Today’s Refi Rates Move Lower

The average 30-year fixed-refinance rate is 6.74 percent, down 6 basis points over the last seven days. The average rate for a 15-year fixed refi is 6.02 percent, down 17 basis points over the last week. The average rate for a 10-year fixed-refinance loan is 6.05 percent, down 20 basis points from a week ago.

Mortgage rates continue to increase: the average rate you’ll pay for a 30-year fixed mortgage is 6.78, the average rate for the benchmark 15-year fixed mortgage is 6.12 percent, and the average 5/1 ARM rate is 5.49 percent.

5 min readNov 30, 2022

What Are Todays Mortgage Rates

Mortgage rates are rising, but borrowers can almost always find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Today’s mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.

Don’t Miss: How Long Are Home Mortgages

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Summary Of Current Mortgage Rates

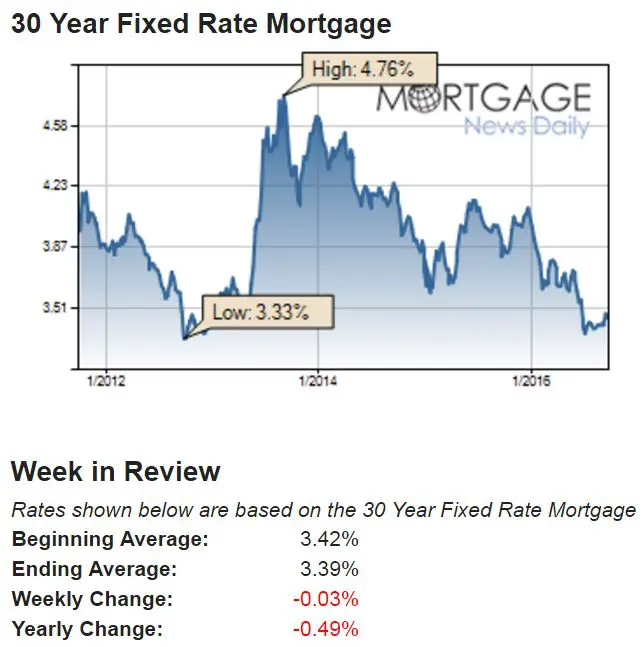

Mortgage rates moved lower this week

- The current rate for a 30-year fixed-rate mortgage is 6.49%, a of 0.09 percentage points from a week ago. The 30-year rate averaged 3.11% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 5.76%, down 0.14 percentage points week-over-week. The 15-year rate averaged 2.39% a year ago this week.

Don’t Miss: How To Choose The Right Mortgage Lender

Repayment Or Credit Risk

The most important risk for the lender is that you wont repay the loan. A high credit score can help lessen this concern, as it shows the lender youve been good at repaying your debts. So, you may pay a lower interest rate than those who have a lower score.

If your mortgage is worth more than 80 percent of the value of the home, youll have to buy mortgage default insurance. But since insurance protects the lender from the risk of default, you may get a lower interest rate than if you go for an uninsured mortgage with a bigger down payment.

How Do Your Credit Scores Affect Your Rate

Your credit scores influence your mortgage interest rate. Lenders call it risk-based pricing. Higher credit scores indicate a lower risk that youll default on a loan so you get a better interest rate. The lower your credit scores, the higher your interest rate.

» MORE:Mortgage rates and credit scores: Dont make a $30,000 mistake

Also Check: How To Figure Mortgage Interest Rate

Mortgage Interest Rates Forecast 2022

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 4.8% to 5.5% by the end of 2022.

While mortgage rates are directly impacted by U.S. Treasury bond yields, rising inflation and the Federal Reserveâs monetary policy indirectly influence mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

âThe pressure to contain inflation will grow and the Fed will have to raise its fed funds rate eight to 10 times with quarter-point hikes this year,â says Lawrence Yun, chief economist and senior vice president of research at the National Association of Realtors . âAdditionally, the Fed will undo the quantitative easing steadily, which will put upward pressure on long-term mortgage rates.â

Here are more detailed predictions from economists, as of mid-April 2022:

- Mortgage Bankers Association : âMortgage rates are expected to end 2022 at 4.8%âand to decline gradually to 4.6%âby 2024 as spreads narrow.â

- NARâs Yun: âAll in all, the 30-year fixed mortgage rate is likely to hit 5.3% to 5.5% by the end of the year. Some consumers may opt for a five-year ARM at 4% by the end of the year.â

- Matthew Speakman, senior economist at Zillow: âCompeting dynamics suggest that there will be little reason for mortgage rates to decline anytime soon.â

Today’s Average Rates For Conventional Loans

| Program | |

|---|---|

| 0% | 0% |

A 30-Year Fixed loan of $300,000 at 6.07% APR with a $75,000 down payment will have a monthly payment of $1,811. A 20-Year Fixed loan of $300,000 at 5.78% APR with a $75,000 down payment will have a monthly payment of $2,112. A 15-Year Fixed loan of $300,000 at 5.07% APR with a $75,000 down payment will have a monthly payment of $2,383. A 10-Year Fixed loan of $300,000 at 4.62% APR with a $75,000 down payment will have a monthly payment of $3,125. A 7/1 ARM loan of $300,000 at 6.21% APR with a $75,000 down payment will have a monthly payment of $1,839. A 5/1 ARM loan of $300,000 at 5.61% APR with a $75,000 down payment will have a monthly payment of $1,724. A 3/1 ARM loan of $0 at 0% APR with a $0 down payment will have a monthly payment of $0. All monthly payments displayed assume a maximum Loan to Value of 80% and 740 credit score, and do not include amount for taxes and insurance. The actual monthly payment may be greater.

Don’t Miss: How To Get A Million Dollar Mortgage

What Affects Mortgage Interest Rates

Mortgage ratesFactorsaffectinterest rateAlthough every situation is different, I would recommend refinancing your mortgage if:

Heres how to get the best mortgage rate:

Know Your Adjustment Period

In order to determine whether an ARM is a good fit, borrowers have to understand some basics about these loans. In essence, the adjustment period is the period between interest rate changes. Take, for instance, an adjustable-rate mortgage that has an adjustment period of one year. The mortgage product would be called a 1-year ARM, and the interest rateand thus the monthly mortgage paymentwould change once every year. If the adjustment period is three years, it is called a 3-year ARM, and the rate would change every three years.

There are also some hybrid products like the 5/1 year ARM, which gives you a fixed rate for the first five years, after which the interest rate adjusts once every year.

Don’t Miss: What To Look For When Applying For A Mortgage

How The Fed Influences Mortgage Rates

The Federal Reserve influences mortgage rates by changing how Wall Street views the future.

The Fed Funds Rate is ill-suited for such a task because its a blunt instrument that changes no more than once every six weeks.

Thankfully, the Fed has a second, more nuanced tool to steer growth in between its meeting its speeches.

On average, at least once per week, a Federal Reserve member appears publicly and speaks about economic growth, threats to the economy, and risks of inflation.

What the Fed says is more important than what the Fed does.

Inflation is when the U.S. dollar is worth less tomorrow than it is today.

Some amount of inflation is healthy and expected. The Fed manages to that. The Federal Reserve has held U.S. inflation near a 2 percent annual target for the last decade. Sometimes, though, inflation advances faster than the Fed wants.

When that happens, everything denominated in U.S. dollars loses value, including mortgage payments.

Mortgages are a 30-year instrument, so inflation hits them hard. Mortgage markets push mortgage rates up because future incoming payments will be less valuable.

Inflation is the enemy of low mortgage rates.

Learn more about mortgages at Mortgage 101.

How Does Your Credit Score Affect Your Rate

Aside from macroeconomic factors that are out of your control, your personal situation will also influence the interest rate youre eligible for. Your down payment and credit score can have a big impact on your mortgage rate.

Lenders set mortgage rates based on how risky they determine a loan to be. So having a lower credit score, or smaller down payment will increase the rate youre likely to qualify for. On the other hand, improving your credit score and having a bigger down payment can have the opposite effect and reduce your interest rate. While each lender has different standards, having a down payment of at least 20% and a credit score of 700 to 740 will typically get you the lowest mortgage rate.

If youre having trouble qualifying for a mortgage or getting a decent interest rate, you may have better luck with a government-secured loan. Certain mortgages are backed by the different departments of the federal government and are considered less risky by lenders. There are loans guaranteed by the Federal Housing Administration , Department of Veterans Affairs , and the Department of Agriculture .

Don’t Miss: Does A Mortgage Loan Cover The Down Payment

Decide Why Youre Refinancing

Refinancing is when you take out a new home loan to replace your old one. You might want to do that for a few reasons. If mortgage rates have dropped or your financial situation has improved significantly, you might be able to get a lower interest rate, meaning lower monthly mortgage payments. If your first loan was an FHA loan, you may have to refinance to a conventional mortgage to get rid of mortgage insurance. You may also want a cash-out refinance, in which you take out a loan for more money than you owe on the old loan to turn some of your equity into cash, maybe for home improvements or debt consolidation.

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Home sales slow down during the winter and competition heats up in the spring which can affect prices. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

Read Also: What Is A Good Ltv For Mortgage

Mortgage Rates Expected To Fall To 54% By Late 2023 Banking Group Projects

After more than doubling this year, mortgage rates are expected to retreat in 2023, according to an updated forecast from the Mortgage Bankers Association.

MBAs economists also said they expect the US to enter into a recession in the first part of next year that will be driven by tighter financial conditions, reduced business investment and slower growth globally. That will, in turn, push the unemployment rate up from its current 3.5% to 5.5% by the end of next year, according to the forecast.

Next year will be particularly challenging for the US and global economies, said Mike Fratantoni, chief economist and senior vice president for research and industry technology. The sharp increase in interest rates this year a consequence of the Federal Reserves efforts to slow inflation, will lead to an equally sharp slowdown in the economy, matching the downturn that is happening right now in the housing market.

But the upshot for homebuyers is that mortgage rates are expected to come down next year, Fratantoni said. MBA is forecasting mortgage rates to end 2023 at around 5.4%. The average rate for a 30-year fixed rate mortgage is currently 6.94%, according to Freddie Mac.

Fratantoni cautioned that mortgage rates will still face plenty of volatility in the comingmonthsas the Fed is expected to continue to raise interest rates this year.

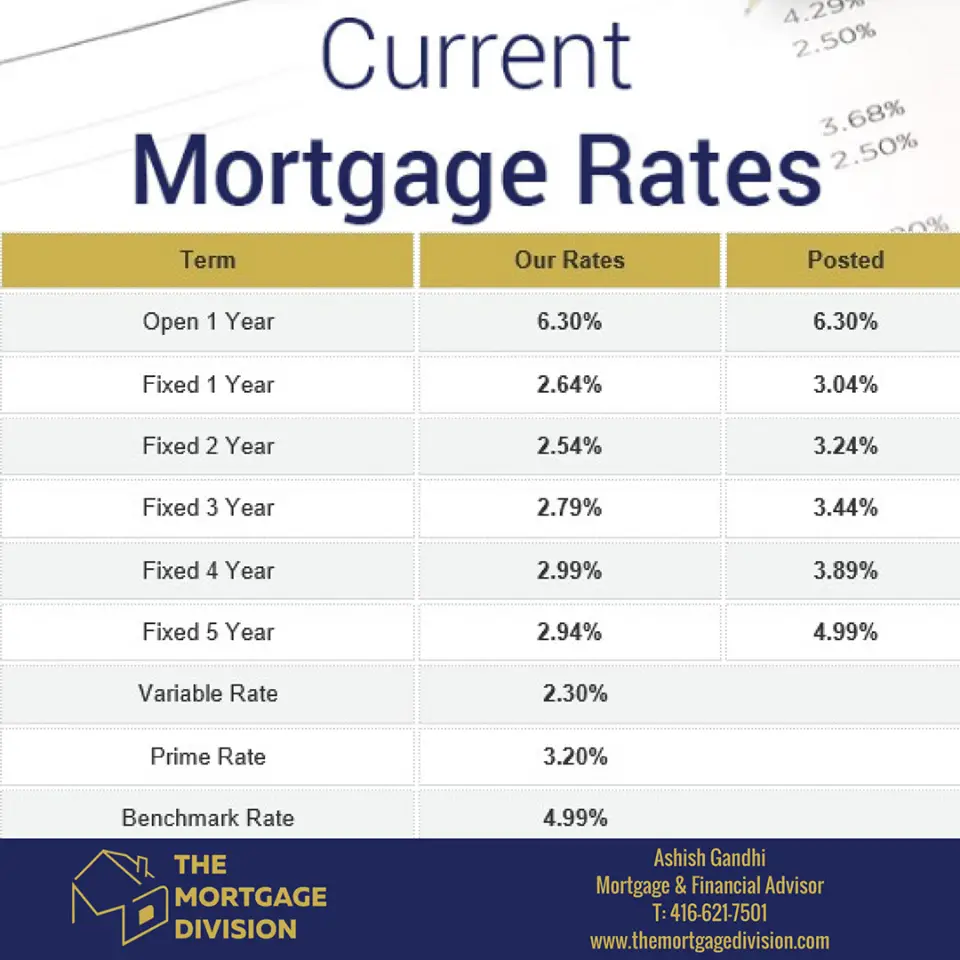

How Do I Compare Mortgage Rates In Canada

When comparing mortgage rates in Canada, its important to look at similar terms and mortgage types to ensure youre measuring similar products and not looking solely at rates. Mortgage rates and features vary by lender so, in order to gain an accurate comparison, you have to look at similar offerings.

Recommended Reading: Are Home Mortgage Rates Going Down

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Also Check: Which Credit Union Is Best For Mortgage

Fed Sees Through November Hike Mortgage Rates At 7 Percent

The benchmark fixed rate on 30-year mortgages now sits at 7 percent, its highest level in 20 years, according to Bankrates national survey of large lenders. This, as the Federal Reserve made good on its promise to raise rates yet again at its .

The interest rate mantra for 2023 is shaping up as higher for longer, says Greg McBride, CFA, Bankrate chief financial analyst. Unfortunately, were likely to feel the pain of a slower economy before we see the gain of lower inflation.

Federal policy doesnt directly impact rates on fixed mortgages, but the central bank has some sway with 10-year Treasury yields, which do drive fixed mortgage movement. The Feds actions affect adjustable-rate mortgages and home equity products, however. Each time the central bank raises its key rate, variable home loan rates move in tandem.

Some analysts believe fixed mortgage rates might hover in the 7 percent range, while others arent ruling out the possibility of the 30-year rate approaching 8 percent. Learn what the experts predict in Bankrates forecast.

Whatever type of mortgage youre looking for, in this environment, its more important than ever to compare rates before selecting a lender.

Conducting an online search can save thousands of dollars by finding lenders offering a lower rate and more competitive fees, says McBride.