How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What That Forecast Got Correct

I look at that year-ago prediction in two ways. The forecasters were wrong in their aggregated prediction that mortgage rates would stay about the same. But they were right about something more important: that rates, when averaged for the year, wouldn’t be higher in 2021 than in 2020.

That prediction wasn’t exactly bold, but it wasn’t intuitive, either. Mortgage rates were low in 2020, with little room to go down and a lot of room to go up. The COVID-19 recession looked like it was ending, and vaccines were on the way. An economic recovery would tend to push mortgage rates higher.

But mortgage rates didn’t move much in 2021 until they turned upward in late September. The forecast is for them to assume an upward trend throughout 2022.

How Much Of A Mortgage Am I Qualified For

Youll need to apply for mortgage preapproval to get an estimated loan amount you could qualify for. Lenders use the preapproval process to review your overall financial picture including your assets, credit history, debt and income to calculate how much theyd be willing to lend you for a mortgage.

You can use the loan amount printed on your preapproval letter as a guide for your house hunting journey. But, be careful not to stretch your budget too thin and borrow to the maximum your preapproval amount doesnt factor in recurring bills that arent regularly reported to the credit bureaus, such as gas, cellphones and other utilities, so youll need to retain enough disposable income to comfortably cover these monthly bills, plus your new mortgage payment.

You May Like: Monthly Mortgage On 1 Million

% And 95% Mortgage Rates Will Remain Attractive

90% and 95% mortgage rates have fallen steadily in the last few months, and analysis from Moneyfacts found average rates on 95% deals have dropped to the lowest levels since it started keeping records in 2011.

The return of low-deposit mortgages in the second half of 2021 was in part stimulated by the introduction of the mortgage guarantee scheme. And with the government continuing to push other initiatives such as First Homes and Help to Buy, its unlikely lenders will turn away from first-time buyers with small deposits in 2022.

If and when we do see a further rise in the base rate, its likely that 90% and 95% mortgages will be less affected than cheaper deals at lower loan-to-value levels.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Also Check: Can You Do A Reverse Mortgage On A Condo

Variable Rates Right Now

The Bank Of Canada made an unexpected emergency rate cut on Friday. This rate cut moved the Central Banks prime rate down from 1.25% to 0.75%.

This cut followed the previous weeks rate cut from 1.75% to 1.25%.

It is likely that more rate cuts are in the works.

If you have a variable rate mortgage, you will likely see a 1% decrease from two weeks ago. Please see below: How Variable Rates Work.

After the new rate cut, variable rates are in the 2.00% to 2.35% range. Its important to note that these current rates may only be temporary. In most cases, I am still advising clients to go fixed!

If you DO have a variable rate mortgage, assume that your next payment will decrease.

How The Interest Rate Rise Might Affect You

Everyone in the UK will be affected by rising prices – from a higher gas bill, to harder choices during the grocery shop.

The idea of raising interest rates is to keep those current and predicted price rises, measured by the rate of inflation, under control.

Policymakers at the Bank of England have now increased interest rates to 0.5% from 0.25%, the second rate rise in three months.

Higher interest rates make borrowing more expensive. For households, that could mean higher mortgage costs, although – for the vast majority of homeowners – the impact is not immediate, and some will escape it entirely.

Analysts have also warned that the potential benefit of a better return on savings could be muted.

You May Like: Rocket Mortgage Loan Requirements

What Will Canadians Do With All Their New Equity

Millions of Canadians have won the Canadian housing lottery in the last year. Of the three quarters of homeowners who have owned for more than five years, theyve amassed over $175,000 of equity, on average. Many, including those most able to spend their equity, have accumulated far more thanks to incessantly rising home values. Canadians have never had this much…

Where Mortgage Rates Are Headed

Worries about a resurgence of coronavirus cases are weighing on stocks and on U.S. Treasury yields, which were in the range of 1.46 percent Wednesday. Last month, yields had climbed as high as 1.65 percent. Meanwhile, the Federal Reserve signaled Wednesday that it will raise rates in a move to rein in inflation.

Mike Fratantoni, chief economist at the Mortgage Bankers Association, says the average rate on a 30-year mortgage will reach 3.5 percent by mid-2022 and 4 percent by late 2022.

Inflation is running well above target, and the job market is booming, Fratantoni says. That is why it was no surprise that the Federal Reserve moved to accelerate their taper of Treasury and purchases, and signaled that the first rate hike will be coming sooner rather than later. Moreover, the median member now expects three rate hikes in 2022.

The Mortgage Bankers Association expects refinancing activity to disappear as rates rise. But it also expects a strong home-sales market in 2022.

Mortgage experts offer mixed predictions about the direction of rates in the next week in Bankrates latest survey.

Meanwhile, the Federal Reserve last month announced its long-anticipated taper of asset purchases, and the Fed has since said it might accelerate the pace of the taper. While that move creates upward pressure, mortgage rates are unlikely to spike as a result of the taper. However, the Feds changing stance does set the stage for a gradual rise in rates.

Also Check: 10 Year Treasury Yield Mortgage Rates

Will Current Mortgage Rates Last

As the new Omicron variant causes a new surge of the virus, uncertainty around the economic recovery is putting downward pressure on rates. With a little over a week left in the year, expect mortgage rates to remain near historic lows. Looking into next year, however, all signs are pointing to increasing rates.

Next year, the Federal Reserve expects to tighten monetary policy sooner than previously thought. Last week, the central bank announced that it expects to end its bond purchasing program by spring 2022 and raise the federal funds rate three times next year. Both of these moves will put upward pressure on mortgage rates.

On Thursday, the yield on the 10-year Treasury note opened at 1.457%, just 0.001 percentage points lower than Wednesday’s close of 1.458%. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

What Are Todays Mortgage Rates

Low mortgage rates are still available. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Todays mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

Read Also: Rocket Mortgage Payment Options

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

All Eyes Will Be On Inflation And The Base Rate

Inflation will be a big theme in the new year. The Bank of England increased the base rate to 0.25% earlier this month in response to soaring inflation, and it could rise further in 2022.

The base rate affects the cost of borrowing for mortgage lenders, so any increase will almost certainly result in higher mortgage costs for consumers.

The good news is that the starting point for rate rises is incredibly low, with mortgages having become very cheap in the second half of 2021. So while its highly unlikely well see the battle to offer sub-1% mortgages repeated next year, dont expect rates to soar either.

- Find out more: best mortgage rates for buyers and remortgagers

Also Check: Does Rocket Mortgage Sell Their Loans

What Is A Good Loan Term

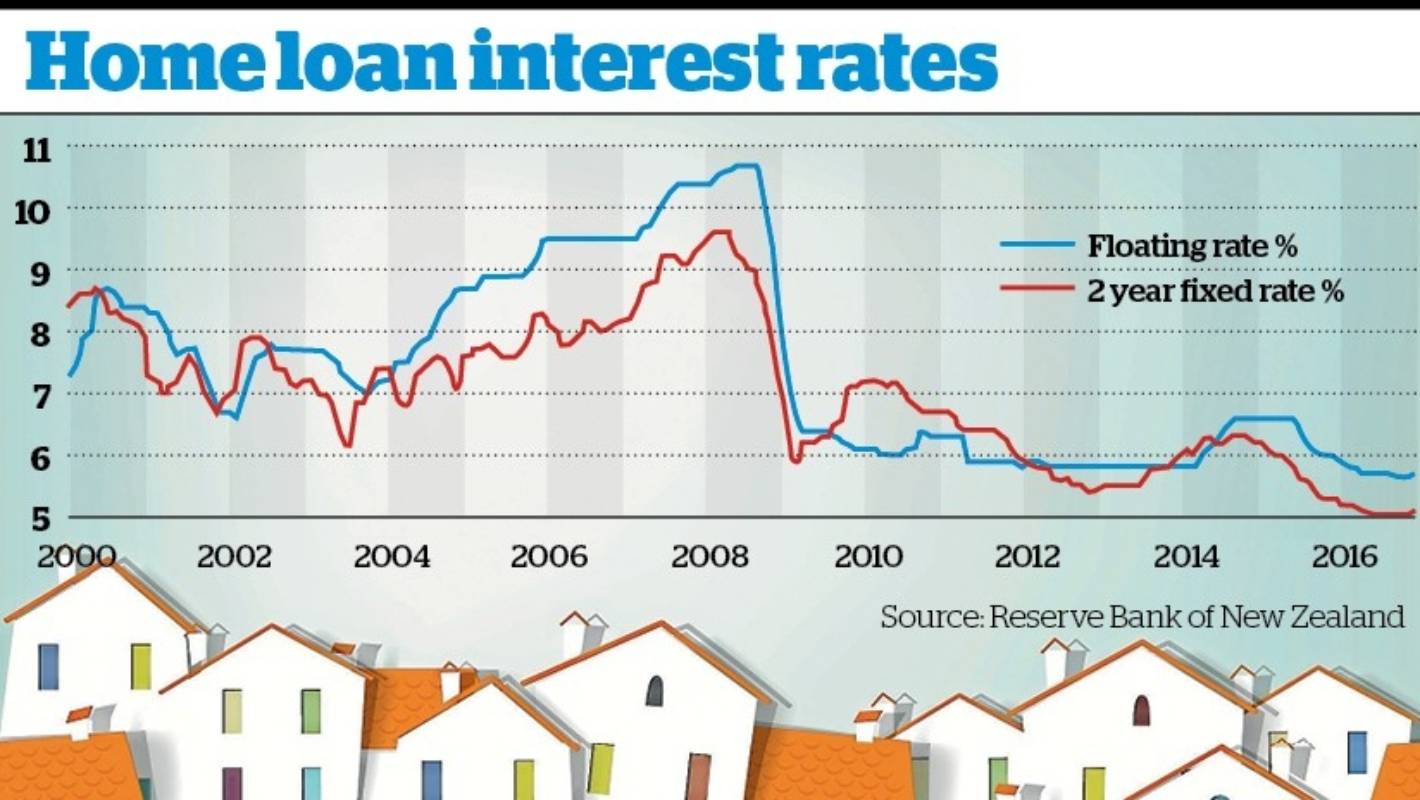

One important factor to consider when choosing a mortgage is the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Another important distinction is between fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are the same for the duration of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only set for a certain amount of time . After that, the rate fluctuates annually based on the market rate.

When deciding between a fixed-rate and adjustable-rate mortgage, you should consider how long you plan to live in your home. For those who plan on staying long-term in a new house, fixed-rate mortgages may be the better option. Fixed-rate mortgages offer more stability over time compared to adjustable-rate mortgages, but adjustable-rate mortgages might offer lower interest rates upfront. If you don’t have plans to keep your new home for more than three to 10 years, however, an adjustable-rate mortgage may give you a better deal. There is no best loan term as an overarching rule it all depends on your goals and your current financial situation. It’s important to do your research and understand your own priorities when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Is The Boc Not Telling Us Something

Theres a widening chasm between what the Bank of Canada is telling Canadians about inflation and what corporate leaders expect. The following chart aint pretty, and it contrasts starkly with the BoCs inflation outlook. This graph from CFIB shows that businesses now plan to boost prices by 4.7% in the next 12 months. That is not only 135% more than…

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bother saving up for a large down payment if you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnt free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage