How To Get A Good Mortgage Rate

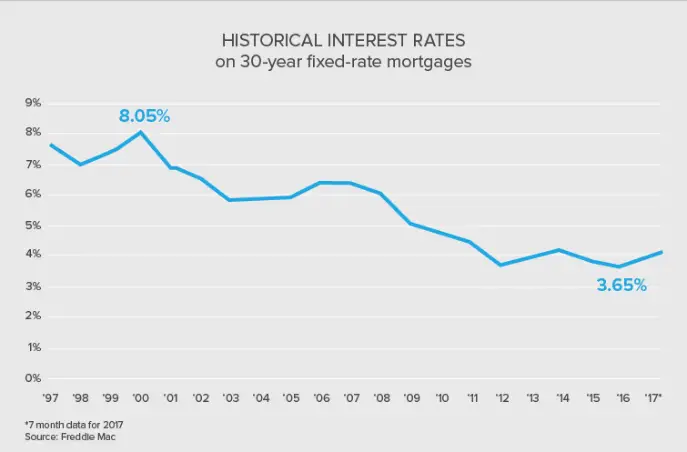

As you can see in the above graph, mortgage rates change year after year, so the factors impacting your potential mortgage rate arent entirely in your hands. Of course, controlling some factors that dictate your mortgage rate are totally in your power. Snagging a lower rate is all about making yourself appear a more trustworthy borrower.

You see, lenders charge different borrowers different rates based on how likely each person is to stop making payments . Since the lender is fronting the money, the lender decides how much risk its willing to take. One way for lenders to mitigate losses is with higher interest rates for riskier borrowers.

Lenders have a number of ways to assess potential borrowers. As a general rule of thumb, lenders believe that someone with plenty of savings, steady income and a good or better score is less likely to stop making payments. It would require a pretty drastic change in circumstances for this kind of homeowner to default.

On the other hand, a potential borrower with a history of late or missed payments is considered a lot more likely to default. A high debt-to-income ratio is another red flag. This is when your income isnt high enough to support your combined debt load, which can include student loans, car loans and credit card balances. Any of these factors can signal to a lender that youre a higher risk for a mortgage.

The Bottom Line: Better Finances Equal Better Rates

Simply put: The better your financial profile, the better rate youll get. When you receive a quote for a rate, its unique to your personal situation. That means it can be hard to compare your rate with someone else’s. Instead, you should focus on getting your best possible rate.

Now that youre a mortgage rate expert, you can review your loan options with confidence. Try out our mortgage calculator to see how different rates might affect your monthly payment, or, if you’re ready, you can apply online now to get started on your mortgage.

Take the first step towards the right mortgage

Rocket Mortgage helps you get started wherever you are in your journey.

What Is The Mortgage Stress Test And How Will It Impact Me

The mortgage stress test was first introduced by the federal government in 2017. The rules applied to both insured and uninsured mortgages. Initially, it required prospective homebuyers to qualify for a mortgage rate which is the higher of the following:

The Bank of Canada five-year rate .

The rate offered by your lender, plus 2%.

Starting in April 2020, homebuyers applying for insured mortgages , will only need to quality for the higher of the following:

The weekly 5-year rate on all insured mortgages, plus 2%.

The rate offered by your lender plus 2%.

Also Check: Chase Mortgage Recast

Historical Canada Mortgage Rates

Looking at historical mortgage rates is a good way to understand which types of mortgage attract higher rates. They also make it easier to understand whether weâre currently in a low or higher rate environment, relatively speaking.

Here are some of Canadaâs mortgage rates for different types of mortgage over the past five years.

| 2016 |

Check Your Credit Score

A vital aspect of applying for a mortgage, which people can choose to ignore at their own peril, is a credit rating. As part of the mortgage application process, your chosen lender will run a credit check on you and whoever else you may be buying the property with. If your credit score isnt good enough, not only will you not get the mortgage, but your credit rating will also be lowered further, potentially making it harder to get a mortgage from another provider.

So, while you may be solely focused on getting that deposit together, dont forget to keep an eye on your and do whatever you can to make sure it is as good as it can be.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Expert Mortgage Rate Forecasts Updated Today

Looking further ahead, Fannie Mae, Freddie Mac and the Mortgage Bankers Association each has a team of economists dedicated to monitoring and forecasting what will happen to the economy, the housing sector and mortgage rates.

And here are their current rate forecasts for the four quarters of 2022 .

The numbers in the table below are for 30year, fixedrate mortgages. Fannies were published on Feb. 18 and the MBAs on Feb. 25. Freddie now publishes these forecasts every quarter, most recently on Jan. 21.

| Forecaster | |

| 4.1% | 4.3% |

Of course, given so many unknowables, the whole current crop of forecasts may be even more speculative than usual.

Best Mortgage Rates From Top Lenders

We looked at the 40 biggest mortgage lenders in 2020 to see how their interest rates stacked up.

The 25 companies with the best mortgage rates on average are as follows:

| Mortgage Lender | |

| Citizens Bank | 3.27% |

Note that average rates shown in this table are from 2020, when rates were near record lows almost all year. Todays mortgage rates could be higher than whats shown.

You can still use last years interest rates as a tool to compare lenders side by side. But before you lock in a loan, youll want to get custom interest rates from a few different lenders to make sure youre getting the best deal available today.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score: You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. To help you better understand how your credit score affects your ability to obtain a mortgage, you can find more information on this page.

How To Get The Lowest Mortgage Loan Rates

How to get the lowest mortgage loan rates?

When you are in the market for a new mortgage, it is important to get the lowest mortgage loan rates that you can. This will help you to keep your monthly payments as low as possible and will also save you money over the life of the loan. Here are a few tips on how to get the best rates:

1. Shop around.

It is important to compare the rates that different lenders are offering before you decide on a loan. You may be surprised at how much of a difference there can be between different lenders.

2. Get pre-approved.

If you are pre-approved for a mortgage, you will have a better chance of getting the lowest mortgage loan rates. This is because the lender has already done a check on your credit and knows that you are a good risk.

3. Keep your credit score high.

Your credit score is one of the factors that lenders look at when deciding on a loan rate. If your score is low, you may have to pay a higher interest rate.

4. Pay down your debt.

If you can pay down your debt, it will help to improve your credit score and could lead to lower mortgage loan rates.

5. Look for a no-fee mortgage.

There are some lenders who offer mortgages with no fees. This can save you a lot of money over the life of the loan.

Avant Mortgage is a leading mortgage loan broker company in Singapore, if you need help with getting the lowest property loan rates, you might been keen on finding us to help you with getting your private property loan done.

Don’t Miss: How Much Is Mortgage On A 1 Million Dollar House

Compare Mortgage Rates From Canadas Leading Banks And Brokers

Hey, homebuyers and homeowners. We have some information we think youll find useful. And unlike most secrets, were inviting you to share this one with all of Canada.

Banks rarely offer their most competitive mortgage rates up front. This little-known fact often forces Canadians to negotiate discounts over the phone or in person. You dont need the hassle.

LowestRates.ca tracks the latest mortgage rates in Canada and can help you secure cheap mortgage rates.

Mortgage rate comparison is essential if you want to get a competitive mortgage rate in Canada. By comparing mortgage rates on LowestRates.ca, you can skip the back-and-forth with your bank and get the best rates available in your area right away.

Our users save thousands of dollars a year on their mortgage rates, and we want you to join them. Keep reading to learn how to get the best mortgage rate in Canada.

How Our Comparison Tool Works

Our comparison tool works by searching through 12,000 deals from 90 lenders.

Using our comparison tool is a great first step to seeing what the market has to offer, but if you want a clearer view along with some expert advice, and chat to one of our advisers.

You can also arrange a quick, free call back and speak to an adviser over the phone.

You May Like: Rocket Mortgage Loan Requirements

Keep Your Income Steady

You want to look like a safe bet for your lender, so keep your employment and income steady before applying for your loan. Just dont change jobs or quit yours too close to the time youre applying for a mortgage ideally lenders want to see that youre with the same employer for at least two years.

If you can increase your income in the time leading up to your loan application, thats even better. Even just some extra income from a side gig or part-time job can be a big help.

How To Find The Best Mortgage Rate

Lets face it: shopping for mortgages can be a struggle. Checking interest rates, filling out loan applications, choosing a lender all the choices and numbers can be overwhelming. But its worth the research and time. Comparing mortgage rates across lenders is one of the first steps in the home buying process. This allows you to budget by giving you an idea of what your monthly mortgage payments will total. Even minor differences in the interest rate on a six-figure loan will add up over the life of a 30-year mortgage. This can have a huge impact on your overall financial goals.

Years ago, it was more common to skip comparison shopping and go right to your primary bank as a mortgage lender. But now, your bank is just one of many lender options you have as a modern homebuyer. You can find reviews, ratings, customer experiences and all sorts of information right from the comfort of your home computer or smartphone. There are lenders who will tell you what rates you qualify for online within minutes and others that require you to speak to a mortgage broker. Whatever your preference, you have all sorts of resources available to you.

A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor near you, try our free online matching tool.

Don’t Miss: Rocket Mortgage Conventional Loan

What Is The Difference Between A Fixed And Variable Mortgage

There are generally two types of mortgage rates you can select from. The first and more common option among Canadians is the fixed mortgage rate, which is set at the beginning of the mortgage term and cant be changed until the term ends and the contract is renewed. The second option is a variable mortgage rate, which fluctuates according to market conditions.

Better Mortgage Company: Best Online Lender

Better.com is an online mortgage lender offering a range of loan products in the majority of states in the U.S, and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can save you time and money with three-minute preapprovals and 21-day closings, on average, and no lender fees. If you get a more competitive mortgage rate from another lender, you can also take advantage of the Better Price Guarantee, in which Better.com either matches that rate or gives you $100. The lender offers seven-days-a-week support by phone, as well, if you need it.

Weaknesses: If youre looking for a VA loan or USDA loan, youll have to search elsewhere Better.com currently doesnt offer these loan types. Although the Better Price Guarantee can help you get a lower rate, its only available if you apply online directly through the lender.

> > Read Bankrate’s full Better Mortgage review

Also Check: Can You Do A Reverse Mortgage On A Condo

Bundled Buildings / Contents Insurance

All lenders will insist you take out buildings insurance, and normally it’s a condition of them giving you the mortgage in the first place. But be very suspicious of deals which insist you buy your buildings insurance through your lender. While the amount quoted may seem reasonable in the first year, you’ll then be trapped into accepting whatever premium increases they foist on you in subsequent years, for as long as the mortgage lasts.

Some lenders might add on an admin fee of around £25 if you decline to take their insurance, but this can normally be recouped from the insurance provider you end up going with. If you go elsewhere for your home cover, some seriously cheap deals are possible. By using cashback sites, some people have even been PAID to take out insurance. See our Home Insurance guide.

Give Your Credit Score A Boost

Credit score and loan-to-value ratio are probably the two most important factors in getting the best rate. -Michele Skipper, Senior Loan Officer and a Credible mortgage expert

Improving your is one of the best things you can do to improve your interest rate. It also can increase your chances of getting a loan in the first place.

Even just a small boost in your credit score can make a big difference, too. Take a look at the recent rate data from FICO. If you had a score of 659 and were able to bump it up to 680, you could shave more than 0.60% off your interest rate.

Here are some quick and easy ways to improve your credit score:

- Pull your credit report and alert the credit bureau of any errors.

- Become an authorized user on another persons account.

- Ask for a credit line increase .

- If you dont have much credit at all, consider a secured card or .

Find Out: How to Improve Your Credit Score in 5 Steps

Read Also: Recast Mortgage Chase

How To Get The Lowest Mortgage Rate

Mortgage rates vary greatly, and theyre highly dependent on a number of factorsthings like your chosen lender, your credit score, the type of loan youve chosen, and the size of your down payment. And because a low mortgage rate can make your monthly payment more affordable and save you in interest charges over the life of your loan, its highly important to prepare your finances early and shop around for your lender and loan.

Why Canadians Use Lowestratesca To Compare Mortgage Rates Online

With LowestRates.ca, youll be able to compare the best mortgage rates from the best mortgage lenders in Canada. Want to know what the current mortgage rates are in Canada right now? LowestRates.ca aggregates live mortgage rates all day every day. Next, we connect you with mortgage brokers who get rates from a variety of lenders. All you have to do is fill out the form above to try our free, no-obligation service and you could be on your way to saving big on your next home.

In fact, LowestRates.ca mortgage rates average more than two whole percentage points lower than the bank rate. People who use our service have the potential to save thousands of dollars each year on their mortgage payments.

With numbers like that, its no surprise that Canadians are increasingly using comparison sites to find the lowest mortgage interest rates in the country.

Our mortgage rate comparison service is Canada-wide and provides quotes from 75+ banks and brokers. So whether you live in Ontario, Alberta, British Columbia, Quebec or anywhere in between, our mortgage rates are tailored to your needs.

Also Check: Chase Recast Calculator

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.