Which Closing Costs Are Negotiable

Some closing costs arent fixed. Here are a few you can negotiate.

- Legal fees: Before you settle on a lawyer, ask about their rates. Youre under no obligation to take a lawyer who is too expensive for you.

- Mortgage fees: Lenders want your business. So be sure to ask where they can get the costs down for you. Your first step should be to compare mortgage interest rates online from a variety of providers before deciding on where youll get your mortgage from.

- Insurance: Similarly, shop around before you choose a home insurance provider. A good broker will also ensure that they are clear about what insurance policies you should have in place.

Compare Quotes For Home Insurance

This is more or less the same process you used with the Loan Estimate Forms get quotes from different, competing home insurers, and see whos offering the lowest rate.

This tip does come with a small disclaimer, though. While everyone likes saving money, the cheapest option isnt always the best one, especially when it comes to something like home insurance. Make sure you read all the fine print on the policy to make sure youre actually covered in the ways that you need to be covered it doesnt matter how much money you save in the short term if your home insurance fails you when you actually need it.

And if you already have car or renters insurance, its a good idea to ask your insurer if they offer discounted home insurance to existing customers. Many insurers do, and you can get a fantastic rate if you bundle your policies in this manner.

How To Avoid Closing Costs

While theres no way for you to outright dodge these fees, there are ways that homeowners can pay vastly less.

Some closing costs are negotiable: attorney fees, commission rates, recording costs, and messenger fees. Check your lenders good-faith estimate for an itemized list of fees. You can also use your GFE to comparison shop with other lenders.

Here are some ways to circumvent the added expenses:

1. Look for a loyalty program. Some banks offer help with their closing costs for buyers if they use the bank to finance their purchase. Bank of America, for instance, offers reduced origination fees for Preferred Rewards members. Its the banks way of offering a reward for being a customer.

2. Close at the end the month. One of the simplest ways for you to reduce your closing costs as a buyer is to schedule your closing at the end of the month. If you close at the beginning of the month, say March 6, you have to pay the per diem interest from the 5th to the 30th. But if you close on the 29th, you pay for only one day of interest.

3. Get the seller to pay. Most loans allow sellers to contribute up to 6% of the sale price to the buyer as a closing-cost credit. Its a way to seal the dealand a tax-deductible expense for the seller. Dont expect this to happen much in hot markets where inventory is scarce .

6. Join a union. AFL-CIO members can get help purchasing or refinancing a home with closing-cost discounts and rebates from the Union Plus Mortgage program.

You May Like: Which Mortgage Lenders Use Transunion

What Are Closing Costs

Closing costs are all the expenses associated with buying a house, other than the price of the home. These fees can add up to anywhere from three to five percent of the purchase price.

The median home value in the U.S. is $226,300, so lets use that as our example. At that price, you should expect to pay between $6,789 and $11,315 in closing costs.

These expenses are called closing costs because theyre due when you close on a house.

Apply For A Closing Cost Assistance Grant

One of the most common ways to pay for closing costs is to apply for a grant with a HUD-approved state or local housing agency or commission. These agencies set aside a certain amount of funds for closing cost grants for low-to-moderate income borrowers. These grants are usually structured as a gift as long you occupy the property and do not refinance your mortgage for a specified number of years. If you sell or vacate the home or refinance your loan prior to the specified number of years you may be required to repay all or part of the grant.

Understand How Closing Cost Assistance Programs Work

Borrowers should be aware that applying for a closing cost assistance grant can be a time-consuming process plus housing agencies and commissions typically have a limited amount of funds for these programs. This means borrower should apply for a grant as early as possible in the mortgage process and well before you submit your loan application.

Visit theHUD WEBSITEto determine the closing cost assistance grants offered by HUD-approved state or local housing agencies

Recommended Reading: Is A Home Loan A Mortgage

Do All Lenders Have The Same Closing Costs

No. On a federally insured HECM loan, all lenders will charge the uniform 2% upfront mortgage insurance premium which is a requirement of the loan and paid to HUD. However, each lender offers its own interest rates, margins and set of closing costs as private companies operate on their own margins. Generally, you will find that brokers have higher costs as they serve more as a middleman to a direct lender. It pays to shop around and compare both rates and total costs.

ARLO recommends these helpful resources:

Mortgage Closing Costs Soared In 2021 Here’s The Average

by Maurie Backman | Published on Oct. 30, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Borrowers are paying more money these days to finalize their home loans.

Getting a mortgage doesn’t just mean bringing funds to the table for a down payment. It also means paying closing costs.

Closing costs are the various fees mortgage lenders charge to finalize a home loan, and they apply to new purchase mortgages as well as loans that are refinanced. Closing costs can vary by lender, and they’re meant to cover costs like title insurance, recording fees, and other administrative aspects of originating a loan. This year, closing costs have gotten more expensive for borrowers.

Don’t Miss: What Is The Current Va Mortgage Rate

Appeal To The Seller For Help

You might be able to get a seller to either lower the purchase price or cover a portion of your closing costs. This is more likely if the seller is motivated and the home has been on the market for a long time with few offers. In many hot housing markets, though, conditions favor sellers, so you might get pushback or a flat-out no if you ask for a sellers help. But it doesnt hurt to ask.

Discount Points ~1% Of The Loan Amount For Each Point You Purchase

Points, or discount points, are an upfront fee that you pay to lower your interest rate on a loan. A typical “point” costs 1% of the amount you borrow that means a point for a $250,000 loan would be $2,500. By buying points youll pay a higher fee upfront in exchange for a lower interest rate , the exact interest rate reduction per point isnt set in stone and will vary by lender.

Conversely, you can also apply for lender credits, which are the exact opposite of discount points lender credits reduce the size of your upfront closing costs in exchange for a higher interest rate on your mortgage. You can use the lender’s discount points and credits to adjust your mortgage terms to your liking, but keep in mind that you will be trading upfront costs for interest rate concessions in most cases.

Read Also: What Is The Benefit Of Refinancing A Mortgage

Who Pays Closing Costs

While most fees are traditionally paid by the buyer and some by the seller, some can be negotiated, depending upon the market. Many buyers believe the only fee that sellers ever pay is the brokers commission, but savvy real estate shoppers can sometimes negotiate some of the other costs into the sellers corner. Its not unusual for buyers to persuade sellers to share some expenses that are paid in advance, including tax and insurance escrow deposits, flood and hazard insurance premiums, property taxes and per-diem interest.

If the seller is urgent about selling the home, he or she may be willing to take on more of the costs, Boies says. In a buyers market the seller may be more willing to pay more of the buyers closing costs than they otherwise would.

Prorated Real Estate Taxes

When someone sells a property, theyre usually required to pay the real estate taxes for the portion of the year for which theyve held the property. This is because the buyer will pay the real estate taxes for the full year when they get their property tax bill at the next billing cycle. The seller is simply crediting back the real estate taxes due for the portion of the year they owned the property.

Don’t Miss: What Is The Federal Interest Rate For Mortgage

Closing Costs V Concessions

One of the big benefits of VA loans is that sellers can pay all of your loan-related closing costs. Again, theyre not required to pay any of them, so this will always be a product of negotiation between buyer and seller.

In addition, you can ask the seller to pay up to 4 percent of the purchase price in concessions, which can cover those non-loan-related costs and more. VA broadly defines seller concessions as anything of value added to the transaction by the builder or seller for which the buyer pays nothing additional and which the seller is not customarily expected or required to pay or provide.

Some of the most common seller concessions include:

- Having a seller cover your prepaid taxes and insurance costs

- Having a seller provide credits for items left behind in the home, like a pool table or a riding lawn mower

- Having a seller pay off your collections, judgments or lease termination fees at closing

In some respects, as long as you stick to that 4 percent cap, the skys the limit when it comes to asking for concessions.

VA buyers are also subject to the VA Funding Fee, a mandatory charge that goes straight to the VA to help keep this loan program running. For most first-time VA buyers, this fee is 2.30 percent of the loan amount, provided youre not making a down payment. Buyers who receive VA disability compensation are exempt from paying this fee.

Average Closing Costs In Florida

The average closing costs in Florida come to approximately 2.58% of the purchase price. It may seem insignificant, but the amount you have to pay can quickly climb if youre buying an expensive home.

Across the state, the average home sells for somewhere between $300,000 and $400,000. If you buy a property in that range, expect to pay between $7,740 and $10,320 in closing costs before taxes. That amount accounts for appraisal, settlement and recording fees, along with title insurance and flood certification which is required by the state.

Other fees

In Florida, youll also have to post a fee for documentary stamps , which is a percentage of the sales price. Then there are the taxes. Youll likely be subject to property and transfer taxes when you add those in, youre looking at around $8,213.44 in closing costs after taxes.

Rocket Mortgage

|

Also Check: Does Mortgage Modification Affect Credit Score

Loan Processing And Settlement Fees

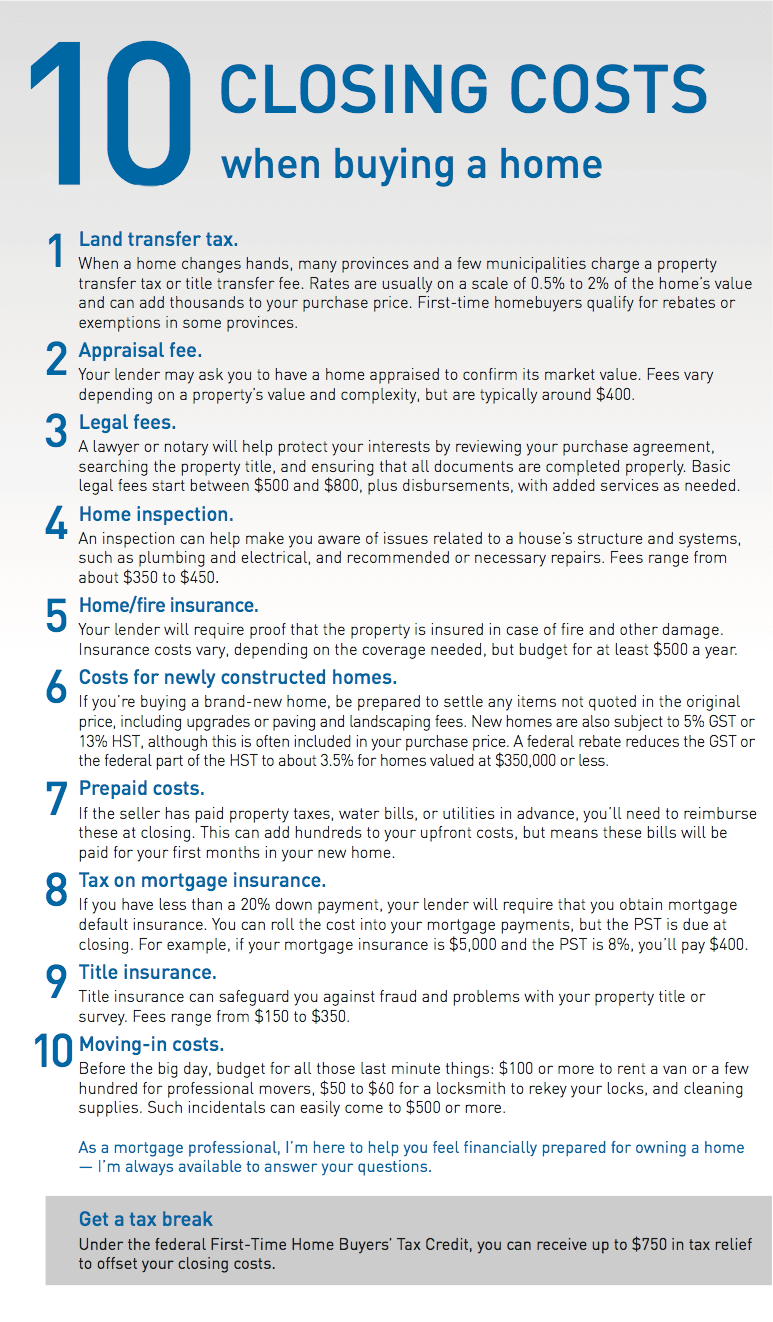

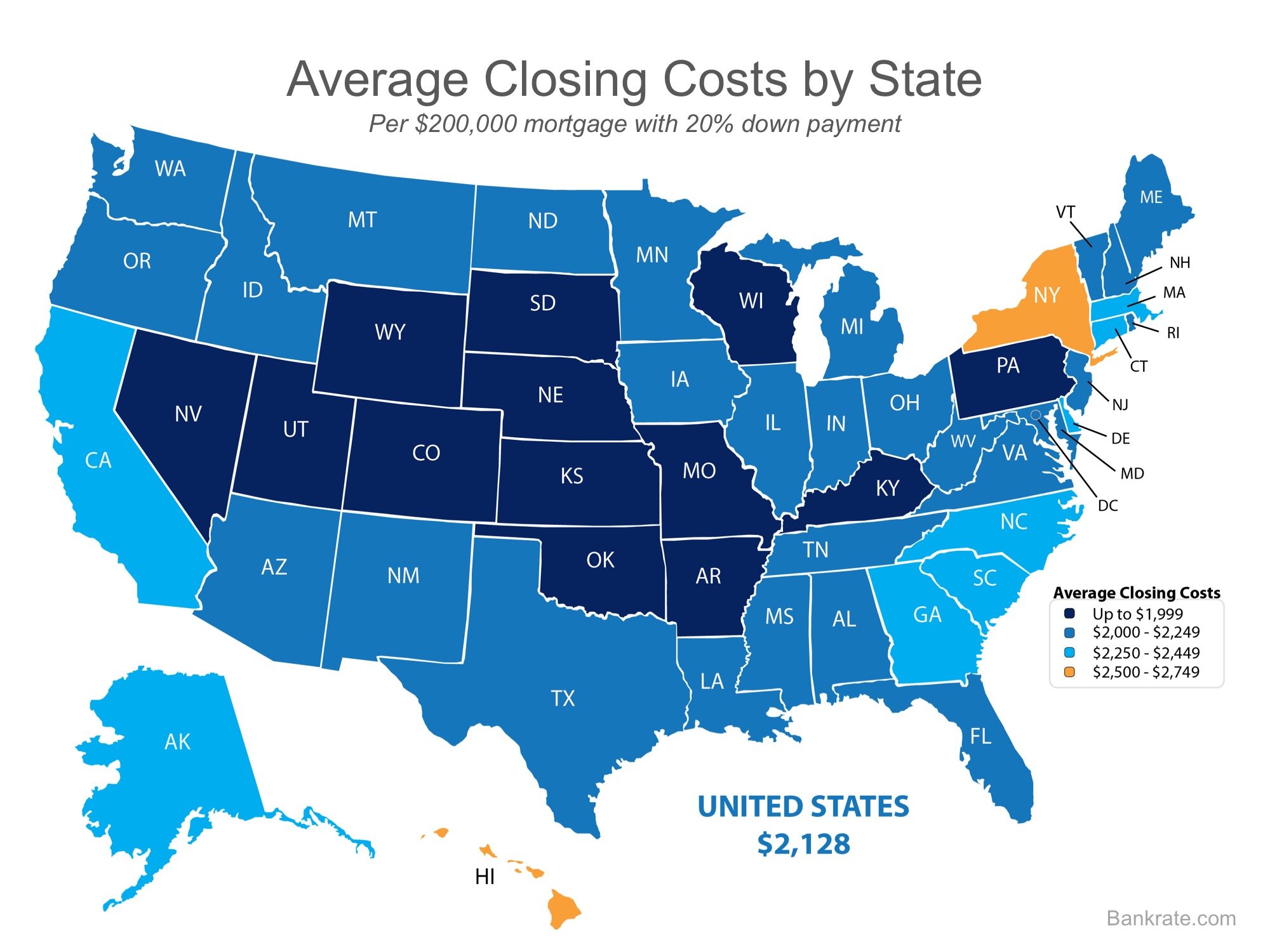

Find the average cost in your state on this Bankrate chart and note the figure. This chart limits itself to the most common lender and third-party fees, so its useful for almost any buyer. Well help you track down the more variable costs below.

Your lenders own fees, known as origination fees, cover the work it takes to create your mortgage loan. While these fees do vary , they don’t vary as much as other costs.

Lenders also pass on fees for outside services needed to process and close on your loan. Here are the most common ones, but you might pay others:

- Attorney, closing, or settlement fees

- Appraisal

- Courier fees

What Are Mortgage Refinance Closing Costs

You already qualified for at least one mortgage when you originally bought your home, so youre likely familiar with closing costs. These are the expenses you pay to borrow money for your home purchase or refinance. Mortgage refinance closing costs include many of the same fees you paid when you closed on your first mortgage.

There isnt a standard method to calculate refi closing costs the amount youll pay depends on your lender and location. One of the best ways to get an idea of how much you might pay is to use a reliable refinance calculator. Youll get an idea of what a refinance can cost you, plus your break-even point the amount of time it could take you to recoup those costs.

Also Check: Is The Property Tax Included In Mortgage Payments

How To Avoid Some Closing Costs

While you cant avoid paying all the closing costs, there are some that can be negotiated, potentially saving you money. Shop mortgage lenders to compare these fees, some of which vary by lender, Boies says.

Many fees are not set in stone and the lender has some latitude to adjust them, but youll need to ask about each one individually, Boies says. If a fee isnt clear, ask the lender what it covers specifically and if it doesnt make sense, ask for the fee to be waived.

Biggest Shock For First

You know its important to save a down payment, even a modest one. But are you planning for the thousands of dollars youll pay in closing costs too? Yes, thousands of dollars. Sorry to break it to you.

The only good news is that were about to help you work up a ballpark estimate of your closing costs in just six steps. That way, you can be sure to save what youll need.

Estimating is tough because closing costs are complex and highly variable. The rule of thumb says youll pay 2 to 5 percent of the price of your home. But thats a big range: $4,000 to $10,000 on a $200,000 home. How much will your closing costs be? And what exactly are you paying for?

We find that most online calculators are either too simple to be accurate or ask for too many obscure figures. Our more individualized approach will help you get closer to reality than most. Its based on your price range and where you intend to buy, and it uses key closing costs you can find right now well show you where. And along the way, well explain the what and the why.

Plan to spend maybe a half hour on working up your estimate.

Recommended Reading: What Does It Mean Refinance Mortgage

Understanding Your Loan Estimate And Closing Disclosure

All lenders use standard loan forms called the LoanEstimate and Closing Disclosure.

Lenders are required to send you a Loan Estimate after you apply. This document will list your loan terms, interest rate, and every closing cost associated with the offer.

All Loan Estimates use the same format, making it easyfor you to compare rates and fees to find the best deal.

You can also use your Loan Estimates as leverage if onelender offers a great rate but another offers lower fees, you can bring yourlow-fee estimate to the first lender and see if it will reduce your costs.

The second document you will receive is the Closing Disclosure .

Lenders are required to send you a CD at least 3business days before your closing date. This document will list the finaldetails of your mortgage which should closely match the rate, terms, andclosing costs on your initial Loan Estimate.

There are legal limits to the amount your closing costscan increase on the CD. If you see a change in your fees before closing, besure to bring it up and get an explanation.

Youre never committed to a mortgage until you sign so before you do, make sure youre getting the deal you were promised.

Common Mortgage Refinance Closing Costs

| Refinance cost |

| $500 to $1,000 |

You may pay additional fees, depending on where you live and which lender you choose. Your lender might require you to pay additional property taxes if you no longer have an escrow account. You also might also encounter smaller fees that can really add up, such as courier, recording, rate lock or prepaid interest charges.

New Fannie Mae and Freddie Mac refinancing fee

Fannie Mae and Freddie Mac are imposing an adverse market refinance fee for conventional loan refinances that conform to their guidelines. The fee applies to rate-and-term and cash-out refinances that close on or after Dec. 1, 2020. Its equal to 0.5% of the loan amount and may cost the average borrower about $1,400.

Don’t Miss: How To Become A Mortgage Broker In Massachusetts

The High Costs Of An Fha Loan

by Matt Frankel, CFP | Updated July 19, 2021 – First published on Dec. 7, 2020

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

FHA loans have some drawbacks, but the benefits might work for you. Find out why.

When you decide to buy a home, there are two broad categories of mortgages you can choose from.

You could choose a conventional loan. These are originated by mortgage lenders. They’re either bought by one of the major mortgage agencies or held by the bank for investment purposes.

Or, you can choose to pursue an FHA home loan. This type of loan is guaranteed by the Federal Housing Administration .

There are other, specialized types of loans such as VA mortgages and USDA loans. However, conventional and FHA mortgages are the two types everyone can apply for, regardless of whether they served in the military or where the property is physically located.

FHA loans allow borrowers easier access to homeownership. But there’s one major downside — they are expensive. Here’s a primer on FHA loans, how much they cost, and why you might want to use one to buy your first home regardless.