How Do You Calculate Debt To Income Ratio If Youre Self

You may wonder if you calculate your DTI ratio using a percentage of your gross income when you run your own business. After all, your gross monthly income may fluctuate quite a bit because you dont receive a regular paycheck like you would with an employer. To calculate your debt to income ratio, Divide your total monthly debt by your gross monthly income .

To become qualified for a mortgage as a self-employed individual, your lender or broker may ask for your last two years of income and expenses as well as current year profit and loss statements. Business and personal tax returns and bank statements supporting ongoing income will likely be requested as well.

Dti Formula And Calculation

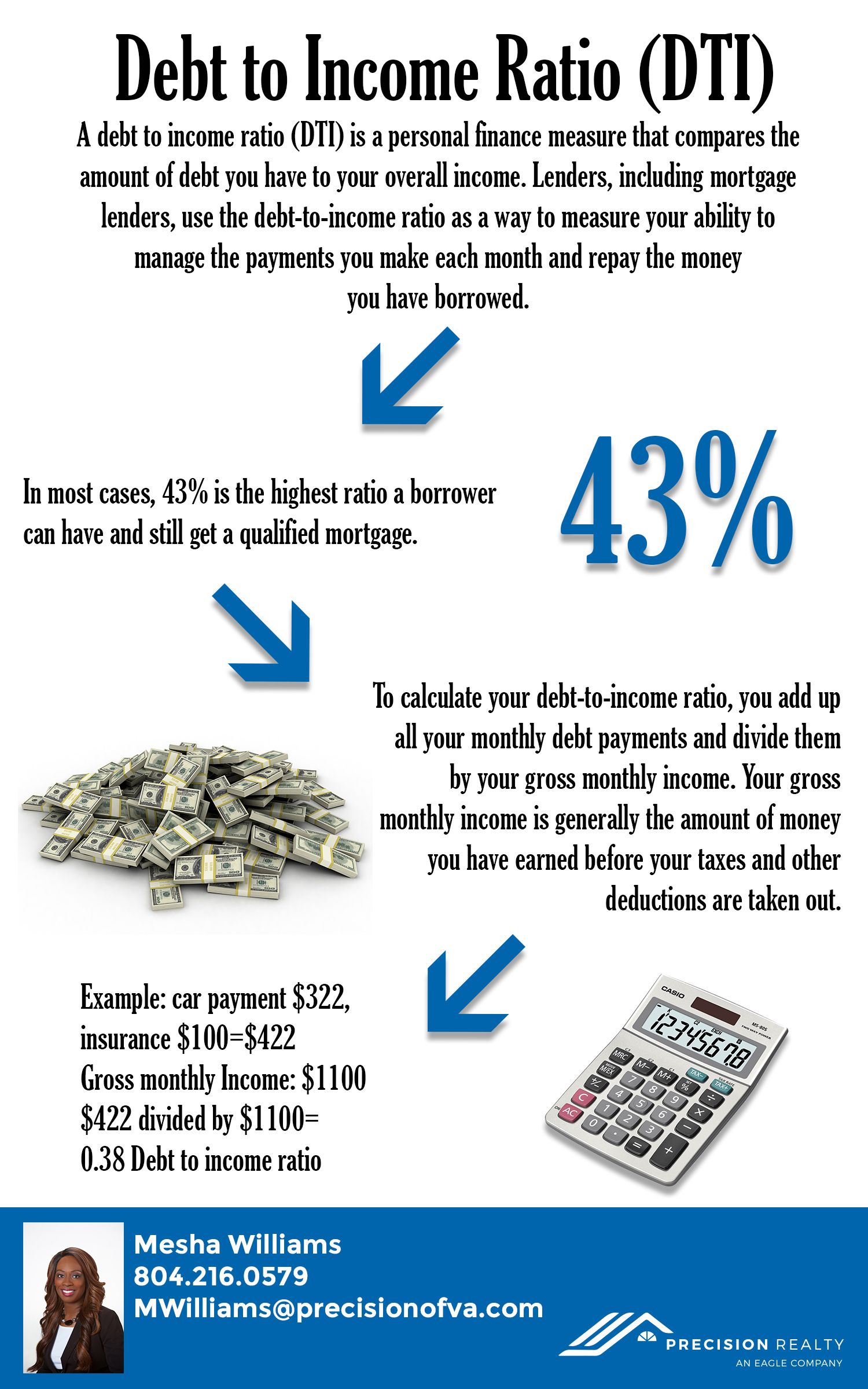

The debt-to-income ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income. Your gross income is your pay before taxes and other deductions are taken out. The debt-to-income ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments.

The DTI ratio is one of the metrics that lenders, including mortgage lenders, use to measure an individuals ability to manage monthly payments and repay debts.

Total of Monthly Debt Payments Gross Monthly Income \begin & \text = \frac } } \\ \end DTI=Gross Monthly IncomeTotal of Monthly Debt Payments

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences.

The debt-to-limit ratio, which is also called the , is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Lower Your Monthly Payments

DTI doesnt consider the full amount of debt you have it only takes into account the amount of your income going toward your debt each month. By reducing your monthly payments, you can reduce the percentage of your income being used for debt.

There are several ways to lower your monthly payments, including refinancing your loans or negotiating the interest rate on your debt. While negotiating your interest rate may be possible for , installment loans like personal loans, auto loans, or student loans will likely require a refinance to adjust the rate.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly W2 income: $10,000

- Monthly recurring debts: $1,500

- Monthly selfemployment income: $10,000

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

Conventional Loan Max Dti

The maximum DTI for a conventional loan through an Automated Underwriting System is 50%. For manually underwritten loans, the maximum front-end DTI is 36% and back-end is 43%. If the borrower has astrong credit scoreor lots of cash in reserve, sometimes exceptions can be made for DTIs as high as 45% for manually underwritten loans.

| Automated underwriting |

|---|

| 41% |

Also Check: Recast Mortgage Chase

Tips To Keep Your Debt

Are you worried that your debt-to-income ratio will make you ineligible for a mortgage loan?

You can follow these tips to lower your DTI and improve your chances of mortgage approval:

Even if your DTI is within the good range for mortgage qualifying, it doesnt hurt to try to lower it before you apply.

The lower your existing debts, the more youll be able to spend on your mortgage.

Working to improve your debt-to-income ratio before you apply for a home loan can make you eligibile for a bigger, more expensive home.

How To Calculate Your Dti

To determine your debt-to-income ratio , start by adding up all your monthly debt payments.

Monthly debts for DTI include:

- Future mortgage payments on the home you want

- Auto loan payments

- Groceries

- Other non-debt expenses that dont appear on your credit report

Next, divide the sum of your debts by your unadjusted gross monthly income. This is the amount you earn every month before taxes and other deductions are taken out otherwise known as your pre-tax income.

Then, multiply that figure by 100.

* 100 = Your DTI

For example, say your monthly debt expenses equal $3,000. Assume your gross monthly income is $7,000.

$3,000 ÷ $7,000 = 0.428 x 100 = 42.8

In this case, your debt-to-income ratio is 42.8% just within the 43% limit most lender will allow.

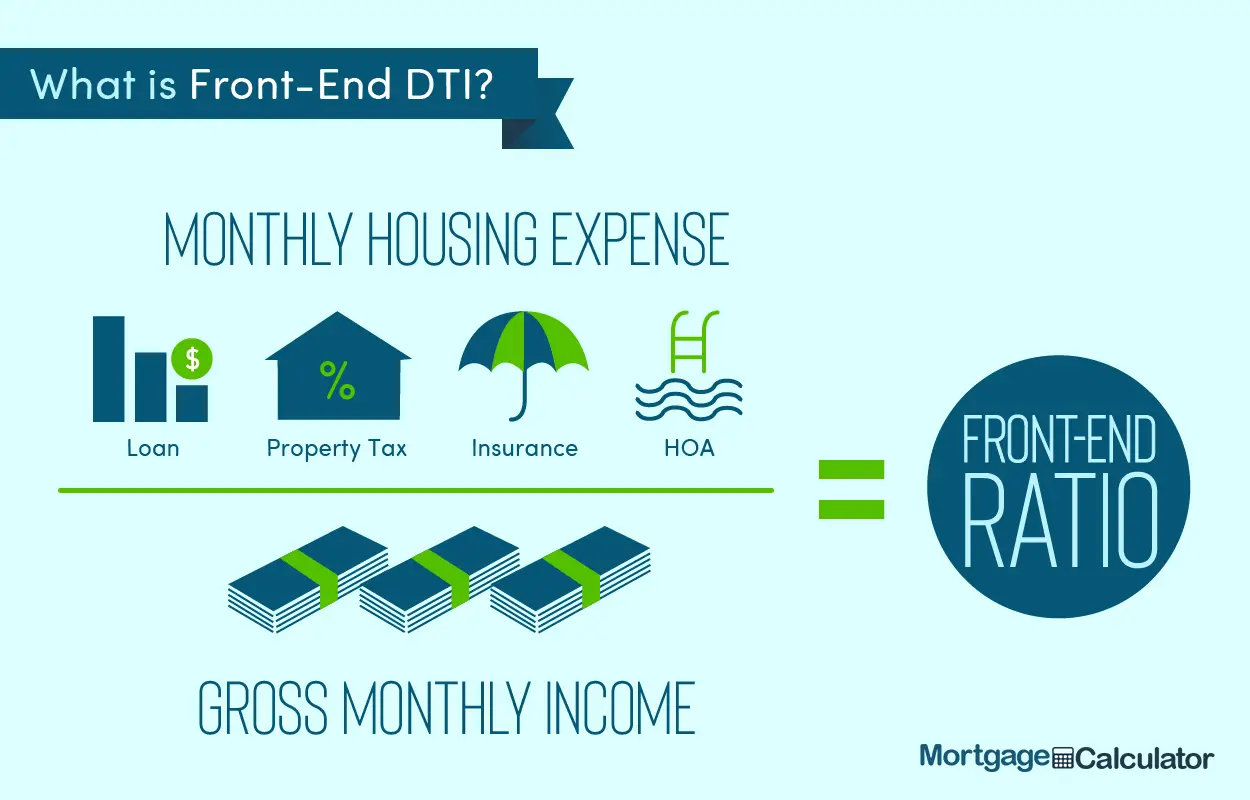

Front-end DTI vs. back-end DTI

Note that lenders will examine your DTIs front-end ratio and back-end ratio.

Your front-end ratio simply looks at your total mortgage payment divided by your monthly gross income, says Cook.

Most lenders want to see a front-end ratio no higher than 28%. That means your housing expenses including principal, interest, property taxes, and homeowners insurance takes up no more than 28% of your gross monthly income.

But in most cases, says Cook, the front-end debt ratio is not the number that matters most in underwriting. Most loan underwriting programs today primarily look at the back-end debt ratio.

Read Also: How Much Is Mortgage On A 1 Million Dollar House

What Is Debt Service Ratio

The two main debt service ratios are the Gross Debt Service and Total Debt Service ratios. These ratios are also called debt service coverage ratios, since it measures how much your income can cover your debt and other payments. Knowing your debt service ratios are important when applying for aninsured mortgagesince the CMHC has recommended maximum limits for these ratios. If your debt service ratio is over the allowed limit, you may find it harder to qualify for a mortgage.

Debt service ratios are used when applying for a mortgage during thestress test. To see if you can pass the stress test, use ourmortgage stress-test calculator.

Put Another Person On The Loan

If youre buying a home with your spouse or partner, your mortgage lender will calculate your DTI using both of your incomes and debts. If your partner has a low DTI, you can lower your total household DTI by adding them to the loan.

However, if your partners DTI is comparable to or higher than yours, then adding them to the loan may not help your situation.

Don’t Miss: Reverse Mortgage On Condo

Gross Debt Service Ratio

Gross Debt Service is your housing costs as a percentage of your income. Monthly housing costs used in the GDS calculation include your monthly mortgage payment, property taxes, heating costs, half of your condo fee, and other applicable rental fees or homeowners association fees. For your HOA fee, only half is included, while the full amount is included for your site rent or ground rent.

To calculate your GDS ratio, you will need to know how much your mortgage payments will be. You can find out this amount by using amortgage calculator. You will need to includeCMHC insurance premiumsin your calculation. You can also use aproperty tax calculatorto estimate your monthly property tax payments. Then, add all of your housing costs together to get your total GDS Ratio Cost.

Next, divide your monthly housing costs by your monthly gross income. Gross income is your income before anyincome taxesor deductions. The result is your GDS ratio.

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Popular Articles

Don’t Miss: Rocket Mortgage Vs Bank

How To Understand Your Dti Ratio

Your DTI can help you determine how to handle your debt and whether you have too much debt.

Heres a general rule-of-thumb breakdown:

-

DTI is less than 36%: Your debt is likely manageable, relative to your income. You shouldnt have trouble accessing new lines of credit.

-

DTI is 36% to 42%:This level of debt could cause lenders concern, and you may have trouble borrowing money. Consider paying down what you owe. You can probably take a do-it-yourself approach two common methods are debt avalanche and debt snowball.

-

DTI is 43% to 50%: Paying off this level of debt may be difficult, and some creditors may decline any applications for more credit. If you have primarily credit card debt, consider a . You may also want to look into a debt management plan from a nonprofit credit counseling agency. Such agencies typically offer free consultations and will help you understand all of your debt relief options.

-

DTI is over 50%: Paying down this level of debt will be difficult, and your borrowing options will be limited. Weigh different debt relief options, including bankruptcy, which may be the fastest and least damaging option.

S Couples Should Take Before Buying A House

Whether youre single or married, you need to take several key steps before setting your down payment goal as you prepare to buy a house. Married couples may be able to afford more with two incomes, but they may also have extra complications if one spouse brings a lot of debt or a bad credit record to the marriage. They need to decide whether its better to apply for the mortgage together or if theyll improve their chances by having the spouse with the better credit record and less debt apply alone.

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

Prioritize Paying Down Debt For Both Spouses

You can improve your debt-to-income ratio and sometimes your credit score by paying down other debts before you apply for a mortgage. If youre married, dont forget to consider both spouses debts when deciding which ones to pay off first. When youre trying to pay down debt, it generally makes sense to target larger debts with higher rates first, Channel said. If you get married and your spouse brings with them a large sum of debt, then you may want to focus on using your combined income to pay down that debt before you start seriously considering buying a house. But dont devote so much money to paying down debt that you end up without enough money for emergencies and other expenses which could end up landing you in more debt in the end.

Remember that some debt isnt necessarily a deal breaker when it comes to applying for a mortgage, so you dont have to worry about being 100% debt-free before you start looking for a mortgage lender, Channel said. With that said, the less debt you have, the more likely you are to find a lender who offers you a competitive rate.

If one spouse has a high balance on federal student loans, it can help to consider the different types of payment plans such as pay as you earn, income-based, or income-contingent repayment plans and the impact the different options can have on the mortgage application, Dellwo said. A HUD-approved housing counselor can help you figure out what strategies might work best for you.

Purchase A Cheaper Home

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time. In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

Read Also: Chase Mortgage Recast Fee

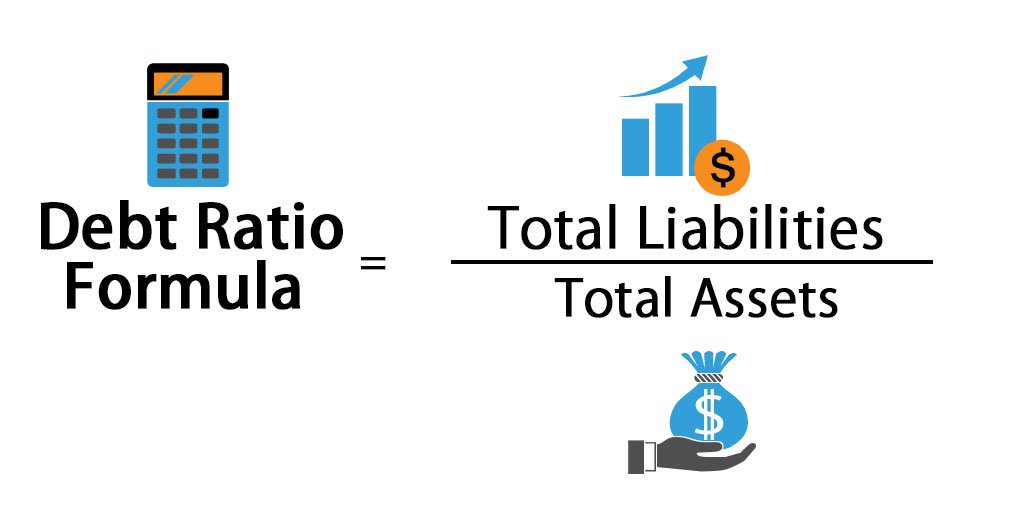

How Do You Calculate Debt

Calculating your DTI is a fairly simple process, as long as you know the right numbers. In the simplest terms, you can calculate your DTI by dividing your total debt each month by your total income. But what expenses actually count toward your total debts? Lets break down what you should include when estimating your DTI.

While you can calculate this manually, you can also use the debt-to-income calculator in this article to calculate your DTI ratio quickly.

Does Dti Indicate Solid Financial Status

DTI is a determinant of how well ones income and expenses are balanced out, however, it is not a judge of a persons financial status. This ratio is not a substitution for domestic cash flow. This is because, DTI excludes most of the comprehensive expense areas, such as utilities, insurance, and food, debt-to-income and takes into accounts only those expenses which directly or indirectly affect the credit report of the applicant. It is, therefore, an incomplete picture of a persons finances. It is at best a good indicator of a persons creditworthiness. A few cost-cutting measures and a meager budget can work wonders in lowering a persons DTI score and increase the credit potential in the market. DTI is but a general indicator of a persons financial goodwill, a creation based on which lenders decide if an applicant of getting the loan or not.

Read Also: Does Rocket Mortgage Sell Their Loans

All About Mortgages: How Is Debt Ratio Calculated For A Mortgage

Financial stability is an important aspect and responsibility that most struggle with. The financial guru Dave Ramsey is known to say that we buy things we dont need with money we dont have to impress people we dont like. One of the methods banks or lenders analyzes a potential borrower is through the debt-to-income ratio. In other words, the potential borrowers responsibility with money.

In this article, you will learn how is debt ratio calculated for a mortgage? This article is part of a series All About Mortgages that answers questions for those who seek out a general knowledge on the subject matter.

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

You May Like: Can You Get A Reverse Mortgage On A Condo

What Is The Cmhc Gds Ratio Limit

The CMHC recommends 39% as the GDS ratio maximum limit. A GDS ratio in excess of 39% may imply that your income is minimal

compared to your housing costs. In other words, you may be unable to sustain or afford your payments.

To fix this, you can work on increasing your income or opt to buy a cheaper home, thereby requiring lower mortgage payments.

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Also Check: Chase Recast

How To Calculate Your Dti Ratio

total monthly debt payments divided by monthly income = debt-to-income ratio

1. Take your annual income and divide it by 12 to get your monthly income.

2. Add up your reoccurring monthly expenses such as:

- Minimum monthly payments on credit cards

- Auto loans

Note: To find your back-end DTI ratio add your monthly mortgage payment

3. Divide your monthly debt obligations by your monthly income to get your DTI ratio

For example: If your yearly income is $60,000 and your total monthly debt payments come to $1,000

$60,000 divided by 12 = $5,000

$1,000 divided by $5,000 = .2

= 20% debt-to-income ratio