Should I Pay For Points On My Mortgage

If you cant afford to make sizable upfront payments at the closing of your mortgage application, you may want to keep the current interest rate and refinance your mortgage at a later date. Refinancing a mortgage is basically taking out a new loan to pay off your first mortgage, but you shop for a better interest rate and terms on the new one. This makes sense if youve made timely payments on your old mortgage, have paid off a decent amount of your principal, and improved your credit score since you first obtained the initial mortgage.

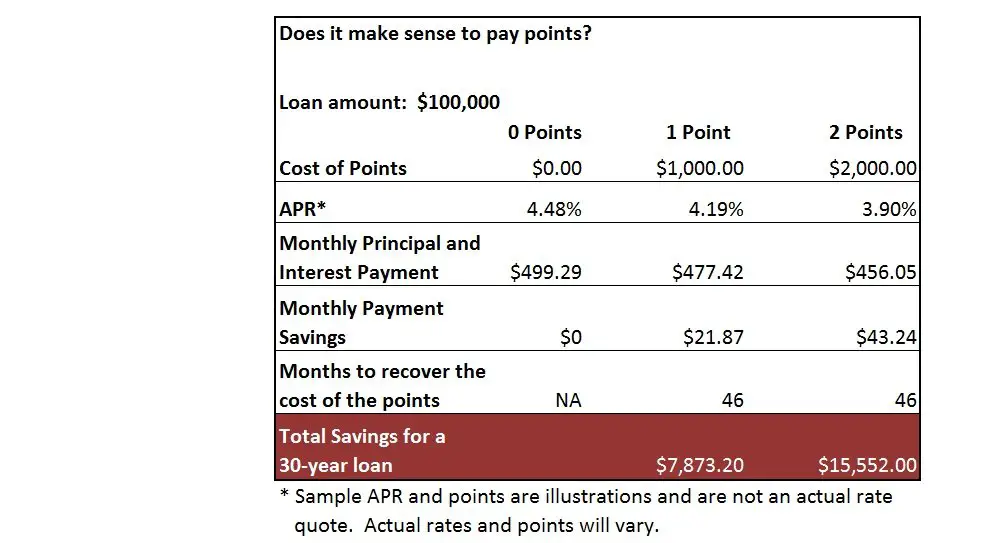

If youve got some money in your reserves and can afford it, buying mortgage points may be a worthwhile investment. In general, buying mortgage points is most beneficial when you both intend to stay in your home for a long period of time and can afford mortgage point payments.

If this is the case for you, it helps to first crunch the numbers to see if mortgage points are truly worth it. A financial advisor can help you through this process if you dont know where to start.

What Is The Average Number Of Points Charged For A Mortgage Loan

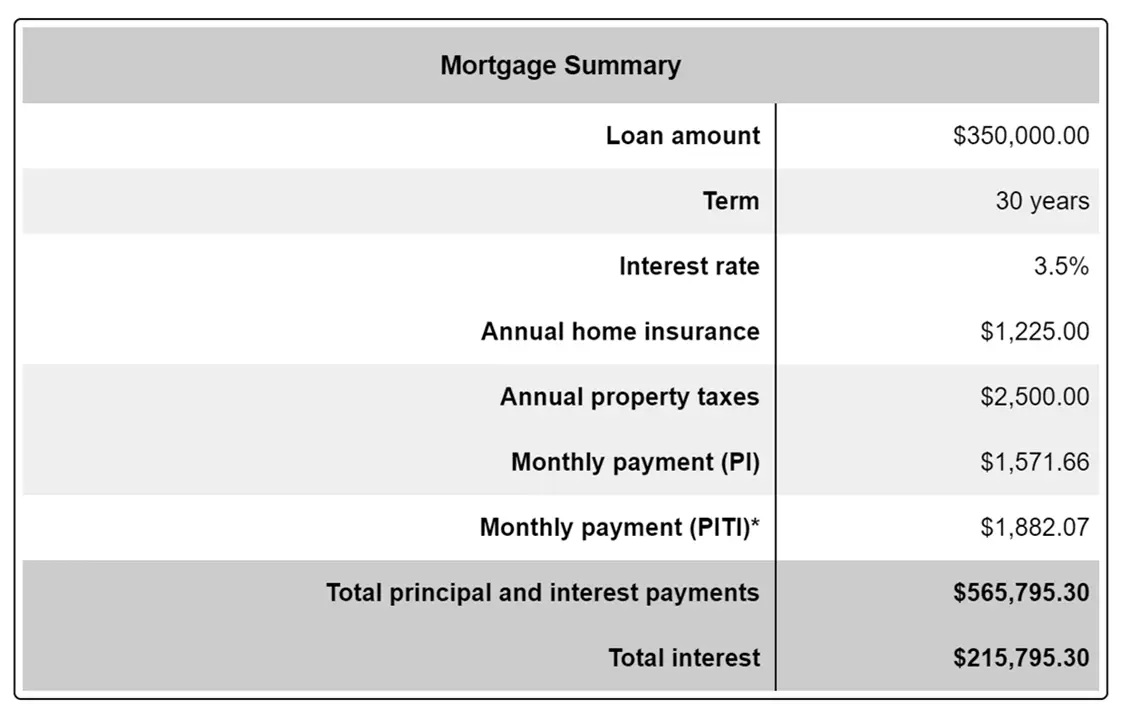

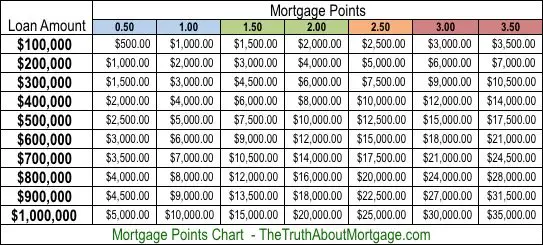

Borrowers who want to reduce their monthly mortgage payment often pay points to the lender at closing. Each point you pay is equal to 1 percent of the loan amount. As an example, for a $300,000 fixed-rate mortgage, one point will cost you $3,000. In return, you get a lower interest rate on your mortgage loan. With points you are paying interest in advance. Interest rate reductions vary by lender so it pays to check with several lenders.

Breaking Even: Should You Buy Points

Buying points is betting that you are going to stay in your home without altering the loan for many years.

Points are an upfront fee which enables the buyer to obtain a lower rate for the duration of the loan. This means the fee is paid upfront & then savings associated with the points accrue over time. The buyer spends thousands of Dollars upfront & then saves some amount like $25, $50 or $100 per month. After some number of years owning the home, the buyer ends up benefiting from the points purchase.

Also Check: Why Would A Mortgage Be Declined

How Discount Points Work

When you apply for a loan and get approved, your lender will give you a loan offer. In your offer, the lender will typically offer you multiple rates, including a base rate, as well as lower rates that you can get if you purchase discount points.

Those discount points represent interest that youre repaying on your loan. If you decide to purchase points, you pay the lender a percentage of your loan amount at closing and, in exchange, you get a lower interest rate for the loan term. Typically, for every point you purchase, you get to lower your interest rate by 0.25%.

Like normal mortgage interest that you pay over the life of your loan, mortgage points are typically tax-deductible. However, points are usually only used for fixed-rate loans. Theyre available for adjustable-rate mortgages , but when you buy them, they only lower your rate for your intro periodseveral years or longeruntil the rate adjusts.

Are Mortgage Points Worth It

Some people argue that money paid on discount points could be invested in the stock market and used to generate a higher return than the amount saved by paying for the points. But for the average homeowner, the fear of getting into a mortgage they can’t afford outweighs the potential benefit that may be accrued if they managed to select the right investment. In many cases, being able to pay off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. While most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.

You May Like: What Is A Mortgage Holder

Purchasing Points Vs Increasing Down Payment

If you are not planning to pay 20% down on your mortgage loan, you must factor the cost of private mortgage insurance into the above calculations. PMI is a premium paid along with your monthly mortgage payment until you reach 20% equity on the home. Let’s return to the example above. If you are only putting down 10% on the loan and your required PMI costs about $150 a month, that would cancel out the savings associated with buying points.

Work with your lender to determine when you can expect to reach 20% equity and compare that number to the break-even point to decide whether or not it makes more sense to increase your down payment instead of buying down your interest rate. You should also compare the costs of a 30-year fixed-rate loan with points to a 15-year fixed-rate loan without points.

Mortgage Discount Points Vs Apr

While buying discount points on your mortgage is effectively prepaying interest, an annual percentage rate is a way to facilitate the comparison of loans among different rate and point combinations. It incorporates not just the interest rate, but also the points you pay and then any fees that the lender charges for providing the credit. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst:

Recommended Reading: How Long Is A Mortgage Rate Good For

What Are Mortgage Origination Points

There is another type of mortgage points called origination points. Origination points are fees paid to lenders to originate, review and process the loan. Origination points typically cost 1 percent of the total mortgage. So, if a lender charges 1.5 origination points on a $250,000 mortgage, the borrower must pay $4,125.

Choosing Between Points And Credits

Both mortgage points and lender credits allow you to save money, but in different ways. Mortgage points allow you to reduce your interest rate by paying more in closing costs. Generally, if you plan to own the home for a long period of time, then mortgage points will result in greater savings.

Lender credits allow you to save money in the short term in exchange for a higher interest rate. This option frees up cash flow, which can help you put down a larger down payment, pay for home improvements and more.

Mortgage points are best for borrowers who can afford a larger upfront cost, but who want to save money over the long term. Lender credits, on the other hand, are best for borrowers who prefer a lower upfront cost, and they may result in greater savings if you plan to own the home for a short time. Given the high cost of buying a home, between the down payment and closing costs, lender credits can help lower the entry barrier, making homeownership more affordable and accessible.

In both cases, it’s also important to consider your short-term and long-term financial goals and whether the immediate increased liquidity that lender credits provide or the long-term savings that mortgage points provide is more important to help you meet those goals.

Don’t Miss: How Much Is Mortgage Insurance In Michigan

When Paying Points Is Worth It

When you buy discount points, you decrease your monthly payment, but you increase the upfront cost of your loan. Due to the difference in monthly payments, it usually takes between five and 10 years to recoup the upfront cost of discount points.

Instead of buying points, many borrowers instead choose to make larger down payments in order to build equity in their homes quicker and pay off their mortgages early, another way to save money on interest payments.

Still, in some cases, buying points may be worthwhile, including when:

- You need to lower your monthly interest cost to make a mortgage more affordable

- Your credit score doesnt qualify you for the lowest rates available

- You have extra money to put down and want the upfront tax deduction

- You plan to keep your home for a long time, so you may recoup the cost

Of course, this really only applies to discount points. Origination points, on the other hand, are closing costs paid to a lender in order to secure a loan. While these fees are sometimes negotiable, borrowers usually have no choice about whether to pay them in order to secure a loan.

Do Mortgage Points Affect Taxes

Mortgage points may be tax deductible as home mortgage interestbut that still doesnt make them worth buying. In order to qualify, the loan must meet a slew of qualifications on a lengthy list of bullet points, all of which are determined by the IRS.

If youve already bought mortgage points, check with a tax advisor to make sure you qualify to receive those tax benefits.

Don’t Miss: What’s Taking Out A Second Mortgage

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

How Mortgage Points Are Factored Into Advertised Rates

Whether you find a rate on a mortgage lenders website or through a third party, the mortgage rates you see advertised might or might not include points. One rate might even seem attractively low, but that could be due to points already factored in that you might not want to pay. On Bankrate, we specify whether advertised mortgage rates include points so you can make a fair comparison between lenders.

Also Check: Should You Buy Down Mortgage Rate

The Seller Pays The Points

This practice is more common in slower housing markets, and with lower-priced properties.

The sellers may offer to pay some, or all, of your closing costs, including points, to entice you to purchase their home.

But what the seller can pay differs based on the type of loan you have.

- For FHA loans, the seller can pay up to 6% of the sales price, regardless of the down payment made.

You should be aware, however, that while sellers may willingly pay a 1% origination point, they may be highly reluctant to pay discount points. Thats because discount points are more about providing you with a lower interest rate and payment than they are about directly facilitating the sale of the property.

Also, sometimes the property seller is a builder. As the seller, the builder can cover the buyers closing costs within the same limits listed above.

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read Also: How Do You Refinance Your Mortgage

The Recovery Period Of Paying Mortgage Points

In the above example, we determined that by paying $9,000 in points upfront on your mortgage, you can save at least $19,440 over the life of the loan .

That sounds like a reasonably good deal on the surface.

But how many years will it take to actually come out ahead? In other words, how long will it take you to recover the cost of the discount points paid on the mortgage?

This is whats known as the recovery period on discount points. It applies whether you are purchasing a home or refinancing an existing loan.

Read more: Will I Save Money By Refinancing My Mortgage?

Are There Any Limitations To The Tax

There is, however, an important limitation to the tax-deductibility of discount points, and mortgage interest in general.

The combination of low interest rates and higher standard deductions has reduced the number of taxpayers eligible to itemize their deductions.

For that reason, and because discount points are amortized over the life of the loan, discount points should never be seen as a viable tax reduction strategy.

Recommended Reading: Does My Husband Have To Be On The Mortgage

Straight Talk About Mortgage Loan Points

When you are shopping for a mortgage loan, interest rates are most likely at the top of your mind. As you shop lenders for the best rate, however, you will hear another term linked to the interest rate. That term is points. For instance, a lender may quote an interest rate of 5.25 percent plus two points. As a borrower, you need to understand the concept of those points and how they relate to your interest rate and mortgage loan.

So what are points? Points are fees paid up front to the lender in exchange for a lower interest rate on a mortgage loan. Paying points lowers your mortgage rate because the lender is getting a prepaid portion of the interest rather than collecting it in payments across the term of the loan.

Because points are used to essentially buy down the mortgage interest rate, they are commonly referred to as discount points. These discount points are paid at the time the loan is closed. They can be paid by the buyer/borrower or seller, or split between the two. Who pays the points depends on what is negotiated in the purchase contract and what is allowable under the terms of the mortgage loan.

Expressed in terms of a percentage, each point is equal to one percent of the total mortgage loan amount. Consequently, on a $200,000 loan, one point would cost $2,000. Using that loan amount and the rate/point combination mentioned earlier of 5.25 percent plus two points, here is an example of how points work:

Mortgage Points And Closing Costs Explained

Lisett Comai-Legrand About The Author

A mortgage point is the amount equal to 1% of the mortgage loan amount. For example, lets say that you take out a loan of $400,000, one point will be $4,000. This article explains mortgage points and closing costs, and offers a few tips to avoid paying them.

First of all, there are two kinds of mortgage points:

- Discount Points

Discount Points

Discount points are a type of pre-paid interest, and is given directly to the lender at closing for the reduction of the interest rate on your mortgage loan. So, the more points you pay, the lower the interest rate goes on the loan. You can pay up to 3 or 4 points, depending on how much you want to lower the rate.

Origination Points

An origination point is a fee that is charged by the lender to cover the processing of the loan. This fee is mostly a percentage of the loan amount rather than a fixed dollar amount.

How do you decide how many points you need, and how you should pay for them?

This is dependent upon factors like how much money you have at hand for closing costs and how long you plan to stay in the house. If you are planning to stay in your home for some time, using points to reduce the interest rate may be a better approach. If you are looking for the lowest possible closing rate, then you should opt for a zero-point option on the loan program.

Should You Pay for the Discount Points?

Closing Costs

Closing Cost Charges

Often the following costs are included:

Also Check: Why Are Mortgage Closing Costs So High

Tips For Buying A Home

- Buying a home is no small feat, so it can be helpful to work with a financial advisor to figure out your finances beforehand. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Before you fall in love with your dream home, figure out what prices are actually within your budget. To help you out, check out SmartAssets how much home can I afford calculator. All you need to know is where youre looking for homes, your marital status, your annual income, your current debt and your credit score.

Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

You May Like: How To Get A 2nd Mortgage