Loan Modification In The Covid

The economic downturn caused by the COVID-19 pandemic has put millions out of work. More than a third of those responding to a U.S. Census Bureau survey in November and December 2020 stated they believed they face eviction from their apartment or foreclosure on their home in the next two months, reports Newsweek. If a federal agency or program backs your mortgage, a government mortgage loan modification plan may be an option:

Choose The Right Type Of Mortgage Lender

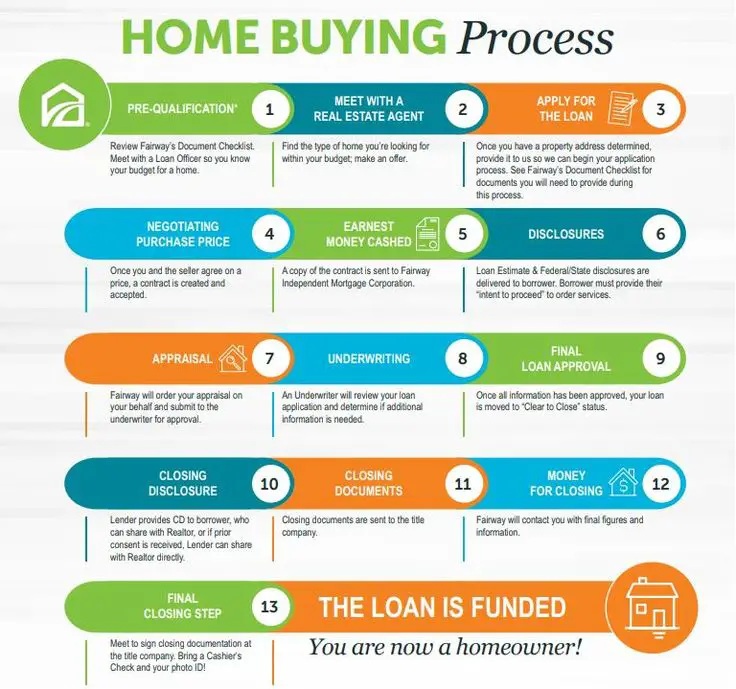

Make a list of mortgage companies and get loan estimates from at least three to five lenders. Or use a rate comparison tool to have lenders contact you before completing a mortgage loan application. Luckily, youll have no shortage of options, including:

Mortgage bankers. Mortgage banks offer a wide variety of programs, and the entire mortgage process is usually handled in-house. This could translate to a faster closing and more flexibility to work with borrowers who have unique situations.

Mortgage brokers. Mortgage brokers work with multiple lenders to provide more options than a single mortgage bank. However, brokers generally rely on the banks to approve and fund your loan, and dont have any say in whether your loan is approved or denied.

Institutional banks. Your local bank may offer mortgages with a lower rate if you carry a large deposit balance. Depending on the bank, though, loan offerings may be limited.

Wondering How To Qualify For A Va Home Loan

To qualify for a VA loan, the most important document youll need is your VA COE. However, you must remember that your COE is just one part of your eligibility. Ultimately, who qualifies for a VA loan depends on a number of additional factors as well.

You must also satisfy your lenders financial requirements and make sure the property meets all the MPRs.

Check out our Best Rated VA home loan lenders.

You May Like: How Much Will My Monthly Mortgage Payment Be

What You Need To Get Approved For A Home Loan

humanmade / Getty Images

A home loan is exactly what it sounds like: money you borrow to purchase a house. If youre ready to become a homeowner, youll need to meet certain criteria to qualify for a home loan. Factors like your credit score, income, and debt-to-income ratio , and even the price of the home you want to buy will all play a role in how much youll pay in interest, and whether you get approved.

Heres how to qualify for a home loan.

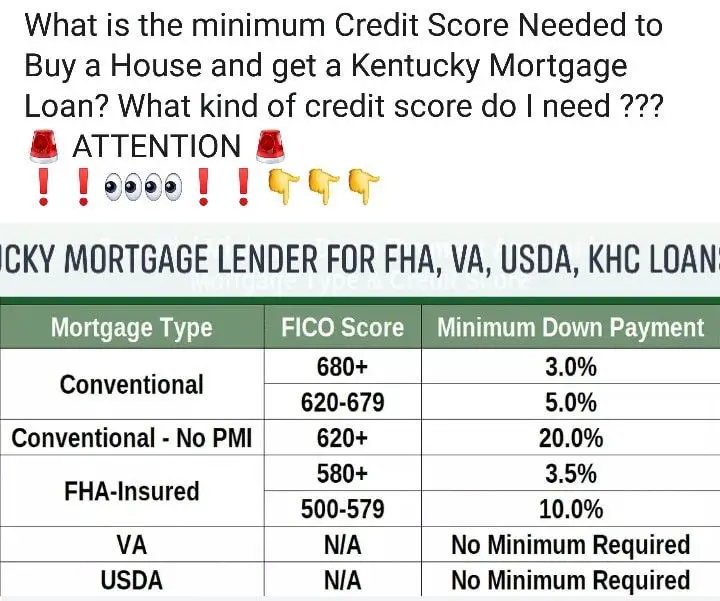

Current Minimum Mortgage Requirements For Usda Loans

Down payment. The USDA loan doesnt require a down payment.

Mortgage insurance. Rather than mortgage insurance, USDA loans require guarantee fees that work much like FHA mortgage insurance. Youll pay an upfront guarantee fee of 1% of your loan amount, which is typically rolled into your loan amount. Youll also pay an annual fee of 0.35% of your loan amount thats divided by 12 and added to your monthly mortgage payment.

The USDA doesnt set a minimum score, but USDA-approved lenders usually require at least a 640 score to qualify.

Employment. The USDA requires documentation of employment for all adult members of a household.

Self-employment. Self-employment guidelines require a two-year history, along with a year-to-date profit and loss analysis and proof the business is still operating.

Income. There are two unique income-qualifying requirements with USDA loans:

Debt-to-income ratio. The DTI limit is set at 41%, with exceptions up to 44% with a 680 credit score, cash reserves and job stability for the past two years.

Also Check: Can You Reverse Mortgage A Condo

What If You Don’t Get Pre

After reviewing a mortgage application, a lender will provide a decision to pre-approve, deny, or pre-approve with conditions. These conditions may require the borrower to provide extra documentation or reduce existing debt to meet the lending guidelines. If denied, the lender should explain and offer options to improve a borrower’s chances for pre-approval.

What Does It Mean To Prequalify For A Home Loan

As you prepare to buy a home, youll likely come across the term loan prequalification. This is the first step in the mortgage process, where a lender provides a ballpark estimate of how much house you can afford.

Prequalification is typically quick and easy. You dont have to provide documents to the lender, and you only answer a few short questions. By getting prequalified, you can be sure youre shopping for homes within your true price range, and not getting your heart set on a home you wont be able to afford.

In this article

Read Also: How To Apply For A Home Mortgage

Capacity To Pay Back The Loan

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

One of the ways that lenders verify your income is by reviewing several years of your federal income tax returns and W2s, along with current pay stubs. They evaluate your income based on:

- The source and type of income

- How long you’ve been receiving the income and whether it’s been stable

- How long that income is expected to continue into the future

Lenders will also look at your recurring monthly debts or liabilities, such as:

- Other debts that you ‘re obligated to pay

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

Don’t Miss: What Makes Up A Monthly Mortgage Payment

Can I Get A Coe In Any Other Situations

You may be able to get a COE if you meet at least one of these requirements.

At least one of these must be true:

- Youre a U.S. citizen who served in the Armed Forces of a government allied with the United States in World War II, or

- You served as a member in certain organizations

These roles in organizations can include:

- Public Health Service officer

- Cadet at the United States Military, Air Force, or Coast Guard Academy

- Midshipman at the United States Naval Academy

- Officer of the National Oceanic & Atmospheric Administration

- Merchant seaman during World War II

Is Loan Modification A Good Idea

It might be, but you need to seriously consider alternatives, including bankruptcy. Among your options are:

- Repayment plans: If youve missed some payments but can resume making payments, this can temporarily increase your monthly payments until youve paid what you missed then the payments go back down to normal.

- Mortgage forbearance: This would suspend or cut your payments for up to 12 months. You would start making regular payments plus repay what you missed. These programs are for those with temporary financial problems.

- Bankruptcy: You should also seriously consider filing for bankruptcy protection under Chapter 13 to re-organize your finances. Your mortgage company cant raise your interest rate or change the loan terms to retaliate against you for your filing.

Read Also: What’s A Conventional Mortgage

How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment

Obtain A Certificate Of Eligibility

An experienced lender can help you obtain whats called a Certificate of Eligibility . The COE will prove that you meet initial eligibility standards for VA loan benefits. It will also let the lender know how much entitlement you can receive, which is the amount the Department of Veterans Affairs will guarantee on your VA loan. To get your COE, youll need to give your lender a bit of information about your military service. Usually, a COE can be acquired online instantly through a lenders portal or through the eBenefits portal on the va.gov website. Those servicemembers or surviving spouses whose COEs cannot be obtained online will have to get theirs by mail. A VA lender or the VA can help direct you to the right resource for your specific situation.

Recommended Reading: How Much Is An Application Fee For A Mortgage

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Debt To Income Requirements

Your debt-to-income ratio is another important factor when it comes to VA loans. Again, the exact DTI for loan approval will depend on your lender and personal situation but, generally speaking, you can expect up to 45% to be the maximum acceptable DTI for a VA loan.

Can you qualify for a VA loan if you do not meet the debt to income requirements?

Every situation is unique and to offer the best answer, contact your mortgage banker. In some cases, your debt-to-income ratio can be adjusted by including any residual income you may have.

Dont Miss: How To Reduce Mortgage Payment Without Refinancing

Also Check: Do Medical Collections Affect Getting A Mortgage

What To Do Before Applying

The first step in applying for a mortgage isn’t necessarily filling in the paperwork. There’s a lot of preparation involved before you reach that point. The more you prepare, the better off you’ll be as you hit each milestone in the application process while trying to close on a house.

Whether you’re becoming a new homeowner or are looking to change homes, the following items are just some things you’ll want to address before kicking things off.

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Our calculator helps take some of the guesswork out of determining a reasonable monthly mortgage payment for your financial situation.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have to because lends must ensure the mortgage gets repaid.

Lenders don’t only take into account the mortgage payments but must also look at the other debts you’ve got that take a bite out of your paychecks each month.

Determining this comes down to the debt-to-income ratio. DTI is the percentage of your total debt payments as a share of your pre-tax income. A common benchmark for DTI is not spending more than 36% of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking.

Some lenders and loan types may allow DTI to exceed 41%. In these cases, the borrower typically receives additional financial scrutiny.

When calculating your debt-to-income ratio, lenders also consider what makes up the entire mortgage payment, including property taxes, homeowner’s insurance, mortgage insurance and condominium or homeowner’s association fees.

You May Like: Should I Refinance My Mortgage With My Current Lender

Submit Your Loan Application

If youve found a home youre interested in purchasing, youre ready to complete a mortgage application. These days, most applications can be done online, but it can sometimes be more efficient to apply with a loan officer in person or over the phone. You might be better able to establish a relationship with the loan officer in person, too, which can work to your advantage if you have questions in the process or issues come up.

The lender will also pull your credit report to verify your creditworthiness.

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

You May Like: How Much Is A 280k Mortgage

How Do I Apply For A Mortgage

To apply for a mortgage, youll need to choose a lender and submit the formal application, which will require you to provide documents like your pay stubs, tax forms, and bank statements. You must also agree to a credit check.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

How To Prequalify For A Home Loan Faq

How long does prequalification take for a mortgage loan?

Many home buyers can get prequalified within an hour. But the amount of time it will take you to prequalify depends on the lender and your personal finances. Some lenders can issue a prequalification in minutes to those with straightforward financial situations, while other lenders may take longer if youre self-employed or your credit history isnt well established.

How long does prequalificaiton last?

A mortgage prequalification letter doesnt normally expire. Unlike preapproval letters, which are usually valid for up to 90 days, a prequalification should last indefinitely as long as your financial circumstances dont change. However, if youve switched employers, lost your job, or maxed out any credit cards, you should apply for prequalification again.

Does prequalification affect your credit score?

Prequalification should not affect your credit score. The three major credit bureaus consider a prequalification a soft inquiry, which means it wont hurt your score in any way.

How hard is it to prequalify for a home loan?

Getting prequalified is generally not too hard for most home buyers because it doesnt involve verifying your income or submitting bank statements and tax returns, like a preapproval will. Instead, youll simply answer questions about your finances before a lender issues a decision.

What if I dont prequalify for a home loan?Can you get prequalified for a refinance?

Also Check: How Much Is Personal Mortgage Insurance

Tips To Prepare Your Credit

Once you know where your credit stands and you’ve checked your credit score, Watson recommends the below four crucial tips to make your credit score as high as possible before applying for a home loan:

And if your credit isn’t yet where you want it, know that there are credit cards that can help you raise your score. Select reviewed the best credit cards that give people with fair or average credit better qualification chances, and our top picks included the Petal® 2 “Cash Back, No Fees” Visa® Credit Card for no fees*, the Capital One QuicksilverOne Cash Rewards Credit Card for cash back and the Capital One Platinum Credit Card for travel.

How To Prepare For Your Application

Before applying for a mortgage, contact the three main credit reference agencies and look at your credit reports. Make sure there is no incorrect information about you. You can do this online either through a paid subscription service or one of the free online services currently available.

You can check you credit score with one of the three main credit ratings agencies:

Also Check: How Long Is A Mortgage Application Good For

Building A Credit History

While it is possible to get a mortgage without a credit score, its not ideal. Fortunately, you can build a credit history quickly

The first step is to apply for a secured credit card. With a secured card, you make a cash deposit, and that deposit becomes your credit limit. If you deposit $1,000, you can use your secured card to charge up to $1,000.

Secured cards are easier to get, even for consumers with little or no credit history. Once you get your card, use it every month. But only charge what you can afford to pay back in full at the end of each month.

Do this long enough, and youll steadily build a credit history. You can then apply for traditional, non-secured credit cards. Use these in the same way, making purchases that you can afford to pay off in full each month. Again, doing this will help you build a credit history over time.

You can also build credit by paying off an auto loan or personal loans. Every payment you make, as long as it is on time, will help boost your credit history.