Get A Credit Strong Credit Builder Loan

One of the best ways to build payment history is to get a Credit Strong credit builder account. Credit Strong is part of an FDIC insured bank and offers credit builder loans. Credit builder loans are special types of loan accounts that build credit easily.

When you apply for a loan from Credit Strong, you can select the term of the loan and the amount of the monthly payment. Credit Strong does not immediately release the funds to you. Instead, the company places the money in a savings account for you.

As you make your monthly payments, it improves your credit by building your payment history. Credit Strong will report your payments to each credit bureau.

When you finish paying off the loan, Credit Strong will give you access to the savings account it established for you, making the program a sort of forced savings plan that also helps you build credit.

Ultimately, with interest and fees, youll pay a bit more for the loan than youll get back at the end, but this can still be a solid option for a borrower who wants to improve their credit while building savings.

Unlike some other credit builder loan providers, Credit Strong is highly flexible, letting you choose from a variety of payment plans. You can also cancel your plan at any time so you wont damage your credit by missing payments if you fall on hard times.

See the credit builder loan pricing and plans here.

Increase Your Available Credit Limit

Increasing your credit limit will reflect on your credit file and improve your credit score as it shows lenders are willing to trust you with more money as well as reducing your current credit utilization .

You can ask your current card provider to increase your credit limit or let you know if you will be eligible for a credit limit. Also ask if they intend to run a hard credit search on you and do not consent to this unless they will pre-approve you for a credit limit increase.

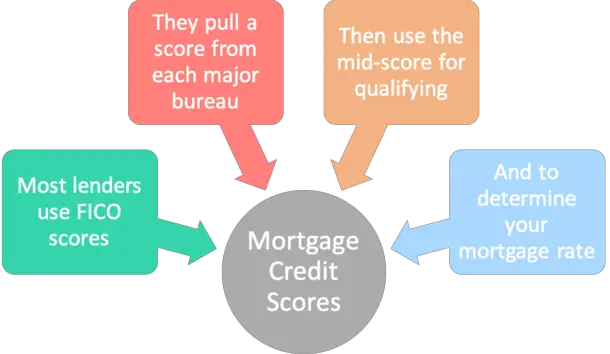

Are Mortgage Credit Scores Different

- Mortgage lenders use FICO scores just like other finance companies

- But pull one version from each of the three major credit bureaus

- To create what is known as a tri-merge credit report

- The mid-score is used for qualifying and mortgage rate purposes

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that theres no sense focusing on something they wont actually look at to determine your creditworthiness.

Ill save you the suspense. The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

I think something like 9 out of 10 lenders use FICO, and its pretty much 100% in the mortgage world.

As for the version of FICO, I dont know if any mortgage lenders use the newer FICO 8 or FICO 9 scores, which are the latest iterations available, because they tend to upgrade slowly to avoid any unwelcome risk.

This also explains why FICO is pretty much the only game in town its hard to change the status quo because there are a lot of moving parts in the mortgage space, so one seemingly small alteration could have major ramifications.

Read Also: How To Apply For A Home Mortgage

It Depends On The Type Of Credit For Which Youre Applying

If youve applied for a credit card, mortgage, or car loan, you probably know that you have a FICO score. However, what you may not realize is that you likely have more than one FICO scorepossibly dozens of them. Thats because lenders look at different versions and types of FICO scores depending on the type of credit youre seeking and other issues. Lets explore the range of FICO scores and which lenders use them.

What Is The Minimum Credit Score For A Mortgage

Below 625. If your score falls below 625, you might not have a high enough credit score to qualify for a home loan. Most people with a credit rating of less than 625 would likely need to look for an unsecured loan from a second tier lender.

You May Like: How To Calculate What Mortgage You Can Qualify For

Open A New Credit Card Account

Opening a new credit account will be your next option if your current credit card provider will not increase your credit limit. You essentially accomplish the same things as your available credit limit increases.

You must repay your balances on your credit card account every month and avoid using over 30% of your available credit. This is a good option if you want to improve your credit score.

Mortgage Lenders Typically Use Fico Scores

The simple answer to the question is, mortgage lenders typically use your FICO score to determine if youd be a good bet for a mortgage.

You might be wondering why mortgage lenders use the FICO model.

Its simple: They have identified a strong parallel between FICO credit scores and consumers mortgage-paying performance.

Basically, the lower your FICO score is, the more likely you are to default on your mortgage.

But its not that cut-and-dried.

Mortgage lenders tend to use all three of your scores from Experian, TransUnion and Equifax to evaluate you for a home loan.

As mentioned, there are different versions of the FICO score, and each credit bureau uses a specific one to determine borrowers creditworthiness.

Here are the FICO scores mortgage lenders typically use from each bureau:

- Experian: FICO Score 2 based on Experian data also known as Experian/Fair Isaac Risk Model Version 2

- Equifax: FICO Score 5 based on Equifax data also called Equifax Beacon 5.0

- TransUnion: FICO Score 4 based on TransUnion data also called TransUnion FICO Risk Score 04

These scores, which range from 300 to 850, dominate the mortgage market because most home loans purchased or securitized by Fannie Mae and Freddie Mac require them, said Alisa Glutz, licensed mortgage professional and author of the book Color My Credit.

These versions of FICO work in conjunction with the current automated underwriting systems each entity requires use of to determine loan eligibility, Glutz said.

Don’t Miss: How Is Home Mortgage Interest Calculated

Get A Secured Credit Card

Secured credit cards can be used to improve your credit score as they allow you to show you can make credit repayments, they add to your available credit which will improve your score and they allow you to show a low credit utilization which will improve your credit score.

Getting approved for most credit cards will be difficult if you have a low credit score but a secured credit card can help you overcome this.

Secured credit cards will approve you if you pay a deposit as part of your secured credit card application.

This deposit is usually your credit limit or a percentage of your credit limit. Secured credit cards arent very common in the Uk.

Capital one was known to offer one and you should contact them to see if this is still available.

You should be aware that secured credit cards will have low credit limits and high APRs. This can lead you to fall into serious debt if you fail to keep up your monthly credit repayments.

Avoid Making Too Many Credit Applications

Making applications for utility or credit can reduce your credit score. This is because everytime a utility or credit provider is about to open a new account they will do a hard credit search. You should only apply for credit or utility which you are pre-approved for. If you make multiple credit applications then multiple hard credit searches will be done on your credit file.

This means your credit score will go lower as the credit bureau will view too many credit applications as you being desperate. If you stop making blind credit applications then your credit score will likely improve.

You should always use an eligibility checker to see if you will be approved for credit or utility accounts before you apply. These checks are done with soft credit searches which only you can see.

You May Like: How To Reduce My Monthly Mortgage Payment

How Do Credit Bureaus Collect Their Information

Credit bureaus rely on creditors and lenders for the information they need, not every single creditor reports to both credit bureaus if they report to them at all, which can cause a discrepancy between your reports from Equifax and TransUnion. Part of the data that is sent to credit bureaus from creditors is your accounts status and payment history, both of these factors contribute to your credit score.

How long does information stay on your credit report? Find out here.

Other information that credit bureaus collect is your personal information, such as your legal name and address, credit account information, inquiry statistics, public records, and collections information. Lenders are interested in how youve handled debt in the past, although, they also consider additional details which is why credit bureaus gather extensive data.

What Are Older Fico Models

FICO 8 and 9 arent the only versions in use. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, these are still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

FICO 2, 4, and 5 are very similar. The main differences between the three is that 2, 4,and 5 use data from Experian, TransUnion, and Equifax respectively. Mortgage lenders pull one of each and compile the reports in a document called a Residential Mortgage Credit Report. Duplicate data is screened and removed, and the middle score of the three is picked to represent your worthiness to pay back the mortgage.

FICO 8 and 9 use data from a single credit bureau, so using FICO 2, 4, and 5 together gives mortgage lenders a more complete view of your creditworthiness because they can see the history of every account youve opened. This is especially helpful for mortgage lenders as many creditors don’t report account history to all three credit bureaus.

Don’t Miss: What Is The Federal Interest Rate For Mortgage

Minimum Fha Credit Score Requirements In 2020

News alert : Some lenders have increased FHA credit score requirements in 2020, due to the ongoing economic crisis. Learn more here.

This article explains the minimum credit score requirements for FHA loans in 2020. It is intended for home buyers and mortgage shoppers who plan to use an FHA-insured loan to buy a house in 2020.

At a Glance: In a hurry? Here’s the gist of this lesson in 100 words or less. The official minimum credit score for an FHA home loan is 500. In order to take advantage of the 3.5% down-payment option, however, you will need a score of 580 or higher. Borrowers with scores between 500 and 579 are required to put more money down, at least 10%.

Mortgage lenders frequently set their own minimum credit-score requirements for FHA loans, and they are usually higher than the official cutoff. In 2020, most lenders want to see a score of 600 or higher. But some are beginning to ease their standards a bit.

Know Your Credit Scores Long Before Applying For A Mortgage

- Its very important to check all 3 of your credit scores

- 3-6 months before you apply for a home loan

- To know exactly where you stand credit-wise

- And to give yourself time to fix any errors/problems that come up

Before you actually head out to get a mortgage, its good practice to view your credit scores long before you apply.

Im talking several months in advance because any necessary credit score changes/improvements take time. Potentially a lot of time.

For example, any mistakes holding your credit score down may take months to get cleared up.

And you wont want to leave anything to chance. Yes, the credit bureaus are bureaucratic, so nothing happens all that quickly.

You May Like: How To Modify Mortgage Loan

Which Credit Report Is The Most Accurate

All of the credit report agencies should only display accurate information about you. If something isnât right on any of them , it could hurt your chances of being accepted for credit.

Thatâs why itâs worth checking all three to make sure all of the information about you and your finances is totally accurate.

If youâve checked it and all the information is correct, you could have a thin credit history which means youâve never borrowed money before. Here are three easy ways to improve your score!

* Please note, the lender hasnât officially confirmed this information.

Disclaimer: this information was sourced from a MoneySavingExpert article published in March 2016. For more details on which credit reference agencies your lender uses, please check with them directly.

Disclaimer: All information and links are correct at the time of publishing.

Become a money maestro!

Sign up for tips on how to improve your credit score, offers and deals to help you save money, exclusive competitions and exciting products!

Why Your Credit Scores Differ

Your credit score may vary depending on whether Experian, TransUnion or Equifax is the source of the data used. Why?

- Not all creditors report to all three credit bureaus. If you have two credit cards but one of those cards only reports to Experian, that cards payment information wont appear on your TransUnion or Equifax credit report.

Also Check: Can You Apply For A Mortgage Before Finding A House

How Does Fico Differ From Other Credit Score Models

VantageScore is another popular credit scoring model. Like FICO, VantageScore 3.0 grades credit on a 300 to 850 point scale and takes credit utilization, credit inquiries, and on-time payments into account. However, the two models differ in a few ways, with one major difference. FICO penalizes all late payments the same way, while VantageScore penalizes late mortgage payments higher than other late payments.

FICO and VantageScore also differ in how they handle combining similar credit inquiries. With FICO, you have a 45 day grace period where similar credit inquiries for auto loans, mortgages, and student loans are combined into one inquiry. VantageScore gives you a smaller 14 day grace period, which can make comparison shopping for loans harder.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

Remove Negative Financial Links

You should check your credit file for financial links that you dont recognise. Some financial links can reduce your credit file as this might mean your credit score is going down due to someone elses bad credit behaviour.

Any financial links which seem out of the blue can be removed from your credit file. Financial links can be generated by just sharing apartments with someone else, getting a loan with someone else etc. You should ask the credit bureaus to correct this.As you remove these negative financial links your credit score should improve.

Read Also: What Do I Need To Become A Mortgage Broker

How To Monitor Your Credit Reports

Since the mortgage industry looks at all three credit reports and scores, you may want to consider a paid credit monitoring service that pulls more comprehensive data than a free version would.

The best credit monitoring services offer triple-bureau protection, looking at your information across all three .

Experian IdentityWorks Premium monitors all three of your reports to make you aware of activity including score changes, new inquiries and accounts opened in your name, changes to your personal information and suspicious activity detected. Plus, youll regularly receive updates to your FICO Score.

-

$9.99 to $29.99 per month

-

Experian for Plus plan or Experian, Equifax and TransUnion for Premium plan

How Can I Raise My Credit Score 100 Points In 30 Days

How to improve your credit score by 100 points in 30 daysGet a copy of your credit report.Identify the negative accounts.Dispute the negative items with the credit bureaus.Dispute Credit Inquiries.Pay down your credit card balances.Do not pay your accounts in collections.Have someone add you as an authorized user.

You May Like: What Is The Highest Interest Rate On Mortgage

What Is A Good Transunion Credit Score What Is A Bad Transunion Credit Score

TransUnion uses something called VantageScore 3.0 to help determine individual scores. These scores are based on an alphabetic categorization:

- 781-850 = A

- 601-657 = D

- 300-600 = F

While your credit score is never the single, determining factor in whether youre able to secure a loan, it plays a huge roll that cant be underestimated. The health of your credit is important, but even if youve had issues in the past, there are multiple things you can do to help repair and rebuild a low credit score:

Not enough emphasis can be placed on taking good care of your credit. Its not a lesson taught in schools, yet its one of the most basic ways to get ahead, and to stay ahead, financially. If your credit score is lower than youd like it to be, use the tips listed above to help you raise it back up to excellent.

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those third-party providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

Also Check: Can You Refinance Mortgage Without A Job