How To Calculate Mortgage Payments

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford. You can use a mortgage calculator to estimate your monthly mortgage payment based on factors including your interest rate, purchase price and down payment. To calculate your monthly mortgage payment, here’s what you’ll need:

- The home price

Current Mortgage Rates Rise To Highest Level Since April

- Leslie Cook

The average rate on a 30-year fixed-rate mortgage increased to 3.14% this week, according to Freddie Mac. The current rate increased 0.05 percentage points from last weeks average of 3.09%.

The 30-year rate has now stayed above the 3% mark for three weeks in a row. The 30-year rate has not been this high since early April more than six months ago.

Current mortgage rates for other loan categories also are also higher today. The average rate on a 15-year fixed-rate mortgage is up to 2.37%. The rate for a 5/1 adjustable-rate mortgage, meanwhile, inched up to 2.56%.

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

Recommended Reading: Can You Get A 30 Year Mortgage On Land

Hybrid Adjustable Rate Mortgage

Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed. These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates 5 years fixed, 1 year adjustable and 7 years fixed, 1 year adjustable . The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time.

How To Find Personalized Mortgage Rates

To find a personalized mortgage rate, meet with your local mortgage broker or use an online mortgage service. When looking into home mortgage rates, think about your goals and current financial situation. Specific mortgage interest rates will vary based on factors including credit score, down payment, debt-to-income ratio and loan-to-value ratio. Having a good credit score, a larger down payment, a low DTI, a low LTV or any combination of those factors can help you get a lower interest rate. The interest rate isn’t the only thing that affects the cost of your home — be sure to also consider fees, closing costs, taxes and discount points. Speak with a variety of lenders — like local and national banks, credit unions and online lenders — and comparison shop to find the best mortgage loan for you.

Don’t Miss: How Do You Calculate Self Employed Income For A Mortgage

Should I Use A Mortgage Broker In New Brunswick

The job of a mortgage broker is to compare the products and rates of multiple mortgage providers on behalf of their clients. This means that by using a mortgage broker, you’ll have access to multiple mortgage products without having to do the hard work yourself. Brokers are mortgage experts, and can quickly identify the products that are available on the market that will suit your needs.

Mortgage brokers also have access to a range of mortgage rates that are not accessible to the retail market. This is because they are often given volume discounts from lenders, along with unique, broker-exclusive products.

It may be convenient to apply for a mortgage directly with your current bank, but it will only be able to offer you its own products. This means you could be missing out on a mortgage with lower rates, or that better suits your needs.

So should you use a broker when you compare mortgage rates in New Brunswick? Consultations with mortgage brokers are free, so you have nothing to lose by speaking with one.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

Getting a mortgage is a big financial commitment, and finding a great mortgage rate is one of the best things you can do to make your mortgage more manageable. Luckily, how to get a lower mortgage rate isnât a secret – all you need to do is plan ahead.

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem more risky. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare not only interest rates, but also the fees and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders around the same time makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans, instead they work with a number of lenders to find you the best deal. But their services arent free, they work on commission paid by either the lender, or the borrower.

You May Like: Can You Get A Mortgage With A 620 Credit Score

How To Navigate Your Finances In Uncertain Times

The economic outlook has brightened considerably in recent months, but the U.S. economy remains on shaky footing. Heres what you can do to prepare your finances for the next crisis:

- Make a plan. Get your financial life in shape. Determine how much youll spend, how much youll save and how youll tackle high-interest debt. If you plan to buy a home in the future, factor a down payment into your savings plan. Now can be a good time to shore up those funds while you wait for housing inventory to open up or decide where you want to live. Having a bigger down payment can help you get more favorable loan terms and afford more house for your money.

- Build a rainy-day fund. Youll sleep better once youve amassed an emergency fund equal to about six months worth of your expenses. Stash the cash in a liquid and accessible vehicle, such as a high-yield savings account. Shop around for the best rate, and for an account that fits your needs.

- Consider refinancing debt. Mortgage rates have risen slightly from record lows, but millions of homeowners still could shave hundreds of dollars from monthly payments by refinancing. If youre carrying high-cost credit card debt, check if a balance transfer card is right for you.

What Is Considered A Jumbo Loan In 2020

A jumbo loan is a mortgage that exceeds the conforming loan limit set by the FHFA for a given area. The most common conforming loan limit for 2021 is $548,250, which means any mortgage thats larger than that is a jumbo loan. If the place youre looking to buy a home in isnt below, its loan limit is $548,250.

Also Check: Does Pre Approval For Mortgage Affect Credit

Take A Look At Our Mortgage Payment Calculator And Learn How Much Home You Can Afford

With a 30 year fixed mortgage, borrowers have the advantage of knowing the mortgage payments they make each month will never increase, allowing them to budget accordingly.

Each monthly payment goes towards paying off the interest and principal, to be paid in 30 years, thus these monthly mortgage payments are quite lower than a shorter-term loan. You will, however, end up paying considerably more in interest this way.

The End Of The Fixed Period

Fixed-rate mortgages

When your fixed period ends the rate will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Tracker mortgages

The tracker mortgage will track the Bank of England base rate for a 2-year fixed period, then it will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Current standard variable rate

Our current standard variable rate for residential mortgages is 3.54%, effective from 1st April 2020. These rates only apply when a fixed or tracker rate no longer applies.

Read Also: How Much Income For A 250k Mortgage

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

How Much Does The Interest Rate Affect Mortgage Payments

In general, the lower the interest rate the lower your monthly payments will be. For example

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . Youll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

You can use a mortgage calculator to determine how different mortgage rates and down payments will affect your monthly payment. Consider steps for improving your credit score in order to qualify for a better rate.

Recommended Reading: Why Do I Pay Escrow On My Mortgage

Current Mortgage Rates Tick Lower

The 30-year fixed-rate loan is averaging 2.86% for the week ending September 16, down just 0.02 percentage points from last week, according to Freddie Mac’s benchmark survey.

Rates have been hovering between 2.86% and 2.88% since August 12. Earlier this year, there was more weekly movement, with the 30-year rate reaching a high of 3.18% on April 1. Since then, rates have been trending lower with occasional bumps.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months. The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases,” said Sam Kahet, Freddie Mac’s chief economist. “While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy-efficient and resilient economy. These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

The direction of rates for various types of loans continues to be mixed this week:

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Also Check: Do Medical Collections Affect Getting A Mortgage

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Also Check: Can You Get A Mortgage With Less Than 20 Down

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable. Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans. Variable-rate mortgages can have lower interest rates up front, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes varies based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

Summary Of Current Mortgage Rates

Current mortgage rates increased once again this week. The average rate for a 30-year mortgage moved up to 3.14%, while the rate for a 15-year fixed-rate loan and a 5/1 adjustable-rate mortgage saw higher rates as well.

Mortgage rates were higher for all loan categories this week:

- The current rate for a 30-year fixed-rate mortgage is 3.14% with 0.7 points paid, an increaseof 0.05 percentage points higher week-over-week and 0.33 percentage points higher than last years rate of 2.81%.

- The current rate for a 15-year fixed-rate mortgage is 2.37% with 0.7 points paid, up 0.04 percentage points over last week and just 0.05 percentage points higher than the same week last year.

- The current rate on a 5/1 adjustable-rate mortgage is 2.56% with 0.3 points paid, ticking up just 0.02 percentage points from last weeks rate and 0.32 percentage points lower than last years rate of 2.87%.

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Moneys full disclaimer.

Don’t Miss: What’s The Average Mortgage Payment

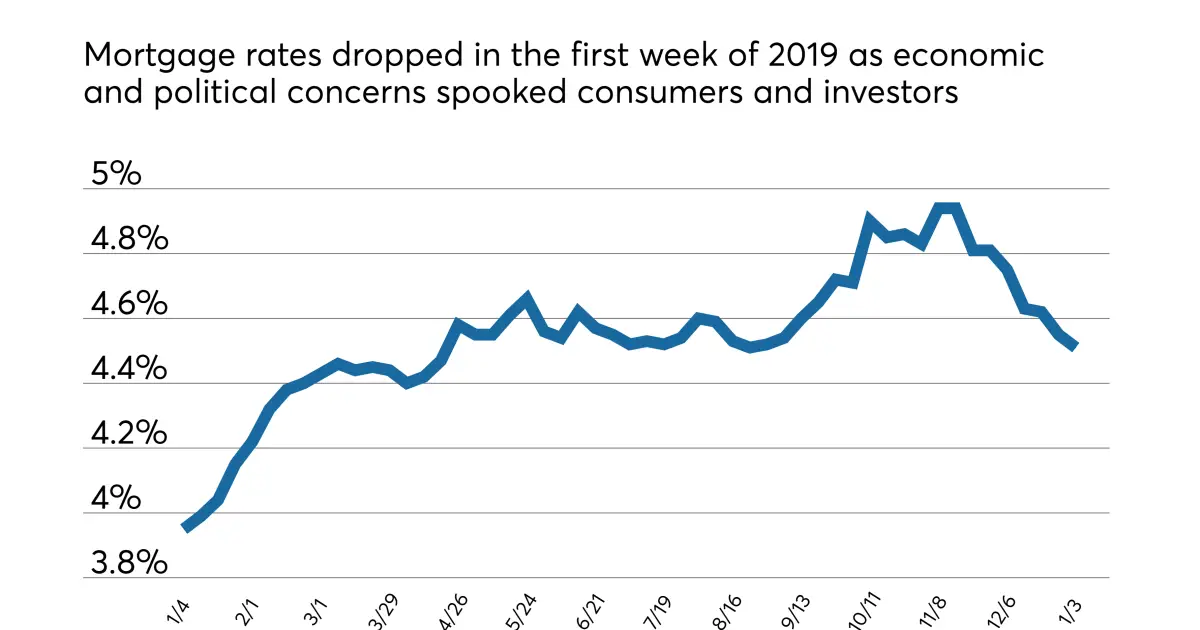

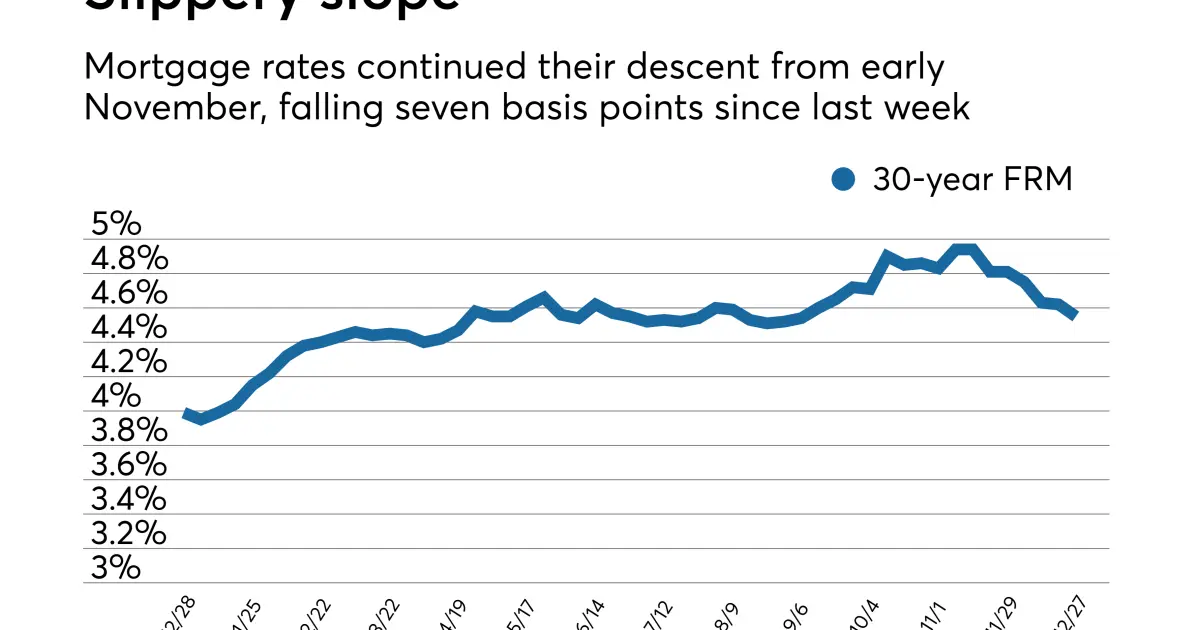

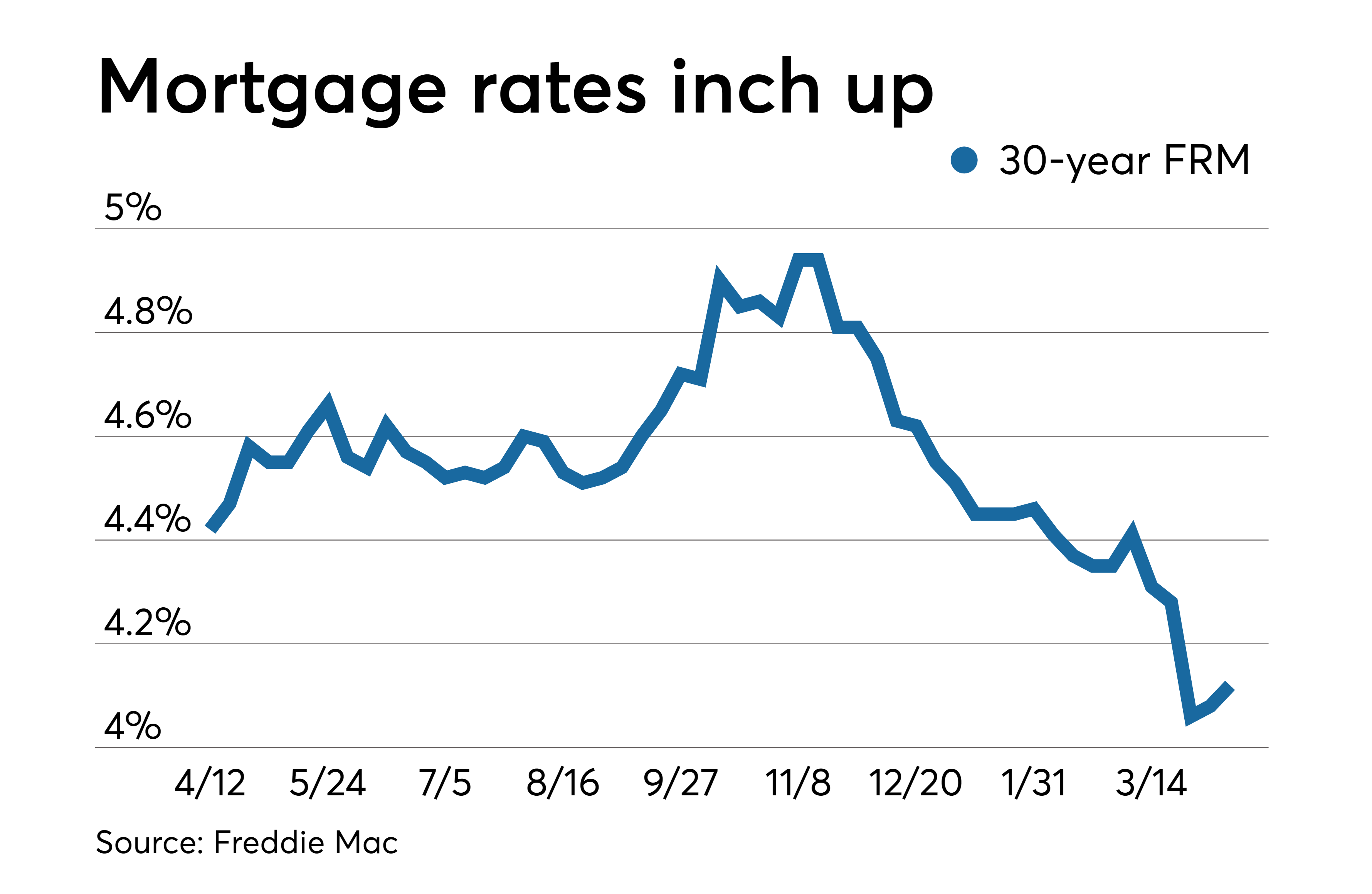

Are Interest Rates Going To Rise

Mortgage rates have fallen since the beginning of 2019, for multiple reasons: trade tensions with China, a perception that the economy is slowing and persistently low inflation. The Federal Reserve cut short-term interest rates by a quarter of a percentage point in July and again in September. While lower short-term interest rates dont immediately affect long-term mortgage rates, they will compel longer-term rates to fall over time.

Mortgage rates are most likely to move higher in response to good economic or political news, and lower in reaction to bad news. The Fed is loosening the money supply because of lower-than-desired inflation and concerns that economic growth is slowing.

Where Is The Market Headed

Expert economists predicted the economy would rebound in 2010. However, the economy was sluggish with slow growth rates for many years beyond that. The economy contracted in the first quarter of 2014, but in the second half of 2014 economic growth picked up. The Federal Reserve tapered their quantitative easing asset purchase program & the price of oil fell sharply. Consumer perception of inflation and inflation expectations are set largely by the price they pay at the pump when they refill their gas. With growth picking up the consensus view is interest rates will continue to head higher for the next couple years into 2020, or until a recession happens. The following table highlights 2019 rate predictions from influential organizations in the real estate & mortgage markets.

Don’t Miss: Can I Use My Partner’s Income For A Mortgage

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.