Best Reverse Mortgage Lenders Of 2021

May 12, 2021 Quontic Bank Best digital option · AAG Best recognized brand · Longbridge Best online tools · All Reverse Mortgage Inc Best customer All Reverse Mortgage Inc: 3.39%6.99%Finance of America Reverse: Not listedLender: Sample Interest RatesQuontic Bank: 4.199%4.815%

The Best Reverse Mortgage Companies A member in good standing with the National Reverse Mortgage Lenders Association, Fairway has become popular among One Reverse Mortgage: Origination fees are nHECM Lenders: Lender HighlightsReverse Mortgage Funding: Provides price maFinance of America Reverse: Available nation

Apr 20, 2021 Looking for the best reverse mortgage companies? Our top picks include FAR, AAG and Liberty Reverse, based on verified customer review data.Who should get a reverse mortgage?How much money do you get from a reverse mortgage?

How Much Will I Owe When My Reverse Mortgage Becomes Due

The amount you will owe on your reverse mortgage will equal all the loan advances you received , plus all the interest that accrued on your loan balance. If this amount is less than your home is worth when you pay back the loan, then you keep whatever amount is left over.

With most reverse mortgages, you can never owe more than your home is worth. The technical term for this cap on your debt is a “non-recourse limit.” It means that the lender, when seeking repayment of your loan, generally does not have legal recourse to anything other than your home’s value and cannot seek repayment from your heirs.

Be aware that since the home will likely need to be sold to pay back the reverse mortgage, these types of loans may not be a good option if you want to leave your home to your children.

Finance Of America Reverse Review

Great Service | 4.75 Stars

Screenshot: Reviews Website

As you can probably tell by its name, Finance of America Reverse specializes in reverse mortgages. The lender is licensed in 50 states and Puerto Rico, and is a member of the National Reverse Mortgage Lenders Association. FAR is armed with a team of reverse mortgage specialists who provide its customers with attentive support.

For anyone whos looking for a reverse mortgage and is unfamiliar with the process, Finance of America Reverse is a good place to start. Customer reviews show the companys agents to be not only knowledgeable but courteous and readily available. Although the companys site lacks a quote calculator, the Contact page collects key contact information and includes a drop-down menu so you can specify exactly what service you need whether youre interested in a reverse mortgage for yourself, looking into one for a loved one, etc.

Numerous customer reviews were particularly positive about FARs customer service, whether it was walking people through the process step-by-step, how the money they could access helped them afford home repairs, competitive pricing or just how easy the process was overall.

To contact Finance of America Reverse, visit their reverse mortgage website or call

Great Closing Speed | 4.65 Stars

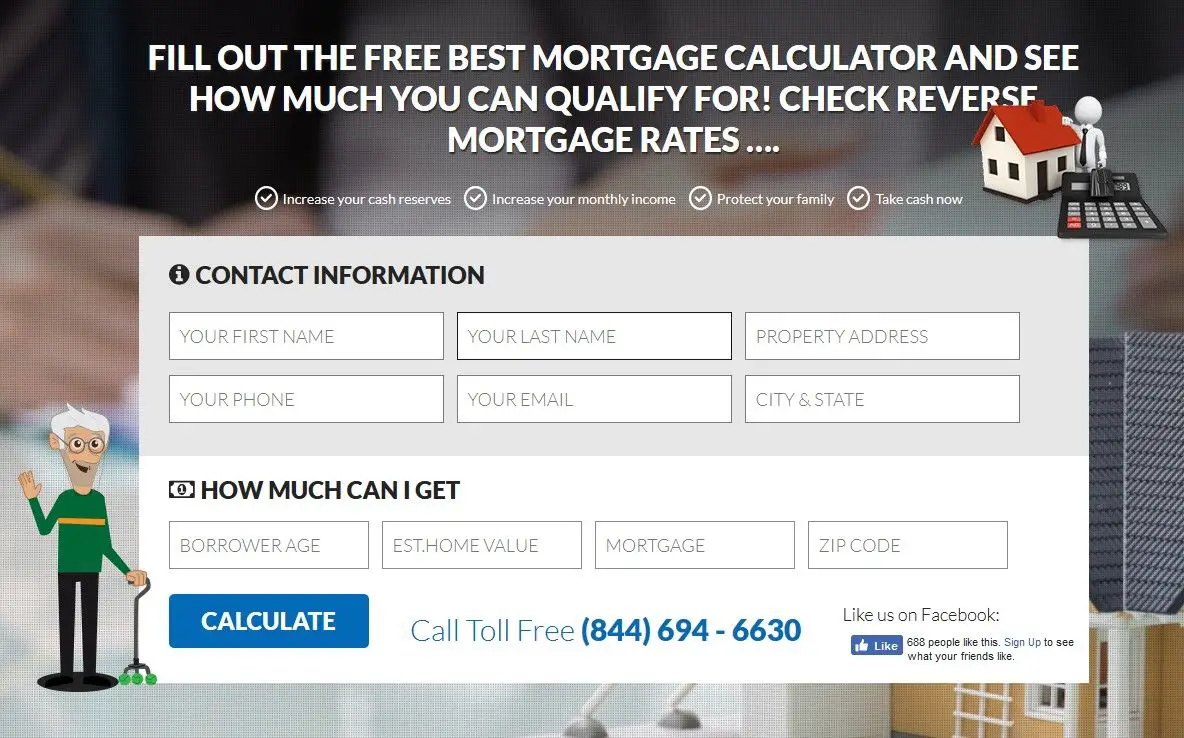

Screenshot: AAG Calculator

Read our comprehensive American Advisors Group review more more information.

Recommended Reading: Rocket Mortgage Qualifications

Financial Freedom Reverse Mortgages Originated

| Year |

|---|

Before exiting the reverse mortgage business, Financial freedom had built up a large portfolio, employed hundreds of loan originators and staff, and was extremely active in the market.

Several other banks share a similar story of having risen in terms of reverse mortgage volume prior to the housing market crash and immediately following it, before deciding to exit reverse mortgage operations. Among them are Bank of America, Wells Fargo and MetLife Bank.

Longbridge Financial: Best For Customer Service

Longbridge Financials customer service starts with its easy-to-navigate website.

The company focuses exclusively on reverse mortgages and offers a customer service guarantee.

That guarantee includes a commitment that will confirm whether a reverse mortgage is wrong for you. Longbridge Financial nabbed an A+ rating from the Better Business Bureau.

Customer reviews consistently praise its loan officers.

Recommended Reading: Chase Recast Calculator

Finding Reverse Mortgages For Low

There is a reverse mortgage option for low- to moderate-income seniors called a single-purpose reverse mortgage. These cost less than a traditional reverse because they provide advances on smaller amounts of a homeowners equity and come with fewer and lower fees. Single purpose loans are only provided for single, crucial expenses that are pre-approved by lenders, like property tax payments or emergency home repairs. Single-purpose loans are not structured or insured by the FHA like a traditional HECM rather, they are available from nonprofit organizations, credit unions and some state and local government institutions which determine their structures and costs.

Its important to note that although Social Security and Medicare eligibility are not affected by a reverse mortgage loan, needs-based government programs like Medicaid and Supplemental Security Income may be affected by the new asset that a loan represents.

Costs and Fees of Single-Purpose Reverse Mortgages

Like traditional HECMs, repayment of a single-purpose reverse is not done on a monthly basis but happens when the homeowner sells the home, moves or passes away. This type of reverse mortgage is less expensive than an HECM and taps less of a homeowners equity than other reverse mortgage options.

Finding a Single-Purpose Reverse Mortgage

Pros And Cons Of American Advisors Group

Pros

- Top HECM lender in the nation, closing more loans than any other lender in the industry.

- Provides a jumbo reverse mortgage option

- Excellent ratings and reviews on trusted websites like Better Business Bureau and TrustPilot

- Offers robust online resource bank with retirement tips, recommended articles and knowledge base

Cons

- Currently offers jumbo reverse mortgage option in only 24 states

Recommended Reading: Chase Mortgage Recast

Home Equity Loan Or Home Equity Line Of Credit

A home equity loan is a second mortgage thats secured by the borrowers home equity and paid out in a lump sum. Similarly, a home equity line of creditor HELOClets homeowners borrow against their equity up to a certain limit and access those funds on an as-needed basis. This means you only pay interest on your current balance, not a lump sum loan.

In contrast to a reverse mortgage, you will have to make monthly payments, and lenders will evaluate your income and credit when reviewing your application.

Talk About Reverse Mortgage Scams

Though traditional HECM reverse mortgages are heavily regulated by the FHA, there are still plenty of enterprising individuals who find ways to take advantage of, or outright rob the elderly using false promises regarding products like reverse mortgages. Discussing what to look out for can protect your loved one from this kind of exploitation.

The FBI states that victim seniors are offered free homes, investment opportunities, and foreclosure or refinance assistance, and that they are also targeted by schemes involving straw real estate buyers. If you or your loved one are offered or asked to procure a reverse mortgage as an opportunity to delay Social Security payments, buy a low-cost property for no money down or fund home repairs, or if youre offered free income with no risk by procuring a reverse, this should put you on your guard.

The following are tactics that can help you protect yourself and your loved ones from reverse mortgage scams.

- Seek out your own HUD approved reverse mortgage counselor

- Do not respond to unsolicited ads or offers

- Be suspicious of anyone who downplays the risks and obligations of a reverse

- Do not sign anything that you dont fully understand

- Do not accept payments or a title for a home you did not purchase

- Make sure that you and your loved one attend the loan closing

- Make sure that your loved one receives payments personally

- Find background info on lenders using the Better Business Bureau and the NMLS

Don’t Miss: 70000 Mortgage Over 30 Years

Know The Available Terms Of Loans

As discussed briefly above, a reverse mortgage can be packaged as a lump sum payment, a Line of Credit, or a series of payments over time .

What is most common today, and the one that I often recommend is the Line of Credit structure.

This allows you to be able to tap into your home equity at any time, but you are NOT being charged an interest fee on the available funds not withdrawn.

This gives you flexibility without the cost.

Why Did Wells Fargo Stop Offering Reverse Mortgages

Upon the announcement that it would exit the reverse mortgage business, Wells Fargos executives told industry press outlet Reverse Mortgage Daily that home price unpredictability combined with HECM program restrictions made it difficult to determine whether borrowers could meet their loan obligations.

These obligations, which continue to apply to reverse mortgages today, include ongoing payment of property tax and homeowners insurance, as well as upkeep of the property to Federal Housing Administration standards.

As part of any FHA-insured reverse mortgage loan, the borrower must maintain these obligations in order to keep the loan current.

In turn, borrowers with FHA-insured reverse mortgages are guaranteed that they will continue to receive their loan payments as stated in the loan contract, and that they will never owe more to repay their reverse mortgage loan than the home is worth at the time of sale.

The housing crash in 2008 led to widespread home price uncertainty Wells Fargo could not predict home prices and the ability for borrowers to meet their loan obligations Banks at the time were focusing on core operating channels rather than ancillary businesses

You May Like: Can You Get A Reverse Mortgage On A Condo

The Top Nine Best And Most Affordable Reverse Mortgage Lenders

Joshua Iversen, President, Syzygy Financial LLC

Between paying medical bills and covering costs for things like hearing and mobility aids, home healthcare, and senior housing, the simple process of aging costs the average American hundreds of thousands of dollars, and Medicare is unlikely to cover it all. However, the costs associated with aging are often vital to a seniors quality of life, and for this reason, reverse mortgages can be extremely advantageous.

Financial products like reverse mortgages aid tens of thousands of retired Americans in paying out-of-pocket healthcare costs and other retirement expenses, and more than 24,000 FHA-secured reverse mortgages were closed in 2019.

Read on for a deep dive into the ins and outs of reverse mortgages, including the top lenders, who should consider a reverse mortgage, and how to find a cost-effective reverse mortgage based on your individual needs.

How We Chose The Best Reverse Mortgage Companies

To find the best reverse mortgage companies, we looked first to find companies that served as many homeowners as possible. Most of our choices service customers nationwide, although not all product offerings are available in all states. We also searched for companies that stood out among their competitors by offering unique programs or guarantees that put the customer first. Along those same lines, we looked for reverse mortgage companies that provided a good amount of educational information to homeowners new to this type of loan. We also considered reverse mortgage companies that offered unique loan types that would benefit homeowners.

Recommended Reading: Rocket Mortgage Payment Options

What Happens When You Sell A House With A Reverse Mortgage

The reverse mortgage will come immediately due when you sell your home. This is just like a traditional mortgage.

You will have to pay the full balance of the loan with the proceeds from the sale.

The seller will keep any equity above the loan payoff.

So, again, very similar to having a traditional forward mortgage.

American Advisors Group: Best Reverse Mortgage Provider Overall

American Advisors Group offers all the information, expertise and experience you would expect from the largest reverse mortgage company in the U.S. The website is well-laid out and brim full of helpful articles and resources, while the application process is clear and fully supported.

If you want an idea of what you might be able to borrow, there is a straightforward calculator that doesn’t require you to share contact details, while there are a number of different loan types to choose from too.

For those wanting an indication of costs, generic fee information is relatively easily found, although the charges specific to you will only become apparent when you speak to a customer service specialist. Thankfully, however, it is in terms of customer service that AAG truly excels, with past patrons extremely generous in their praise of a company that is consistently marked highly for its professionalism, transparency and knowledge.

Liberty Reverse Mortgage is open, accessible and widely-praised by its past customers. Its application process is straightforward, all of the reverse mortgage information you might need is easily found, and there is even some welcome transparency over the type of costs you might face.

However, with some excellent customer reviews, there is a good chance that you will like what you see. And if you feel slightly let down at any point, you will probably find that Liberty has a guarantee in place to make sure that any disappointment doesn’t linger.

Also Check: Can You Do A Reverse Mortgage On A Condo

What To Ask A Lender About Reverse Mortgages

Before getting a reverse mortgage, ask your lender about:

- how you can get the money from a reverse mortgage

- if there are any fees you have to pay

- what interest rate you have to pay on the money you borrow

- what can cause you to default on the loan

- any penalties you have to pay if you sell your home within a certain period of time

- how much time you have to pay off the loans balance if you move

- how much time your estate has to pay off the loans balance if you die

- what happens if it takes your estate longer than the stated period to fully repay the loan when you die

- what happens if the amount of the loan ends up being higher than your homes value when it’s time to pay the loan back

How To Find A Cost

The factors most responsible for determining a borrowers total reverse mortgage costs are the type of HECM they choose, the interest rate they are offered, and their total loan amount, which is based on a borrowers home value among other considerations.

Finding the best interest rate requires that consumers receive reverse mortgage estimates directly from multiple lenders. In doing so, its best that reverse mortgage shoppers begin fielding offers with a clear understanding of what costs and fees they are likely to face and what payout and rate structures would best suit their needs.

In addition to reviewing our top lenders of 2021 above, we recommend using the following information to find your best reverse mortgage option.

Recommended Reading: Requirements For Mortgage Approval

Get Your Heirs Involved In The Process

Your decision to take out a reverse mortgage loan could affect family you leave behind, so include them in the decision-making process as much as you can. If you pass away and leave the home to your children or any other heir, they have the option to pay whats left on the loan so they can keep it or sell the house. If they sell it, many reverse mortgage loans include a non-recourse clause which means heirs dont owe more than the homes worth when its sold. So, if the reverse mortgage loan was for $300,000 and it only sells for $260,000, your heirs dont have to pay the $40,000 difference.

Pros And Cons Of Retirement Funding Solutions

Pros

- Owned by Mutal of Omaha, a well-known and financially stable bank

- Extensive online tools, including free calculators for reverse mortgages, HECM For Purchase and Social Security benefits

- With their HomeSafe reverse mortgage, borrowers can receive proceeds as monthly term payments , or as a lump sum

- HomeSafe loans have a competitive, fixed interest rate

Cons

- No loan rates or fees listed on the website

Read Also: Bofa Home Loan Navigator

Why We Recommend Quontic Bank

Quontic Bank stands out for us because it has a long history as a brick-and-mortar institution, offering many different types of financial products, including personal banking. Though Quontic has originated fewer reverse mortgages in 2022 than the other lenders we have covered thus far, the customer service environment that this lender can offer surpasses many others especially those that do business only online or over the phone. Quontic has locations all over the country where they service reverse mortgage loans, student loans, traditional mortgages, and many other products.

Consumers have reviewed Quontic very positively on sites like BBB.org and Lending Tree, like Bill I. in Long Island, who stated, I am not one to write reviews but I would be remiss if I did not praise the work of Quontic Bank in general and in particular, Michael B****** and his staff on Long Island . In helping us to buy our house, they went out of their way to be courteous, helpful, and creative. Even when we threw them a few late changes, they never complained but simply found a way for things to work.

What Customers Are Saying

Client Testimonials

Texas Lending made us feel uncomfortable with actions and narrative going on so we withdrew. A third try this summer gave us Quontic Bank and Megan Hardin. Our first conversation with Megan gave us a good feeling that she is someone who understands what weve been going through and would do all she could do to refinance our home.

What Are The Pros And Cons Of A Reverse Mortgage

There are several considerations to make before deciding to proceed with a reverse mortgage loan. As with any large decision, its helpful to have an understanding of the pros and cons associated. Some of them include:

Pros:

- You continue to live in your home and retain title to your home as long as you continue to pay your property taxes, insurance, and maintenance.

- You generally receive the proceeds of the loan as tax-free cash in which you can use the money as you see fit. It is recommended though to speak with your financial advisor to verify your specific situation.

- You do not make any monthly mortgage payments during the course of the loan. You do have to follow the constructs of the loan guidelines and are responsible for paying your property taxes, insurance and maintenance.

- A reverse mortgage is a non-recourse loan. Neither you nor your heirs are liable for any amount of the mortgage that transcends the value of your home.

- You choose the disbursement option. There are several ways in which you can receive the proceeds of the loan.

- Many lenders offer a free reverse mortgage loan calculator which allows you to get an estimate as to how much you may qualify for.

Cons:

- Fees associated with the loan are generally higher than with other financial products. You should ask your lender about options available.

- The balance of the loan increases over time as does the interest on the loan and the fees associated.

Recommended Reading: Does Rocket Mortgage Sell Their Loans