Property Address Cannot Change

This is very important to note: the property address cannot change on a locked loan. If a property address changes, the loan must be withdrawn and a new application must be originated with the new property address. The pricing will be subject to current market rates at the time of the new application.

Rates Vary From Day To Day

Mortgage interest rates arent set by a single entity but instead are influenced by a wide range of market factors, much like the stock market. Rates fluctuate from day to day and week to week. And when you see specific rates mentioned in the news, it is usually referencing a mortgage rate survey such as the weekly survey thats done by Freddie Mac.

These types of surveys dont account for your personal situation, and also could be slightly out of date by the time youre seeing them. You may have a higher credit score or be putting a bigger down payment down on your house then the minimum borrower standards required for the survey, or vice versa. So the rate survey trends might be more useful than the specific interest rates mentioned.

What Is The Difference Between A Fixed Vs A Variable Mortgage Rate

If you choose to get a fixed mortgage rate, your mortgage rate and, therefore, your mortgage payment stays the same throughout your entire mortgage term. If youre risk-averse and/or just feel more comfortable knowing how much youll need to budget for each month, you should consider getting a fixed mortgage rate but know that the security comes with a premium, in the form of a higher interest rate. Of all the mortgages in Canada, 66% currently have fixed rates.

Variable mortgage rates, on the other hand, are historically lower than fixed rates but can vary throughout the duration of your mortgage term. Variable rates are attached to Prime, so if Prime fluctuates up or down, so does your mortgage rate and, therefore, your mortgage payment. If youre comfortable taking on some risk, a variable mortgage rate could potentially save you a lot of money throughout the life of your mortgage. Of all the mortgages in Canada, 26% currently have variable rates.

You May Like: How To Determine Ltv Mortgage

Give Yourself Time To Switch Lenders

If you decide to switch lenders, you may be wondering when should I start looking to remortgage? The answer is as early as possible. Youll need to submit a mortgage application as though you are applying for a new mortgage, which means youll need to provide documentation including:

- Copy of your mortgage renewal letter

- Proof of income

- Proof you own your home

- Proof of property insurance

It usually takes a mortgage broker over a week to process your application, so make sure to leave plenty of leeway between when you start the process and when your mortgage is due to renew, otherwise you may end up sticking with your current lender for your next mortgage term.

Fha Mortgage Rates Change Constantly

The first thing you need to understand is that FHA rates change on a daily basis. The more significant changes usually happen over a period of weeks. But they can also change slightly from one day to the next. This is an important concept to understand when shopping for an FHA loan. You never know if interest rates are going to rise or fall you just know theyre going to change. This is why its so important to lock in a mortgage rate when you get a good one.

Common statement:Ill lock in eventually. I just want to shop around for a bit longer. I figure the FHA rates wont change much within the next couple of months.

This kind of logic could cost you a lot of money over the life of your loan. Sure, its important to shop around for the best rates. Thats why we recommend that you compare rates online before moving forward. But there comes a time when you need to lock the mortgage rate down, to prevent further fluctuations. Theres a fine line between smart shopping and procrastinating. Heres an example of how the latter scenario can cost you money.

This table shows what would happen if I were taking out a $250,000 FHA loan at various interest rates. These calculations do not include property tax or insurance. To keep things simple, Ive only included the principal and the interest.

| Rate | |

| $1,613 | $330,750 |

You May Like: How Big A Mortgage Can I Get With My Salary

Important Mortgage Rate Lock Considerations

-

Should I lock my mortgage rate today? If you have a good mortgage rate, lock it. Dont expect the interest rate market to work any magic for you. It can work against you, too. But always ask your loan advisor for their input, as well.

-

What are todays mortgage rates? If youre looking for a benchmark to compare your interest rate to, explore todays mortgage rates for your area and credit score.

-

What happens if my rate lock expires before closing? Your rate will begin to float with daily interest rate movements. The best idea is to talk to your lender well before your lock expires to see if they will extend it. If youve been responding promptly to each information request from the lender, the delays may not be your fault and you might get a little extra time.

About the author:Hal Bundrick is a personal finance writer and a NerdWallet authority in money matters. He is a certified financial planner and former financial advisor. Read more

Whats A Mortgage Rate Lock

A mortgage rate lock is an agreement between a borrower and a lender that allows the borrower to keep a certain interest rate on a mortgage for a specified time period. The rate you lock is protected from increasing during this period.

Interest rates fluctuate daily. So when you lock, youll be able to estimate your monthly payment with close accuracy and protect yourself from changes in the market.

Locking an interest rate is a risk to a lender because if rates go up, they must still honor the one you locked.

Don’t Miss: What Is A Teaser Rate Mortgage

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, you’re considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

- months until end of the term: 24

- current interest rate for a 5-year term offered by the current lender: 4.0%

- current term: 5 years or 60 months

- payment frequency: monthly

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |

Got A Good Mortgage Rate Lock It In

Obtaining the lowest available interest rate on a mortgage should be every prospective homeowner’s objective. Lower interest rates result in lower monthly payments, so you should spend a lot of time and effort searching for the best rate. If you do, you’ll probably find the most competitive one available.

Read Also: Does My Husband Have To Be On The Mortgage

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

How Long Can You Get A Float Down Rate For

Some lenders allow you to float down the rate until closing, while others set limits. For example, you might be able to request a lower rate just once after asking for a rate lock. But always check with the lender, and ask whether they charge a fee.

All of the mortgage lenders in the table below are our partners.

Kim Porter is an expert in credit, mortgages, student loans, and debt management. She has been featured in U.S. News & World Report, Reviewed.com, Bankrate, Credit Karma, and more.

Also Check: How To Shave Years Off Your Mortgage

What If My Rate Lock Will Expire Before My Loan Closing Date

If your rate lock will expire prior to closing and disbursement of funds, a rate lock extension will be required to close your loan. We will extend your rate lock at no cost to you. Please be sure to respond promptly to all requests for information and documentation so we can move closer to closing your loan.

Some common reasons a rate lock extension may be needed include:

- Information you provide us is incomplete or delayed.

- The property is not ready to be occupied.

- There are issues clearing the title.

If your closing date becomes unknown or uncertain and you need more time to close the loan, you may be able to return to float by unlocking your rate.

You may cancel/withdraw your loan application at any time.

If youre using a Bond program and your loan will not close by the rate lock expiration date, contact your home mortgage consultant to see if the bond program youve chosen allows your rate to be extended, or you may cancel/withdraw your loan.

How Much Does A Mortgage Rate Lock Cost

Some lenders charge a separate fee for a rate lock. This fee varies and can be expressed as a dollar amount, such as $1,000, or as a percentage of the loan amount, such as 0.25% of the total loan value.

Other lenders might not charge a fee for a rate lock, but this usually just means its included in the rate youre offered.

Recommended Reading: What Is A Mortgage Modification Agreement

Are Extended Locks Worth The Money

To determine whether an extended mortgage rate lock is worth the money, youll need to know a little bit about the future of mortgage interest rates.

After all, doing an extended rate lock is really just a hedge against the future.

So, whats the likelihood of mortgage rates soaring between now and the six or twelve months it will take until your home is ready for closing? If recent history is any indication, the chances are pretty low.

Between 2000 and 2015, looking at rolling six-month changes, there was a period during which 30-year mortgage rates spiked 96 basis points within six months and a period during which they plunged 139 basis points .

As a home buyer, youd be nervous when mortgage rates rose but ecstatic to see mortgage rates drop. However, these shifts are at the extremes.

Rates rose more than 75 basis points only 3 times and they dropped more than 125 basis points only 3 times, also. During every other 6-month period, rates hardly moved much at all.

Since 2000, during any given 6-month period, 30-year mortgage rates moved just 14 basis points on average, affecting monthly mortgage payments by just $8 per month per $100,000 borrowed.

Furthermore, if we exclude months during which mortgage rates dropped only counting the months in which they rose the average 6-month change in rates was just 32 basis points .

A Guide To The Mortgage Rate Lock

4-minute read

Mortgage interest rates can fluctuate rapidly they move up and down from day to day and even from hour to hour. This can impact the amount you pay when you refinance your mortgage. A mortgage rate lock protects you from costly fluctuations and freezes your interest rate while you close on your refinance.

Also Check: Can I Have A Co Signer On A Mortgage

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

What Happens If The Rate Goes Up Or Down After You Lock In The Rate

If interest rates rise during your lock-in period, you will not be impacted you will still pay the lower rate that you locked in. If, however, you lock in a rate but then rates drop, you typically will not be able to take advantage of those lower rates instead, youll pay the higher rate that you locked in. There are some exceptions to this: First, if you have a so-called float down provision which states that if rates drop during the rate lock period, the borrower can take advantage of the lower rates in your written rate lock agreement, you should be able to get a loan with the lower interest rate. . Second, you can rewrite your rate lock so that it reflects the new, lower rate, but this, too, can prove costly.

You May Like: Is 3.99 A Good Mortgage Rate

Understand That Rates May Drop

When you lock in your rate, you should be prepared for the possibility that rates will drop. This is just another reality of the process, and it shouldn’t necessarily change your plans to close on your mortgage. Still, borrowers often wonder what to do if they really feel they’re missing out on a great rate.

Your options vary depending on your rate lock agreement. In some cases, you may be able to withdraw and reapply for your loan, but this will significantly delay your buying process.

The best advice we can give you? Talk to your lender. Losing a borrower between a loan offer and closing is known as fallout risk, and lenders will usually work with you to prevent that from happening.

Can You Change Lenders After Locking A Rate

Yes, you can change lenders even after locking a rate. Its legal and doesnt carry a specific fee or penalty.

Sometimes borrowers choose to switch lenders in the middle of the transaction. While this isnt ideal for you, it may be necessary if your mortgage adviser is unresponsive or slow and if they lose paperwork or cant close on time.

Also Check: How Long Is The Mortgage Process

Our National Builder Division Team Is Here For You

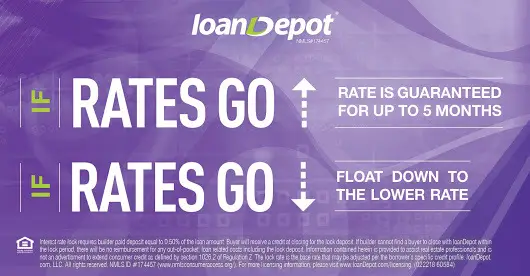

Builder Rate Lock Advantage

Interest rates can be locked in early – for up to 12 months. Not only does this protect against rising interest rates, there’s even a one-time option to re-lock to a lower interest rate or discount points, or both.

A network of mortgage specialists

We’ll work closely with your homebuyers from application to closing and keep you informed every step of the way.

A PRO team

Our Project Review Office helps make condo approvals easier.

Access to Appraisal Professionals

We work with high-quality professional appraisers who are experienced in new construction appraisals.

Bank of America Real Estate Center®

The Bank of America Real Estate Center® provides buyers with easy access to your available homes from a computer or mobile device.

Access to Data

The National Builder Division works with several data providers to bring you up-to-date local market trends and insights.

Bank of America does not offer construction financing for homeowners, but we do offer very competitive terms for permanent financing on new construction homes . Our ability to lock in a buyers permanent interest rate for up to 360 days in advance of completion of the home, gives them the ability to run their construction financing and permanent loan applications concurrently, taking the guess work out of what the future interest rate environment may offer. Buyers can secure their permanent interest rate now through our Builder Rate Lock Advantage program.

How A Mortgage Rate Lock Works

The best way to understand how a rate lock works is to consider the different scenarios of interest rate movements: staying the same, moving higher or dipping lower.

If mortgage rates stay the same: It could happen. Mortgage rates can dance around for weeks, going up or down a notch or two and end up right where they started when you began the process. In that case, you might feel as though whatever you paid for the rate lock, if anything, was wasted. But remember, your goal was to prevent rising rates from rocking your budget. A rate lock ensures that they wont.

If interest rates go up: This is the best possible scenario: If rates go up, youre protected. Your interest rate is set. Thats when a rate lock is well worth the price.

If mortgage rates go down: Rates may also go down before your closing. Unless you have a one-time “float down” option on your lock , youll miss the lower rate.

You May Like: Who Uses Equifax For Mortgages