Other Businesses And Investments

Gilbert is a founding partner in private equity group LLC . The partnership invests in growing businesses in the financial services, Internet technology, consumer-direct marketing, and the sports and entertainment industries.

RBE has significant investments in ,, and , among other ventures.

Gilbert is also an investor in Courtside Ventures, a venture capital fund investing across early-stage technology and media companies with a focus on sports and is a founding partner of Detroit Venture Partners , a venture capital firm that funds start-up and early-stage technology companies based primarily in . Some of the companies DVP has invested in includes LevelEleven, iRule and Marxent Labs.

Gilbert cofounded StockX, a stock market of things for high-demand, limited edition products such as sneakers. Gilbert is also invested and involved in the operation of several consumer-based technology-centered businesses, including , , , and .

Gilbert launched nonprofit in 2007, which promotes both tech and brick-and-mortar entrepreneurship in Detroit and Cleveland by supporting on-the-ground service providers.

In November 2009, Gilbert and a group of partners successfully backed a statewide referendum to bring gaming to ‘s four largest cities. Through a joint venture with , the groups operate urban-based casinos in both and . The first of the casinos, , opened in May 2012.

What Credit Score Do I Need To Get Approved

You can get approved with a , as long as you meet our other eligibility criteria. Check your credit score through our sister company, Rocket Homes®.

Keep in mind that the score we use might be slightly different from the one you get from your credit card company or other source. We use a FICO® Score, but educational sources might use a different credit scoring model, such as a VantageScore.

We still encourage you to apply even if you think your score is slightly below 580. Our free Fresh Start program can help you boost your credit just call 769-6133.

Quicken Loans Review Vs Guild Mortgage Review

Guild Mortgage is better if you have a low credit score , because it accepts alternative credit data like utility bills. Guild also offers more types of mortgages, so you can use it if you need a USDA mortgage, reverse mortgage, or renovation loan.

You’ll want to go with Quicken Loans if you live in New York or New Jersey, though, because Guild Mortgage doesn’t operate in those states.

Don’t Miss: How Quickly Can You Get Pre Approved For A Mortgage

Mortgage Loan Products At Rocket Mortgage

Rocket Mortgage can offer the following loan options:

- Fixed-rate mortgages Most people choose a 30-year fixed-rate loan. But with Rockets YOURGage program, you can choose a term anywhere from 8 to 30 years

- Adjustable-rate mortgages These can be more affordable than fixed-rate mortgages at first, but they come with the risk of higher rates later. You can fix your rate for a period of 5, 7, or 10 years, after which it will move up and down with the market

- FHA loans Backed by the Federal Housing Administration, FHA loans are great for home buyers with imperfect credit and low down payments . But they come with high monthly mortgage insurance payments

- VA loans Eligible service members, veterans, and surviving spouses can buy homes with no down payment, lower credit requirements, and no continuing mortgage insurance payments

- Jumbo loans Borrow up to $3 million, if Fannie Mae and Freddie Macs conforming loan caps are cramping your style

The big things Rocket doesnt offer are construction loans, home equity loans, and USDA-backed loans.

USDA loans help rural home buyers and require no down payment. If youre interested in this type of mortgage, youll need to check out some other lenders.

Who Can Use Rocket Mortgage

Rocket Mortgage® is best for people who have a credit score of 580 or above and are ready to buy a home or refinance within the next few months. Check your credit score through our sister company, Rocket Homes®.

If you already have a signed purchase agreement, apply online to get started. Afterwards, one of our Home Loan Experts will give you a call so we can speed up your mortgage process.

If youre self-employed, you can start your application with Rocket Mortgage®, but you wont be able to do everything online. Well connect you with a Home Loan Expert along the way.

Read Also: What Are Prepaids On A Mortgage Loan

The Mortgage Lenders Parent Company Went Public Last Year Under The Name Rocket Companies

Quicken Loans will be known as Rocket Mortgage moving forward.

Its not gonna be a long, long time until Quicken Loans has a new name.

The countrys largest mortgage lender is officially rebranding as Rocket Mortgage on July 31. The name change will align the lender with the other subsidiaries of Rocket Companies RKT, +1.20% , their holding company that went public last year.

With this official name change, we will have a consistent brand that is synonymous with innovation and excellence, said Jay Farner, CEO of both Rocket Mortgage and Rocket Cos. The company also owns auto financer Rocket Auto and personal loans company Rocket Loans, among other subsidiaries.

Before Rocket Cos. went public , the company noted in a filing with the Securities and Exchange Commission that it does not own the rights to the Quicken Loans trademark, but licenses the name and trademark from Intuit INTU,

Rocket Mortgage Wants To Be The Cool And Easy Mortgage

- Rocket Mortgage is essentially a brand-name home loan that exudes speed and simplicity

- The company relies on the latest technology to target Millennials and Generation Z home buyers and homeowners

- Those who prefer to use smartphones and texts to get things done as opposed to speaking to humans

- They compete with other disruptors in the space that are trying to accomplish the same thing with so-called digital mortgages

The nascent space is still in its infancy, but there are already multiple players Quicken needs to keep its eye on, including the likes of Better Mortgage, Lenda, Sindeo, SoFi, LendingHome, and many others, some of which are popular with Millennials thanks to offerings like student loan refinances and the like.

Most of the startups above consider themselves online mortgage lenders that cut out the middleman , while promising to make home buying or refinancing a lot easier than it has traditionally been.

Quicken seems to have taken notice with their latest move, referring to themselves in the press release as the nations leading FinTech mortgage lender.

Short for financial technology, FinTech is the latest buzzword taking Silicon Valley by storm. It basically describes any financial company harnessing the power of the Internet to conduct business more efficiently.

Quicken Loans claims it took more than 500 Detroit-based developers and various other employees some three years to completely redesign the highly complex mortgage process.

Also Check: Can You Reverse Mortgage A Condo

Quicken Loans Is Officially Rebranding To Rocket Mortgage

Quicken Loans announced it will officially change its name to Rocket Mortgage on July 31. The change is being made to align the overall Rocket brand, while also making it clear to homebuyers that technology, a core tenet of Rocket Companies, is injected throughout the entire home buying lifecycle from home search to mortgage closing, according to a press release.

More than 20 years ago, Dan Gilbert, our founder and chairman, had a vision of putting the entire mortgage process online to simplify the lending experience and add more transparency. Since then, we developed proprietary technology to improve every piece of the process but we officially revolutionized the mortgage industry when we launched Rocket Mortgage in 2015, said Jay Farner, Rocket Mortgage CEO. With this official name change, we will have a consistent brand that is synonymous with innovation and excellence.

In late 2015, Quicken Loans launched a fully digital, completely online, mortgage experience Rocket Mortgage. This was the first time a consumer could go from application to closing on their own, without speaking to a human. Rocket Mortgage was revealed to the world in a 2016 Super Bowl ad.

With a boost from the incredibly popular Rocket Mortgage home loan process, Quicken Loans became the largest lender in the country, closing more loans than any other retail mortgage lender, in the fourth quarter of 2017, according to the press release.

Entertainment And Performing Arts

Major theaters in Detroit include the , , the , , the , the , , , the , and , which hosts the renowned . The , the largest controller of Broadway productions in New York City, originated with the purchase of the in 1922 by the Nederlander family.

with 535,000 square feet produces movies in Detroit and the surrounding area based at the Pontiac Centerpoint Business Campus for a film industry expected to employ over 4,000 people in the metro area.

Because of its , , and , Detroit has enjoyed increased prominence as a tourist destination in recent years. listed Detroit as the 9th-best destination in its list of 52 Places to Go in 2017, while travel guide publisher named Detroit the second-best city in the world to visit in 2018.

Many of the area’s prominent museums are in the historic neighborhood around and the . These museums include the , the , , the , as well as the main branch of the . Other cultural highlights include , the museum, the studio and school, the Museum, , the Dossin Great Lakes Museum, the , the Contemporary Art Institute of Detroit , and the Belle Isle Conservatory.

Artist Tyree Guyton created the controversial street art exhibit known as the in 1986, using found objects including cars, clothing and shoes found in the neighborhood near and on Heidelberg Street on the near East Side of Detroit.

Recommended Reading: How Much Per 1000 On Mortgage

Primary And Secondary Schools

As of 2016 many K-12 students in Detroit frequently change schools, with some children having been enrolled in seven schools before finishing their K-12 careers. There is a concentration of senior high schools and in the area, which had wealthier residents and more gentrification relative to other parts of Detroit: Downtown, northwest Detroit, and northeast Detroit have 1,894, 3,742, and 6,018 students of high school age each, respectively, while they have 11, three, and two high schools each, respectively.

As of 2016 because of the lack of public transportation and the lack of school bus services, many Detroit families have to rely on themselves to transport children to school.

Public schools and charter schools

With about 66,000 public school students , the district is the largest in Michigan. Detroit has an additional 56,000 students for a combined enrollment of about 122,000 students. As of 2009 there are about as many students in charter schools as there are in district schools. As of 2016 DPS continues to have the majority of the special education pupils. In addition, some Detroit students, as of 2016, attend public schools in other municipalities.

Detroit public schools students scored the lowest on tests of and of all major cities in the in 2015. Among eighth-graders, only 27% showed basic proficiency in math and 44% in reading. Nearly half of Detroit’s adults are .

Private schools

Detroit Free PressDetroit News

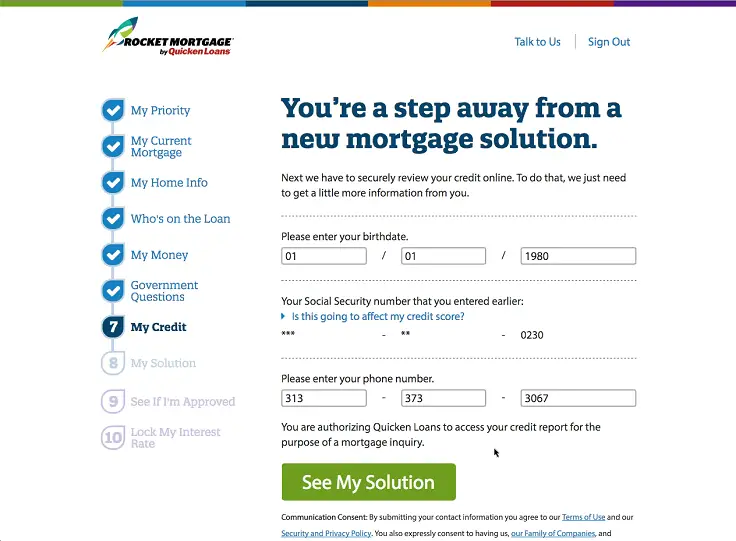

Quick Fast Mortgage Application Process Online

Yes, you can get an online mortgage pre-approval almost instantly. Credit Score, income verification, credit history, and debt to income ratio are not reviewed. This does stop the hassle of talking to your banker, filling out an application with more questions and financial documents needed.

At the same time, the reward can be getting a loan pre-approval instantly. The drawback is the quality of the application.

Online mortgage lenders ask basic questions to get their application in the system in hopes that the information you provided is correct. A great example is Rocket Mortgages question on whats your household income? Their questionnaire doesnt ask if its pre-tax, cash, commission, or salary. All of these income questions matter when it comes to receiving the best interest rates for your home loan.

Online home loan applications can be smooth through the transaction of buying and selling a home. The problem arises when hiccups come. Most real estate transactions have some type of issue. Issues with real estate transactions can include missing financial documents.

Do you have your taxes filed? Are your pay stubs correct? Can you verify large deposits into your bank account? Are you commission-based?

Don’t Miss: When You Sign A Mortgage You Are

One Giant Leap: Quicken Loans Announces Its Changing Name To Rocket Mortgage

The Rocket name is synonymous with simplifying traditionally complex transactions to make processes easier for consumers

DETROIT, May 12, 2021 Quicken Loans, Americas largest mortgage lender and a part of Rocket Companies , today announced it will officially change its name to Rocket Mortgage on July 31. This change will bring alignment to the overall Rocket brand, while also making it clear to homebuyers that technology, a core tenet of Rocket Companies, is injected throughout the entire homebuying lifecycle from home search to mortgage closing.

More than 20 years ago, Dan Gilbert, our founder and chairman, had a vision of putting the entire mortgage process online to simplify the lending experience and add more transparency. Since then, we developed proprietary technology to improve every piece of the process but we officially revolutionized the mortgage industry when we launched Rocket Mortgage in 2015, said Jay Farner, Rocket Mortgage CEO. Rocket Mortgage has grown to be the industry leader and the measuring stick for all other lenders. With this official name change, we will have a consistent brand that is synonymous with innovation and excellence.

Several of Rocket Mortgages sister companies have already embraced the Rocket name including Rocket Homes, Rocket Auto and Rocket Loans. These businesses, which are also part of the Rocket Companies platform, take a digital-first approach to real estate, vehicle sales and personal loans respectively.

# # #

Drawbacks Of Rocket Home Loan

The greatest downside of utilizing Rocket Mortgage by Quicken Loans is which you have less guidance than youd when applying within the phone or in individual. Its not required in most cases though you have the option to chat or contact a Home Loan Expert. » »This shortage of hand-holding might make the mortgage that is overall more confusing, particularly for first-time homebuyers.

It is additionally perhaps maybe perhaps not the option that is best for purchasers with woeful credit or that are self-employed. Rocket Mortgage calls for a minimal credit rating of 580, and self-employed applicants need certainly to assist a real estate agent to get authorized. » »

Convenient application procedure

Recommended Reading: How To Get A 15 Year Fixed Mortgage

How Does Rocket Mortgage Do Appraisals

After you apply with Rocket Mortgage® and get approved, Rocket Mortgage will order an appraisal on your behalf, if its required for your loan.

The appraisal youll get with Rocket Mortgage® is just like the appraisal youd get when you apply with any other lender. A third-party appraiser will visit the home youre buying or refinancing to assess the property. From there, theyll compare your property against similar, recently sold homes in the area to come up with an opinion of value.

Rocket Mortgage Customer Service Reviews

Rocket Mortgage may not always offer the lowest rates, but its customer satisfaction is a huge draw for many borrowers.

Quicken and Rocket have topped J.D. Powers U.S. Primary Mortgage Origination Satisfaction Study for 11 years running, earning top scores in categories like application/approval process communication loan closing and loan offerings.

In case youre researching these results, Rocket Mortgage tends to be lumped in with Quicken Loans in customer satisfaction surveys.

Customer service reviews at major lenders

| 848/1,000 |

Unsurprisingly, Rocket and Quickens high satisfaction scores are reflected in low complaints.

Federal regulator the Consumer Financial Protection Bureau maintains a public, online database of consumer complaints against mortgage lenders. And in it, Quicken Loans has one of the lowest numbers of complaints less than one per one hundred mortgages.

Also Check: How To Become A Certified Mortgage Underwriter

Rocket Mortgage Review: Full Approval In Just 8 Minutes

Do you know how long it takes for the space shuttle to reach orbit? Apparently it takes just eight minutes, the same amount of time it will take borrowers to get a full mortgage approval online via Rocket Mortgage.

At least, this is the powerful claim the company is touting via a new online mortgage approval engine that promises to shake up the age-old, and very stale home loan process. They created quite a stir during their Super Bowl ad as well.

The company launched the end-to-end online product in late 2015 in what appeared to be a direct response to the many online mortgage startups now in existence.

Essentially, parent company Quicken Loans didnt want to get left behind, and in fact, wanted to be a leader in the new digital mortgage world. So far, it seems to be working.

Rocket Mortgage Review: Is It The Best Online Home Financing Option

Sally Jones Updated: March 15, 2017

To sustain this free service, we receive affiliate commissions via some of our links. This doesnt affect rankings. Our review process.

Are you searching for your dream home and need an affordable mortgage loan? Or want to refinance your existing mortgage to reduce your interest rate? Move over big banks. Theres a hugely popular online mortgage lender thats putting traditional lending in its place. Rocket Mortgage has become the go-to mortgage lending source for millions of Americans. Read our Rocket Mortgage reviews to see what they can offer you.

- Extremely easy application and approval process

- Competitive interest and APR rates

- Widest variety of loan types and terms out of companies weve reviewed

- Many home-purchase and refinancing loans available

- Available in all 50 states

- Excellent customer support via live chat, phone and email 7 days/week

- BBB rating: A+

- Minimum credit score of 620

- No physical branches

- No set fees listed on website

- Doesnt offer home equity loans

Read Also: How Do I Qualify For A Zero Down Mortgage