What Is A 5

A 5-year fixed rate refers to a mortgage that has an interest rate that is locked in for five years. The rate and payments cannot increase or decrease until the mortgage comes up for renewal unless you refinance.

Most 5-year fixed rates are closed, meaning you cannot get out of the mortgage contract early unless you pay a prepayment charge .

Should I Refinance My Home Mortgage

Q: Many of my friends have refinanced their mortgage recently, and theyre urging me to do the same thing. Money is always a bit tight, and the thought of an extra few hundred dollars a month is very tempting. Should I refinance?

A: Refinancing a mortgage is essentially paying off the remaining balance on an existing home loan and then taking out another mortgage, usually at a lower interest rate. It may sound like a no-brainer, but there are lots of factors to consider before deciding to refinance.

Year Fixed And 5year Arms Drop Into The 3s

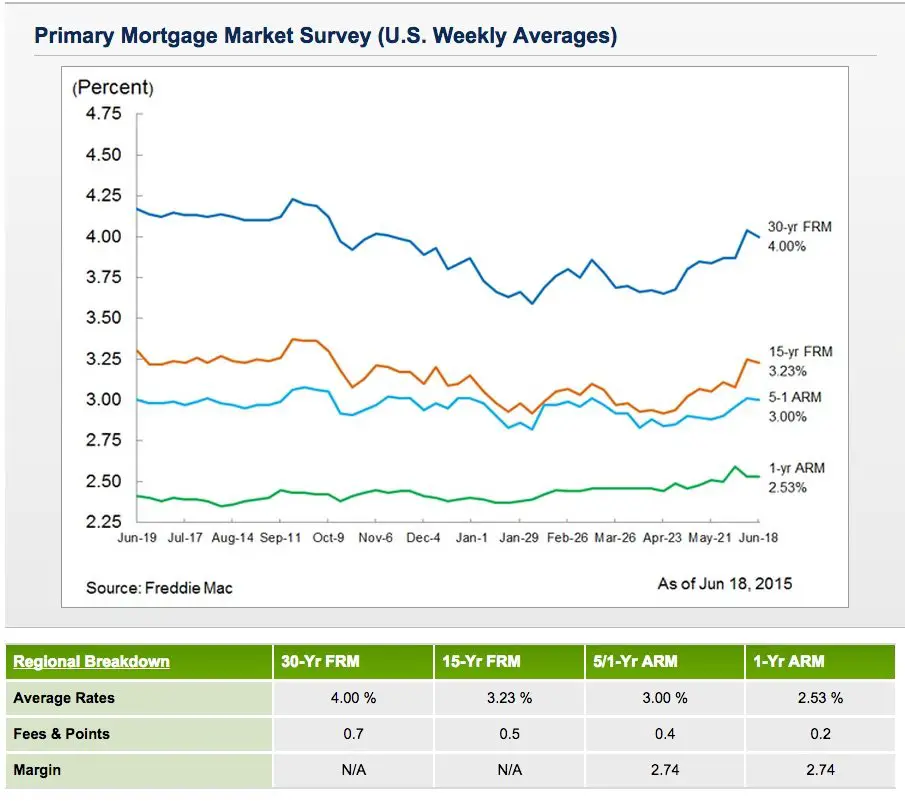

The 30year fixed rate gets all the attention, but other types of mortgages should be making headlines, too.

Rates for 15year fixed and 5year ARM loans are now in the 3s according to Freddie Mac.

- 15year fixed: 3.89%

- 5year ARM: 3.83%

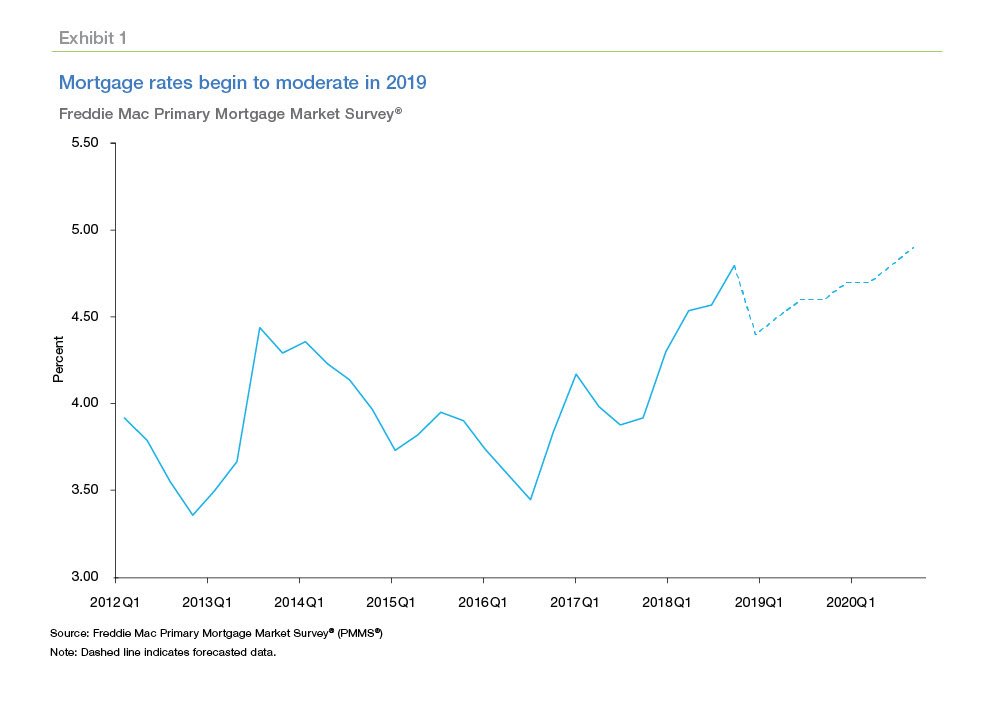

These alternatives to the 30year give homeowners the opportunity to secure pre2018 rates before rates started spiking in earnest.

For instance, someone buying a home may have found they could no longer afford monthly payments at todays 30year fixed rate.

But they choose a 5year ARM rate instead and shave more than $100 per month from todays 30year payment.

Fiveyear ARMs are fixed for five years, then start adjusting based on the market. These loans are perfect for homeowners who plan to stay in their homes only 57 years.

Those who are impressed at todays dropping 30year rate will find shortterm rates even more enticing.

Read Also: How 10 Year Treasury Affect Mortgage Rates

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

How Does Your Rate Compare

Wondering if your current interest rate is competitive? If not, this does not mean that you cant do anything about it.

You may qualify to refinance at a lower rate with a private lender. Keep in mind that borrowers refinancing federal loans with a private lender lose government benefits like access to income-driven repayment programs and the potential to qualify for loan forgiveness.

Credible makes refinancing your student loans easy. You can compare your prequalified rates from top lenders without having to share any sensitive information or authorizing a hard credit pull.

Also Check: Chase Mortgage Recast Fee

To Convert Between Adjustable

Homeowners often opt for an Adjustable Rate Mortgage because of the lower rate it offers. Over time, though, adjustments can increase these rates until they top the going rate for fixed-rate mortgages. When this happens, switching to a fixed-rate mortgage can lower the homeowners interest rate and offer them stability instead of future rate increases.

On the flip side, when interest rates are falling, it often makes sense to convert a fixed-rate mortgage to an ARM. This ensures smaller monthly payments and lower interest rates without refinancing every time the rate drops. This is not advisable in the current climate, since interest rates are more likely to climb rather than decrease.

Mortgage Point Heres Why They Matter

In the mortgage world, there are these things called points. In the simplest terms, a point is an upfront fee paid to lower your interest rate by a fixed amount .

For example, if you take out a $200,000 loan at 4.25% interest, you might be able to pay a $2,000 fee to reduce the rate to 4.125%.

Paying points makes sense if you: 1) have the cash to pay them AND you 2) plan to hold the loan for a long time.

If you dont hold the loan long enough, the upfront cost of paying points often outweighs interest savings over time. Youll want to consider points carefully. If youre fairly certain that you will stay in your home for a long time and that you will not pay off the mortgage or refinance early, points can save you a good deal of money.

If, however, you pay points and, just a few years later, move, refinance, or pay off your mortgage, youll likely fare worse than if you did not pay points and instead took out a loan with a higher rate.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

Get A Fixed Rate Or Arm

Mortgages have either fixed interest rates or adjustable rates. Fixed-rate mortgages lock you into a consistent interest rate that youll pay over the life of the loan. The part of your mortgage payment that goes toward principal plus interest remains constant throughout the loan term, though insurance, property taxes and other costs may fluctuate.

The interest rate on an adjustable-rate mortgage can change over time. An ARM usually begins with an introductory period of 10, seven, five or three years , during which your interest rate holds steady. After that, the rate may change periodically.

» MORE:Get a mortgage preapproval

You May Like: Rocket Mortgage Launchpad

When Refinancing Your Mortgage Is A Bad Idea

In certain circumstances, the worst thing you can do for your financial situation is refinance your mortgage.

- When youre in debt If youre looking for the extra stash of cash each month to pull you out of debt, you probably shouldnt be refinancing. Most people who refinance for this reason end up spending all the money they save, and then some. Without making any real changes to your spending habits, giving yourself extra money to blow is only enabling you to fall deeper into debt.

- When a refinance will greatly lengthen the loans terms If youve only got 10 years left on your mortgage and you want to refinance to stretch out those payments over 30 years, you wont come out ahead. Any money you save on lower payments will be lost in the cost of the refinance and the extra 20 years of interest youll be paying on your mortgage.

- When you dont plan on living in your home much longer If you plan on moving within the next few years, the money you save might not even come close to the prohibitive price you paid for your refinance.

What Are Average Interest Rates On Private Student Loans

During the week of Dec. 6, 2021, the average private student loan interest rates for borrowers using the Credible marketplace were:

- 4.12% for borrowers taking out five-year variable-rate loans

- 5.72% for borrowers taking out 10-year fixed-rate loans

Rates on private student loans vary from lender to lender. Federal loans for undergraduates generally have lower interest rates than private loans. However, rates offered by private lenders can be competitive with rates on federal loans for graduate students and parents, including PLUS loans.

While rates on federal student loans are one-size-fits-all, private lenders offer lower rates to borrowers with good credit scores. Since most students dont have the credit history and earnings to qualify for a private student loan on their own, most private student loans are cosigned by a parent or other relative. Having a cosigner can help borrowers get a significantly lower interest rate.

An analysis of thousands of rate requests submitted to the Credible marketplace over the course of a year found that adding a cosigner reduced the lowest prequalified interest rate by 2.36 percentage points.

Keep in mind that the shorter the loan term, the lower the interest rate offered by most lenders. In addition, private lenders typically offer a choice of variable- or fixed-rate loans. Borrowers taking out variable-rate loans can start out with a lower rate, but that rate can fluctuate over the life of the loan .

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Top 5 Bankrate Mortgage Lenders In California

- Better.com Best online lender

- AmeriSave Mortgage Corporation Best non-bank lender

- Watermark Home Loans Best for VA loans

Methodology

Bankrate helps thousands of borrowers find mortgage and refinance lenders every day. To determine the top mortgage lenders, we analyzed proprietary data across more than 150 lenders to assess which on our platform received the most inquiries within a three-month period. We then assigned superlatives based on factors such as fees, products offered, convenience and other criteria. These top lenders are updated regularly.

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W2 forms or pay stubs to prove a steady income. If youre selfemployed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Throughout the first half of 2021, the best mortgage rates have been in the high2% range. And a good mortgage rate has been around 3% to 3.25%.

Of course, these numbers vary a lot from one borrower to the next, as we explain below.

Toptier borrowers could see mortgage rates in the 2.53% range at the same time lowercredit borrowers are seeing rates in the high3% to 4% range.

In addition, looking forward in 2021, interest rates seem likely to increase. So a good mortgage rate later this year could be substantially higher than what it is today.

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

Also Check: Chase Recast Calculator

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

Average 5/1 Arm Rates

Average 5/1 ARMs tend to feature lower rates than comparable 30-year and 15-year home loans, at least during the initial 5 year promotional period.

Rates will adjust to market rates, plus a spread, following the expiration of the initial 5 year period.

Here are the current average 5/1 adjustable rates mortgage rates for each state.

Average 5/1-ARM Rates by State

| State |

|---|

Rates assume a loan amount of $200,000 and a loan-to-value ratio of 80%.

While ARMs do offer lower monthly payments in the short run, the variable interest rates on 5/1 ARMs means that your monthly payments adjust to market rates upon expiration of the temporary promotional rate period.

This means that your monthly payments may increase significantly on an annual basis, especially if interest rates are on the rise.

This makes them a risky proposition unless you’re committed to selling or refinancing the property within a few years.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Read Also: Reverse Mortgage Mobile Home

Interpreting Central Pa & Md Mortgage Rates: Other Factors To Consider

Keep in mind that an advertised mortgage rate may not be the actual rate you end up receiving from a lender. The price you pay ultimately depends on additional factors such as:

- Down payment size: A larger down payment reduces the lender’s risk and helps you get a lower rate.

- Term length: A shorter loan term comes with a lower interest rate.

- A high credit score and strong credit history give the lender more confidence that you’ll repay the loan, resulting in a lower rate.

About Our Pa & Md Home Mortgage Rates

They might change all the time, but mortgage rates are currently low and favorable for qualified borrowers. Its your market. All you have to do is fill out this quick form and go find a new place to live. We monitor daily rates so you don’t have to. Heres what you need to know. Now, talk to your loan officer and get started on your mortgage loan application.

- Property is one unit

- Closing costs are paid out of pocket

- No seller assistance

Also Check: Can You Do A Reverse Mortgage On A Condo

What Are The Closing Costs

Closing costs are fees charged by the lender and third parties. Closing costs don’t affect the mortgage rate . But they do have an impact on your pocketbook. Closing costs usually amount to about 3% of the purchase price of your home and are paid at the time you close, or finalize, the purchase. Closing costs comprise various fees, including the lender’s underwriting and processing charges, and title insurance and appraisal fees, among others.

Youre allowed to shop around for lower fees in some cases, and the Loan Estimate form will tell you which services you may shop for so you can reduce closing costs.

» MORE:Calculate your expected closing costs

Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

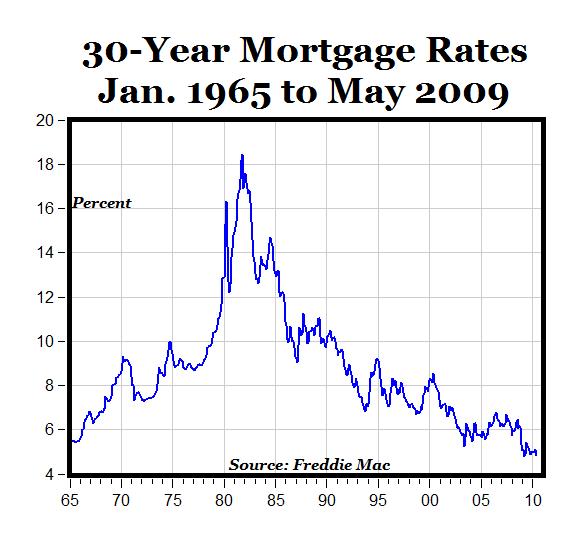

On the day this was written, Freddie Macs weekly average rate for a 30year, fixedrate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit