How About Property Taxes

You cant escape taxesperiod. From the moment you buy a house, until, well, forever, your local government makes you pay property taxes. How do they calculate these taxes? Theyll send a property assessor to find out how much your house is worth, then theyll use that number to figure out how much you owe them.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

You May Like: How Can I Mortgage My House

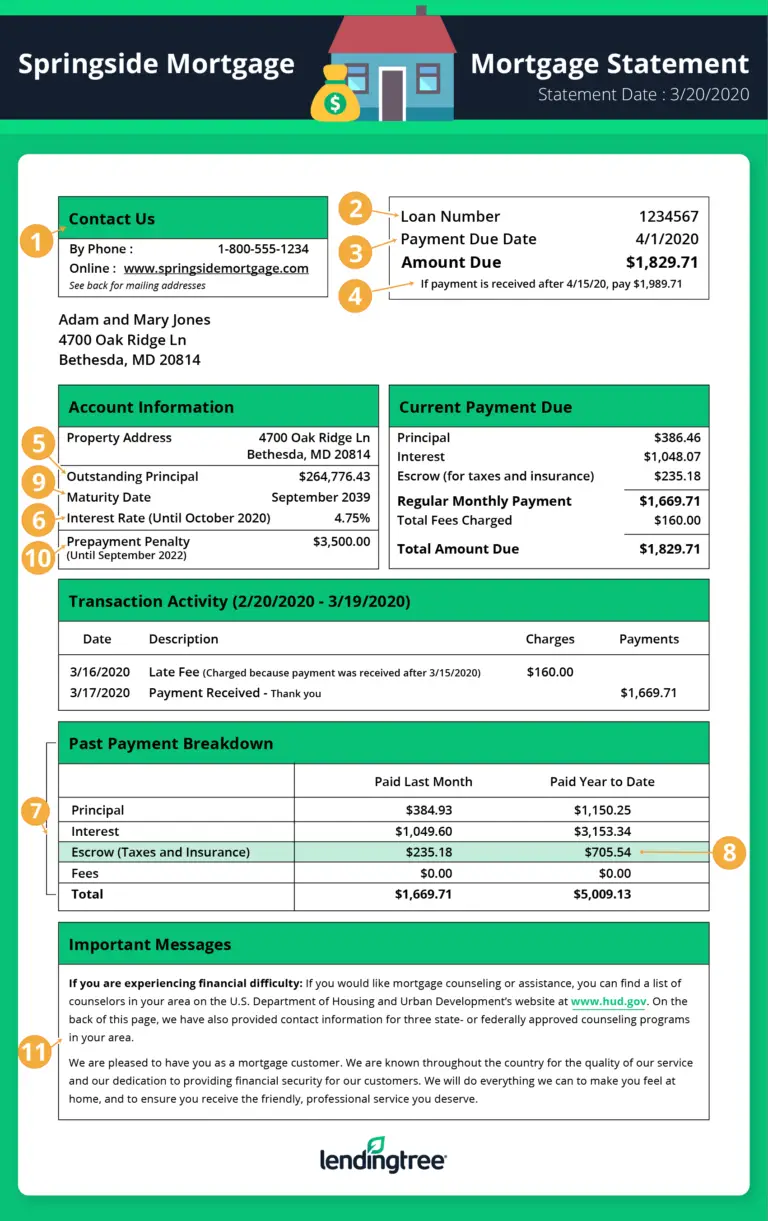

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

You May Like: What Does A Mortgage Payment Consist Of

What Are The Most Common Reasons To Refinance A Mortgage

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Read Also: Who Has The Best Reverse Mortgage Rates

The Mortgage Payment Calculator In Action

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

If you switch from monthly to accelerated weekly payments, for example, you’ll increase your repayment frequency from 12 monthly payments to 52 weekly payments. That can shave two years and 10 months off your mortgage, versus monthly payments .

Similarly, if you switch from monthly to an accelerated bi-weekly payment schedule, youll increase your repayment frequency from 12 monthly payments to 26 bi-weekly payments. This means youll make a payment every two weeks. That too adds up to one extra monthly payment over the course of a year. As with accelerated weekly, accelerated bi-weekly payments shave about two years and 10 months off your mortgage, versus monthly repayment.

What Is Mortgage Amortization

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Mortgage amortization is how a home loan is paid down: The debt diminishes slowly at the beginning and then rapidly toward the end.

-

At first, most of each mortgage payment goes toward interest.

-

In later years, most of the payment reduces debt.

The gradual shift from paying mostly interest to mostly debt payment is the hallmark of an amortized mortgage.

Using a mortgage amortization calculator, you can:

-

Find out how much total interest you would pay over the life of a loan.

-

Determine the remaining loan balance in any given month.

-

Figure out how much of each month’s payment goes toward principal and interest.

-

Compare the total cost of a 30-year loan versus a mortgage with a shorter term, such as 15 years.

-

Know when you’re approaching 20% equity, so you can cancel private mortgage insurance.

“Amortization” is pronounced am-ur-ti-ZAY-shun. “Amortize” is pronounced AM-ur-tize.

When loan officers talk about amortization, they often mean the loan’s term, or the number of years it will take to pay it in full. A “30-year amortization” and a “30-year mortgage term” mean the same thing.

You May Like: Do Mortgage Lenders Look At Medical Collections

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make. When youre ready to apply, compile necessary documentation like income verification and proof of assets and start shopping for the best rates.

How Do You Lower Your Interest Expense

These are the most common ways to lower your interest costs. Some of these methods are similar to above and some are the exact opposite:

- Lower the purchase price

- Make a larger down payment

- Find a lower interest rate

- Reduce the amortization

- Choose accelerated payments

- Make lump-sum prepayments

Things that save you interest generally lower your amortization, resulting in you paying off your mortgage sooner.

Don’t Miss: Does Pre Approval For Mortgage Affect Credit

Basic Mortgage Payment Calculator

This calculator requires the use of Javascript enabled and capable browsers. This script calculates the monthly payment of a typical mortgage contract. Enter the dollar amount of the loan using just numbers and the decimal. Next, enter the published interest rate you expect to pay on this mortgage. Finally, enter the number of years to pay on the mortgage. Click on the Calculate button and the monthly payment, principal and interest only, will be returned. You may click on Clear Values to do another calculation. In our example, a loan of $100,000.00 for 30 years at 6% will yield a payment of just less than $600.00 a month for principal and interest. Designation

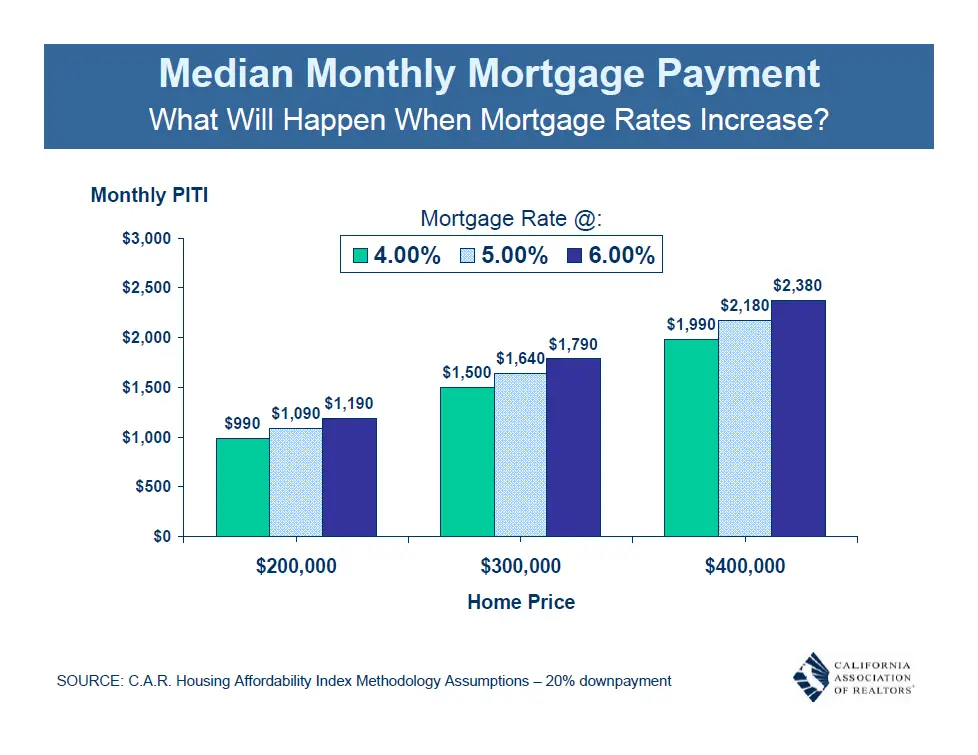

Whats The Average Mortgage Payment

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

Recommended Reading: Why Would A Mortgage Be Declined

Choose The Home And Apply For Approval

Once you’ve chosen the lender you want to work with, choose the home you want to buy. After selecting the home, apply for a mortgage approval.

The lender will check back in with your finances, then set up an appraisal for the home to make sure everything is above board. If everything passes the test, then it will approve you for a mortgage.

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

You May Like: Which Bank Is Best To Get A Mortgage

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

You May Like: How To Get A Mortgage After Chapter 7

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

Also Check: Can You Write Off Points On A Mortgage

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

You May Like: Can You Get A Mortgage With 0 Down

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on January 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for the month of February, is then due March 1.

As an example, lets assume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment. Your monthly payment works out to $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, which is the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

Recommended Reading: Why Is Mortgage Cheaper Than Rent

How Much Monthly Mortgage Payment Can You Afford

Weve looked at the median monthly mortgage payments, and youve even learned how one is calculated. But now the big question remains: How much mortgage can you afford?

Once youve set a ballpark housing budget, give Churchill Mortgage a call. Not only will they help you get a mortgage the smart way , but theyll also pay close attention to your budget and make sure you can actually afford it. Theyre real friendly folks. Get started with one of their loan specialists today! If youre wondering how much you can afford, dont sit around twiddling your thumbs. Get answers from a trustworthy lender now!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.