Investment Property Mortgage Requirements

Mortgage lenders get to set their own requirements. And the guidelines for investment property loans are usually stricter than for a primary residence.

Though rules vary by lender, here are the broad guidelines you can usually expect to see for an investment property mortgage.

- Minimum down payment: Often 15%, though some lenders still require 20%. Youll get better rates with 25% down

- Minimum credit score: 680 with a 15% down payment 620 with 25% down

- Maximum DTI: This is your debt-to-income ratio. Typically, your non-housing debts should be no greater than 28% of your gross monthly income. And your total debts plus housing costs shouldnt exceed 36%. But some lenders are less strict, often allowing 36% and 45% respectively

- Cash reserves: Many lenders want you to have cash reserves that are sufficient for you to cope for six months without rental income

- Loan limits: Government-backed mortgages and conforming mortgages have limits on the amount you can borrow. These vary according to local home prices

- Documentation: Expect lenders to request two years of tax returns, two years of W-2s, and two months of bank statements at a minimum

In addition to your finances, mortgage lenders will also evaluate the property you hope to buy.

Examples Of Mortgage Investment In A Sentence

-

EXHIBIT 1 DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Parts 1 and 602 RIN 1545-AW98 Real Estate Mortgage Investment Conduits AGENCY: Internal Revenue Service , Treasury.

-

Within 30 days after the Closing Date, the REMIC Administrator shall prepare and file with the Internal Revenue Service Form 8811, “Information Return for Real Estate Mortgage Investment Conduits and Issuers of Collateralized Debt Obligations” for each REMIC created hereunder.

-

In connection with the Quarterly Report of JAVELIN Mortgage Investment Corp.

-

An entity treated as a Real Estate Mortgage Investment Conduit for federal income tax purposes.

-

About PennyMac Mortgage Investment TrustPennyMac Mortgage Investment Trust is a mortgage real estate investment trust that invests primarily in residential mortgage loans and mortgage-related assets.

Why Consider An Investment Property

If you have funds to invest, real estate may be a good option for you. There is no guarantee in any investment, but real estate proves to be a steady rate of return and profit.

There can be tax benefits to owning a property and renting it out. As an investor, you may be able to treat your mortgage interest rate as an expense and deduct it from your rental profits. There is also an opportunity for depreciation deductions against the price of your home and various home improvements. These depreciations are annual income tax deductions. You can visit the IRS or contact your personal tax advisor to learn more about how your investment property might qualify.

Don’t Miss: What Were Mortgage Rates In 1980

What Should I Know Before I Apply

Eligibility requirements

To apply for an investment property mortgage, you need to meet the following criteria:

- Be at least 18 years old

- Be a citizen or resident of Canada

- Be free from bankruptcy or other forms of unmanageable debt

Mortgage qualifications

You may need to provide a number of documents to qualify for an investment property mortgage. These can include the following:

- Proof of income. Youll be required to submit documents like pay stubs and letters of employment to verify how much money you make.

- Proof of down payment. Youll usually have to show that you have enough money in the bank to cover your down payments .

- You may need to authorize your broker or the bank to pull your credit report so that they can assess your creditworthiness.

- Government-issued ID. Youll have to show proof of ID like your drivers licence or passport to start the application process.

- Property documentation. You may be required to show property listings and zoning documentation for the property you want to buy.

- Other financial information. You could be required to provide a list of your debts and assets so that your lender can calculate your debt ratio.

How do lenders assess your financial eligibility?

There are 3 main debt ratio calculations a lender might use to figure out if youre eligible for a mortgage, and what your investment property mortgage rates should be.

Which Loans Are Available For Investment Properties

Residential investment property mortgages differ from primary home mortgages in four key areas:

Down payment: Investment property mortgages usually require a larger down payment

Interest rate: Investment property mortgages usually have higher rates

Loan underwriting: Residential investment property mortgages may be underwritten differently than properties that are owner-occupied

Property size: At TD Bank, residential mortgages for investment properties are for buildings with 1-4 units. If you’re interested in a building that is mixed-use, commercial or more than 5 units, you may need to consider commercial financing for your mortgage needs

You can learn more about your best loan options and get a realistic price range for your search when you talk to your TD Bank loan officer to get prequalified.

- To get prequalified, you will need to provide your basic debt, income and asset information your loan officer will pull a credit report

Read Also: Will I Get Approved For A Mortgage

The Bottom Line: Learn The Steps On How To Invest In Property Before Getting Started

Investing in real estate is a great way to diversify your portfolio and potentially make a substantial amount of additional income for yourself. It isnt risk-free, however, and comes with a lot of work and responsibilities that you must be prepared to tackle if you want to invest.

Like any investment, you should consider your financial goals and future before sinking any money into it. Doing proper research can help you make a more informed investment that will better benefit you.

For more tips on getting started investing and getting into homeownership, read our guide to the steps to buying a house.

Can I Get A Mortgage To Buy A Second Investment Property

Yes. Many investment mortgage lenders are willing to offer more than one investment mortgage to the same borrower, as long as they can prove theyll be earning enough income to cover all of the mortgages theyve taken out. There are even mortgage lenders and brokers who specialise in people with multiple investment properties, known as portfolio landlords.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

We are an information-only website and aim to provide the best guides and tips but cant guarantee to be perfect, so do note you use the information at your own risk and we cant accept liability if things go wrong. Please email us at if you see anything that needs updating and we will do so ASAP.

You May Like: What Day Of The Week Are Mortgage Rates Lowest

How To Find The Right Investment Property

There are many things you should consider when finding the right investment property for you. Here are a few things to ask yourself:

- What does the market look like? It is important to remain up to date with estate trends.

- Try to make sure youre coming in at a time that is financially sound for you. Acting on emotion is not recommended but remaining proactive and reactive to market trends is.

- Where do you want to buy?

- Where is smart to buy?

- How much can you afford?

- Do you want to invest alone or as a group?

- How much could you charge as a rental?

- How much do other homes cost in the area?

- Does this area have a high rate of appreciation if youre looking to sell?

- What kind of attractions and job opportunities are around?

- Is this a vacation destination? If so, how can you remain competitive with other rental properties nearby?

If you know someone who has invested in real estate, it might be helpful to pick their brain. Knowledge is power!

What If I Live In A Different State From The Investment Property

If your investment property is in a different state, keep in mind that your lender must be authorized to lend in that state. TD Bank operates in 15 states from Maine to Florida. Find a TD Bank near your property

Additional considerations:

- Documentation and closing procedures may vary from state-to-state, so work closely with your loan officer, real estate professional and closing agent

- Be prepared to be present for both your property inspection and your closing

- If you can’t attend your property inspection, make sure you get the report and ask the inspector any questions

- If you can’t attend your closing, your loan officer can help you identify who can legally represent you

Read Also: What Is A Cd In A Mortgage Process

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Why Get An Investment Property Loan

Whether a borrower plans to purchase a single-family home, townhouse, condominium, or multi-family dwelling, there are different requirements to secure a loan on an investment property versus obtaining a mortgage for residential purposes. Since investment properties inherently carry more risk, the financing guidelines are different from traditional loans – they also offer additional benefits:

- Rental opportunity: Renting out your property to tenants creates additional cash flow. Consider purchasing properties near downtown areas, vacation spots or college campuses as these are popular among renters.

- Increased cash flow: Your investment property can provide income to offset your expenses. You may even profit from your rental property!

- Potential tax benefits: There can be many tax advantages to owning rental properties, such as deductions for mortgage interest, property and real estate taxes. Be sure to consult a tax adviser.

- Build your investment portfolio: You can diversify your portfolio by owning an investment property.

Also Check: What Is The Best Reverse Mortgage Company

Tax Treatment For Investment Property Mortgages

If you have a rental property, this will show up in a section called Schedule E of your tax returns, which shows all the income and expenses of your rental property.

Expenses include mortgage interest, as well as many other things like property taxes, insurance, HOA dues , maintenance fees, rental management fees, and depreciation.

If the net number on Schedule E is positive, that number counts as income, and youre taxed on it.

If the net number is negative, that number counts as a loss, and reduces your taxable income. But theres a catch here because higher earners dont always get the benefit of reduced taxable income each year. If you make too much, a rental property loss on Schedule E would instead accrue yearly and count as an offset to capital gains when you sell the rental property.

Talk to your tax advisor for advice on which scenario would fit your profile.

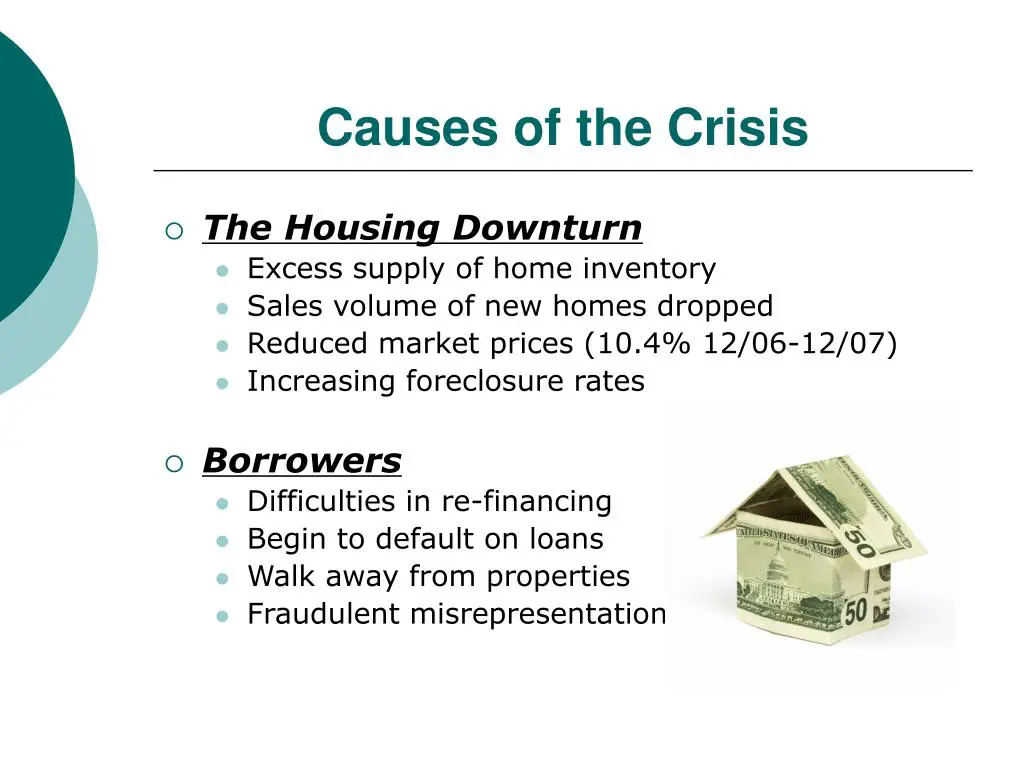

Will Investment Property Interest Rates Drop In 2020

Average mortgage rates fluctuate daily and are influenced by economic trends including the inflation rate, the job market and the overall rate of economic growth. Unpredictable events, from natural disasters to election outcomes, can impact all of those factors. See NerdWallets mortgage interest rates forecast to get our current take.

Don’t Miss: When Can I Drop My Mortgage Insurance

Tips On Investment Property Loans

Ready to take that step and borrow towards real estate investing? Here is some advice:

Have money for a large down paymentyou will need at least 15% to put down to obtain traditional financing on such a property, and mortgage insurance does not apply. With 25% down, you may even qualify for an even better interest rate.

Check your credit scoreyou could end up paying more for the same interest rate if your score is under 740 or having to accept a higher interest rate. Lenders will also want to see that you have at least six months of personal and investment-related expenses available.

You have optionsConsider a bank like New American Funding to get financing for your investment property loan rather than a big bank if you dont have as big of a down payment as youd like. Mortgage banks like New American Funding may have access to a wider range of loan products.

Get creativeready to pull the trigger on an investment property with a high probability of making you a profit? Take advantage of other means of obtaining a down payment by way of a home equity line of credit, or life insurance policies.

Talk to us about a cash out refinance on your current home to buy an investment property.

Second Home Mortgage Requirements

Second-home loans regularly have a lower interest rate than investment-property loans and might include a Second Home Rider along with the mortgage. This rider usually states that:

- the borrower will occupy and only use the property as the borrower’s second home

- that the property will be kept available for the borrower’s exclusive use and enjoyment at all times

- the property can’t be subject to any timesharing arrangement or rental pool, and

- the property can’t be subject to any agreements that require the borrower to rent the property or give a management firm control over the occupancy and use of the property.

Don’t Miss: Does It Make Sense To Pay Off Mortgage Early

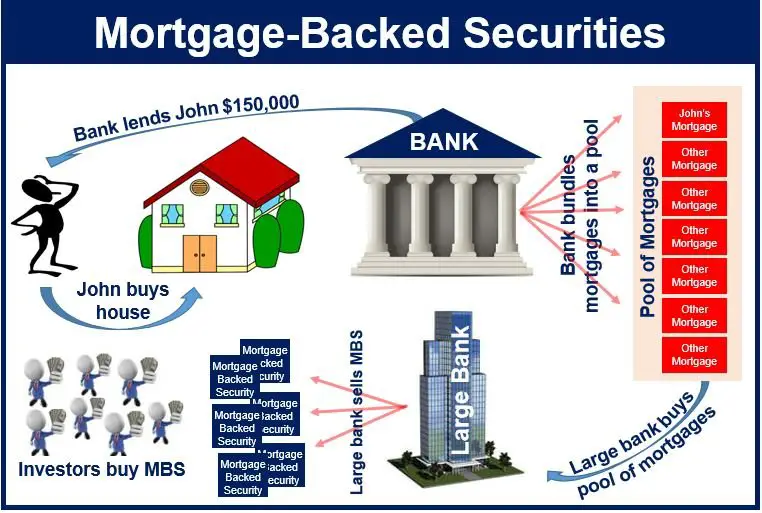

How Does A Mortgage Loan Work

When you get a mortgage, your lender gives you a set amount of money to buy the home. You agree to pay back your loan with interest over a period of several years. The lender’s rights to the home continue until the mortgage is fully paid off. Fully amortized loans have a set payment schedule so that the loan is paid off at the end of your term.

The difference between a mortgage and other loans is that if you fail to repay the loan, your lender can sell your home to recoup its losses. Contrast that to what happens if you fail to make credit card payments: You dont have to return the things you bought with the credit card, though you may have to pay late fees to bring your account current in addition to dealing with negative impacts on your credit score.

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE: Get your credit score for free

Read Also: How To Calculate Mortgage Insurance On A Conventional Loan

We’ll Help You Cut Through The Mortgage Red Tape

The rules around mortgages, insured mortgages â and even affording a mortgage â are subject to change.

In fact, there have been a number of changes in the past few years, such as in 2016 , 2020 , and most recently in June 2021, the tougher stress-test affordability rules set out by the federal government.

We really know mortgages, and are always up-to-date on the latest changes and what they mean for your situation. We can quickly set out all your details. You’ll be able to make a clear decision for your best mortgage experience, ever.

Plus, a few minutes with True North Mortgage could save you thousands with your best-possible rate.

How Many Investment Property Mortgages Can I Have

In theory, there is no strict limit since there are lenders who cater for portfolio landlords with an unlimited number of properties on their books. That said, other lenders do impose some restrictions and might limit either the total number of BTL mortgages theyre willing to offer to one applicant, or the total amount one applicant can borrow for their portfolio.

The typical cap for buy-to-let mortgages can be anywhere between three and 10 properties, while maximum borrowing for one application can be around £3 million.

If youve looking to take out investment mortgages for a large number of properties, your best bet is to work with a specialist buy-to-let mortgage broker who can help you find a lender with no limit on the number of properties theyre willing to offer finance for.

Read Also: How Can I Mortgage My House

Best For Commercial Property: Lendio

Lendio

Why We Chose It: We chose Lendio as our best for commercial property loans because their marketplace platform is the easiest way for an investor to fill out one application and receive offers from multiple competing lenders.

-

Wide variety of financing options and lenders

-

Personalized guidance and expertise to help you interpret your loan offers

-

High interest rates on some loans

-

You have to fill out their online application to see loan terms

Lendio is a free online service for investors where users receive potential commercial loan offers within minutes from the company’s marketplace of more than 75 lenders. Over 300,000 loans have been funded through Lendio, giving it a good reputation for success.

A marketplace like Lendio is great for commercial property investors because they can quickly and efficiently shop for the best terms. Unlike other commercial property options, they make the process simple with one application to shop rates.

Lendio lenders underwrite residential, multi-unit, and commercial real estate loans, as well as an array of business loans too. Down payments can be as low as 3.5% if you qualify for one of the agency loans, like FHA. Otherwise, traditional commercial property loan programs require 25% to 30% down.

Interest rates start at 4.25% on the Lendio platform for commercial property loans. Terms range from 20 to 25 years and take a minimum of 45 days to fund. Commercial property loan amounts range from $250,000 to $5 million.