Work On Improving Your Credit Score

While this is not the answer borrowers want to read or hear, its the most practical and can save you thousands in interest payments.

Not only will you have more mortgage options, but you might be able to get your loan with a lower income requirement and down payment.

Of course, as stated above, if you have a score below 500, you probably wont be able to do anything except wait until you increase your score.

If you have a bankruptcy on your credit, you will need to wait at least 2 years before a lender will start considering you for a new mortgage.

You can take the necessary steps to grow your score by understanding the following:

Payment history : Your payment history is responsible for 35% of your score. This is the main reason why people are continually saying pay your bills on time when it comes to your credit score.

The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit youre using, the higher your credit utilization, the lower your score can become. It would help if you looked to keep your total credit usage under 30%.

Age of credit history : This is most often referred to as your Average Age of Accounts and is one of the few factors you have almost no control over. Your credit history is basically the age of your oldest credit account, new credit accounts and the average ages of all the accounts on your credit report.

Get your free credit report and score.

Usda Loan Credit Score Requirements

USDA loans have different credit score requirements depending on the program and the lender. Section 502 Guaranteed Loans, for example, dont have a minimum credit score requirement. USDA mortgages are available to low- to moderate-income borrowers who want to buy a home in an area with a population of less than 35,000.

Can I Get A Bad Credit Mortgage If My Partner Has Good Credit

Yes, its possible to get a bad credit mortgage if your partner has good credit as there are lenders who specialise in joint applications involving only one bad credit applicant. In this scenario, your bad credit will still be factored in when the overall strength of the application is being assessed, and it might mean the deals you qualify for are fewer.

That said, mortgage approval and favourable rates could still be possible if you apply through a specialist broker who knows exactly which lenders to approach.

Recommended Reading: Can You Get A Mortgage While In Chapter 13

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Next Steps: Explore Alternatives If You Cant Get A Mortgage With Bad Credit

If youre frustrated by the difficulty of getting a home loan with bad credit, you may wonder if you can buy a home using other sources of funding, such as personal loans.

Mortgage lenders typically dont allow borrowers to take out a personal loan for a down payment. Most lenders will want to know what the loan is for, and may not want to give you the loan for the purpose of purchasing real estate. And even if they do, paying for a home with a personal loan means you wont get the tax benefits associated with a mortgage, such as the ability to deduct mortgage interest when itemizing federal income tax deductions. On top of that, personal loans typically have higher APRs, which means youll likely end up paying more in interest over the life of the loan.

If you can qualify for a smaller mortgage and afford a less-expensive home, you might want to consider buying a fixer-upper and using a personal loan to make improvements after the home has been purchased.

You could also consider using a personal loan to consolidate and pay down high-interest debt more quickly. By repaying debt and making payments on time, you can lower your credit utilization and build a positive payment history, which can improve your credit. Both of these things can help you qualify for a mortgage more easily.

About the author:

Read More

Don’t Miss: How To Mortgage Property In Monopoly

What Is The Minimum Credit Score To Get A Mortgage

There isnt a minimum credit score you need to get a mortgage in the UK. Thats because theres no such thing as a ‘universally recognised credit score’. Its possible to get a mortgage whatever your credit rating, but generally the higher your score, the more likely you are to find a lender to loan you the money to buy a house.

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

You May Like: What Lender Has The Lowest Mortgage Rates

Besides Credit Scores What Else Do Mortgage Lenders Look At

Your credit score is a main factor that lenders look at when qualifying you for a mortgage, but itâs not the only one. Other factors mortgage lenders consider when approving you for a mortgage include:

-

Your income

-

Your employment

-

Your payment history

Your current sources of debt include:

-

Student loan payments

-

Open lines of credit

Youâll also need to pass the mortgage stress test. The mortgage stress test proves to the lender that you can afford higher mortgage payments if and when higher mortgage rates arrive.

A mortgage lender will take all of these factors into account when deciding whether to approve your mortgage application. You donât have to be perfect, although if youâre strong in all or most of these areas, it can help make the mortgage approval process go much smoother.

Itâs a good idea to get pre-approved with a mortgage broker before looking at properties. If youâre not qualifying for the purchase price that you want, the mortgage broker can make suggestions to help you qualify, such paying down debt or bringing on additional income via a co-signer.

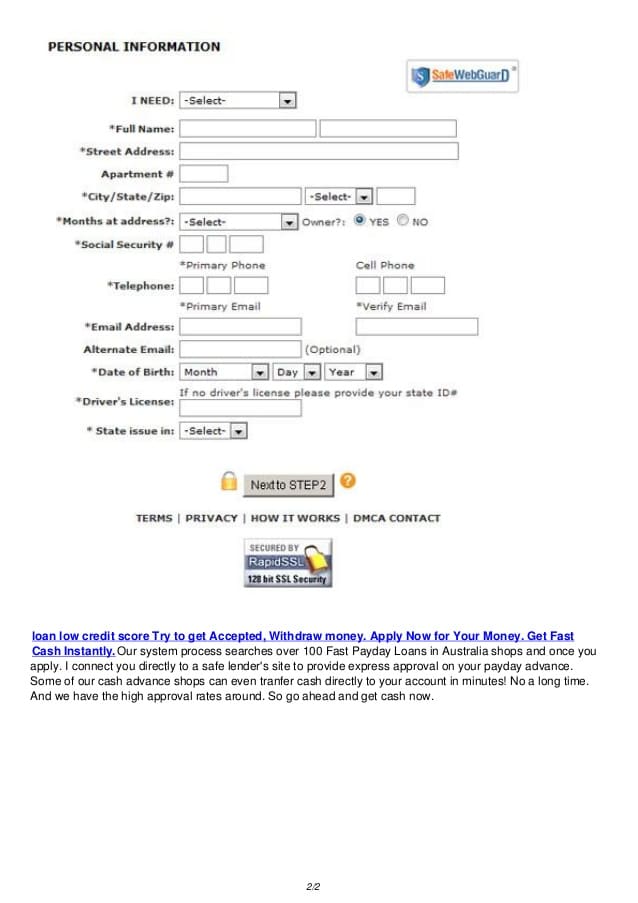

Watch For Bad Credit Mortgages And Guaranteed Approval

As you work to improve your credit score and build your standing as a creditworthy mortgage borrower, be wary of bad credit loan offers. If you see ads promising guaranteed approval for a mortgage, thats a red flag. Under federal rules, a lender must verify the ability of a borrower to repay the mortgage, so there cant be a guarantee unless that happens.

On these kinds of offers, you might even get that guaranteed approval, but itll come with costs. If you see an offer like this, ask yourself: What are the fees, what is the interest rate and what is the prepayment penalty? These costs might be inflated or excessive, which will hurt you in the long run.

You May Like: Can You Refinance Mortgage Without A Job

Start Building A Good Credit History

In order to prove you will handle your accounts responsibly, you have to have some accounts to handle. That means you need to access some form of credit. If you have a mobile phone on a monthly contract, then thats a start and it should help but not as much as having a loan from a major bank, for example. Here are some suggestions.

What If I Cant Fix My Credit Score

Its important to keep in mind that your credit score isnt the only thing that mortgage lenders look at. If you are not able to improve your credit score and dont want to consider a private mortgage lender, you can consider other options. Making a large down payment can make it easier to be approved for a bad credit mortgage. If you can find a co-signer, their credit score will be considered as well. This is helpful if they have a strong credit score or more income.

If you are over 55 years old, you are eligible forreverse mortgages. Reverse mortgages have no income or credit score requirements, and there are also nomortgage paymentsrequired either. This is particularly useful for seniors as a source of income during retirement.

Renting instead of buyinga home might also be a temporary solution in the meantime. If there is a particular property that you would like to purchase, but cannot afford to do so currently,rent-to-own homeprograms allow you to rent the home for a period of a few years, with a portion of your rent payments going towards your eventual down payment on the house. This allows you to save up money until you canafford a mortgage.

Also Check: How Do Mortgage Companies Decide How Much To Lend

Private Mortgage Lenders For Bad Credit

There are plenty ofprivate mortgage lendersthat offer bad credit mortgages in Canada. A few examples include Alpine Credits, Prudent Financial, Clover Mortgage, Canadalend, and Guardian Financing. Forprivate mortgage lenders in Ontario, a few examples include Castleton Mortgages, MortgageCaptain, and MortgageKings. You might be required to go through a bad credit mortgage broker in order to access some private lenders, as some may only work through brokers.

Some private lenders have no minimum credit score requirements, and some even allow you to make interest-only payments on your mortgage. This can help you keep up with your payments if you are having cash-flow issues. Making regular mortgage payments to a private lender can also help improve your credit score, making it easier to eventuallyrefinance your mortgageat a lower mortgage rate with another lender.

Buying A House Is A Big Investment But It Can Also Turn Into A Financial Disaster If You End Up With The Wrong Mortgage

Homeownership can help you build wealth. But if high interest rates and unfavorable terms mean youll struggle to repay your mortgage or worse, default on the loan buying a home could actually undermine your financial well-being.

Its possible to find a manageable mortgage with bad credit, but you need to know what to look for and how to avoid loans that will be difficult for you to repay.

Well review what you should consider and some different types of loans that may be a good fit depending on your circumstances.

Recommended Reading: What Documents Do I Need To Get A Mortgage

What Credit Score Do Mortgage Lenders Use

As explained above, the most commonly used mortgage credit scores are the FICO credit scores that you have with the UKs main three credit reference agencies: TransUnion, Experian, and Equifax.

Mortgage lenders will normally look at your credit score from each of the CRAs when you apply for a mortgage. If a borrower has three different scores according to each scoring system, then they will use the middle credit rating to assess your application.

But, if two credit agencies agree on your credit score, the mortgage lender will just use that credit rating in their assessment.

Best Mortgage Lenders Of 2021 For Low Or Bad Credit Score Borrowers

A home loan with bad credit is possible, even if youre a first-time home buyer. These low credit score mortgage lenders specialize in serving borrowers with credit challenges.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit score tells lenders how likely you are to pay back the money you borrow. A high score sends all the right signals, while a low credit score, sometimes referred to as bad credit, can keep you from getting approved. A bad credit score generally falls below 630.

The depends on the type of loan. Government-backed loan programs FHA, VA and USDA generally have lower credit score requirements than conventional mortgages. But its the lender that ultimately decides what the minimum credit score will be for each loan product.

If your is at or near a lender’s minimum, they could demand a bigger down payment, charge a higher interest rate or require you to pay more fees. In short, you could end up paying more for your home loan. The best way to avoid these penalties is to elevate your credit score before you apply.

You May Like: Can I Use My Partner’s Income For A Mortgage

What Is The Easiest Mortgage To Qualify For

An FHA mortgage is usually the easiest home loan to get. You can qualify with a credit score as low as 580 or even 500 . You can also usually qualify for an FHA mortgage with more debt than with a conforming mortgage.

These are general rules of thumb, but exact requirements will vary by mortgage lender.

The Experts’ Advice On Choosing A Mortgage Lender

We consulted mortgage and financial experts to inform these picks and provide their insights about mortgage lenders. Our experts have also provided advice about how to know whether you’re ready to get a mortgage, and how to decide which type of mortgage is best for you.

- , mortgage broker, founder of Aragon Lending Team

- Laura Grace Tarpley, certified educator in personal finance, editor of banking and mortgage at Personal Finance Insider

Here’s what they had to say about mortgages.

Read Also: How Much Money Should You Spend On Mortgage

Get Matched With A Bad Credit Mortgage Expert Today

If you have bad credit of any kind, getting a mortgage can be more difficult and the consequences of approaching the wrong lender or being declined can be more severe. But the good news is that bad credit doesnt mean you cant get a good deal, and help is out there.

The right mortgage broker could help you get onto the property ladder despite your credit issues, and the rates they help you secure might even surprise you. We offer a free broker-matching service that can find the right broker for you by assessing your needs and circumstances and pairing them with an advisor who has the expertise you need.

Call 0808 189 2301 or make an enquiry online and well set up a free, no-obligation chat between you and your ideal bad credit mortgage broker today.

What Credit Score Do You Need For A Mortgage

Sean Cooper

â¢10 min read

Article Contents

To qualify for the best available mortgage rates, itâs important to have a strong credit score. A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2021. Some mortgage providers allow you to qualify with credit scores between 600 and 680, but these providers may charge higher interest rates.

Want to see your credit score before applying for a mortgage?

Get your free credit score and apply for mortgages with confidence. Use Borrowell to compare mortgage options that you’re likely to qualify for.

You may be wondering why lenders in Canada care so much about your credit score. Mortgages represent a large sum of money for lenders. Just like you wouldnât lend money to a complete stranger, a lender isnât going to lend you a large sum of money without vetting you first. Your credit score is one of the main ways that lenders vet you for your creditworthiness.

A good credit score shows lenders your ability to pay bills on time. The higher your score, the more likely that lenders are willing to work with you. A good credit score can also help you qualify for better mortgage rates, which will help you save more money on your mortgage payments. The interest rate you receive on your mortgage matters, as even a slightly lower interest rate can have a major impact on what you pay in interest.

Read Also: Are Mortgage Rates Going To Rise

How To Find A Mortgage With Bad Credit

Anyone who shops for a mortgage, regardless of where their credit scores land, should compare rates and terms from different lenders. This is especially important when your credit makes it difficult to find a mortgage loan with affordable terms. You can compare loans from different types of lenders, like

- Mortgage companies

- National and community banks

Mortgage brokers can compare rates for you to match you with a lender based on your needs, but they arent required to find you the best deal unless theyre acting as your agent under contract. Brokers also typically charge a fee for services, which could be paid at closing or could come in the form of a higher interest rate. This fee may be separate from other mortgage-origination costs or other fees. And it can sometimes be difficult to tell if youre working with a lender or a broker, so be sure to ask.

When you have bad credit, many lenders may be unwilling to work with you, or you may find interest rates are prohibitively high from lenders who are willing to offer you a loan. To find lenders offering FHA loans that might have better terms, use the Lender Search List made available by the U.S. Department of Housing and Urban Development.