So How Do You Know What Mortgage Insurance Factor To Plug Into The Calculator

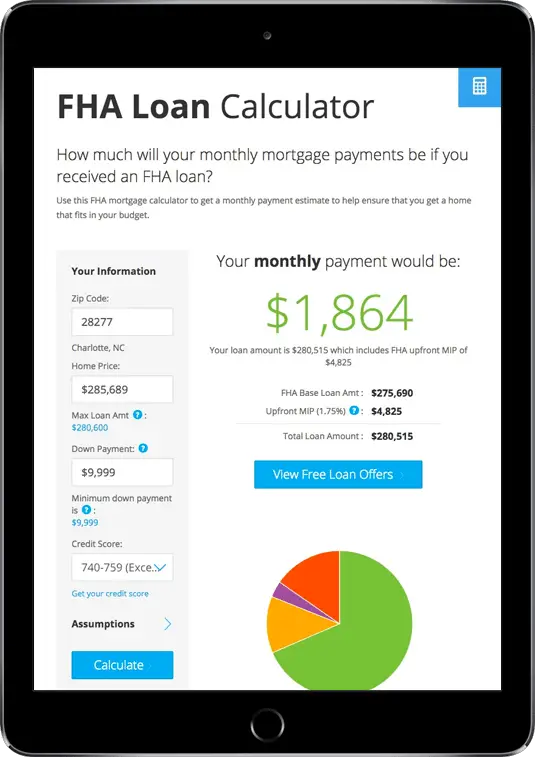

Some home loan programs, such as FHA and USDA have a one-size-fits-all factor that applies to all people using that particular loan type. Others such as VA don’t have monthly PMI at all.

Here is a breakdown of the most common programs and associated PMI factors:

-

FHA Home Loans – Monthly PMI factor for 30 year fixed loans is , but if you put down 5% or more the factor goes down to

-

USDA Home Loans – Monthly PMI factor for all 30 year fixed loans

-

VA Home Loans – Plug in no mortgage insurance required!

-

Conventional Home Loans – Conventional loans a.k.a. Conforming, Fannie Mae, or Freddie Mac are more complicated. Go to MGIC’s webpage to get your factor.

If all this has your head spinning, give us a call at and schedule a consultation. We can break everything down in laymans terms and answer all your mortgage-related questions. From PMI to home loan types to what you should be doing right now if you want to buy a home in the next year, Cascadia Home Loans is your partner in homeownership.

How Much Does Lmi Cost

LMI can be a big expense and can cost anywhere from a few thousand dollars up to tens of thousands of dollars. This is why its important to factor this cost into your overall buying budget.

The cost of LMI can vary based on a few factors including:

-

If youre a first-home buyer

-

Which state your property is in

-

If youre an owner occupier or investor

-

The size of the loan

-

Your loan-to-value-ratio

-

Your job/industry

Using the Genworth LMI calculator, heres how much LMI could cost you depending on the property value and the size of your deposit.

|

Property value |

|---|

These estimates are for first home buyers on an owner occupied loan.

In Summary: Term Life Insurance Offers Better More Flexible Protection Than Mortgage Insurance

If you have a mortgage and a young family, having some sort of coverage for your mortgage only makes sense.

Itâs easy to see from the tables above that term life insurance is usually cheaper than mortgage life insurance. And sometimes, it’s cheaper by a lot.

In short, if you’re looking for broad coverage that’s flexible and affordable, pass on mortgage life insurance and buy a term life insurance policy instead.

That said, mortgage life insurance could be a good option for your family if you have an existing medical condition. In that case, standard life insurance may be unaffordable or unavailable to you.

Ready to see how affordable term life insurance can be? Get your quote today.

Weâre not only affordable: PolicyMe is backed by Canadian insurance giants, with coverage options from $100,000 to $5M.

Questions? Talk to one of our Toronto-based, licensed advisors via chat, email or phone. No strings attached.

Also Check: Bofa Home Loan Navigator

Why Do I Need A Pmi Policy

Private mortgage insurance minimizes the risk for lenders to offer loans to borrowers who dont have a 20% down payment and therefore have less equity in their homes once they are purchased. This equity would help pay the loan balance in the event you default and go into foreclosure.

Your lender requires you to have private mortgage insurance so that if you can no longer make payments on your home, the lender will still get paid . PMI basically safeguards the lender in the event of borrower default. It does not protect you, the borrower, if you fall behind on your mortgage payment. If you fall behind on your payments, your credit score could suffer or you could lose your home through foreclosure.

What Does Private Mortgage Insurance Cover

When you take out a mortgage and you cannot afford to put a 20% down payment, the lender is at risk. First, since you cannot afford to make a 20% down payment you are viewed as a riskier borrower. Secondly, when the lender has to lend you more money than they would have with the 20% down payment, a greater amount of money is put at greater risk. Therefore, lenders turn to private mortgage insurance companies to assume some of that risk.

The coverage a private mortgage insurance company offers determines what portion of the amount lost the lender will be able to recover in the case that the borrower defaults on their mortgage. For example, if the PMI provider provides 30% coverage, this means that the lender will be paid back by the insurer for 30% of the losses related to the borrowers default. These losses can include the unpaid principal balance, interest that the lender would otherwise get, and 30% coverage for the lenders costs associated with the foreclosure.

For example, imagine that you wish to purchase a $300,000 home with a 5% down payment. The coverage provided by the PMI company is 30%. If you then default on your mortgage while you still owe 90% or $270,000 to the lender, the lender would be able to recover $81,000 from PMI, instead of losing the whole amount. This can help supplement the amount recovered from aforeclosure. PMI would also cover 30% of interest loss and foreclosure costs.

Also Check: Chase Recast Mortgage

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. If you’re a Rocket Mortgage® client, you can avoid the process of finding a stamp altogether and just give us a call at 508-0944.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment.

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

While its possible to avoid PMI by taking out a different type of loan, FHA and USDA loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

The only loan without mortgage insurance is the VA loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

The size of the funding fee varies according to the amount of your down payment or equity and whether its a first-time or subsequent use. The funding fee can be anywhere between 1.4 3.6% of the loan amount. On a VA Streamline, also known as an Interest Rate Reduction Refinance Loan, the funding fee is always 0.5%.

Don’t Miss: Who Is Rocket Mortgage Owned By

Who Is Required To Have Pmi

Typically on a conventional loan, if your down payment is less than 20 percent of the value of the home, lenders will require you to carry private mortgage insurance. Usually, you pay those mortgage insurance premiums until you have enough equity in your home to have a loan-to-value ratio this is simply the amount of money you borrowed divided by the value of the property you bought of 80 percent.

For example, lets say you bought a home with a value of $100,000 and put a down payment of 10%, or $10,000, and got a $90,000 loan to pay the rest. Your LTV in this case would be $90,000 divided by $100,000, or 90 percent. The longer you pay down your mortgage, the lower your loan-to-value will become. On government loans, mortgage insurance is normally required regardless of the LTV.

What Does Pmi Cost

On average, PMI costs range between 0.22% to 2.25% of your mortgage. How much you pay depends on two main factors:

- Your total loan amount: As a general rule, PMI expenses are higher for larger mortgages.

- Your credit score: Lenders typically charge borrowers with high credit scores lower PMI percentages.

Lenders typically maintain charts that show the PMI percentage to charge in various situations. You can ask your lender for a specific percentage to make your calculations easier.

Read Also: Recast Mortgage Chase

How Do You Calculate Mortgage Default Insurance

To understand how mortgage default insurance is calculated and paid for quickly, watch the video below. Scroll down further for more details on the calcultions.

Let’s say you just purchased a home for $300,000 and made a $40,000 down payment. Your mortgage default insurance premium would be calculated as follows:

Pay Down Your Current Mortgage Balance

If you’re planning to refinance your home but the current LTV is over 80%, consider paying off more of your mortgage balance first. If your mortgage servicer doesn’t penalize you for prepayments, you can consider paying off more of your mortgage right away. Otherwise, you may have to wait until you’ve made a few more monthly payments.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

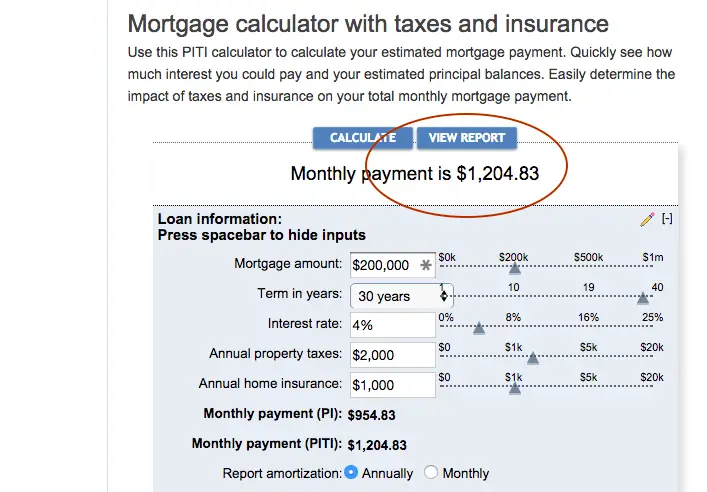

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

States With The Highest Mortgage Insurance Costs

Washington, D.C and states including Hawaii. and California have the most expensive PMI costs mostly due to their higher home prices.

In Hawaii, where the median listing price of a single-family home was $1 million in September, buyers with a credit score of 620-639 and a 3.5% down payment can expect to pay around 1.86% in mortgage insurance, according to the Urban Institute. That equates to paying $19,083 per year or $1,590 per month in PMIthe insurance required on conventional loans when the borrower has a down payment of less than 20%.

In Washington, DC, buyers are paying about $14,675 annually, or $1,223 per month, for PMI based on the median listing price of $789,000 in September. And California homebuyers can expect to pay about $13,931 annually, or $1,161 per month, based on the median listing price of $749,000.

This has also made it more difficult to justify a home purchase if the value does not appreciate as fast as the upfront costs coupled with the PMI payments over time.

Some homeowners are buying real estate as investments, but if the PMI is above appreciation, it is hard to justify the investment, says Omer Reiner, owner of Florida Cash Home Buyers. Higher PMI is not only making it more expensive to own a home but negating the potential for it to build wealth for first-time homebuyers.

You May Like: Reverse Mortgage Mobile Home

Example Of Private Mortgage Insurance

Assume you have a 30-year, 2.9% fixed-rate mortgage for $200,000 in New York. Your monthly mortgage payment would be $832.00. If PMI costs 0.5%, you would pay an additional $1,000 per year or . As a result, your monthly PMI payment would be $83.33 each month, or , increasing your monthly payment to $915.33.

You may also be able to pay your PMI upfront in a single lump sum, eliminating the need for a monthly payment. The payment can be made in full at the closing or financed within the mortgage loan. In many cases, this is the more affordable option as long as you plan on staying in the home for at least three years. For the same $200,000 loan, you might pay 1.4% upfront, or $2,800.

However, it’s important to consult your lender for details on your PMI options and the costs before making a decision.

Why Do I Need To Pay For Pmi When It Is For The Lenders Benefit

The reason for this is because the lender is taking on additional risk by lending to you while youre putting up less money upfront and can default on future payments.

However, it is important to understand that it isbeneficial for you too because if PMI or insurance was not an option, lenders may not have offered a mortgage for anything less than a 20% down payment, preventing a lot of individuals from becoming homeowners.

PMI also has an additional benefit because lenders can give you a bettermortgage rateif you take PMI. The reason for this is because PMI allows lenders to recover a greater portion of their investment as compared to individuals who do not take PMI, allowing them to give you a better rate on your mortgage.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Us Department Of Agriculture Loan

If you get a US Department of Agriculture loan, the program is similar to the Federal Housing Administration, but typically cheaper. Youll pay for the insurance both at closing and as part of your monthly payment. Like with FHA loans, you can roll the upfront portion of the insurance premium into your mortgage instead of paying it out of pocket, but doing so increases both your loan amount and your overall costs.

Department Of Veterans Affairs

If you get a Department of Veterans Affairs -backed loan, the VA guarantee replaces mortgage insurance, and functions similarly. With VA-backed loans, which are loans intended to help servicemembers, veterans, and their families, there is no monthly mortgage insurance premium. However, you will pay an upfront funding fee. The amount of that fee varies based on:

- Your type of military service

- Your down payment amount

Also Check: Rocket Mortgage Conventional Loan

Cancelling Pmi On A Multi

If you have a multi-unit primary property or investment property, things work a little bit differently.

Fannie Mae lets you request cancellation of your PMI once you reach 30% equity, while Freddie Mac requires 35% equity.

Freddie Mac doesnt auto cancel mortgage insurance on multi-unit residences or investment properties. Fannie Mae mortgage insurance cancels halfway through the loan term if you do nothing.

Why Do I Have To Pay For Pmi

Although PMI may seem like yet another expense in the home buying process, it is a requirement for many borrowers. In the same way that homeowners insurance can protect you against damage to your home, PMI protects your lender if you default on your mortgage.

If you wish to avoid paying PMI, you may want to consider waiting to purchase a home until you can secure a larger down payment.

Also Check: 10 Year Treasury Yield Mortgage Rates

Estimating Rates For Private Mortgage Insurance

Many companies offer mortgage insurance. Their rates may differ slightly, and your lendernot youwill select the insurer. Nevertheless, you can get an idea of what rate you will pay by studying the mortgage insurance rate card. MGIC, Radian, Essent, National MI, United Guaranty, and Genworth are major private mortgage insurance providers.

Mortgage insurance rate cards can be confusing at first glance. Heres how to use them.

How Do I Make Pmi Payments

There are three primary schedules for making PMI payments. The options available to you will vary depending on your lender.

- Monthly: The most common method is paying PMI premiums monthly with your mortgage payment. This boosts the size of your monthly bill, but allows you to spread out the premiums over the course of the year.

- Upfront: Another option is an upfront PMI payment, meaning you pay the full premium amount for the year all at once. Your monthly mortgage payment will be lower, but you need to be ready for that larger annual expense. Additionally, if you move sometime in the year, you might not be able to get part of your PMI refunded.

- Hybrid: The third option is a hybrid one: paying some upfront and some each month. This can be useful if you have extra cash early in the year and want to limit your monthly housing costs.

Ask your lender if you have a choice for your payment plan, and decide which option is best for you.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home