What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Fixed Or Variable Mortgage: How To Minimize The Risk Associated With A Variable Mortgage

Here we revisit the fundamental question of why we are even taking the time to a fixed or variable mortgage. The answer for most is to save more money on their mortgage, in one way or another.

The strategy here will show you how to lower your risk on a variable mortgage while also setting you up to save substantially on interest over time.

I call this more specifically, variable rate risk mitigation and it involves using the extra payment/ prepayment privileges found in the mortgage fine print terms to increase your variable mortgage payment to the same payment that you would be making at a higher rate 5 year fixed rate mortgage.

For example:

25 YR Amortization

Payment: $1,270

Then using prepayments, boost the variable payment by $72 per month to $1,342 the same payment as you would have been making on the fixed rate.

How A Mortgage Rate Lock Works

A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases.

Locks are usually in place for at least a month, to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate.

Its possible the market rate for your loan could fall below your locked-in rate, but you wont be able to take advantage of the lower rate unless you have a float down option.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- New down payment amount

- Appraisal on your home that is different from the estimated value in your application

- Decrease in your because you are delinquent on payments or took out an unrelated loan

- Income on your application that cant be verified

An interest rate lock agreement will include the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its better if you get them in writing, as well.

Don’t Miss: How To Get Approved For Mortgage With Low Income

What It Means To Lock Your Loan

When you lock a loan, it means you and your lender have reached an agreement on your loans mortgage rate and discount points and the lender has put its commitment in writing.

Loan locks protect you from an increase in mortgage rates between today and your closing date. If mortgage rates rise, the bank cant assign you the new, higher rate.

Conversely, if mortgage rates dip, the bank wont assign you the new, lower rate.

Your mortgage rate lock is a contract and its valid for an agreed-upon number of days.

The most common rate lock period is 30 days, but many home buyers will request rate locks from the lenders of 45 or 60 days because it can take that long to close on a home.

When your loan fails to close while your rate lock is in effect, you may be subject to worst-case pricing, which means that you get the worser pricing of your original locked rate, or todays updated rates.

Its often best to lock your mortgage rate for the minimum number of days possible, with maybe a day or two of cushion just in case something goes unexpectedly wrong at closing.

Its rare, but it happens.

Apply For A Mortgage With Us

![How to Get the Lowest Mortgage Rates in 2012 [Survey] How to Get the Lowest Mortgage Rates in 2012 [Survey]](https://www.mortgageinfoguide.com/wp-content/uploads/how-to-get-the-lowest-mortgage-rates-in-2012-survey.png)

Applying for a mortgage can be a complicated process, since there are several things lenders will review. Knowing what lenders are looking for and making that as attractive as possible is one of the best steps you can take in getting a great mortgage rate. Luckily, you have us.

At Assurance Financial, well work with you, assessing your situation and doing all the heavy lifting for you. Contact one of our experts today and let us help you get the perfect mortgage rate!

You May Like: How Do You Get A Second Mortgage On Your House

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Scoring A Low Interest Rate

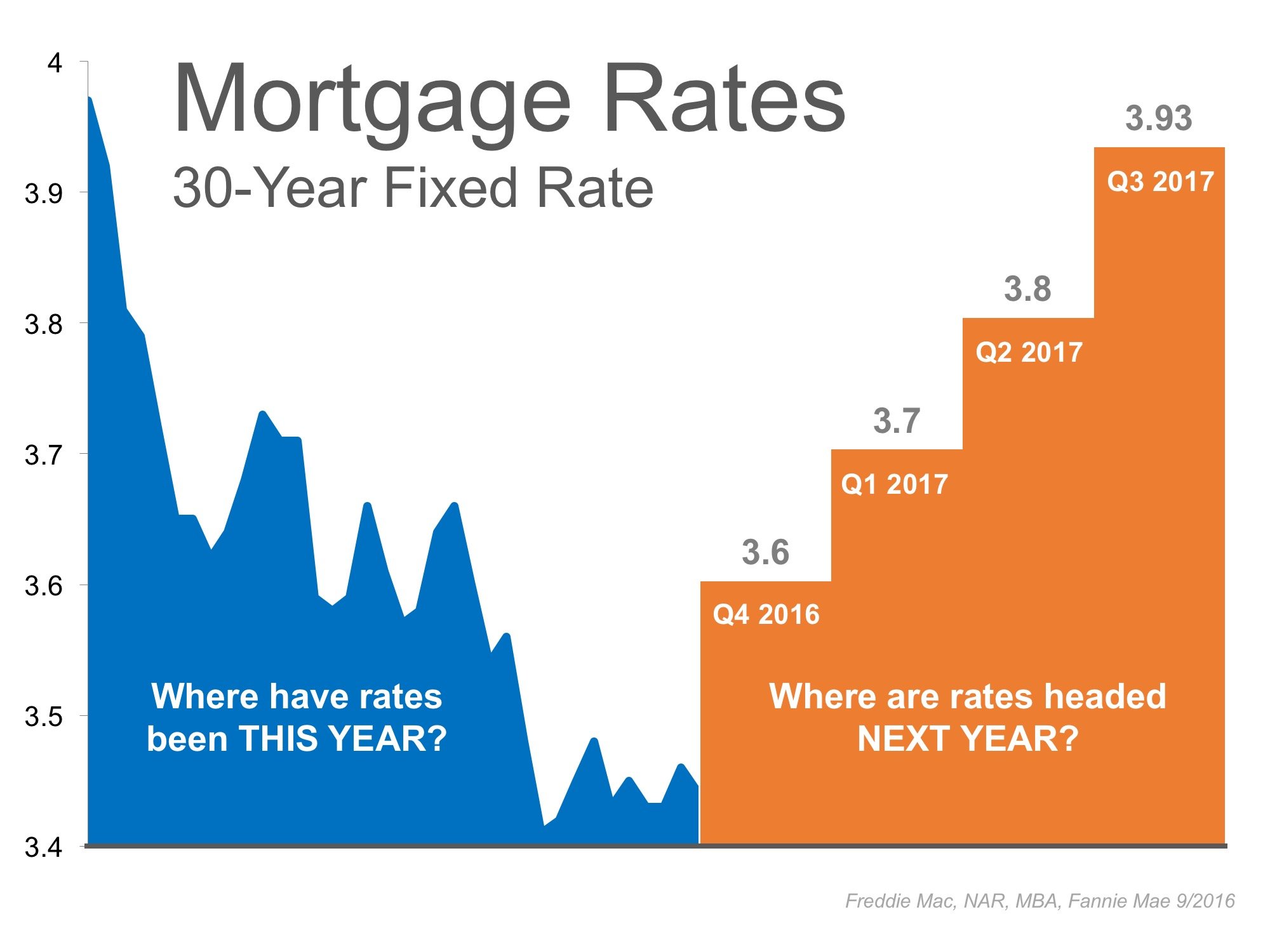

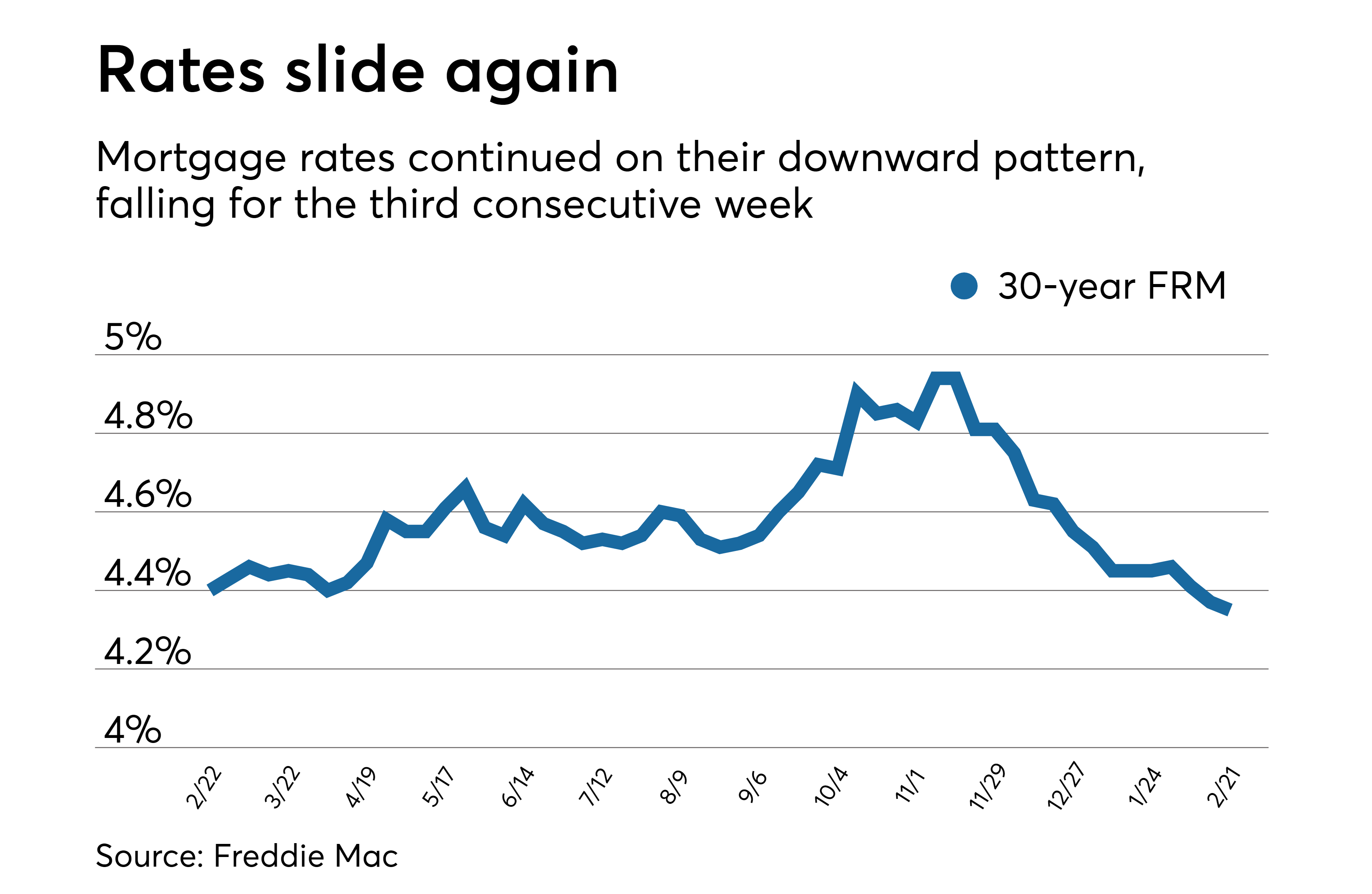

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

You May Like: How To Recruit Mortgage Loan Officers

S To Refinancing A Mortgage

The refinancing process hasnt changed much, but there have been a few tweaks made since the coronavirus hit, say the experts.

Michael Oursler, chief operating officer with NewDay USA, a Fulton, Maryland-based lender serving veterans, explains that the traditional steps required to refinance your mortgage still apply:

Close On The New Loan

Execute your closing documents, typically in the office of a title company or attorney, or remotely from your car or other location with COVID-19 safeguards in place.

One step that has either been eliminated or altered is the lenders requirement to have your home appraised by a professional.

Due to the pandemic, many lenders are waiving property inspections, which saves consumers time and money, says Jared Maxwell, direct sales division leader for Embrace Home Loans in Middletown, Rhode Island.

In other cases, appraisers are conducting their home tours remotely by videoconferencing with homeowners.

Thanks to technology, the whole process has become more streamlined. By introducing digital signatures, using e-notaries and even eliminating the need to upload documents , borrowers should be able to close on a refinance faster than you may expect, says John Sweeney, head of wealth and asset management at Figure Technologies.

Don’t Miss: Are Current Mortgage Rates Good

What Factors Impact Mortgage Prices

As you look around this site, youll notice we have access to all of the most relevant lenders. That includes all the major banks, all top credit unions, all major mortgage finance companies and an array of top mortgage brokers. Shopping among them is quick, easy andmost importantlyfree.

Rate Tip: Once you’ve chosen the rate you’re most interested in, click the < Get Rate> button to contact the lender or broker directly. Ask them all the questions you need in order to feel comfortable with their mortgage product and service level.

Be sure to spend some time at this and compare multiple mortgage rates. The cost savings of even a puny five-basis-point-cheaper rate can save you $700 over 60 months on a $300,000 mortgage.

On the other hand, the cheapest rates can often cost you more later due to unexpected fees or limitations. Well talk about that momentarily.

In the meantime, lets have a look at what factors impact mortgage prices in Canada.

Make The Best Offer Youre Comfortable With

When youre competing against a dozen other people for a house it can be tempting to increase your offer or to waive certain buyer contingencies to make your offer more appealing. But you shouldnt do this without understanding the consequences.

If home prices are rapidly rising in your area, consider starting your home search with properties listed below your home buying budget. That way you can comfortably raise your offer amount without paying more than you can afford.

When making an offer you should also carefully consider what contingencies you will include or waive, if any. Waiving an appraisal contingency means that if the appraised value is less than your offer price, you could have to pay the difference out of pocket or risk losing your earnest money deposit. So be sure you fully understand and accept all of the risks associated with waiving contingencies beforehand.

You May Like: How Much Is A Habitat For Humanity Mortgage

Should I Fix My Mortgage For 10 Years

It depends on how much certainty you want! If you want to know exactly how much your monthly repayments are going to be for 10 years, then this might be the best option for you.

However, weâd only recommend fixing your mortgage for 10 years if you know youâre going to be staying in your property for at least this long. Otherwise, youâll have to pay early repayment charges when you leave.

What Is A Mortgage Rate Lock

A rate lock freezes the interest rate, usually for a fee paid when you agree to the terms of the loan. The lender guarantees that the mortgage rate offered to a borrower will remain available to that borrower for a stated period. With a lock, the borrower doesnt have to worry if rates go up between the time they submit an offer and close on the home.

Rate locks typically last from 30 to 60 days, though they sometimes last 120 days or more. Some lenders do offer a free rate lock for a specified period. After that, however, even those generous lenders may charge fees for extending the lock.

You May Like: Is 3.99 A Good Mortgage Rate

Shop At A Mix Of Financial Institutions

Your finances are in order, and you know what type of loan you want. Now its time to shop around for a mortgage.

This is likely going to be the biggest purchase of your life its not a bad idea to go to two or three financial institutions, Morse says. Rates can fluctuate daily and even from hour to hour, he adds, so take that into account while shopping. You might want to shop on different days to get a mix of options.

Start with your bank or credit union, as they may offer you a better rate simply for having an existing banking relationship with them. Make sure youre also checking other credit unions, national banks, and local or regional banks.

From one lender to the next, you may see different promotional rates, fees, interest rates and offers for discount points. For example, Morse says his credit union doesnt charge an application fee, which saves about $500. Fortunately, lenders must provide you with a standard Loan Estimate, which makes it easier for you to compare loans.

Heads up: Shopping for a mortgage will add a hard inquiry to your credit reports, which may temporarily lower your scores. Try to limit your shopping to a 45-day window, as multiple credit inquiries from mortgage lenders within this time frame may be treated as just one.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

Don’t Miss: How To Calculate Principal And Interest For Mortgage

When Should You Lock A Mortgage Rate

If youre approved for a home loan at an interest rate youre comfortable with, and the resulting monthly payment fits your budget, thats the time to consider locking your rate.

Trying to predict home loan interest rates is like forecasting the stock market: It cant be done. Rates are up one day and down the next. Even noted economists who insist on declaring long-term trends are often wrong. Get the best rate you can earn and lock it in.

» MORE: How to get the best mortgage rate

How Do You Qualify For The Best Mortgage Rates

Getting the best mortgage rates requires five main things:

Read Also: What Is Verifiable Income For A Mortgage

Chase Home Lending At A Glance

With home loan offices in more than half the states, Chase is one of the most prolific mortgage lenders in the country. To appeal to a wide range of borrowers, Chase offers a broad lineup of mortgage products, along with lower rates and fees than many other lenders. It has a robust online rate-shopping experience. Completing an application requires a talk with a home loan advisor but after that, Chase gives borrowers the option of a fully online experience.

Here’s a breakdown of Chase Home Lending’s overall score:

-

Variety of loan types: 4 of 5 stars

-

Ease of application: 4 of 5 stars

-

Rates and fees: 3 of 5 stars

-

Rate transparency: 5 of 5 stars

» MORE:Compare Chase Home Lending with other mortgage lenders

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Recommended Reading: Is A Reverse Mortgage Good Or Bad

Stay In Touch With Your Broker

Stay reachable, in case your mortgage broker has any questions about your documentation. This means avoiding vacations or business trips where you wont have access to email or phone. If you arent available, they may make assumptions about your intent, and reject your mortgage pre-approval. If you absolutely must leave town, make sure to inform your mortgage broker in advance.

What Questions Are On A Mortgage Refinance Application

Applying for a mortgage refinance is just like applying for a new loan. The lender will verify your income and employment information, as well as check your credit score and request a home appraisal. The interest rate you qualify for will largely depend on your credit profile .

What may be different nowadays is the kind of questions youre asked during the application.

You may be asked more invasive questions about your income, employment status, current assets, existing debts, tax returns, debt-to-income ratio and more, says Silvermann.

Ralph DiBugnara, president of New York City-headquartered Home Qualified, a digital resource for buyers, sellers and Realtors, agrees.

The questions on a mortgage refinance application that are more common and prevalent today relate to job status and payment history, explains DiBugnara. Unfortunately, those who are recently unemployed due to the pandemic will not qualify for a refinance. And those who are furloughed can be approved but will not be able to close until they are actively back to work.

Youll likely be asked if youve missed mortgage payments and entered into forbearance with your current lender. If the answer is yes, you should still be able to refinance, but only after providing a specific history of what caused the missed payments as well as a letter from their current mortgage servicer saying the forbearance has ended or will end, DiBugnara adds.

You May Like: How Much Is Mortgage On 1 Million