What’s The Difference Between A Mortgage Lender And A Bank

| Mortgage Lenders | |

| Offer a variety of loan options | Have fewer loan options |

| Have more lenient credit requirements | Tend to have strict credit requirements |

| May sell your mortgage loan to another lender after closing | You’ll pay and work with the same bank throughout the life of your loan |

Both banks and mortgage lenders can help you get the funds you need to buy your home, as long as your credit, income, and debts meet their qualifications. But they each come with a unique set of pros and cons.

Mortgage lenders usually offer a larger variety of loan options, and they can be more forgiving of borrowers with damaged credit. Banks typically have fewer loan options and stricter lending criteria.

The best fit for your purchase will depend on your unique home-buying scenario, your finances, and your goals.

Home Loan Vs Mortgage Loan

Both home loans and mortgage loans are secured advances used to cover large expenses. However, they differ significantly:

- Documents about the property being mortgaged/ purchased

- IT returns

- In the case of mortgage loans, you will also need to have complete paperwork of the property that is being pledged

What Are The Pros And Cons Of A Conventional Loan

What Are the Pros and Cons of a Conventional Loan?

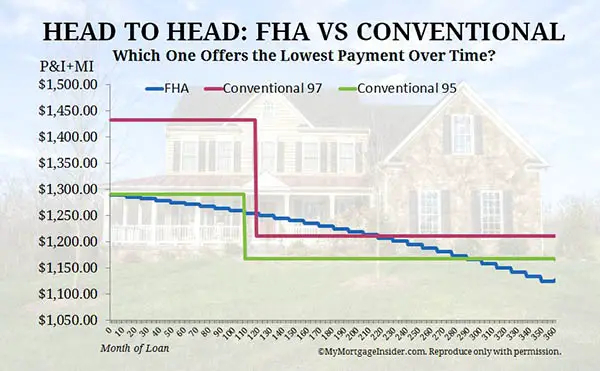

- Competitive interest rates. Typically, rates are lower for conventional loans than for FHA loans. …

- Low down payments. …

- PMI premiums can eventually be canceled. …

- Choice between fixed or adjustable interest rates. …

- Can be used for all types of properties.

Read Also: Does Rocket Mortgage Sell Their Loans

Other Types Of Mortgages

There are many other kinds of mortgages, including interest-only mortgages, adjustable-rate mortgages , and reverse mortgages, among others. Fixed-rate mortgages remain the most common type of mortgage, by far, with 30-year fixed-rate programs being the most popular form of them.

Deed of Trust

Some U.S. states do not use mortgages very often, if at all, and instead use a trust deed system, wherein a third party, known as a trustee, acts as a sort of mediator between lenders and borrowers. To learn more about the differences between mortgages and deeds of trust, see Deed Of Trust vs Mortgage.

Mortgage Broker Vs Bank

In general, if your loan is a straightforward transaction, and your credit, income, and assets are strong, you may be able to save time and money with a bank.

If your application involves challenges, a broker who knows which lenders are most flexible can help.

For instance, a broker might be best if your FICO score is 580 and you have a sparse credit report, because youd be right on the borderline of qualifying for an FHA loan.

A good broker would know which lenders are lenient on credit and more likely to approve your application.

That said, many brokers today offer competitive pricing in line with that of direct lenders. And many banks today have a larger variety of programs. Look for portfolio lenders if you need something really creative.

To get the best of both worlds, obtain loan quotes from at least one broker and at least one bank when you shop for a mortgage.

Don’t Miss: Rocket Mortgage Launchpad

What Is A Lien

A lien is a legal claim on an asset. It can be part of the mortgage process when one is placed on a property in a secured loan. In the lending process, this legal claim states that when a borrower seeks a loan to buy property, the lender has the legal right to take that property and liquidate it to ensure they recover the amount of money borrowed.

How Collateral Fits Within Our Triple C Guarantee

As you can see, collateral is a major component of a mortgage, but isn’t the only factor lenders look for when reviewing a loan application.

Commitment to close

We close quickly and on time because our process is different than most lenders, meaning less surprises. While most lenders take over 30 days or longer to close, we are able to achieve the same in as little as two weeks. That’s because we know the loan process inside out and share our knowledge with borrowers so they are able to prepare for their mortgage even before they apply.

Commitment to convenience

We offer a wide variety of innovative products, power by state of the art technology. This helps us evaluate market trends and find the loan terms that are most favorable for everyone involved.

Commitment to communicate

We have lenders all around the country who are experts in your local market. They are available to meet however and wherever is most convenient to you – whether it be through email, on the phone or even your local coffee shop. They can answer your questions and walk you through the loan process so you have a trusted friend along the way, not just a loan officer.

Being familiar with your local area allows lenders to be attuned to the current state of the market and regional specialties. This makes understanding the collateral component of the mortgage better for everyone involved.

Also Check: Does Rocket Mortgage Service Their Own Loans

Can You Buy A House With A Personal Loan

Since a personal loan can be used for just about anything, you may wonder if you can buy a house with one. In most cases, its better to buy a home with a mortgage. If youd like a single-family house thats a couple hundred thousand dollars, a mortgage is your best bet. Youll likely qualify for a larger loan and land a lower interest rate and longer terms such as 15, 20 or 30 years, so you can really take your time paying off your house.

Instead, we recommend a personal loan to help out with your home journey. For example, some great ways that a personal loan can help are: if you need to raise your credit score to qualify for a mortgage, cover moving expenses, or possibly fix up your old house prior to selling .

Apply For A Personal Loan.

What Is A Mortgage Loan

Unlike a home loan, mortgage loans can be taken and used for any purpose by the borrower. However, it shares one similarity with home loans the lender takes ownership of the property of the borrower till the repayment is complete.

The LTV ratio in mortgages is 60-70%. It means the borrower will be eligible to get only 60-70% of the collaterals present market value as a loan. The processing fee on these loans is typically 1.5% of the loan amount, and a top-up facility is available as well. This facility allows the borrower to get additional funding on the existing loan without much paperwork. In mortgage loans, the tenor is up to 15 years. Interest rates on mortgage loans are somewhat higher than the interest rates offered on home loans.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

Short Vs Long Term Amortization Periods

Many home buyers choose shorter amortization periods resulting in higher monthly payments if they can afford to do so, knowing that it promotes positive saving behaviour and reduces the total interest payable. For example, let us consider a $300,000 mortgage, and compare a 25-year versus 30-year amortization period.

| Scenario A | |

|---|---|

| $339,659 | $111,079 |

The mortgage payments under scenario B are smaller each month, but the home owner will make monthly payments for 5 additional years. The total interest saved by going with a shorter amortization period exceeds $100,000.

For the savvy investor, these savings should be compared to the opportunity cost of other investments. Using the example above, the monthly savings of $142 under scenario B, could be invested elsewhere, and, depending on the rate of return, could come out ahead after 35 years.

Prepayment privileges set out by your lender will determine whether you can shorten your amortization period, by either increasing your regular monthly payments and/or putting lump sum payments towards the principal, without penalty. However, beyond these privileges, you will often incur costly penalties for making additional payments. According to the Canadian Association of Mortgage Professionals, 24% of Canadians took advantage of prepayment options in 2009.

What Is The Difference Between Collateral And Mortgage

Applying for a mortgage can be just as overwhelming as it is exciting. Amongst the paperwork and meetings, you have probably run into terminology both familiar and foreign.

Understanding the loan process is crucial for making a sound financial decision – and it all starts with gaining a grasp of real estate vocabulary. The terms collateral and mortgage are often used alongside one another in the path to homeownership, but grasping their differences is the key to understanding how lenders evaluate loan applications.

Here is everything you need to know about collateral and mortgage, from how they differ and ultimately come together as part of the loan process.

You May Like: Requirements For Mortgage Approval

Difference Between Loan And Conventional Mortgage #: Collateral

Collateral is what is used to protect the lenders. The collateral is what the lender will get from the payer if they fail to pay the loan. A loan with collateral is going to have much lower interest rates, as the collateral gives the lender assurance that they will not suffer a loss if the loan does not get paid back.

Mortgage: The collateral on a mortgage is the property itself. The adjustable rate mortgages are typically lower because the threat of foreclosing on the property is enough to ensure that most homeowners will do everything in their power to pay back their mortgage in a timely manner. Also, have in mind that home properties are assets that keep their value over time.

That makes them excellent collateral: if everything goes wrong and the mortgage holder cant make the scheduled payments, the bank probably will be able to resell the property at market value. This kind of assurance allows for a lower interest rate. The value of a piece of equipment that you may present as collateral for a business loan, however, is surely going to decrease . Thats one of the reasons interest rates are higher on business loans.

Business Loan: The collateral for business loans again varies depending on the lender and type of loan. Those loans backed by collateral are called secured loans. Typically the collateral for a business loan would be something that can be quickly liquidated to earn money.

How Do You Use Loans Or Mortgages

A loan can be used for home purchases or other financial needs. Here are a few common loan types to give you an idea:

- Secured loans are often used for larger purchases such as a vehicle. The vehicle is considered collateral for the loan.

- Unsecured personal term loans can be used for a variety of purchases, including a bedroom remodel, wedding or debt repayment.

- Revolving loans come in the form of credit cards and lines of credit. They can be used over and over as borrowers repay the debt placed on the card or withdrawn from the line of credit.

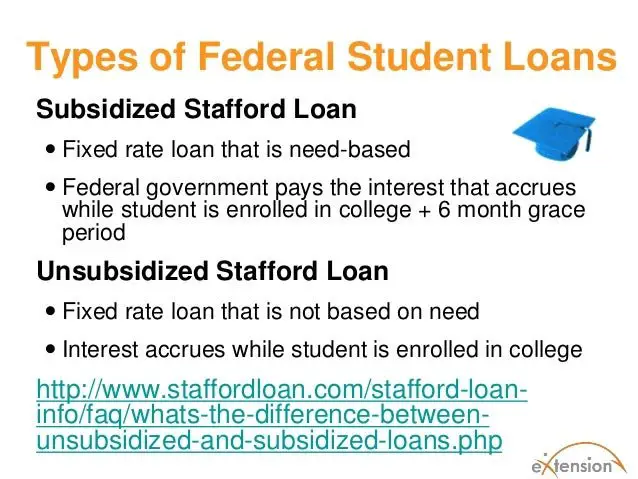

- Student loans to help pay for your education have set repayment terms. Sometimes, when a student loan is backed by the government, borrowers can access special repayment assistance programs when in need.

- Mortgages are used for home and property purchases and home refinances. Scotiabank offers the Scotia Total Equity Plan® . By leveraging equity in your home, STEP offers access to a broad range of borrowing products at lower interest rates to cater to your individual long-term and short-term financial plans.

Don’t Miss: Reverse Mortgage Mobile Home

What Is A Difference Between Loan And Mortgage

Looking to buy a home? Lets explore your borrowing options.

If you are embarking on the exciting adventure of buying a new home, then youve probably heard the terms loan and mortgage used interchangeably. While a mortgage is a type of loan, the two dont necessarily work the same way. Lets break down how mortgages and loans work.

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Are The Payment Plans Different From A Conventional To An Insured Mortgage

Mujtaba Syed:

So, the way that repayment works is exactly the same. They’re both mortgages.

It’s just that now the rate might be differ, and your amortization might be differ, and it might not be insured. But the repayments are going to work the same way.

You can have weekly, biweekly, monthly, semi-monthly payments. And it gets paid down the same amount.

What Is A Loan Originator

A Mortgage Loan Originator, also referred to as an MLO, is a financial professional who helps homebuyers with a mortgage application to acquire loans when purchasing property, while also performing loan origination for their clients. MLOs work closely with real estate agents, helping borrowers field the financial side of a home purchase. While Mortgage Brokers work for a brokerage, Mortgage Loan Originators are often employed by a bank or mortgage company.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

What’s The Difference Between Homeowners Insurance And Mortgage Insurance

You dont need to be an insurance expert when you set out to buy your first home, but it can be a challenge when you come across the terms homeowners insurance and mortgage insurance for the first time. As you learn about your insurance needs at this important new milestone in your life, it may help to know that there is a difference between homeowners insurance and mortgage insurance. Depending on many factors, not every home owner needs mortgage insurance, but to ensure their new home is sufficiently protected, homeowners insurance is usually a necessity.

As you start house hunting and explore the process of getting pre-qualified for mortgage loans, heres a look at each type of insurance, why you would need it, what it can help cover and when you might buy it.

Which Borrowing Option Is Better Suited For Me

The better option will depend on your needs as a borrower. Mortgages are the most common option because they’re meant for real estate. You’ll have the choice between a few different options, including mortgages with fixed rates and other mortgages that change with the financial environment. In addition, buying a home outright on $100,000 or less is nearly impossible in most parts of the country. Some lenders will allow you to use a personal loan as a down payment, but otherwise, you’ll have a hard time covering the costs of a purchase.

However, if youre looking to fill that new home with some furniture, a personal loan is an option to consider. Personal loans can be used for many purposes, which makes them useful when it comes to home improvements or other big purchases.

Using a personal loan as a down payment

Generally, you won’t be able to use a personal loan as a down payment because lenders will ask for proof that you have the funds available to pay yourself. However, if you have no existing debt, some lenders may allow you to use a personal loan and consider it in your debt-to-income ratio when reviewing your application.

If you can’t afford a down payment and won’t be able to use a personal loan, there may be a first-time home buyer program available in your state to help you afford the down payment.

Also Check: Bofa Home Loan Navigator

How Do I Know Whether To Use A Mortgage Or A More General Type Of Loan

Loans and mortgages are two types of borrowing solutions that can help borrowers fund their dream purchases. What will work best for you will depend on your specific financial situation. By working with an advisor, you can find what borrowing path will work best for you as you built towards your financial goals.

Mortgage Term Vs Amortization

One of the most common sources of confusion for prospective home buyers is the difference between a mortgage term and amortization period. Here is a short answer: A mortgage term is the length of your current contract, at the end of which you’ll need to renew The amoritization period is the total life of your mortgage. A typical mortgage in Canada has a 5-year term with a 25-year amortization period.

| Mortgage term | Mortgage amortization | |

|---|---|---|

| Description | The length of time you are committed to a mortgage rate, lender, and conditions set out by the lender. | The length of time if takes you to pay off your entire mortgage. |

| Time frame | CMHC-insured mortgage: Maximum 25 yearsNon CMHC-insured mortgage: 35-40 years |

Also Check: How Does 10 Year Treasury Affect Mortgage Rates