What Is Rocket Mortgage By Quicken

- A streamlined home loan approval process offered by Quicken Loans

- One of the largest mortgage lenders in the nation

- Allows customers to import financial information into the loan application

- Instead of faxing/printing/uploading documents slowly

Officially, its known as Rocket Mortgage by Quicken Loans, but the fine print says the lending services are provided by Quicken Loans Inc., a subsidiary of Rock Holdings Inc.

So in a sense, its just Quicken Loans new persona, which is aimed at making things super easy, something everyone is really into these days thanks to the internet.

They also have a personal loans subsidiary known as RocketLoans that is known as a Quicken Loans family company. Its unclear if these are separate companies, or if Rocket Mortgage is simply a brand.

Anyway, the process goes beyond just taking online applications and actually gives applicants the ability to import documentation from other vendors, similar to how TurboTax will allow you to import your financials.

So you can simply enter login info for checking accounts, a brokerage account, mutual funds, a Roth IRA, and so on, instead of downloading documents and uploading them.

This makes the home loan process, whether youre refinancing or buying, more accurate and a lot faster.

I took Rocket Mortgage for a spin this morning but only made it so far before I was asked to enter my social security number. Thats when I closed the browser and gave up, for obvious reasons.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How Long Can You Lock In A Mortgage Rate

When you lock your rate, itll be locked for a specified period of time. The exact lock period varies based on your loan type, where you live, and the lender you choose. Most rate locks have a lock period of 15 to 60 days. If the rate lock expires before your loan closes, you may have the option to pay a fee to extend the lock period. Otherwise, youll get the interest rate thats available when you lock before closing.

If things change with regard to your application or financial situation, your lender might void your rate lock. Since your interest rate is based on factors like your income and credit, changes to your situation may mean youre no longer eligible for the rate that was originally offered. Opening a new line of credit while youre getting a mortgage, for example, could result in a change to your debt-to-income ratio or credit score, which means your lender will need to reevaluate your eligibility for the loan and interest rate.

Don’t Miss: What Salary Do I Need For A 200k Mortgage

Looking At Todays Mortgage Refinance Rates

Todays mortgage refinance rates are unchanged since yesterday. If youre considering refinancing an existing home, check out what refinance rates look like:

-

30-year fixed refinance rates: 3.125%, unchanged

-

20-year fixed refinance rates: 2.750%, unchanged

-

15-year fixed refinance rates: 2.375%, unchanged

-

10-year fixed refinance rates: 2.250%, unchanged

Rates last updated on Oct. 26, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

Summary Of Best Online Mortgage Lenders Of October 2021

| Lender | NerdWallet Rating

NerdWallet’s ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

Min. Credit Score Minimum credit score on top loans other loan types or factors may selectively influence minimum credit score standards |

National / Regional |

|---|

Read Also: What Mortgage Can You Afford Based On Salary

Tips For Choosing The Right Lender

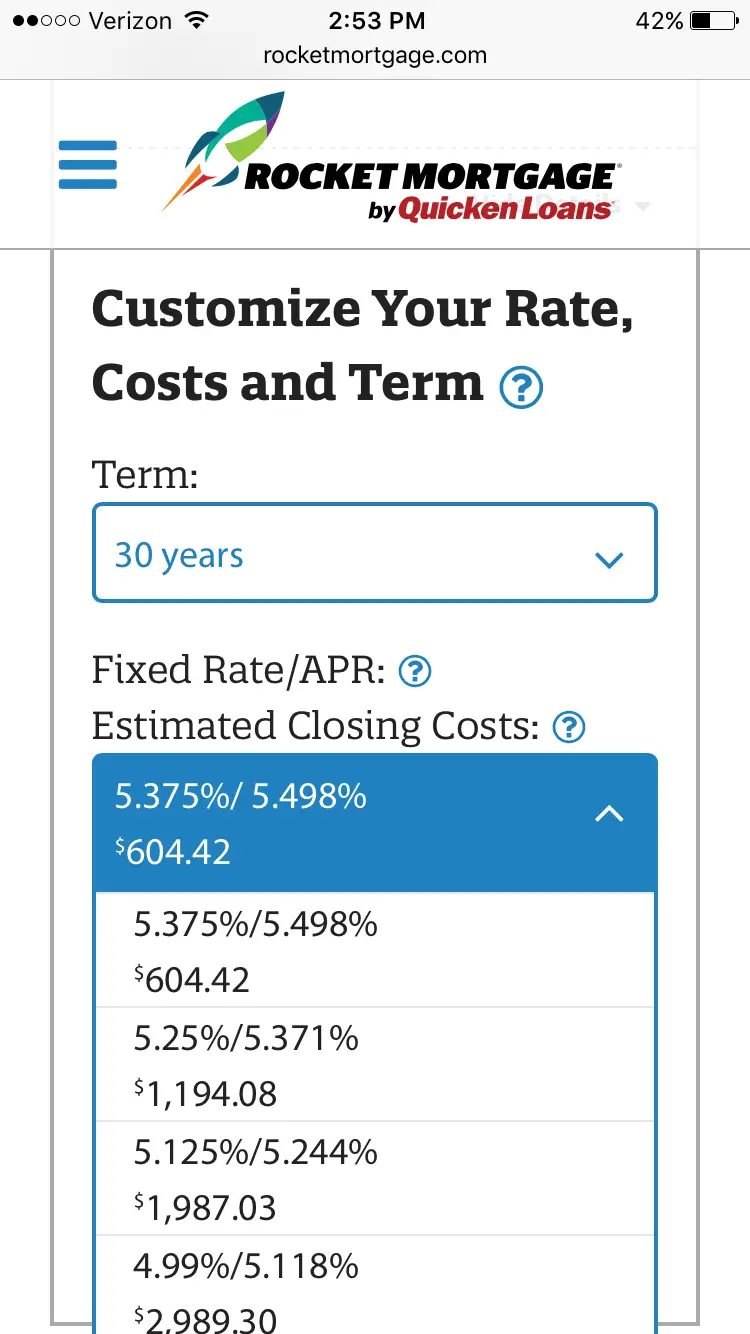

- While interest rates might seem like the most pressing factor when picking a mortgage lender, that shouldn’t be your only consideration. For example, the closing costs and other fees associated with a particular lender are possibly just as important, as they paint a clearer picture of what your actual costs will be.

- A mortgage has a long lasting effect on your financial life, as its terms typically last anywhere from 10 to 30 years. In order to make sure that this doesn’t hamstring you, a financial advisor might be your best choice. The SmartAsset financial advisor matching tool can pair you with advisors in your area, based on your answers to a few simple questions about your situation.

Get Instant Rate Quotes

You can get an instant rate quote online tailored to your situation by filling out a quick form.

And if you want to figure out how discount points may impact your finances for the life of your loan, PennyMac provides a calculator for that, too.

PennyMac is also transparent about possible interest rates on its website, with sample rates updated daily for conventional, FHA loans, and VA mortgages.

But bear in mind that your actual rates can change based on your location, down payment, credit score, loan term, and other factors.

Don’t Miss: Can A Mortgage Include Renovation Costs

What Are Current Mortgage Rates

Current mortgage and refinance rates are still at historic lows, creating great deals for home buyers and homeowners.

Comparing loan offers from a variety of lenders is key to finding your best rate. But rate shopping is just one part of the home buying process.

Getting the right loan type and saving money on closing costs and other fees can help you lower your overall borrowing costs.

Be sure to look at fees, loan terms, and long-term borrowing costs as well as interest rates when youre mortgage shopping. Thats the surest way to save money on your new home loan.

1Top 40 lenders for 2020 sourced from S& P Global, HousingWire, and Scotsman Guide.

2Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Averages include all 30-year loans reported by each lender for the previous year. Your own rate and loan costs will vary.

Popular Articles

Step by Step Guide

Rocket Mortgage Vs Quicken Loans

If youre wondering what the difference is between Rocket Mortgage and Quicken Loans, its purely a branding thing.

In fact, the Quicken Loans name was officially changed to Rocket Mortgage on July 31st, 2021.

Over time, you will see less and less of the Quicken Loans brand as it is phased out, despite their website remaining operational.

Originally, Rocket was simply the digital technology that powered Quicken Loans, but the immense popularity of the name itself eventually eclipsed its parent company.

Long story short, they are the same company, so if you apply with either, your experience should be no different.

They say youll still be able to visit the QuickenLoans.com website, but the company behind it will be Rocket Mortgage.

And it will simply direct you to apply for a home loan with Rocket Mortgage.

You May Like: What Is Loan To Value Mortgage

Average Days To Close Loan

After youre approved for a home loan and the buyer accepts your offer, youre ready to move into the closing process. This process includes your home appraisal, home inspection, mortgage underwriting, closing disclosure acknowledgment, final walkthrough and closing.

Rocket Mortgage® orders your home appraisal once your mortgage is approved to ensure your homes value is correct. After your appraisal is verified, you can schedule your home inspection to make sure your home doesnt have any significant problems or repairs that were not disclosed. While this is happening, Rocket Mortgage® underwrites your loan to complete your mortgage.

Next, youll receive a closing disclosure 3 days before your closing date, which youll need to acknowledge for the closing process to move forward. Then, youll do a final walkthrough of your property to confirm its in the condition agreed upon in your contract and that all required repairs were made.

The part youve been waiting for youll show up for closing with your proof of down payment, sign all necessary paperwork and get the keys to your new home. Most closings take an average of 30 days with Rocket Mortgage®.

Expect to complete some other steps that are important to protect your new home, like buying title insurance and finding homeowners insurance.

Quicken Loans Rateshield Approval

- They now offer a combined pre-approval and rate lock product

- Available on home purchase loans

- That protects you in the event interest rates rise while searching for a home

- It can potentially make your offer stronger if facing other competition

The company recently launched a new benefit called RateShield Approval in which you can lock your interest rate before actually finding a home to purchase.

When obtaining a pre-approval from the company, you can lock your interest rate for up to 90 days.

Once you eventually submit your signed home purchase agreement, theyll compare your locked rate to published rates for that date.

If rates increase between that time, your original locked rate is good to go. If rates happen to fall, theyll re-lock your rate at the lower of the two rates for another 40 to 60 days.

This so-called RateShield Approval can make your offer more competitive as well, with home sellers knowing youre approved for a mortgage regardless of what happens to interest rates along the way.

RateShield Approval is available on conventional, FHA, and VA loans, but only for 30-year fixed mortgages.

Read Also: Are Home Mortgage Rates Going Down

How Can You Get Pre

There are two ways to start the mortgage process: a pre-qualification and a pre-approval.

Getting prequalified is an informational step to get an idea of what rates to expect and how much you can borrow based on your income and debt levels. You dont have to supply any documentation at this time.

The quotes you receive are not set in stone and are subject to change with your official application. But its good to find out what type of loans you should consider, how much cash youll likely need, and what price range of home you should look at.

Youll need more to actually make an offer on a home because most sellers dont view a pre-qualification as official enough to indicate likely financing.

What Could Be Improved

No physical branches

You cannot do business in person with Rocket Mortgage or Quicken Loans. It is a strictly online process. Live humans are available to assist, but you won’t be able to talk face to face.

No home equity loan or home equity line of credit

You can’t get a home equity loan or home equity line of credit with Rocket. If you’re interested in accessing a portion of your home equity in the form of cash, the only way to do so through Rocket Mortgage or Quicken Loans is with a cash-out refinance loan.

Limited low down payment eligibility

If you don’t qualify for an FHA or VA loan, you’ll probably need to come up with a down payment. Also, Rocket Mortgage does not offer a low down payment mortgage without private mortgage insurance .

No USDA loan

Currently, Rocket Mortgage does not offer this loan type.

Don’t Miss: Are Mortgage Discount Points Worth It

How Do Home Loans Work

A home loan, also known as a mortgage, is a loan you use to purchase a home. The loan is also secured by your home, which means that if you stop paying on your loan, the lender can seize the home and sell it. There are several types of home loans, including conventional, FHA, VA, and USDA mortgages. Home loans can also have fixed rates, which have the same interest rate for the length of the loan, or variable rates, which the lender can change subject to specific limits.

Rocket Mortgage Review: Full Approval In Just 8 Minutes

Do you know how long it takes for the space shuttle to reach orbit? Apparently it takes just eight minutes, the same amount of time it will take borrowers to get a full mortgage approval online via Rocket Mortgage.

At least, this is the powerful claim the company is touting via a new online mortgage approval engine that promises to shake up the age-old, and very stale home loan process. They created quite a stir during their Super Bowl ad as well.

The company launched the end-to-end online product in late 2015 in what appeared to be a direct response to the many online mortgage startups now in existence.

Essentially, parent company Quicken Loans didnt want to get left behind, and in fact, wanted to be a leader in the new digital mortgage world. So far, it seems to be working.

Don’t Miss: What Is A Mortgage Modification Agreement

Why Mortgage Rates Change

Mortgage rates can fluctuate on a daily basis as theyve done for much of 2021. Many factors influence the movement of mortgage interest rates, including

-

Actions the Federal Reserve takes on short-term interest rates

-

Current home sales and housing starts

-

Inflation

-

Unemployment

-

Corporate earnings

Because mortgage rates are so volatile, it can be a good idea to get pre-approved and lock in a low mortgage rate as soon as possible when youre shopping for a house.

Credible lets you see prequalified rates for conventional mortgages from multiple lenders all within a few minutes. Visit Credible today to get started.

Quicken Loans Vs Your Local Bank For Mortgage Loans: An Overview

Since the dot-com boom of the late 1990s, online mortgage companies have become an increasingly significant force in the home loan industry. Leading the charge is Quicken Loans, now the largest retail mortgage lender in the country.

Does the growth of players like Quicken Loans, which offers an automated approval process through its Rocket Mortgage platform, mean web-based firms have more to offer than your community bank down the street? Not necessarily. Where you go for a loan is largely a matter of what is comfortable for youand where you can get the best rates.

Both types of lenders offer mortgage pre-approval. Being pre-approved can sometimes help you have your offer on a home accepted. However, they have other significant differences that could shape which one you find preferable.

- In recent years, online lender Quicken Loans has become known for convenience and strong customer service.

- If meeting with lenders face-to-face is important to you, a local bank with a good reputation is a sound choice.

- Local banks may also have better rates or lower fees than online options.

- Both types of lenders offer mortgage pre-approval.

Also Check: Can You Get A Mortgage To Buy A Foreclosed Home

Rocket Mortgage Online Convenience

Rocket Mortgage was launched by Quicken Loans in a blast of commercials touting push-button convenience at orbit-achieving speed.

Everything in the Rocket Mortgage process is about gradually but quickly moving from one step to the next. It feels casual. Well, as casual as taking out a six-figure loan can.

How To Lock A Mortgage Rate For Your Refinance

Its important to be able to lock your rate quickly so you can take advantage of unexpected interest rate dips. You can use Rocket Mortgage® to lock your rate online. Heres how it works:

Rocket Mortgage® is available 24/7 so you dont ever have to wait to lock your rate.

Recommended Reading: Is Total Mortgage A Good Company

Shorten Your Loan Term

You can save a lot of money if you shorten your term from 30 to 15 years. Even if you shorten to a term like 27 years, you can get a lower interest rate in addition to paying off your mortgage sooner because investors dont have to project inflation as far out.

Although your monthly payment will be higher, you could potentially save tens of thousands in interest over the life of the loan. Not only will your interest rate be lower, but youre also benefiting from the fact that you pay more toward your mortgage balance faster than you would on a traditional 30-year loan.