Which Loan Is Right For You

When choosing a mortgage, you need to consider a wide range of personal factors and balance them with the economic realities of an ever-changing marketplace. Individuals personal finances often experience periods of advance and decline, interest rates rise and fall, and the strength of the economy waxes and wanes. To put your loan selection into the context of these factors, consider the following questions:

- How large a mortgage payment can you afford today?

- Could you still afford an ARM if interest rates rise?

- How long do you intend to live on the property?

- In what direction are interest rates heading, and do you anticipate that trend to continue?

If you are considering an ARM, you should run the numbers to determine the worst-case scenario. If you can still afford it if the mortgage resets to the maximum cap in the future, an ARM will save you money every month. Ideally, you should use the savings compared to a fixed-rate mortgage to make extra principal payments each month, so that the total loan is smaller when the reset occurs, further lowering costs.

If interest rates are high and expected to fall, an ARM will ensure that you get to take advantage of the drop, as youre not locked into a particular rate. If interest rates are climbing or a steady, predictable payment is important to you, a fixed-rate mortgage may be the way to go.

Evaluate Adjustable Rate Mortgage Loans

Adjustable rate mortgages typically offer home buyers the advantage of having a lower mortgage payment during the initial period of the mortgage. Adjustable rate mortgages are generally offered on a 1, 3, 5 or 7-year basis. Once the initial period expires, the mortgage rate will reset at then current interest rate levels. Depending on the direction interest rates are taking, these resets can result in higher or lower monthly payments to the borrower. This adjustable rate mortgage analyzer will help you understand the implication of your adjustable rate terms by showing what your monthly payment will be under different scenarios. You can use this adjustable rate mortgage calculator to determine whether this is the best type of loan for you.

Who Are Arms Good For

Likely Movers: Adjustable-rate mortgages are not for everyone, but they can look very attractive to people who are either planning to move out of the house in a few years. If your reset point is seven years away and you plan to move out of the house before then, you can manage to get out of Dodge before the costlier payment schedule kicks in.

Growing Incomes: Those who will benefit greatly from the flexibility of an ARM are people who expect a sizeable raise, promotion, or expansion in their careers. They can afford to buy a bigger house right now, and they will have more money to work with in the future when the reset date arrives. When the reset happens if rates haven’t moved up they can refinance into a FRM. Homebuyers working for a hot startup who are waiting for their stock options to vest also fit in this category. If you believe the home will appreciate significantly and your income will go up then you can refinance an ARM into a fixed-rate loan.

Home Flippers: Real estate investors who rapidly turn over homes plan on selling most homes before any ARM rate reset would take place, so opting for whichever loan offers the lowest rate is a prudent move if they are experienced and are certain they’ll sell the home soon.

Recommended Reading: Can You Refinance A Mortgage Without A Job

Interest Rate Changes With An Arm

In order to get a grasp on what is in store for you with an adjustable-rate mortgage, you first have to understand how the product works. With an ARM, borrowers lock in an interest rate, usually a low one, for a set period of time. When that time frame ends, the mortgage interest rate resets to whatever the prevailing interest rate is. The initial period in which the rate doesn’t change ranges anywhere from six months to ten years, according to the Federal Home Loan Mortgage Corporation, or Freddie Mac.For some ARM products, the interest rate a borrower pays can increase substantially later on in the loan.

Because of the initial low interest rate, it can be attractive to borrowers, particularly those who dont plan to stay in their homes for too long or who are knowledgeable enough to refinance if interest rates go up. In recent years, with interest rates hovering at record lows, borrowers who had an adjustable-rate mortgage reset or adjusted didnt see too big a jump in their monthly payments. But that could change depending on how much and how quickly the Federal Reserve raises its benchmark rate.

What Is The Difference Between A Standard Arm Loan And Hybrid Arms

A hybrid ARM has a honeymoon period where rates are fixed. Typically it is 5 or 7 years, though in some cases it may last either 3 or 10 years.

Some hybrid ARM loans also have less frequent rate resets after the initial grace period. For example a 5/5 ARM would be an ARM loan which used a fixed rate for 5 years in between each adjustment.

A standard ARM loan which is not a hybrid ARM either resets once per year every year throughout the duration of the loan or, in some cases, once every 6 months throughout the duration of the loan.

Also Check: 10 Year Treasury Yield Mortgage Rates

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

About Adjustable Rate Mortgage Calculator

The formula for computing Adjustable Rate Mortgage is per below steps:

Mortgage Initial Payment with Fixed-Rate

EMI = ^N)/^N-1)

Next, we need to find out the outstanding principal balance just before the rate changes.

Mortgage subsequent payments

EMI = ^N)/^N-1)

Wherein,

- P is the loan amount

- R is the rate of interest per annum

- R is the rate applicable subsequently.

- N is the number of periods or frequency wherein the loan amount is to be paid.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

What Are The Four Types Of Caps That Affect Adjustable

The following four types of caps may apply to an adjustable-rate mortgage:

- Initial adjustment caps – The upper limit of the interest rate increase during the first adjustment.

- Subsequent adjustment caps – These limit the amount your interest rate can increase in one adjustment period after the initial adjustment.

- Lifetime caps – These limit the amount your interest rate can increase over the life of your loan. Nearly all ARMs have a lifetime cap, according to the Consumer Financial Protection Bureau .

- Payment caps – These limit the amount your monthly payment can increase at each adjustment.

In our adjustable rate mortgage calculator, you can apply lifetime caps on your interest rate.

Choosing The Right Adjustable

With so many types of adjustable-rate mortgages, how do you know which one to choose? Here are a few questions to ask yourself:

- How long do you plan to stay in your home?

- Do you expect any big life events in the next 5 10 years ?

- Do you need time to comfortably afford a larger monthly payment? How much time?

- Is your income unstable or going to be unpredictable in the next few years?

- What adjustable-rate mortgage options does your lender offer?

Recommended Reading: Rocket Mortgage Payment Options

How Interest Rates Affect Payments

The initial interest rate is fixed for a period of time, then adjusts at regular intervals. When the interest rate on a loan changes, the payment changes as well. While interest rates could decrease, its more common for them to increase after the initial interest period, resulting in a higher monthly payment.

How To Use The Arm Mortgage Calculator

Now that you’ve gotten some insight into adjustable-rate mortgages, it is time to get familiarize yourself with our ARM mortgage calculator. Here is a guide on how to use it to its full potential:

-

Mortgage balance – The original loan amount of your mortgage

-

Term – The remaining or original mortgage term

-

Interest rate at the beginning of term – Set the introductory annual interest rate here, which is applied at the beginning of the mortgage term

-

Compounding frequency – How the lender computes interest on the principal

-

Mortgage points – An upfront fee as a percentage of the new balance

-

Up-front fee – The upfront fee paid on the mortgage

-

Annual fee – The yearly mortgage cost, which is paid monthly

-

ARM type – You can set one of the following, or you can choose to customize it individually:

- 10/1 ARM mortgage – The initial interest rate is fixed for ten years then adjusted yearly

- 7/1 ARM mortgage – The initial interest rate is fixed for seven years then adjusted yearly

- 5/1 ARM mortgage – The initial interest rate is fixed for five years then adjusted yearly and

- 3/1 ARM mortgage – The initial interest rate is fixed for three years then adjusted yearly.

Adjustments by:

Also Check: Rocket Mortgage Qualifications

Minimum Rate Remains Fixed

In the case of fluctuating market conditions, businesses still need to be up. Lenders for an adjustable mortgage rate set it at the bare minimum for principal amounts. That is the rate at which the rate remains fixed. The interest rate cannot drop any further than this despite any issues in the market. Let us take that the rate remains fixed is at 4%, and the current interest rate is 4.25%. If the expected adjustment is at 0.5% negative for the next installment, it should drop to 3.75%. But since the lowest is only 4%, the interest rate remains fixed at 4% until the market develops.

What Are The Common Reset Points

The reset point is the date your ARM changes from the introductory rate to the adjustable-rate based on market conditions. Many consumers wrongly believe this honeymoon period of having a preset low monthly payment needs to be as short as it is sweet.

But nowadays, it is not uncommon to set mortgage reset points years down the road. Reset points are typically set between one and five years ahead. Here are examples of the most popular mortgage reset points:

- 1 Year ARM – Your APR resets every year. This loan format is called a traditional ARM, though most buyers using an ARM opt for a hybrid ARM. The following options are all hybrid ARMs.

- 3/1 ARM – Your APR is set for three years, then adjusts for the next 27 years.

- 5/1 ARM – Your APR is set for five years, then adjusts for the next 25 years.

- 7/1 ARM – Your APR is set for seven years, then adjusts for the next 23 years.

- 10/1 ARM – Your APR is set for ten years, then adjusts for the next 20 years.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

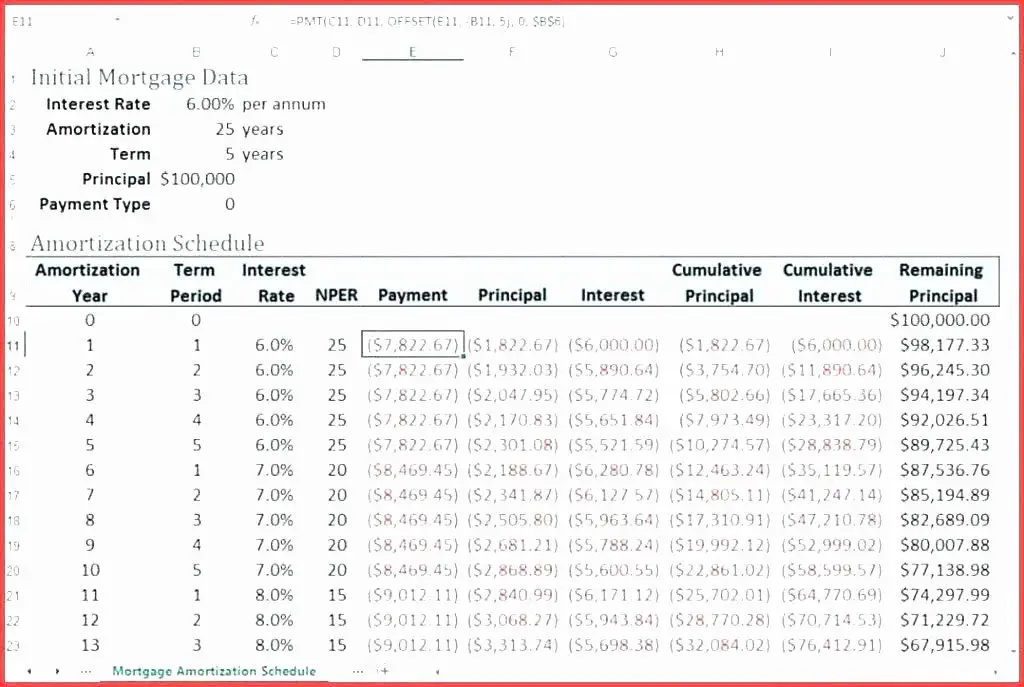

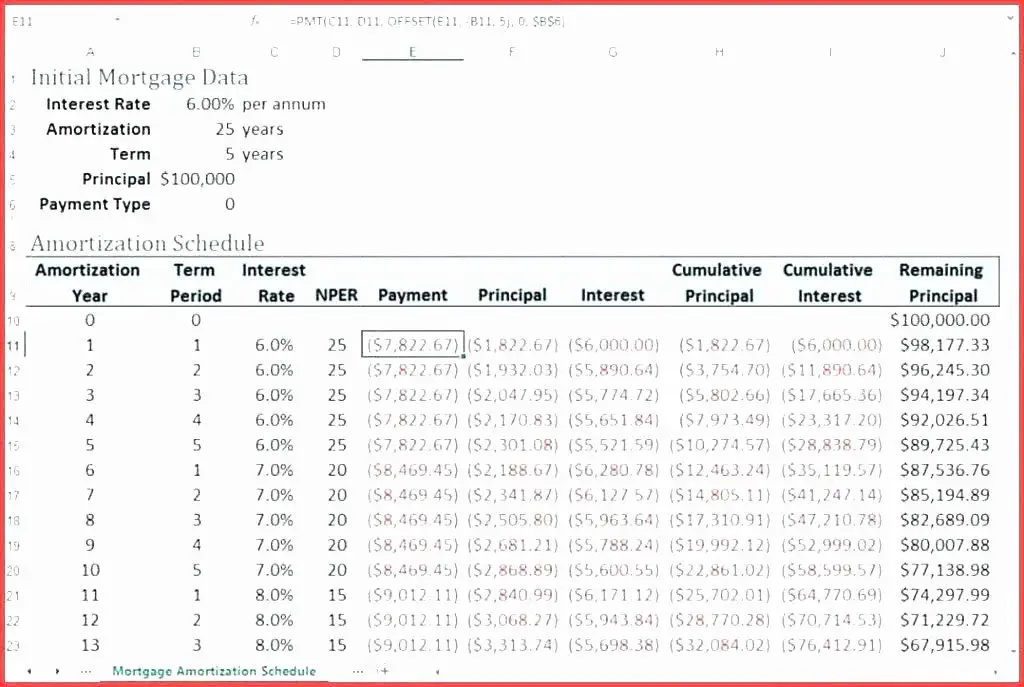

Adjustable Rate Mortgage Calculator Example

Mr. Bean has taken a loan for a very short-term mortgage loan that is for 5 years, and the term is 3/1 ARM, and which means that the rate of interest will remain fixed for 3 years and after that rate of interest shall change for the remaining of the term annually. The initial interest rate was 6.75%. It will be reset by 0.10% on every reset date. Based on the given information, you are required to calculate the total mortgage installment amount at each reset date, assuming the initial loan amount was $100,000, and installments are paid on a monthly basis.

Solution:

We will first calculate the monthly installments based on the initial loan amount as the first step.

The monthly rate of interest will be 6.75% / 12, which is 0.56%, and the period would be 5 years x 12, which is 60 months.

EMI = ^N)/^N-1)

- = ^60 ) / ^60 1 )

- = $1,968.35

Monthly Installments based on the initial loan amount is shown below:

Now the rate of interest changes to 6.75% + 0.10% which is 6.85% at end of 3 years and now the remaining period will be that is 60 36 which is 24 months. Now we need to find out the principal balance at the end of year 3 which can be calculated per below:

The monthly rate of interest will be 6.85% / 12 which is 0.57% and the outstanding principal balance is 44,074.69.

At the end of 3 years

New EMI = ^N)/^N-1)

- = ^24 ) / ^24 1 )

- = $1,970.34

Monthly Installments based on the initial loan amount is shown below:

At the end of 4 years

New EMI = ^N)/^N-1)

Old Faithful: The Fixed

A fixed-rate mortgage is what most people think of when they imagine how to finance a home purchase. When youget a fixed-rate mortgage, youll commit to a single interest rate for the life of the loan. That rate depends on market interest rates, on your credit score and on your down payment.

If interest rates are high when you get your mortgage, your monthly payments will be high too because youre locked in to the fixed rate. And if interest rates later go down youll have torefinance your mortgage in order to take advantage of the lower rates. To refinance, youll have to go through the hassle of putting together your paperwork, applying for a mortgage and paying for closing costs all over again.

The big draw of the fixed-rate mortgage, though, is that it gives the homebuyer some certainty in an uncertain world. Lots of things can happen over the life of your mortgage: job loss, uninsured illness, tax increases, etc. But with a fixed-rate mortgage, you can be sure that a hike in the interest you pay each month wont be one of those financial snags.

With a fixed-rate mortgage, the lender bears the risk that interest rates will go up and theyll miss out on the chance to charge you more each month. If rates go up, theres no way they can increase your payments and you can rest easy. In other words, the fixed-rate mortgage is the dependable option.

Also Check: Bofa Home Loan Navigator

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

How Can We Help

Routing Number: 074900657

First Merchants Private Wealth Advisors products are not FDIC insured, are not deposits of First Merchants Bank, are not guaranteed by any federal government agency, and may lose value. Investments are not guaranteed by First Merchants Bank and are not insured by any government agency.

FIRST MERCHANTS and the Shield Logo are federally registered trademarks of First Merchants Corporation

Read Also: Rocket Mortgage Loan Requirements

Understand The Basis For The Rate Change

In addition to knowing how often your ARM will adjust, borrowers have to understand the basis for the change in the interest rate. Lenders base ARM rates on various indexes, with the most common being the one-year constant-maturity Treasury securities, the Cost of Funds Index, and the prime rate. Before taking out an ARM, make sure to ask the lender which index will be used and examine how it has fluctuated in the past.

Advantages Of An Adjustable

The biggest advantage of an adjustable-rate mortgage is the initial fixed-rate term, which can provide you with a lower initial rate and monthly payment than other loans even when compared to a fixed-rate loan. Some other advantages of an ARM loan include:

- If you plan to move or sell your house within a few years, you can reap the benefits of a low fixed rate and sell the home before the rate adjusts.

- Remember, interest rates can go up and down, and if mortgage interest rates fall, you could get an even lower monthly payment than you had before.

- If rates do fall, youll be able to reap the benefits without having to go through the costs or paperwork of a refinance.

Recommended Reading: Reverse Mortgage For Mobile Homes

What Are The Common Types Of Adjustable Rate Mortgages

There are multiple types of adjustable-rate mortgages, and you can typically distinguish them numerically. The first number indicates how long the initial rate will remain fixed. The second number indicates how often the rate will change. For example:

- 10/1 ARM – A 10/1 ARM mortgage has a fixed interest rate for the first ten years, adjusting annually over the remaining 20 years.

- 7/1 ARM – A 7/1 ARM loan has a fixed rate of interest for the first seven years and becomes floating over the remaining 25 years, adjusted annually.

- 5/6 ARM – A 5/6 ARM loan has a fixed interest rate for the first five years of the mortgage. After that, the rate adjusts every six months over the remaining 25 years.

- 7/6 ARM – A 7/6 ARM loan has a fixed interest rate for the first seven years of the loan. After that, the interest rate will adjust once every six months over the remaining 23 years.