Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Saving Money By Getting Below Pmi Requirements

Mortgage companies require PMI when the borrower does not have 20% or more for a down payment. It is protection for the lender in case the borrower defaults on the loan. So, if a home was purchased with less than a 20% down payment, the bank is probably charging PMI. However, once the borrower owns 20% of the home, this charge could be eliminated. Some borrowers take out a second mortgage to bypass the PMI requirement.

Some banks may automatically charge for PMI until you loan-to-value is at 78%, but you can call them when your loan hits 80% to get PMI charges removed.

Adding Extra Each Month

Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early. Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years! There are several ways to find that extra $100 per month taking on a part time job, cutting back on eating out, giving up that extra cup of coffee each day, or perhaps some other unique plan. Consider the possibilities it may be surprising how easily this can be accomplished.

Also Check: How To Pay Off Your Mortgage Quickly

Recast Your Mortgage Instead Of Refinancing

Mortgage recasting is different from refinancing because you get to keep your existing loan.

You just pay a lump sum toward theprincipal, and the bank will adjust your payoff schedule to reflect the newbalance. This will result in a shorter loan term.

One major benefit to recasting isthat the fees are significantly lower than refinancing.

Typically, mortgage recasting feesare just a few hundred dollars. Refinance closing costs, bycomparison, are usually a few thousand.

Plus, if you already have alow interest rate, you get to keep it when you recast your mortgage. If you havea higherinterest rate, refinancing might be a better option.

Check with your lender or servicer if youlike this option. Not all companies will allow a mortgage recast.

Pay Off Credit Card Debt

If youre having a hard time with like many Americans, its more than likely you dont have enough available cash to commit to paying extra on your mortgage. Your credit card rates are going to be significantly higher than your home loan interest rate so it makes sense to tackle credit card debt first. Credit cards typically carry the highest cost to borrow with an average variable interest rate of about 16%.

You May Like: Is Closing Cost Part Of Mortgage

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Will Your Mortgage Company Let You Pay It Off Early

When you pay off your mortgage faster, you pay less interest, and your mortgage company makes less money off your loan. For this reason, not all mortgage companies permit their clients to pay off their loans earlier than stipulated in their contract. So, before you make any grand plans, double-check that your lender will, in fact, allow you to pay off your mortgage faster.

Read Also: How To Become A Mortgage Broker In Massachusetts

Paying Down Your Mortgage Example

So lets assume its still the early days for your mortgagewithin the first decade. Lets say you have a 30-year fixed $200,000 loan at a 4.38% rate that amounts to a lifetime interest charge of $159,485 if you pay the usual 12 times a year. Make that a lucky 13 payments each year, though, and you save $27,216 in interest overall. If you kicked in an extra $200 each month, youd save $6,000 in 10 years, $50,745 in 22½ yearsand youd have the mortgage paid off, too.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

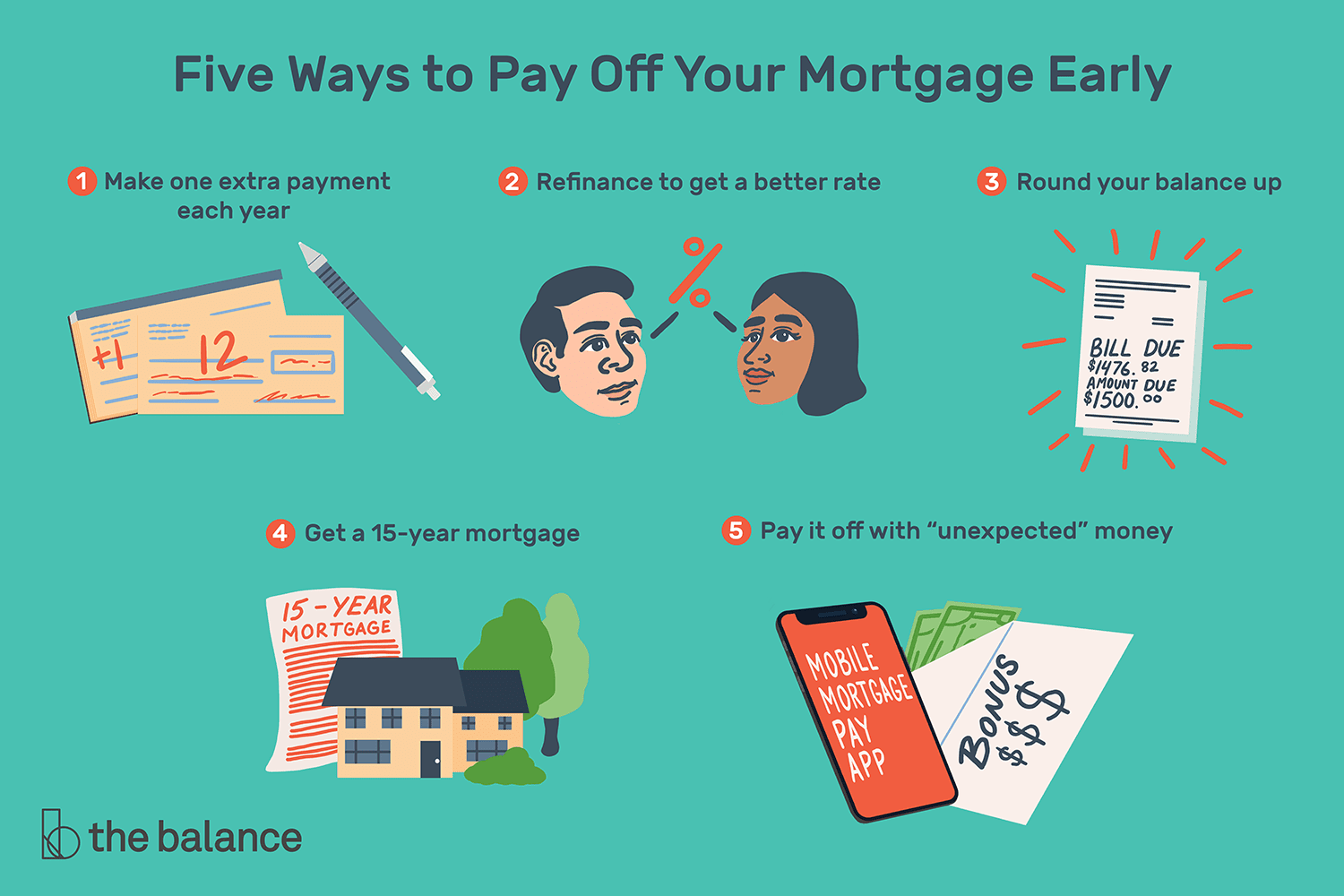

How To Pay Off Your Mortgage Early: 5 Of The Best Options To Explore

Paying off your mortgage early can free up money in your budget and give you the peace of mind that comes with owning your home free and clear. But how can you actually pay it off early?

For many families, their mortgage is the single biggest payment they make each month. And once that mortgage is paid off, you free up a lot of extra money in your budget. Not only that, but you have the peace of mind of knowing you own your home, free and clear.

Once youve paid off your mortgage, you can use that money for other important goals like sending your child to college or buying a rental property. Plus, paying off your home loan will drastically reduce your monthly expenses, making it easier to retire.

But how do you pay off your mortgage early? Weve rounded up five of the best tips to help you become mortgage-free faster.

How to pay off your mortgage faster

1. Refinance your loan to get a lower interest rate

Mortgage interest rates have reached historic lows throughout the past year as a result of action by the Federal Reserve during the coronavirus pandemic. Many homeowners have taken advantage of these low rates to drastically reduce their mortgage rates.

Visit Credible to see current refinance rates and see whether you could get a better deal on your mortgage.

Next steps

Hit The Principal Early

Over the first few years of your mortgage, it may seem that you are only paying interest and the principal isnt reducing at all, says Nila Sweeney, managing editor or Property Market Insider. Unfortunately, youre probably right, as this is one of the unfortunate effects of compound interest. So you need to try everything you can to get some of the principal repaid early and youll notice the difference.

Every dollar you put into your mortgage above your repayment amount attacks the capital, which means down the track youll be paying interest on a smaller amount. Extra lump sums or regular additional repayments will help you cut many years off the term of your loan.

Recommended Reading: What Is The Mortgage Rate In Florida

Losing The Benefits Of Interest Deductions

Before deciding to pay off a mortgage early, it would be a good idea to weigh the pros and cons. The interest charged on up to $750,000 of mortgage debt used to purchase a principal residence can be used as a deduction on taxes in the year that it is paid. Because most of the monthly payments in the early years of a loan are interest, this can really add up. The mortgage interest deduction to homeowners is a very popular subsidy. However, the benefit would be lost if the mortgage is paid off early. In years gone by interest paid on home equity loans or HELOCs was tax deductible, but that is no longer the case in 2018, as equity debt is no longer treated like mortgage debt unless it is obtained to build or substantially improve the homeowner’s dwelling.

Build Up A Rainy Day Fund

Save for an emergency. We recommend setting aside three to six months’ worth of living expenses in savings in case you lose your job or incur unexpected costs. Without those financial reserves in place, you could put your mortgage in jeopardy, which includes the extra money you worked so hard to put toward it if youre making extra mortgage payments

Also Check: Is A Home Loan A Mortgage

Mistakes To Avoid When Paying Off Your Mortgage Early

If you can afford to pay off your mortgage ahead of schedule, youll save some money on your loans interest. In fact, getting rid of your home loan just one or two years early could potentially save you hundreds or even thousands of dollars. But if youre planning to take that approach, youll need to consider if theres a prepayment penalty, among other possible issues. Below are five mistakes that you should avoid when paying your mortgage off early. A financial advisor can help you figure out your mortgage needs and goals.

More Stories From The Mortgage

After paying off our mortgage, I thought it would be fun to learn from and feature other families who did the same. The freedom and options these families have because they are now mortgage-free is incredible. Check out these stories below and find one that resonates with you.

These are just a handful of the stories we’ve collected about families paying off their mortgages early. If you’re interested in listening or reading more stories about how to pay off your mortgage early, .

And hey, if you’ve paid off your mortgage, I’d love to hear from you. Sharing your financial wins could inspire others to win too. More inspiration. More mortgage free families. And so on. What a wonderful mortgage free world that would be!

How would paying off your mortgage early change your life?

Please let me know in the comments below.

Don’t Miss: How Do You Buy Down A Mortgage Rate

Should You Pay Off Your Mortgage Early Or Refinance

Do you want to pay off yourmortgage faster because youre worried about how much youre spending oninterest?

If youre simply concerned about your mortgage interest rate, consider refinancing to a lower rate and maybe a shorter term instead of making extra payments on your existing mortgage.

But if you already have a competitive interest rate and anideal loan term, you probably dont need to refinance. You may be tempted topay less interest by paying off your mortgage faster.

As you make your decision, consider whether you could earnmore investing in securities than youd save by paying down your mortgagebalance more quickly. Investing that money in a tax-preferred IRA could offermore financial peace of mind than owning your home outright sooner.

Any kind of investing can be risky. Check with a personalfinancial advisor before making any big moves if youre not sure about therisks youre taking.

Refinanceor Pretend You Did

Another way to pay off your mortgage early is to trade it in for a better loan with a shorter termlike a 15-year fixed-rate mortgage. Lets see how this would impact our earlier example. If you keep the 30-year mortgage, youll pay more than $158,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage, youll save over $85,000and youll pay off your home in half the time!

Sure, a 15-year mortgage will probably come with a bigger monthly payment. But if it fits within your housing budget, itll totally be worth it! And hey, maybe youve boosted your income or lowered your cost of living since when you first took out your mortgagethen youd definitely be able to handle the bigger payment.

You can refinance a longer-term mortgage into a 15-year loan. Or if you already have a low interest rate, save on the closing costs of a refinance and simply pay on your 30-year mortgage like its a 15-year mortgage. What if you already have a 15-year mortgage? If you can swing it, imagine increasing your payments to pay it off in 10 years!

Also Check: What Is The Highest Interest Rate On Mortgage

Early Mortgage Payoff Examples

Imagine a $500,000 mortgage with a 30-year fixed interest rate of 5%. If you paid an extra $500 per month, youd save around $153,000 over the full loan term and it would result in a full payoff after about 21 years and three months.

If you had a $400,000 loan amount set at 4% on a 30-year fixed, paying an extra $100 per month would save you nearly $30,000 and youd pay off your loan two years and eight months early.

If you had a $300,000 loan amount set at 4.5% on a 30-year fixed, paying an extra $250 per month would save you almost $70,000 and youd pay off your loan seven years and six months ahead of schedule.

Or consider a $600,000 loan amount set at 6% for 30 years. Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, itd shave nearly 12 and a half years off the loan term.

The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

The list goes on and the savings may shock you. While most people tend to be alarmed by the amount of interest they pay the bank over 30 years, its equally shocking how much you can save simply by paying a little extra.

How To Pay Off Your Mortgage In Half The Time

What if we combined some of these little known mortgage pay off tricks?

Could we cut our 30-year mortgage in half?

Which two tips sound the most reasonable to use?

Lets combine rounding up along with paying extra at the start of the mortgage.

These allow for the most flexibility and will show us what a little extra payment does in the long run.

Recommended Reading: Can I Change Mortgage Companies

Refinance To A Shorter Term

The 30-year home loan is mostpopular, but lenders offer shorter loan terms, too. A 15-year loan is acommon alternative, and many lenders also offer 10-, 20-, and 25-year loans.

Shorter repayment periods mean higher monthly payments, butless interest over the life of the loan.

Lets compare a 20-year term to a30-year term.

Most 20-year mortgages carry lowerrates than 30-year mortgages. Typically, 20-year rates can beanywhere from one eighth to a quarter percent lower.

- Lets say youre financing a$250,000 loan on a 30-year term at 3.75%. Your principal and interest paymentswould be about $1,150 per month

- Using the same loan amount, but with a20-year term at 3.625%, your monthly payment would be $1,450

- Youd pay a few hundred more per month, butyou would be mortgage-free a decade sooner

The best part? The savings in interest onthat 20-year mortgage would be over $65,000 if you kept the loan untilit was paid off.

Another benefit of refinancing toa shorter term is that you dont have to start over with 30 more years.

For many homeowners who are wellinto their original mortgage term, starting over with another 30 years worth of interest mightnot make sense.

But with a 15-year refinance, you could lock in a low interest rate and a shorter loan term to pay off your mortgage faster. Just note: the shorter your mortgage term, the higher your monthly mortgage payments will be.

Make Dreams Become A Reality

The sense of freedom we now have is incredible. Without a mortgage, my personal stress levels have decreased immensely. Our young family’s future looks bright.

Here are some of the ways we are already bringing our post-mortgage dreams to life:

Travel More

The following spring after we paid off our mortgage, we took our family to Cabo San Lucas for a week of fun in the sun. We hit up Disney World, Los Angeles and Florida that year.

Now, were addicted to getting out of town when its cold in Michigan. Money well spent!

Give More

Our family charitable giving has gone from 1% to 5% . Were proud to give more, but were more proud to highlight the fine people leading these charities.

Here are a few charities that I admire and Ive had the pleasure to interview on my podcast:

- Sandy Hook Promise: Preventing gun violence in schools

- Feeding America: Helping 37 million Americans who face hunger

Design a 30-Hour Work Week We Enjoy

Nicole recently took a part-time job that she loves. After 5+ years as a stay-at-home Mom, she was ready to add something else into her life. Now, she has a nice balance of work and family life that makes her smile.

I decided to leave my full-time career in corporate event marketing and pursue my passion of helping young families build wealth full time. It was a big decision to leave a six-figure career and become an entrepreneur, but we were financially prepared for the big leap and I was ready for a change.

You May Like: Who Owns American Pacific Mortgage