Mortgage Rates Sink To All

Mortgage rates plummeted this week to the lowest levels in the history of Freddie Macs survey, which dates to 1971.

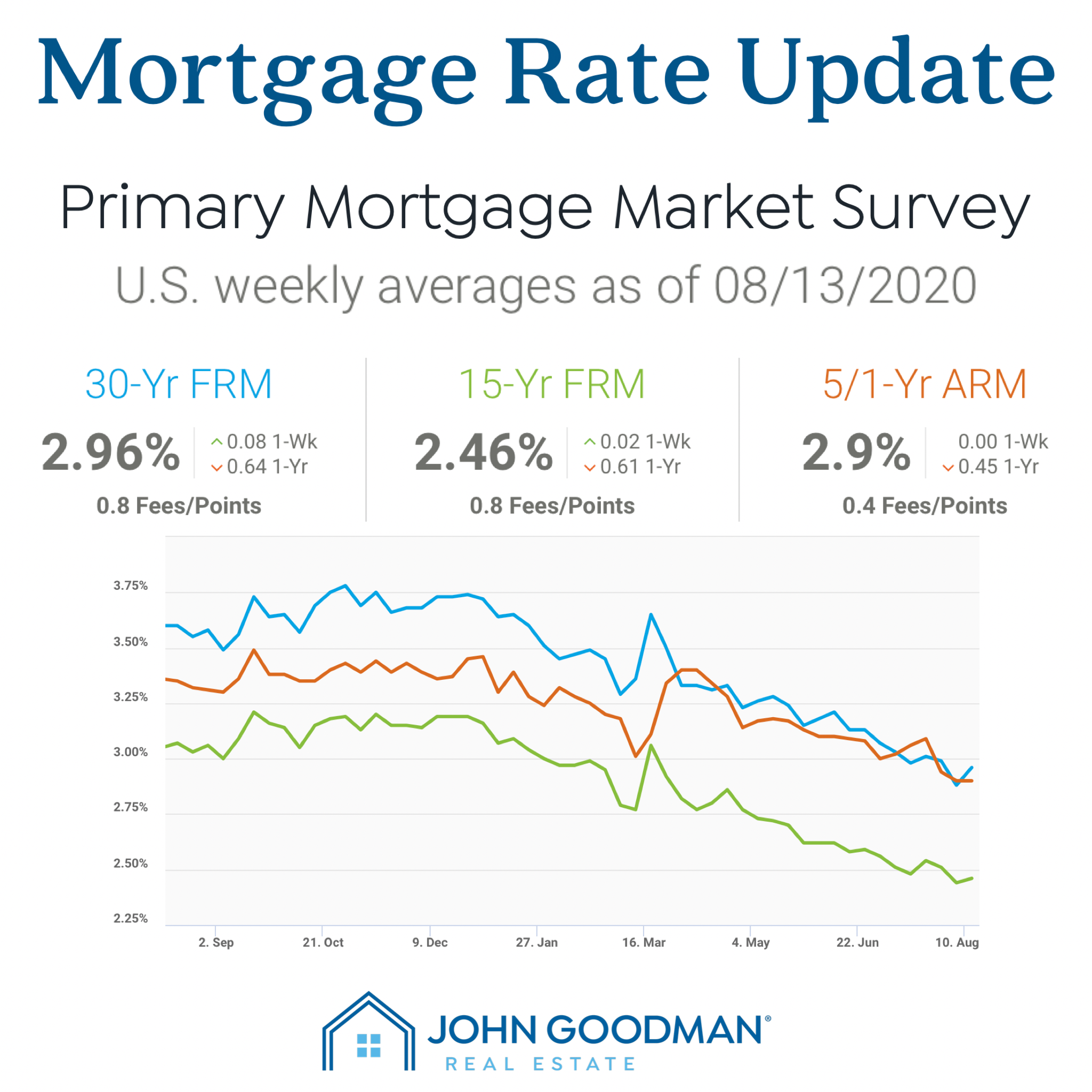

According to the latest data released Thursday by the federally chartered mortgage investor, the 30-year fixed-rate average tumbled to 3.23 percent with an average 0.7 point. It was 3.33 percent a week ago and 4.14 percent a year ago.

Freddie Mac aggregates rates from 125 lenders nationwide to come up with national average mortgage rates. It uses rates for borrowers with flawless credit scores. These rates are not available to every borrower.

The 15-year fixed-rate average dropped to 2.77 percent with an average 0.6 point. It was 2.86 percent a week ago and 3.6 percent a year ago. The five-year adjustable-rate average fell to 3.14 percent with an average 0.4 point. It was 3.28 percent a week ago and 3.68 percent a year ago.

The number of mortgages in forbearance has increased substantially in the past month amid the coronavirus pandemic. Earlier this week, the Mortgage Bankers Association announced that 3.5 million home loans, close to 7 percent, have entered forbearance. At the beginning of March, less than 1 percent of loans were in forbearance. When a loan goes into forbearance, payments are reduced or postponed but interest continues to accrue.

The index was pushed up by an increase in purchase applications. The purchase index jumped 12 percent but was 20 percent lower than it was a year ago.

Mortgage Rates And The Housing Market: What To Expect

Experts predicted we would see increasing rates and volatility in December and going into 2022, and thats largely been the case. Last weeks increase of the average 30-year fixed mortgage rate from 3.26% to 3.27% is just below the highest rate average 3.28% in eight months.

Experts expect the increases to continue. The Federal Reserve said last month there could be as many as three rate hikes in 2022, which translates into higher rates for mortgages and other types of lending. Even before last weeks Fed announcements, consumers expected rates to increase over the next 12 months, according to a recent Fannie Mae housing study. How fast or slow they increase is likely to depend on the health of the economy.

While more increases are expected, housing experts believe rates will increase gradually, rather than skyrocket. Joel Kan, an economist at the Mortgage Bankers Association, said recently his forecast is for the 30-year fixed mortgage rates to hit 4% by the end of 2022.

The economy also seems better prepared to handle new waves of rising COVID cases than it did during the pandemics early days. Subsequent surges in COVID cases havent had as much of a negative impact on the economy as the initial wave, Logan Mohtashami, HousingWire data analyst, recently told us.

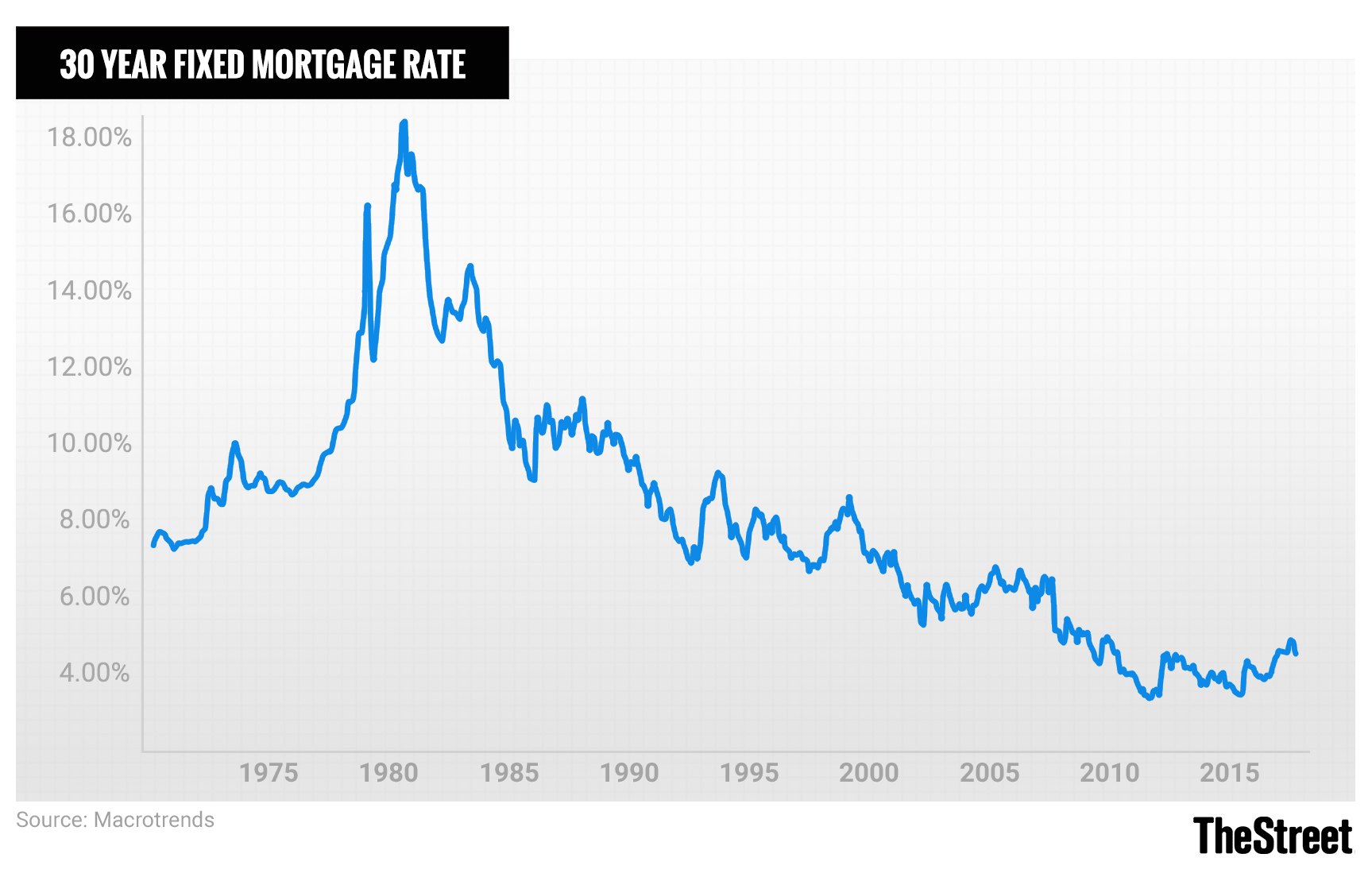

While current rates arent as low as the sub-3% we saw earlier this year, they are still very low from a historical perspective.

Summary Of Current Mortgage Rates

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Don’t Miss: Recast Mortgage Chase

What Does That Mean For You As A Borrower

It means you should take low rates as they come. Whether youre buying a home or refinancing, todays lowest rates represent a great deal one not worth passing up in hopes of slightly lower rates later on.

And borrowers shouldnt try too hard to time the market.

Mortgage rates are unpredictable right now. So keep a laser focus on your own personal goals, and lock a mortgage rate when the time is right for you regardless of what the market might do.

Us Housing Price Trends 2021

In today’s housing market, buyers are driving up property prices, leading homes to sell rapidly. Some hyperactive buyers make offers without seeing the property and forego contingencies to win bidding wars in the highly competitive housing market. The historically low mortgage rates have fueled an increase in demand, particularly among millennials. However, they are running into a shortage of available housing. Many buyers are still in the hope of finding a home that fits their budget and needs.

Despite popular belief that now is not a good time to buy, many home buyers are looking to lock in their monthly housing payments by taking advantage of still-low mortgage rates. However, in this hot real estate market, it’s difficult for buyers to find a good deal, especially with the typical asking price rising by double digits. Although the housing market is still expected to favor sellers we appear to be at a tipping point in the housing market, where prices have risen so dramatically that buyers are backing off and home sales are slowing down.

House prices rose nationwide in August, up 1.0 percent from the previous month, according to the latest Federal Housing Finance Agency House Price Index . House prices rose 18.5 percent from August 2020 to August 2021. The previously reported 1.4 percent price change for July 2021 remained unchanged.

U.S. House Price Index Report 2021 Q2

The top five states with the highest annual house appreciation were:

References

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

You May Like: Rocket Mortgage Vs Bank

Most Mortgage Rates Inch Higher While Lagging Jumbo 30

Most fixed-rate mortgage averages rose by small increments Friday, with an exception being Jumbo 30-year rates, which bolted dramatically higher. Given the strong general trend upward since New Year’s, every major mortgage average is now above its highest point of 2021, with most sitting at levels not seen since spring 2020.

| National Averages of Lenders’ Best Rates | |

|---|---|

| Loan Type | |

| 3.34% | 3.45% |

What’s The Reaction So Far

As might be expected, many borrowers are moving to lock in rates now on the expectation that mortgage rates could climb higher, according to Alex Elezaj, chief strategy officer at Pontiac-based United Wholesale Mortgage.

“The market is changing very fast,” Elezaj said.

While refinancing has slowed down in general for the industry, he said, there continues to be a strong demand from many homeowners who continue to refinance in order to take cash out of their homes as home values have gone up.

Some people want that cash now because they’re remodeling their homes or paying down other higher cost debt, he said. The available homes for sale remain limited in many markets, he said, giving homeowners more reason to remodel their existing home and not move elsewhere.

“I think people will continue to tap into the equity,” he said.

As for home buyers, Elezaj said, 30-year mortgage rates continue to be available now in the low 3% to mid-3% range for those who qualify and shop around.

“We do see it trending upward, for sure,” he said. The expectation is that mortgage rates would see a bigger increase in the summer and later this year.

Working with a local independent mortgage broker, he said, can help people shop around and discover options for first-time homebuyers, veterans and others. UWM powers a website called FindAMortgageBroker.com.

Studying what’s available by just reviewing rates on the internet may not be enough.

“You just Google it, good luck.”

Read Also: Can I Get A Reverse Mortgage On A Condo

Which Mortgage Loan Is Best

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits which max out at $548,250 in most parts of the U.S.

On the other hand, if youre a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance . But you need an eligible service history to qualify.

Conforming loans and FHA loans are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates similar to VA and reduced mortgage insurance costs. The catch? You need to live in a rural area and have moderate or low income to be USDA-eligible.

What Is A Mortgage Rate

A mortgage rate is a percentage of the total loan amount paid by the borrower to the lender for the term of the loan. Fixed mortgage rates stay the same for the term of the mortgage, while variable mortgage rates fluctuate with a benchmark interest rate that is updated publicly to reflect the cost of borrowing money in different markets.

You May Like: Rocket Mortgage Requirements

What Is A Good Mortgage Rate

Average mortgage rates have been at historically low levels for months, even dipping below 3% for the first time earlier this year. Since then, rates have been on a slow but steady increase but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are approximately 1% lower than pre-pandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Also Check: How Does Rocket Mortgage Work

Will Mortgage Rates Go Down In December

Mortgage rates keep trending sideways, only making small moves week-to-week driven by the opposing pulls of worsening coronavirus numbers and an improving economy. However, the latest news from the Federal Reserve points to rate hikes on the horizon for 2022.

Mortgage rates inched up as a result of economic improvement and a shift in monetary policy guidance, said Freddie Mac Chief Economist Sam Khater.

We expect rates to continue to increase into 2022 which may leave some potential homebuyers with less room in their budgets on the sideline.

Most housing experts are expecting an overall upward trend through the end of 2021 and into 2022. And thats because the forces pushing mortgage rates higher arent going away:

- Inflation Higher inflation typically leads to higher rates. And the annual U.S. inflation rate was at a 30-year high in October

- Economic recovery Retail sales increased by a wider margin than expected in October. And unemployment claims fell to their lowest level since March 2020. Both are strong indicators of an improving economy, which should lead to increased rates

- Fed policy changes As the Federal Reserve continues to pull back on its Covid-era stimulus, mortgage rates should continue to rise

But there are other forces working to pull rates down, which is why weve seen spikes and drops over the past few weeks.

As has been the case since 2020, Covid trends are one of the biggest indicators for mortgage rates right now.

Will The Housing Market Crash Due To The Foreclosures

Is there going to be a housing market crash in 2022? What a difference a pandemic like Covid makes on the housing market, which advances in the opposite direction of what one would expect in a recession! We are unlikely to see a housing market crash similar to the one that occurred during the 2008 housing bubble. We do see the momentum cooling over the next year. The economic factors resulting in that housing crash were much different than today. Here’s an overview of how to think about a potential housing market crash and the factors that affect real estate cycles.

Early on in the COVID-19 crisis, it appeared that the housing market might collapse. Instead, a housing boom has occurred with the median home prices rising by an astounding 24 percent since the crisis began. The mortgages backed by the federal government were exempted from the foreclosure moratorium. It kept the housing market afloat during the crisis. To help borrowers at risk of losing their homes due to the coronavirus national emergency, FHFA announced that Fannie Mae and Freddie Mac are extending the moratoriums on single-family foreclosures and real estate owned evictions until June 30, d2021.

With moratoria lifted, foreclosures begin to increase, but remain 80% below pre-pandemic levels the delinquency rate falls to 4% for the first time since early 2020, according to Black Knight’s First Look at August 2021 Mortgage Data.

US Housing Foreclosure Statistics 2021

- California

- Illinois

- Michigan

- New York

Also Check: Reverse Mortgage Manufactured Home

Housing Market Trends For Median Listing Prices

Realtor.com’s data shows that the median national home listing price remained the same from September through November, at $379,000. The median listing price again grew by 8.6% over last year, the same growth rate since August. As previously stated, while median listing price increase has slowed to single digits, this trend reflects a shift in the inventory mix available for sale this year, with more small homes available for sale this year. The median listing price of a typical 2,000 square-foot single-family house is up 18.7 percent year over year.

Asking prices in the nations largest metro housing markets grew by an average of 4.5% compared to last year, slightly lower than last months rate of 5.2%. Price growth in the nation’s largest metros is slowing slightly faster than in other areas, but the primary reason is new inventory bringing relatively smaller homes to the market.

Housing Markets that saw the largest year-over-year increase in listing prices in November:

- Austin, where median listing price grew by +31.7%

- Las Vegas, where median listing price grew by +30.2%

- Tampa, where median listing price grew by +24.6%

Housing Markets that saw the greatest increase in their share of price reductions compared to last year:

- Austin

- Baltimore

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

New Home Sales Increased In October 2021

The Commerce Department reported Wednesday that new home sales in the United States increased 0.4 percent in October to a seasonally adjusted annual rate of 745,000 from 742,000 the previous month. Because of the small sample size, sales figures are frequently revised sharply. The initial estimate for September sales was 800,000.

In October, the median sales price of new houses sold was $407,700, setting a new high. Between September and October, the supply of new homes for sale increased by 3.3 percent, resulting in a 6.3-month supply. Regionally, sales were strong in the Midwest, slightly higher in the South, and lower in the Northeast and West.

For homebuyers who were dissatisfied with this year’s extremely limited supply of existing homes, new construction may appear to be an appealing alternative. At the end of October, the seasonally adjusted estimate of new houses for sale was 389,000. At the current sales rate, this equates to 6.3 months of supply.