How Does Dti Ratio Differ From Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

Understanding Gross Income Net Income And Mortgages

Before you can calculate the income percentage for your mortgage, youll need to understand what defines gross income, net income, and mortgages.

As such, lets break these definitionsone-by-one.

Gross Income

Gross income for individuals is the total payment you receive from your employer before any taxes or other deductions. Gross income is not limited to cash payments it includes services received and property. Your gross annual income is the amount of money you earn in a year before tax and includes all your income sources.

For businesses, gross income is identical to gross margin or gross profit. As printed on their income statement, a companys gross income is the revenue earned from all sources minus the cost or services or cost of goods sold .

Net Income

Net income is the total amount earned by a person in any given period from their taxable wages, investment incomes, tips, and any other income. The amount is calculated after Social Security taxes, income taxes, Federal Insurance Contributions Act tax, 401k payments, health insurance, and any outstanding legal obligations such as child support, loan payments, and wage garnishments.

For individuals, net income is calculated using this equation:

Total amount Earned Paycheck Deductions = Net Income.

Mortgages

Mortgages are paid back over time, typically over 15 or 30-year terms. The property purchased acts as collateral for the money lent by an individual to buy the home.

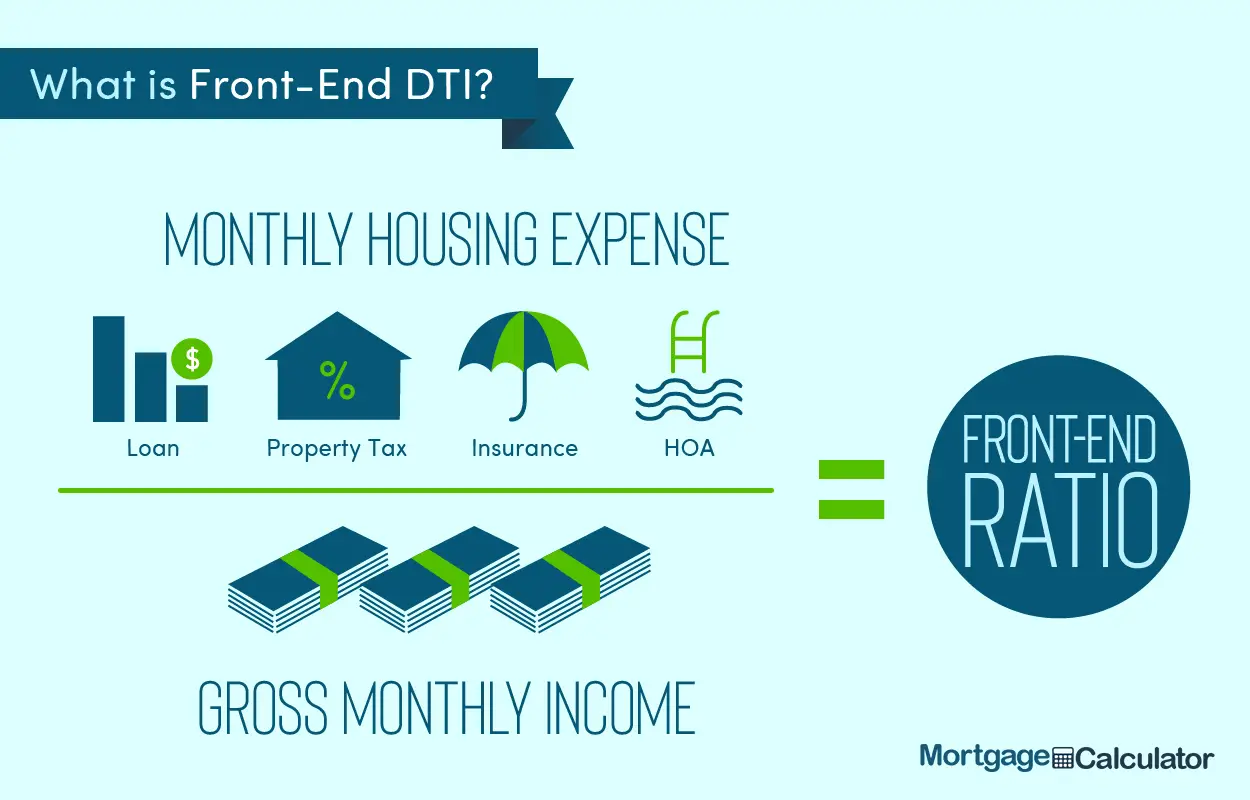

Front-End Ratio and Back-End Ratio

Read Also: What Were Mortgage Interest Rates In 2006

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan is another refinance program which waives traditional home loan Debt-to-Income requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W-2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixed-rate loan.

Also Check: How Does A Reverse Mortgage Work When The Owner Dies

Other Mortgage Qualification Factors

In addition to your debt service ratios, down payment, and cash for closing costs, mortgage lenders will also consider your credit history and your income when qualifying you for a mortgage. All of these factors are equally important. For example, even if you have good credit, a sizeable down payment, and no debts, but an unstable income, you might have difficulty getting approved for a mortgage.

Keep in mind that the mortgage affordability calculator can only provide an estimate of how much you’ll be approved for, and assumes youre an ideal candidate for a mortgage. To get the most accurate picture of what you qualify for, speak to a mortgage broker about getting a mortgage pre-approval.

What Is A Good Dti Ratio

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Don’t Miss: Can You Get A Mortgage While In Chapter 13

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

You May Like: What Is Payment On 30 Year Mortgage

How To Get A Loan With A High Debt

A high debt-to-income ratio can result in a turned-down mortgage application. Luckily, there are ways to get approved even with high debt levels.

1. Try a more forgiving program

Different programs come with varying DTI limits. For example, Fannie Mae sets its maximum DTI at 36 percent for those with smaller down payments and lower credit scores. Forty-five is often the limit for those with higher down payments or credit scores.

FHA loans, on the other hand, allow a DTI of up to 50 percent in some cases, and your credit does not have to be top-notch.

Likewise, USDA loans are designed to promote homeownership in rural areas places where income might be lower than highly populated employment centers.

Perhaps the most lenient of all are VA loans, which is zero-down financing reserved for current and former military service members. DTI for these loans can be quite high, if justified by a high level of residual income. If youre fortunate enough to be eligible, a VA loan is likely the best option for high-debt borrowers.

2. Restructure your debts

Sometimes, you can reduce your ratios by refinancing or restructuring debt.

Student loan repayment can often be extended over a longer term. You may be able to pay off credit cards with a personal loan at a lower interest rate and payment. Or, refinance your car loan to a longer term, lower rate or both.

3. Pay down accounts

Or you can reduce your credit card balances to lower your monthly minimum.

| Balance | |

| $150 | 5.0% |

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Recommended Reading: What Is The Mortgage Rate In Florida

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

What Is An Ideal Debt

Lenders typically say the ideal front-end ratio should be no more than 28 percent, and the back-end ratio, including all expenses, should be 36 percent or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan you’re applying for.

For conventional loans backed by Fannie Mae and Freddie Mac, lenders now accept a DTI ratio as high as 50 percent. That means half of your monthly income is going toward housing expenses and recurring monthly debt obligations.

You May Like: How To Build A Mortgage Business

What’s The Ideal Debt

When you purchase a home and take out a mortgage, you might not realize that the interest rate you pay on this type of loan can change. If you have an adjustable-rate mortgage, for example, the lender can change your interest rate in certain cases and this may result in you paying more in interest. Mortgage rates around the country also change periodically based on a variety of factors, such as inflation or the countrys economic growth. The interest rate you pay has a large impact on how much you actually pay to own your home over time, and you may decide to refinance your mortgage to obtain a lower interest rate .

The process of qualifying for refinancing has many similarities to qualifying for an initial mortgage loan in the first place refinancing is essentially the process of getting a new home loan that pays off your old mortgage. And, similarly to getting a conventional mortgage, one of the biggest factors that impacts your credit and determines whether a lender will refinance your home is your debt-to-income ratio. If youre considering a refinance, learn how this ratio impacts a loan, along with the general ratio mortgage loan refinance lenders look for.

What Is The Debt

To put it simply, your debt-to-income is used to calculate the amount of monthly payments you have in relation to your gross monthly income . It provides a picture of your essential payments to lenders, who will then use this to see if you fit their affordability requirements.

To calculate your debt-to-income ratio when applying for a mortgage, youll first need to add up your recurring monthly debt. Next, add up your monthly income and gross wages this can include money earned from freelance work or child benefit, if applicable.

Finally, divide your monthly recurring debts by your monthly income, then multiply this figure by 100.

So, for example, if your debts came to £1,000 per month and your monthly income is £2,500, your debt-to-income ratio would be 40%.

Don’t Miss: How Much Is Average Mortgage Insurance

Add Up Total Monthly Debts

The very first step is to calculate what your monthly debt total is, which will be impacted by the DTI calculation you need. If its your front-end DTI, or housing expense ratio, youll add up expenses involved with maintaining your home: mortgage principal and interest, homeowners insurance, HOA fees and property taxes.

Principal + Interest + Property Taxes + Homeowners Insurance + Association Dues

If youre interested in your back-end DTI to see the bigger picture, youll want to include all applicable debt payments. This means adding in those same household expenses from a moment ago as well as things like student loan payments, minimum credit card payments, car payments, HELOC payments and the like.

Monthly Housing Expenses + Other Monthly Debts

This gives you an idea of your total debt burden.

What Kind Of Debt To Income Ratio For Mortgage

Asked by: Kaela Ryan

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment.

be no more than 28 percentmortgage payment shouldn’t be more than 28% of your monthly pre-tax income and 36% of your total debtat least $1,692 a month35 related questions found

Recommended Reading: Which Credit Reporting Agency Do Mortgage Lenders Use

What Is Best Way To Pay Off Credit Card Debt

Ways to pay off credit card debt. Pay the most expensive balance first. If you want to get out of debt as quickly as possible, list your debts from the highest interest rate to the lowest. . The snowball method. . Consider a balance transfer credit card. . Get your spending under control. . Grow your emergency fund. . Switch to cash.

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Recommended Reading: What To Expect When Applying For A Mortgage Loan

Speak To A Mortgage Expert About Debt

If you have questions and want to speak to an expert for the right advice, make an enquiry.

The expert brokers we work with are whole-of-market, meaning that they can find the best deals for you from a wide selection of mortgage lenders.

We dont charge a fee, theres no obligation to invest, and there are no marks made against your credit rating.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker