Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Don’t Miss: How Much Do Mortgage Underwriters Make

See The Real Cost Of Debt

The above calculator also has a second tab which shows the current interest rates on savings accounts. This further shows how expensive debt is because most forms of consumer debt charge a far higher rate of interest than banks pay savers AND savers get taxed on interest income they earn at their ordinary tax rates. The table below shows the full cost of $10,000 of debt at various rates of interest. While different consumer debt types typically have different amounts, we kept the amount column constant to show the absolute difference in cost per Dollar earned or borrowed. We also presumed interest-only payments on the debt & a 25% tax rate on income.

| Account Type |

|---|

What To Expect When Visiting Our Dealership

There are many reasons to visit Permian Ford Lincoln, from the vehicles we sell to the online car shopping tools we provide. Youllfind all sorts of trucks and SUVs in our new inventory, and we love to talk about what makes our new Ford models so great. You may prefer the value of one of our used vehicles. Of course, its more than just our vehicles that draw drivers to us as we have a Ford service center near Andrews, TX that is where to come for everything from oil changes to Ford accessories!

Recommended Reading: Recast Mortgage Chase

Recommended Reading: Can You Combine 2 Mortgages Into One

Should I Include Projected Repair Costs In My Monthly Payment Calculation

Repair costs arent something that you should include in your monthly payment calculation, but you absolutely should keep them in mind. If the property that you are considering is in need of significant repairs or renovations, then you absolutely will need to consider how you will cover those costs before you sign on to a mortgage on the home.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

You May Like: Is It Hard To Get Approved For A Second Mortgage

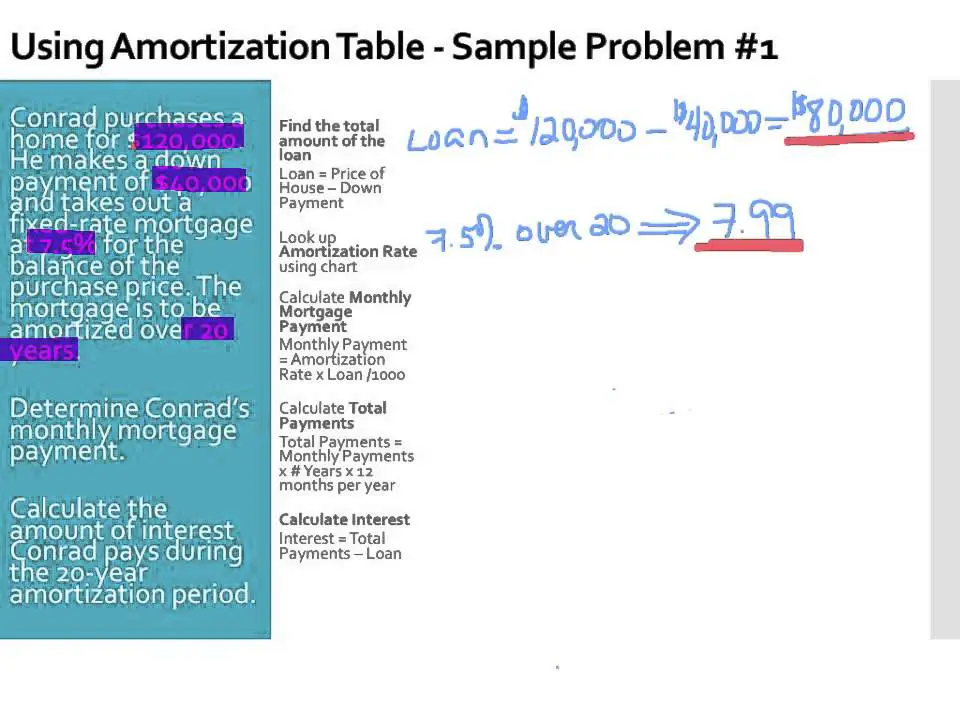

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Read Also: Where To Prequalify For A Mortgage

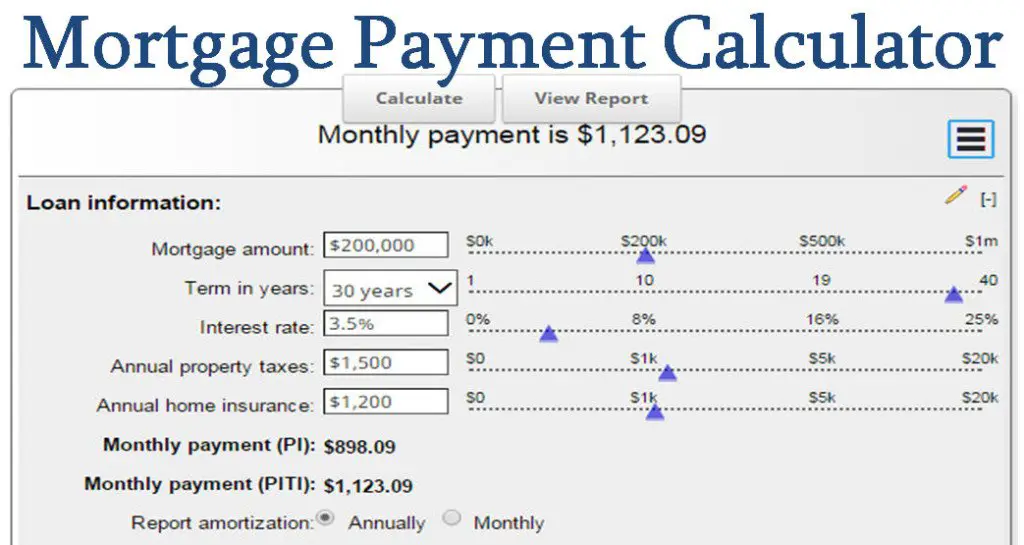

Using Online Mortgage Calculators

If you dont want to calculate your mortgage by hand, you can find a free payment calculator to use online there are many to choose from. These work by asking for a certain amount of variables and instantly providing you with a fixed monthly cost. Theyre usually easy to use and very convenient since you dont have to do any math by hand.

Keep in mind that an online mortgage calculator is only as helpful as the inputs you provide. You wont be able to go back and check the math, so if you make a mistake with the numbers you provide, it could be hard to catch an incorrect output.

Furthermore, it could be hard to find a customizable mortgage calc that uses all the variables youd like to include. You may have a unique scenario that the calculator mortgage doesnt take into account.

Some expenses that most mortgage calculators dont take into account include your monthly home maintenance costs, such as pest control and security, and your monthly utilities . You may also have a monthly HOA fee, property taxes, and homeowners insurance. These are all monthly costs that are separate from your mortgage but still need to be considered well ahead of time, so you understand the full scope of your budget.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

You May Like: What’s The Best Mortgage Loan To Get

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Don’t Miss: What Questions To Ask About Refinancing A Mortgage

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to break even in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

The Bottom Line: Mortgage Calculators Can Help You Decide How Much House You Can Afford

Mortgage calculators are great for giving you an estimate of what you might expect when purchasing or refinancing a home. While not an official qualification, the act of using a calculator is a nice starting point.

If youre ready to take the next step and get started, you can do so online with Rocket Mortgage®.

Save money with a lower interest rate.

Lock in your rate today before they rise.

Read Also: How To Figure Out How Much A Mortgage Would Be

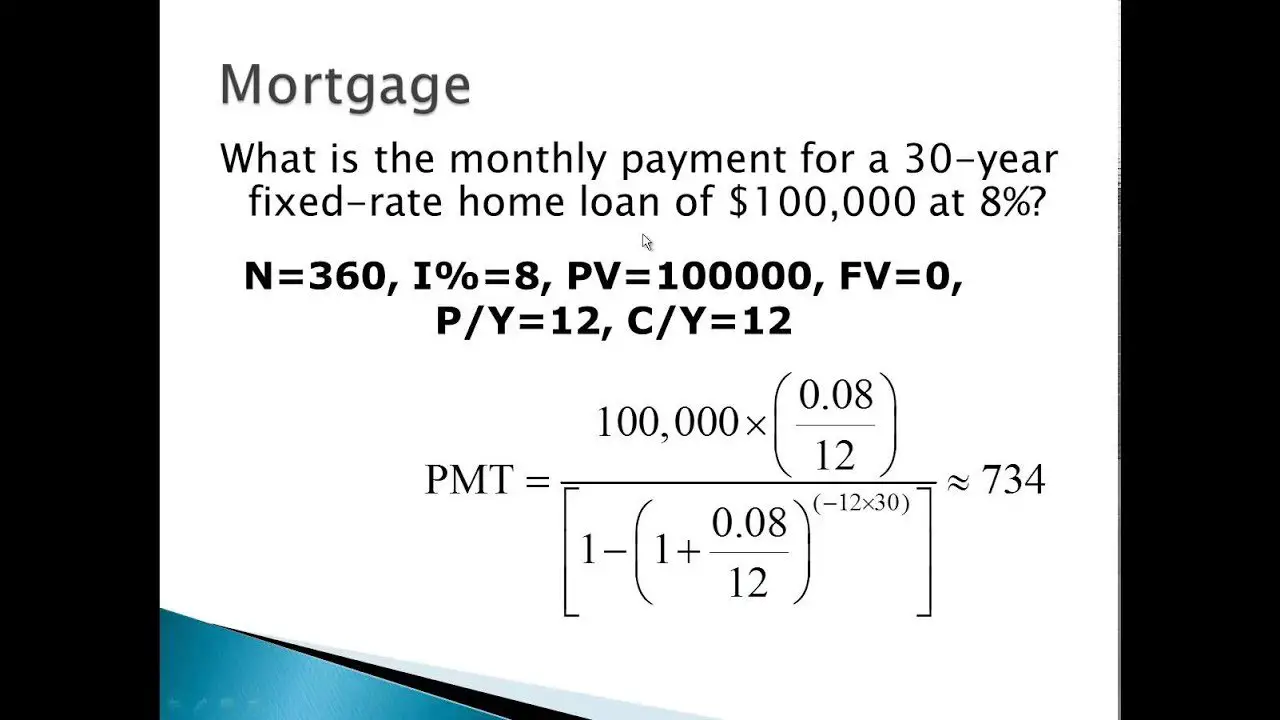

Determine The Number Of Payments

Now that you have the principal and the monthly interest rate, its time to determine the number of payments you need to make. Some people can pay in fifteen years, while others take thirty to own their home.

You can determine the number of payments by taking twelve months and multiplying them by the years you plan to pay. For example, a fifteen-year loan would require 180 payments, and a thirty-year loan would need 360 payments. Thats a long time to pay for a home.

If you have a different loan, you can use an online calculator to determine your number of payments. Its critical to know this number to prepare yourself for the future.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Recommended Reading: Can You Get A Mortgage With No Savings

What Is Mortgage Insurance

There are two kinds of insurance associated with a mortgage payment. The first one is property insurance, which protects the home and everything in it, more or less, from man-made and natural disasters. The second kind of mortgage insurance is called PMI and if you bought your home with a downpayment of less than 20%, you will have to pay this insurance in order to protect the lender, if you suddenly can’t pay your loan back.

What Does A Mortgage Broker Think

Ella Dromgool, a mortgage broker from Catalyst Financial, is in favour of interest-only loans, especially if the investor has their own home mortgage as well.

Ella says the aim of the game is to pay down your debt on your owner-occupier. So, if you have one, make that your focus.

Investors utilise interest-only loans to increase cashflow, which can be spent to invest elsewhere.

But while you arent paying down debt, at least not immediately, the investor is relying on the premise the property is going to increase in capital gain. This historically has always been true over the long term.

What Is The Right Choice For Me?

Read Also: How To Get A Mortgage After Bankruptcy

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: Is 15 Or 30 Year Mortgage Better