What Term Should I Fix My Interest Rate For In Todays Market

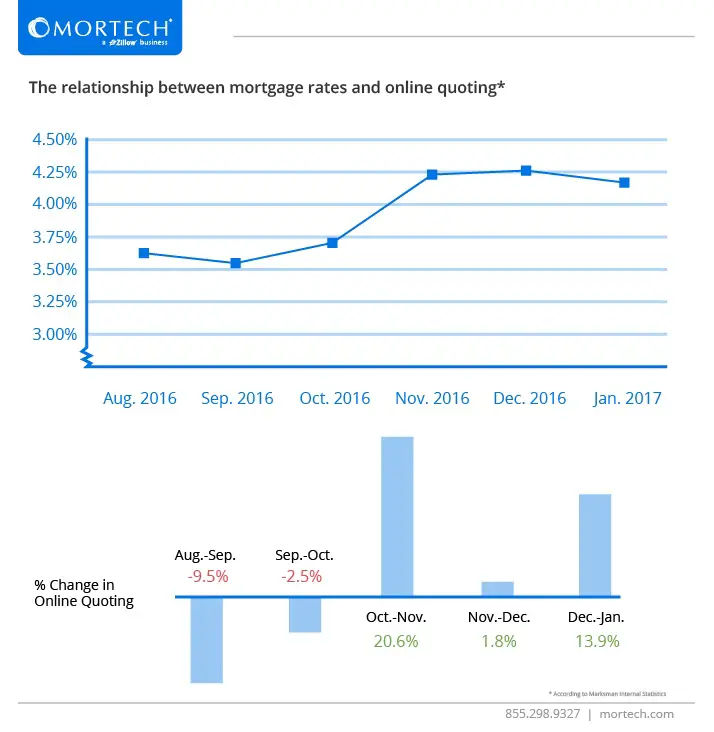

With current interest rates on the rise people might be thinking: Ive got to fix at a longer rate to avoid hiking interest rates.

But today there could be a real risk in people fixing a rate for too long a term.

Yes, the one-year rate is likely to increase potentially above what the 3 and 5-year rate is today, but on average the 1-year rate has tended to be cheaper.

For instance, interest rates are likely to rise, but after inflation is curbed they are likely to take a downturn. So if you lock in for 3 years, you risk locking in a rate that looks not great today, OK in a years time, and expensive in 3 years time.

So, in our view, there is more risk in fixing for too long than fixing for too short.

Yes, youll likely pay a higher interest rate in a years time, but on average your rate is likely to be lower.

Lets look at the maths, based on Tony Alexanders modelling.

This shows that if you fix on the 1-year rate for 2 years, your average interest rate will be 5.12% .

But, the current 2-year fixed rate is 5.19%. So that suggests that the 1-year rate is marginally cheaper.

Where is gets really telling is at the longer term rates. Fixing for the 1-year rate for 5 years, the average is modelled to be 4.7%, but the current fixed is 5.79%.

So youre saving an average of 1.09% in interest per year, based on the modelling.

Just remember, its not necessarily cheaper to lock in for longer because interest rates are going up.

What If You’re Wrong?

Mortgage Interest Rates Forecast For 2022

Are you planning to purchase a home this year? If you’re like many individuals who are looking for information about what will happen with interest rates, it’s worth considering the 2022 mortgage interest rates forecast.

But the big question is, are interest rates going up? More specifically, are mortgage rates going up?

According to 2022 housing market predictions, mortgage rates are likely to continue to rise going into the rest of this year. Let’s go over factors that affect mortgage rates and more information about their movement in 2022.

Year Mortgage Rate Forecast For 2022 2023 2024 2025 And 2026

| Month |

| 102.2% |

30 Year Mortgage Rate forecast for .Maximum interest rate 6.07%, minimum 5.71%. The average for the month 5.89%. The 30 Year Mortgage Rate forecast at the end of the month 5.89%.

Mortgage Interest Rate forecast for .Maximum interest rate 6.31%, minimum 5.89%. The average for the month 6.06%. The 30 Year Mortgage Rate forecast at the end of the month 6.13%.

30 Year Mortgage Rate forecast for .Maximum interest rate 6.70%, minimum 6.13%. The average for the month 6.37%. The 30 Year Mortgage Rate forecast at the end of the month 6.50%.

Mortgage Interest Rate forecast for .Maximum interest rate 6.81%, minimum 6.41%. The average for the month 6.58%. The 30 Year Mortgage Rate forecast at the end of the month 6.61%.

30 Year Mortgage Rate forecast for .Maximum interest rate 6.91%, minimum 6.51%. The average for the month 6.69%. The 30 Year Mortgage Rate forecast at the end of the month 6.71%.

Mortgage Interest Rate forecast for .Maximum interest rate 7.32%, minimum 6.71%. The average for the month 6.96%. The 30 Year Mortgage Rate forecast at the end of the month 7.11%.

30 Year Mortgage Rate forecast for .Maximum interest rate 7.52%, minimum 7.08%. The average for the month 7.25%. The 30 Year Mortgage Rate forecast at the end of the month 7.30%.

Mortgage Interest Rate forecast for .Maximum interest rate 7.97%, minimum 7.30%. The average for the month 7.58%. The 30 Year Mortgage Rate forecast at the end of the month 7.74%.

Also Check: What Is The Average Mortgage Payment In Colorado

Expert Mortgage Rate Forecasts

While consumers may be preparing for significantly higher rates over the coming years, industry experts are more tempered in their expectations. NAR is forecasting the 30-year rate to average between 5% and 5.5% throughout most of 2023.

As the Fed raises interest rates, the mortgage market will simply yawn, says Yun, explaining that the mortgage market has already factored in all the Fed rate hikes possible this year.

The Federal Reserve doesnt directly set mortgage rates, but it does influence them by establishing monetary policy to control inflation and keep the job market running smoothly. One of the main tools to do this is the federal funds rate a short term rate banks charge each other. As this rate goes up, so do mortgage rates. But the central bank has so far taken a cautious approach.

The Fed has shown they are more than willing to let the economy run a little hot than raise rates excessively and risk a recession, says McLaughlin. As such, I expect 8% to be near the upper bound of where mortgage rates will settle over the next three to five years.

Although the NAR doesnt have a forecast out to 2025, Yun expects rates to stabilize around 5.5% over the next few years.

Other mortgage experts agree that rates wont get as high as consumers are anticipating. The Mortgage Bankers Association is actually expecting rates to average 4.8% by the end of this year and to steadily decrease to an average of 4.6% by 2024.

What Are Interest Rates Based On

Fixed mortgage interest rates operate in their own market. Theyre not directly tied to the Federal Reserves fed funds rate, although this benchmark rate can help influence the direction mortgage rates are headed. Other factors that influence mortgage rates include the health of the economy, the inflation rate, and how much demand lenders are seeing for home buying and refinancing. Only adjustable-rate mortgages are directly tied to market indices and therefore to the Feds benchmark rate.

Don’t Miss: What Are Current Mortgage Rates

Very Low Mortgage Rates

Fixed rates have risen significantly from the pandemic-induced record lows, and they are expected to continue rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases.

Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets.

If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

Where Are Mortgage Rates Headed

Senior Mortgage Advisor at HouseAmerica Financial

Theres never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Flem Theres never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American.

You know, the fallacy of economic forecasting is: Dont ever try and forecast interest rates and or, more specifically, if youre a real estate economist mortgage rates, because you will always invariably be wrong.

Coming into this year, most experts projected mortgage rates would gradually increase and end 2022 in the high three-percent range. Its only April, and rates have already blown past those numbers. Freddie Mac announced last week that the 30-year fixed-rate mortgage is already at 4.72%.

Danielle Hale, Chief Economist at realtor.com, tweeted on March 31

Continuing on the recent trajectory, would have mortgage rates hitting 5% within a matter of weeks. . . .

Just five days later, on April 5, the Mortgage News Daily quoted a rate of 5.02%.

No one knows how swiftly mortgage rates will rise moving forward. However, at least to this point, they havent significantly impacted purchaser demand. Ali Wolf, Chief Economist at Zonda, explains:

Mortgage rates jumped much quicker and much higher than even the most aggressive forecasts called for at the end of last year, and yet housing demand appears to be holding steady.

Also Check: What Is The Typical Closing Costs For A Mortgage

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Mortgage Interest Rates Forecast

At their December 15 meeting, Fed officials announced that they expect to boost rates three times in 2022. However, it’s important to note that the Fed doesn’t raise mortgage interest rates directly. As of March 17, 2022, the Board of Governors of the Federal Reserve System voted unanimously to approve a 1/4 percentage point increase in the primary credit rate to 0.5%, affecting borrowers.

More recently, the Fed has indicated they may raise the federal funds rate more aggressively in an attempt to control inflation.

You May Like: How Much Debt Is Too Much For Mortgage

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

What The Interest Rate Rise Means For Savings

In theory, a rate rise should lead to higher interest on savings accounts.

However, many lenders are yet to pass on the last six base rate rises to savers, and those that have done so have been very slow about it.

In any case, the average savings rate remains well below inflation , so even if your bank passed on the full amount, youd still find your money losing value in real terms.

If you have money put by, it may be worth using it to pay off debts. Interest rates for borrowing are much higher than on savings deals and some loans are about to get more expensive.

Alternatively, you could use that lump sum to make a mortgage overpayment, meaning you will pay less interest over time.

If you are relying on savings to fund big future purchases or as a safeguard against potential emergencies such as losing your job, dont assume the rise in the Banks best rate will automatically mean your account delivers better value.

Check the best savings accounts for the best value places to save and read more on how to recession-proof your money.

Also Check: Who Is United Wholesale Mortgage

How Does Your Credit Score Affect Your Rate

Your credit score measures your likelihood of making continuous, on-time mortgage payments. Homebuyers with higher credit scores seem less risky to lenders. So, in general, the higher your credit score, the lower your mortgage rate. But other factors such as your personal debt, down payment size, and loan program also influence your rate.

Should You Fix Your Mortgage For 2 3 5 10 Years Or Longer

If you have a low loan-to-value then you will almost certainly benefit from fixing, as you will be able to secure a low fixed-interest rate.

Now, of course, the longer your fixed term, the longer you are locked into a lower interest rate. And although there is no limit to how many times you can remortgage, if you decide on a long fixed-term period, there will likely be exit penalties and early redemption fees if you want to repay your mortgage or move.

These factors need to be traded off against the cost of exiting your current deal and the certainty that a fixed-term mortgage provides.

Longer-term fixed-rate mortgage deals are a recent development in the mortgage market, with some providers even offering up to a 40-year fixed-rate mortgage.

These have a higher rate but offer certainty and stability over the amount you will pay long-term. And these longer mortgages also remove the effort and cost of needing to remortgage every few years.

Read Also: How To Get Out Of Mortgage Insurance

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: Are Mortgage Discount Points Worth It

Expert Mortgage Rate Predictions For September

Paul Buege, chief executive officer and president at Inlanta Mortgage

Prediction: Rates will rise

I think were going to be range-bound and well see rates stay at this level, maybe a little bit higher. The market is responding to the Feds two significant rate increases and the economy is cooling. What youre seeing right now is the initial response: a recession and people arent buying as much.

But always lurking in the background is going to be some economic news showing that things havent cooled to the level that you might think. Thats why I think youre gonna have these little rate bumps up and down. If you wanted to work with a really broad range, probably 6% would be the high and 5% might be the low. Thats what were using as we manage our book of business as a company.

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

There isnt a Fed meeting but there is the annual economic policy symposium in Jackson Hole that a lot of the Fed decision makers participate in. Investors will look to that symposium to get an updated sense of how the Fed is thinking about monetary policy and we may see mortgage rates react to whatever is discussed.

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will moderate

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

Jessica Lautz, VP of demographics and behavioral insights at National Association of Realtors

Prediction: Rates will moderate

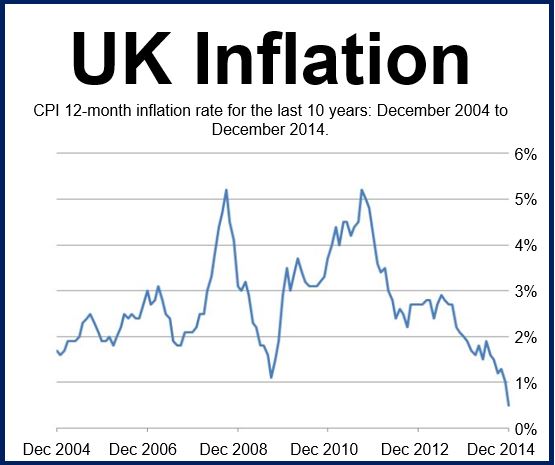

History Of The Fed’s Interest Rate Policy

Like other major Western economies, the US has enjoyed an unparalleled period of low price and interest rate volatility. The current bout of price rises means investors could need to reassess how they allocate their portfolios.

The FFR was at a similar rate to where it is now in the 1950s, amid the postwar stimulus and income growth across the US. The rate see-sawed over a 20 year period, rising and falling between 3% and 10% during the 1960s and 1970s, before skyrocketing inflation, exceeding 13% in 1980, forced rates to a still-record high of 19.1%.

As inflation was brought under control, the FFR hovered 5% through the 90s, before recessions in 2001 and 2008 forced them down to a floor, with the keeping rates down until 2016.

The Covid-19 pandemic imposed another cut to almost 0%, with recent inflationary pressure created as a result forcing the Fed to begin quickly tightening policy. The most recent was a 0.75% hike to a range between 2.25% and 2.5%, the second consecutive 0.75% rise in what was initially the biggest jump since 1994.

Past Performance is not a reliable indicator of future results

Don’t Miss: Can You Combine 2 Mortgages Into One