent for all buyers, six percent for firsttime buyers, and 16 percent for repeat buyers. National Association of Realtors

According to the National Association of Realtors, in 2019, the median down payment was 12 percent for all buyers, six percent for firsttime buyers, and 16 percent for repeat buyers.

In recent years lender thinking has changed. Research by the Urban Institute has found that the default rates for buyers with 3% down and 10% upfront are the same.

What counts most what makes a difference is the borrowers credit standing.

The result is that conventional financing with as little as 3% down is now available with the Freddie Mac Home Possible and Fannie Mae HomeReady programs.

Youll Throw Away Money On Higher Rates & Closing Costs

If refinancing isnt going to significantly lower your rate, then youre really just tossing money out the window.

Interest rates aside, youll pay closing costs for a cash-out refinance as you would any refinance. These typically range from 2-5% of the entire mortgage amount, which for a $200K loan can be $5,000 – $12,500.

When you compare this to less than $900 in closing costs for home equity loans, its pretty clear why we say youre just throwing money away. By choosing a home equity loan over a refinance, you are saving thousands in closing costs.

Before you choose a traditional cash-out refinance for your renovation project, be sure to do your homework into the alternatives that are available to you.

Youve already spent however many years paying into a loan, so dont end up back at square one without any incentive – like a major reduction in your rate.

And, if you decide you do want to refinance to get that major reduction in your rate but are falling short on how much you need to fund your renovation, consider a RenoFi Cash-out Refinance

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Goal : Lower The Total Cost Of Your Mortgage

Lowering the cost of your mortgage can be done in two ways: You can keep the total length of the mortgagecalled the amortization periodthe same and reduce each monthly payment or you can keep your monthly payments the same, and shave years off your amortization period so youll own your home outright sooner. Either way, it could save you a pile of money.

When is it worth breaking my mortgage?

The rule used to be that its worth breaking your mortgage when you can get a new rate thats at least two percentage points lower than your current one. But thats all changed. Because the rates are so low now, its worth switching for a much smaller drop.

For instance, if you had a five-year fixed mortgage at 5.0% you might be eyeing a current rate of 3.39%. Thats a difference of less than two percentage points, but it actually means reducing your rate by more than a quarter, which could translate into reducing each monthly payment by 30%. If you were paying $1,500 a month before, youd save about $450 every month. Most mortgage experts would agree thats worth switching for.

Because each percentage point drop represents a bigger proportion of the total rate, the new rule is that if you see a rate thats just 30 basis points lower than your current rate, its worth running the numbers. Depending on the penalty for breaking your existing mortgage, you could see big savings.

So, what will breaking my mortgage cost me?

Whats the penalty for breaking a fixed-rate mortgage?