Bank Of America Mortgage Loan Types And Products

The lender, based in Charlotte, North Carolina, offers a wide range of purchase and refinance loans, including 15-, 20- and 30-year fixed-rate loans and adjustable-rate mortgages with 5/1, 7/1 and 10/1 terms. It also issues jumbo loans up to $2.5 million and government-insured mortgage products such as Federal Housing Administration and Veterans Affairs loans.

The lender also offers a home equity line of credit, or HELOC. These second mortgages are one way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation. Bank of Americas HELOC features an introductory interest rate that resets higher after six months. The lender offers several options for HELOC rate discounts, including setting up automatic payments, making an initial withdrawal, and being a Preferred Rewards client.

Bank of Americas Community Homeownership Commitment is designed to make homeownership more affordable for first-time and low- to moderate-income home buyers in communities across the country. The program offers:

-

Up to $10,000 in down payment assistance in select cities.

-

Up to $7,500 for nonrecurring closing expenses like title insurance and recording fees available in some parts of the country.

-

Two mortgage products with 3% minimum down payments: the Affordable Loan Solution mortgage and the Freddie Mac Home Possible mortgage.

Best Mortgage Rates Faq

What are todays mortgage rates?

Between 2019 and 2021, mortgage dropped from over 4 percent to below 2 percent. Currently, mortgage rates are hovering near 3 percent for the best borrowers. Thats incredibly low compared to the historical average of about 8 percent for a 30-year fixed-rate mortgage .

Whats a good mortgage rate?

Historically speaking, anything below 4 percent is a very good mortgage rate. In todays market, the best rates might be in the high 2 percent or low 3 percent range. Remember that the lowest mortgage rates go to borrowers with strong credit, few debts, and at least 20 percent down payment.

Who has the best mortgage rates?

In our analysis of 40 top lenders, the ones with the best mortgage rates on average were Freedom Mortgage, Better Mortgage, Citibank, Guild Mortgage Company, and American Financial Network. These rankings are based on 30-year mortgage rates from 2020 Your own best mortgage rate could easily come from a different lender, which is why its important to compare personalized offers before choosing a lender.

How do I compare current mortgage rates? What is the best mortgage loan type for me?How do I choose a mortgage lender?How is your mortgage interest rate determined?Does my down payment affect my rate?Are jumbo mortgage rates higher?Whats better, a fixed-rate mortgage or adjustable-rate mortgage?Whats better, a 30-year mortgage or a 15-year mortgage?

Bank Of America At A Glance

Bank of America has many loan options, including geographically targeted programs that can be especially helpful for low- and moderate-income home buyers. Online convenience and relatively low rates and fees are also pluses for this lender.

Here’s a breakdown of Bank of America’s overall score:

-

Variety of loan types: 5 of 5 stars

-

Variety of loan products: 4 of 5 stars

-

Online convenience: 5 of 5 stars

-

Rates and fees: 4.5 of 5 stars

-

Rate transparency: 5 of 5 stars

Its one of the largest banks in the world, but Bank of America doesnt want to be known just for its mammoth size. Then again, being one of the biggest does have its advantages, especially in mortgage lending.

Bank of America provides multiple loan options, high-tech customer service and a step-by-step walk-through of the underwriting process as it works to make getting a mortgage easier, says John Schleck, senior vice president of centralized and online sales.

Here’s how Bank of America’s mortgage offerings stack up.

You May Like: How Do Rocket Mortgage Rates Compare

Bank Of America Personal Loan Review

Bank of America does not offer personal loans. However, it does provide a variety of loans for specific needs, including mortgages, auto loans, credit cards, business loans and lines of credit.

This guide features an overview of the loan products BofA does offer, as well as a list of alternative lenders including other banks, credit unions and online lenders that do offer personal loans.

About Bank Of America

Bank of America is a full-service national bank with 240 years of historyits the second largest U.S. bank by assets. It offers 4,300 financial centers nationwide, an online banking platform and a highly rated mobile app. Bank of America provides personal, business and commercial banking products and services.

Also Check: What Is Needed For Mortgage Application

Bank Rates Vs Broker Rates

As you may have noticed, bank mortgage rates are almost always higher than those of mortgage brokers. That is because mortgage brokers have access to rates from multiple banks and credit unions, as well as insurance and trust companies. That means they can essentially “shop around” for you. Brokers also receive discounts from lenders based on the high volume of their business, which they can pass along to you.

As a result, itâs unlikely that a bank will post a lower rate than a mortgage broker. However, if you present the lowest market rate to your bank as part of the negotiation process, they may offer to match it. That said, we donât recommend pitting the banks and brokers against each other to compete for your business. What we do recommend is comparing broker mortgage rates and bank mortgage rates alongside each other, and deciding which offer is best for you.

Is Bank Of America Trustworthy

The Better Business Bureau gives Bank of America an A+ in trustworthiness. A strong BBB grade indicates a company responds to customer complaints effectively and is transparent about business practices.

Bank of America ranks second in customer satisfaction in the JD Power 2020 Primary Mortgage Origination Satisfaction Survey, after Rocket Mortgage.

However, Bank of America does have some recent public scandals involving discrimination:

- The Department of Justice charged Bank of America for unfairly denying home loans to adults with disabilities, even though they qualified for loans. Bank of America paid around $300,000 total to people who were refused loans.

- The Department of Labor required Bank of America to pay $4.2 million to people who claimed the bank discriminated against women, Black, and Hispanic applicants in the hiring process.

If these issues bother you, you may prefer to use a different lender.

Read Also: Can Low Credit Score Get Mortgage

Bank Of America Reviews And Complaints

Bank of America has been accredited with the Better Business Bureau since 1949, boasting an A+ rating for its operations after closing over 6,000 customer complaints over the last three years.

However, it falls short in the customer service department, earning slightly over a one-star rating from 475 customer reviews. Its a similar story on Trustpilot, where the bank has a 1.3 rating based on 844 reviews as of August 2021. While customers praised the savvy online experience and diversity of mortgage products, many were frustrated with the service they received.

Its worth noting that these consumer reviews are for Bank of America as a whole and not for its mortgages specifically.

How To Find Your Lowest Mortgage Rate

Mortgage rates are highly personal. Factors like your credit score and debt-to-income ratio will have a big impact on the rate you get.

That means the company with the lowest average rates wont always be the cheapest lender for everyone.

For example: Among the 40 mortgage lenders in our study, Freedom Mortgage had the lowest average mortgage rate in 2020, at just 2.92% for a 30-year loan.

But average rates tell only part of the story. Overall, Freedom Mortgage rates ranged from under 2% to over 6%. So some people got much lower rates than others.

To find your best deal, you have to request rate quotes from more than one company and compare offers.

Recommended Reading: What Is The Payoff On My Mortgage

What Is A Mortgage Interest Rate

Mortgage interest rates reflect lenders cost of money, a cost that they pass on to you in the form of an interest rate. Your rate sets the amount of interest you pay over the life of your mortgage.

Even though nearly all mortgages come with fixed rates these days, small differences in interest rates can drive your monthly payments up or down. Over a 30-year term, that difference can add up. Just $50 a month equals more than $18,000 over the loans term. Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation.

Bank Of America Mortgage Rates And Fees

If youre already a Bank of America customer, you may qualify for a reduction of up to $600 in the mortgage lender origination fee.

One of the most important considerations when choosing a mortgage lender is understanding what the loan will cost. In order to provide consumers with a general sense of what a lender might charge, NerdWallet scores lenders on two factors regarding fees and mortgage rates:

-

A lender’s average origination fee compared with the median of all lenders reporting under the Home Mortgage Disclosure Act. Bank of America earns 4 out of 5 stars on this factor.

-

A lender’s offered mortgage rates compared with the best available on comparable loans. Bank of America earns 5 out of 5 stars on this factor.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

You can decide to buy discount points a fee paid with your closing costs to reduce your mortgage rate.

Deciding whether to pay higher upfront fees is a matter of considering how long you plan to live in your home and how much cash you have to apply toward closing costs when you sign the loan paperwork.

Also Check: Do Multiple Mortgage Applications Hurt Credit

Should You Get A Mortgage From Bank Of America

SmartAssets in-depth lender review of Bank of America ranked the bank favorably, giving it an overall rating of 4.06 out of 5 possible stars. The bank seemingly has it all, with good interest rates, reasonable APRs, plenty of physical branches and a variety of different loan types to choose from. Aside from typical low down payment options like FHA and VA loans, which BofA offers, the Affordable Loan Solution® mortgage program presents a great mortgage opportunity as well.

Though some may be inclined either to undervalue or overvalue the words of current and former customers, its important to take them into account at least partially. Unfortunately for Bank of America, these reviews havent been so kind, so be sure to check some of them out and make a final decision for yourself as to how much they should matter.

Do All Cds Charge An Early Withdrawal Penalty

It depends on the type of CD and financial institution. Some banks offer no-penalty CDs, which are a type of CD that doesnt charge an early withdrawal penalty. Depending on the bank, the APY on no-penalty CDs may be lower than a standard CDyou may have to agree to accept a lower yield in exchange for more liquidity.

Also Check: What Is The Biggest Mortgage I Can Get

Bank Of America Mortgage Interest Rate And Cost Review

Is Bank of America a cheap or expensive mortgage lender? To help you shop for a mortgage, we compare the interest rates and closing costs charged by Bank of America to those of other lenders for a comparable set of borrowers. Here is our review of Bank of America nationally:

| Review Item | |

|---|---|

| lower than other lenders | |

| Loan Related Closing Costs | lower than other lenders |

| National Rate and Closing Cost Star Rating |

On average, Bank of Americas interest rates were lower than those of other lenders . Its loan related closing costs were also lower than those of other lenders, with a difference of -$636. Overall, combining interest rates and closing costs we estimate that Bank of America tends to be a cheap lender, and give it a National Rate and Closing Costs Rating of 4.5 out of 5 stars. This is an excellent rating and places it among the top 15% of lenders nationwide.

We maintain our independence by not accepting any money from the mortgage lenders we review. To visit Bank of America, check out its website at: .

Bank of Americas Rate Review by City

Mortgage lenders often set different rates in different geographical markets. For our list of the top mortgage lenders by city, click here. In particular, among the cities we track Bank of America was most active in:

Bank Of America Mortgage Products

Bank of America offers a broad selection of mortgages at competitive rates, including conventional, jumbo, FHA, and VA loans. Youll typically have a choice of a fixed- or variable-rate loan, with a range of repayment terms.

If you only have enough savings to make a small down payment, FHA and VA loans may be an option. Bank of America also offers an Affordable Solution Mortgage, which is a fixed-rate loan with a 25- or 30-year repayment term that allows for down payments of as little as 3%.

Don’t Miss: What Is A Mortgage Deposit

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

How To Apply For A Mortgage With Bank Of America

You can apply for a mortgage in person, over the phone or online through the Bank of America Digital Mortgage Experience. The application takes around 30 minutes to complete.

To apply online:

Also Check: Does Navy Federal Sell Their Mortgages

Bank Of America Mortgage Full Review

As one of the worlds leading financial institutions, Bank of America has branches located in 38 states but originates mortgage loans across all 50 states in the U.S. It offers a number of different mortgage loans, including refinance, home equity,conventional, jumbo, FHA and VA loans.

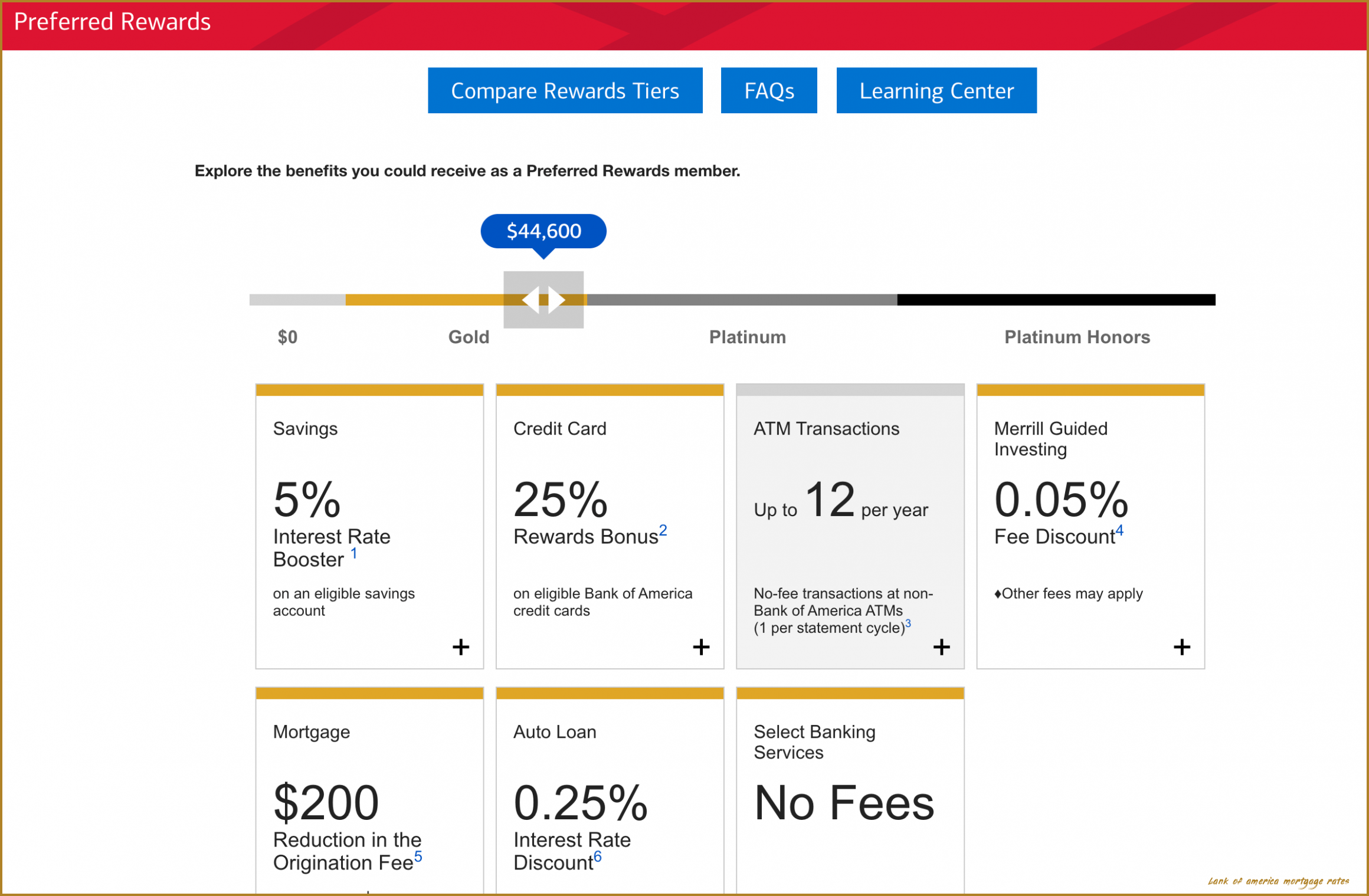

Customers can begin the mortgage application process by applying online, over the phone, or in person at one of the banks branch locations. What makes this lender stand out is its Preferred Rewards program. Preferred rewards members see perks such as discounted mortgage origination fees and discounted home equity interest rates. The price of membership, though, is high. The lowest tier with the lowest rewards starts with a balance of $20,000 in combined Bank of America accounts. This perk makes the company a competitive mortgage lender for those who have high cash flow balances.

While the banks website does provide a good amount of basic information about the mortgage process, customers who have questions may find it difficult to get a clear answer from lending specialists. Here are a few things you should know about Bank of America before applying.

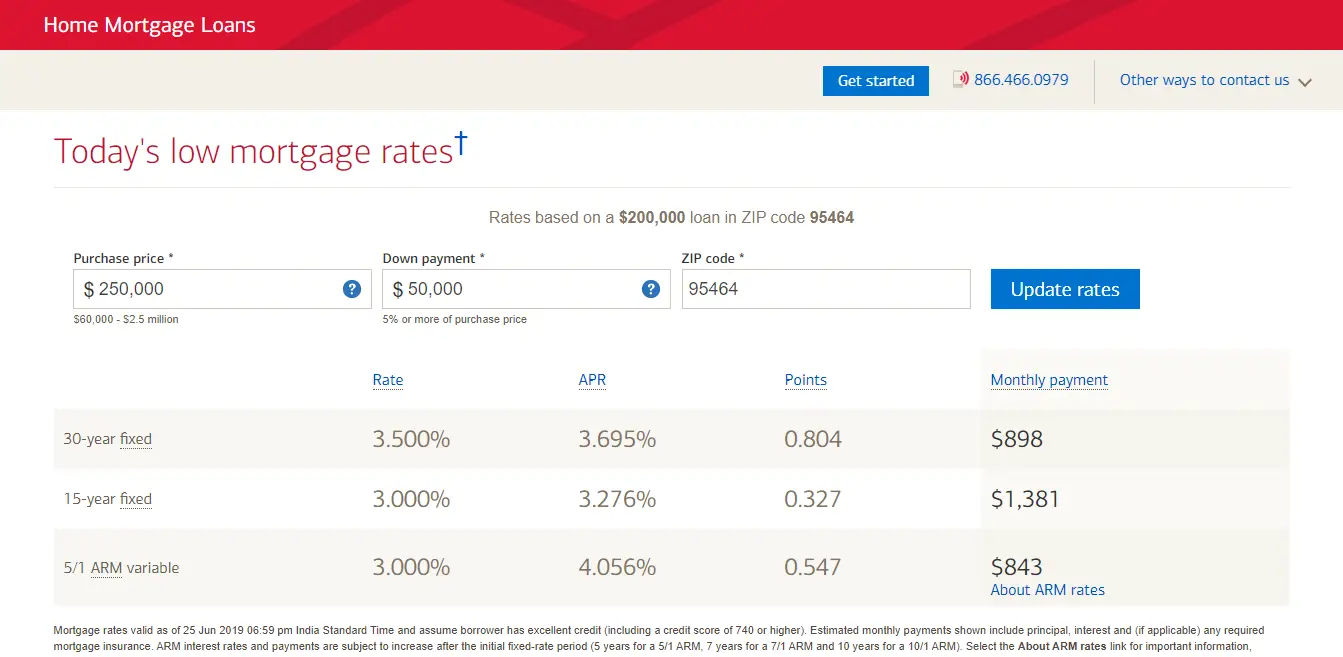

Bank Of America: Rates And Fees

Customers looking to purchase or refinance a home can find interest rates listed on Bank of Americas website for 15-year fixed, 20-year fixed, 30-year fixed, 10y/6m ARM, 7y/6m ARM, 5y/6m ARM, jumbo, and home equity loans. Interest rates may change daily and vary based on a variety of factors, such as your credit score or down payment amount.

Fees for refinancing a mortgage are not listed. Instead, customers are instructed to call or submit a formal loan application to get a loan estimate. However, homebuyers can use the banks online closing cost calculator to view an estimate of closing costs based on a purchase price, down payment, loan type, and zip code of the property.

These closing costs include:

- Life of loan flood monitoring

- Title endorsement

- Mortgage recording fee

- Owners title insurance

Bank of America states there are no application fees, closing costs, annual fees for its home equity loans. However, an early closure fee may be charged if the HELOC is closed within 36 months. This fee can be as much as $450 plus any closing agent or attorney fees the bank may have paid on your behalf. Otherwise, Bank of America does not charge any prepayment penalty for its FHA, VA, Jumbo, or Conventional mortgage loans.

Don’t Miss: Can I Change Mortgage Companies