Who Is This Calculator For

This calculator is most useful if you:

- Are a new potential homeowner needing to know your budget constraints

- Have decided on a new home but want to ensure you can afford it

- Are looking to plan and budget for the future

Once you’re entered your information and obtained your results, you can use the Get FREE Quote box at right to request personalized rate quotes tailored to you from mortgage lenders. This will give you a better idea of what interest rate to expect and help gage your ability to qualify for a mortgage.

How Much Income Is Needed For A 250k Mortgage +

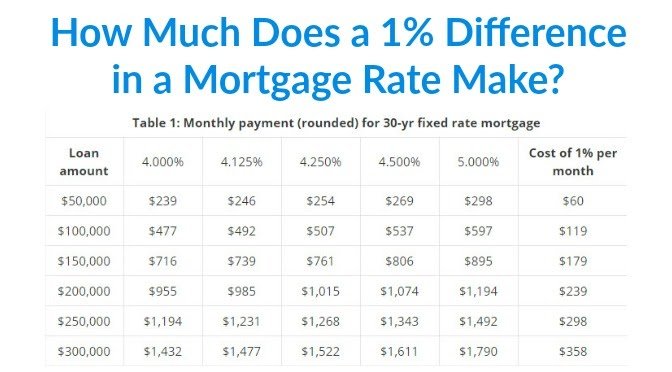

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Don’t Miss: Rocket Mortgage Payment Options

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

You May Like: Recast Mortgage Chase

What Is The Total Amount Repayable

When you take out a mortgage, you agree to pay the principal and interest over the life of the loan. Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes.

This means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

Estimate your monthly loan repayments on a £600,000 mortgage at 4% fixed interest with our total amount repayable schedule over 15 and 30 years.

How Do I Use The Mortgage Calculator

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Don’t Miss: How Much Is Mortgage On 1 Million

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

Also Check: How To Get Preapproved For A Mortgage With Bad Credit

How Much Home Loan Can I Get On 16000 Salary

The maximum loan amount may range between 8 to 10 times your monthly income. Henceforth, you may become eligible for a maximum loan amount of Rs. 1,60,000 which can be repaid in a tenure that is comfortable to you. In case you are looking for a loan at better terms, you may check your eligibility here.

How Much House Can 80k Salary

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Also Check: Rocket Mortgage Loan Types

Dont Overextend Your Budget

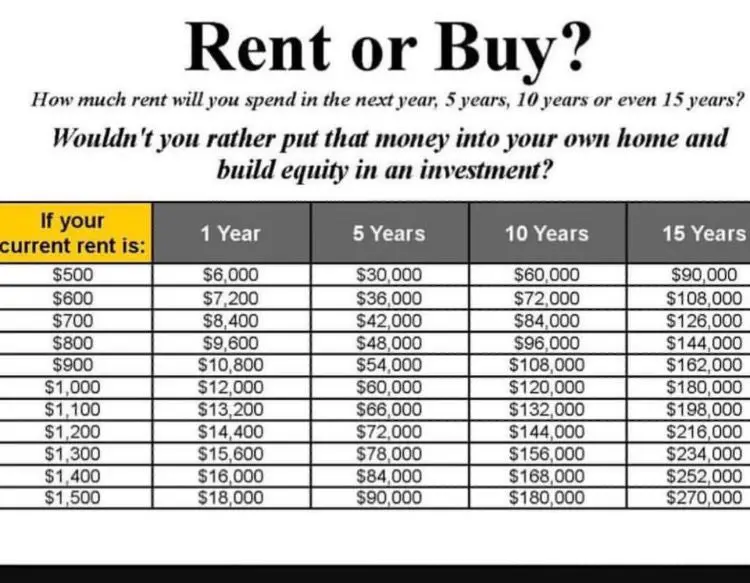

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Can I Get A Mortgage For 60000

Yes, it may be possible for you to get a £60,000 mortgage. If youve saved up a significant deposit and youre looking for a smaller mortgage to purchase a property, lenders will look on you favourably and you may secure a better interest rate.

If you already have an existing mortgage and wish to take out another mortgage to purchase a more expensive home or a second property, mortgage lenders will tend to have stricter requirements.

For more information, speak to an expert for an initial free consultation.

Recommended Reading: Chase Recast

I Make $60000 A Year How Much House Can I Afford

You can afford a $150,397.13 house with a monthly payment of $1,200.00.

| $1,300.00 | $0.00 |

Estimate how much house you can afford if you make $60,000 a year with our home affordability calculator. Generate an amortization schedule that will give you a breakdown of each monthly payment, and a summary of the total interest, principal paid, and payments at payoff. You have the options to include property tax, insurance, and HOA fees into your calculation.

Monthly Payments On A 600000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £2,864.49 a month, while over a 15-year term it might cost £4,438.13 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

-

£626,426.58

Recommended Reading: Rocket Mortgage Launchpad

Monthly Payments For A $150000 Mortgage

Your mortgage payment will include a few line items, including principal, interest, and sometimes, escrow costs.

Heres what those entail:

- Principal: This money is applied straight to your loan balance.

- Interest: This one is the cost of borrowing the money. How much youll pay is indicated by your interest rate.

- Escrow costs: Sometimes, your lender might require you to use an escrow account to cover property taxes, homeowners insurance, and mortgage insurance. When this is the case, youll pay money into your escrow account monthly, too.

Let us know where you are in the homebuying process below. Credible can help you find a great mortgage in just a few minutes and put you on the path to pre-approval.

See what your estimated monthly payment will be using our mortgage payment calculator below.

For a $150,000, 30-year mortgage with a 4% rate, your basic monthly payment meaning just principal and interest should come to $716.12. If you have an escrow account, the costs would be higher and depend on your insurance premiums, your local property tax rates, and more.

Heres an in-depth look at what your typical monthly principal and interest payments would look like for that same $150,000 mortgage:

| Interest rate |

|---|

Find Out: How Long It Takes to Buy a House

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

Where To Get A $150000 Mortgage

Traditionally, getting a mortgage loan would mean researching lenders, applying at three to five, and then completing the loan applications for each one. Youd then receive loan estimates from each that breaks down your expected interest rate, loan costs, origination fees, any mortgage points, and closing costs. From there, you could then choose your best offer and move forward with the loan process.

Fortunately, with Credible, theres a more streamlined way to shop for a mortgage. Simply fill out a short form, and you can compare loan offers from all of our partners in the table below at once.

How Much Is A 60000 Mortgage

A number of factors are involved with taking out a mortgage, the length of repayment, the interest on the loan and most importantly how much to take out in the first place. For a mortgage of £60k the costs of repayment can vary dramatically when the different criteria is applied.

Play with our calculator here for an accurate measure of what a mortgage will cost, and you can also check how much you can borrow as well as get approved by the best lender, with our partners Mojo, for FREE!

You May Like: What Does Rocket Mortgage Do

Total Interest Paid On A $150000 Mortgage

Longer-term loans will always come with more interest costs than loans with shorter lifespans. For example, a 15-year, $150,000 mortgage with a 4% fixed rate would mean spending $49,715 over the course of the loan. A 30-year mortgage with the same terms, however, would cost $107,804 in interest nearly $60,000 more once all is said and done.

Enter your loan information to calculate how much you could pay

Learn: How to Buy a House: Step-by-Step Guide

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

How Much Do I Need To Put Down

A down payment of 20% or more will get you the best interest rates and the most loan options. But you dont have to put 20% down to buy a house. There are a variety of low-down-payment options available for home buyers. You may be able to buy a home with as little as 3% down, although there are some loan programs that require no money down.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

You May Like: Reverse Mortgage Mobile Home

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Buy What You Can Afford

There are other considerations that you may need to take into account such as the cost of living. The cost of living varies state by state, if you buy a house, do you need to cut costs on your other expenses, such as eating out?The most important thing to remember is to buy what you can afford as costs can add up quickly. If you are not sure what kind of house you can afford, always take the conservative route and buy a house that you are 100% sure that you can afford.Every family is different, it is hard to calculate exactly how much you can afford based on your income. However, you can use our home affordability calculator to get a general sense of what kind of house you can afford.

You May Like: Chase Mortgage Recast

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.