Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Mortgage Term Should I Input In The Mortgage Pre

The term is there to allow you to see how much your mortgage balance would be after 1 to 5 years. Most people choose a 5 year term, but you can choose any term.

If you are interest in knowing how much principle you have paid off after 1 year, or 2 years, etc., then change the term to 1 or 2 years, etc. and see the result at the bottom right of the calculator results.

A principle and interest payment and total housing costs is important to know so that you can do some budgeting.

It’s also nice to know how quickly your mortgage is being paid down based on these payments.

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

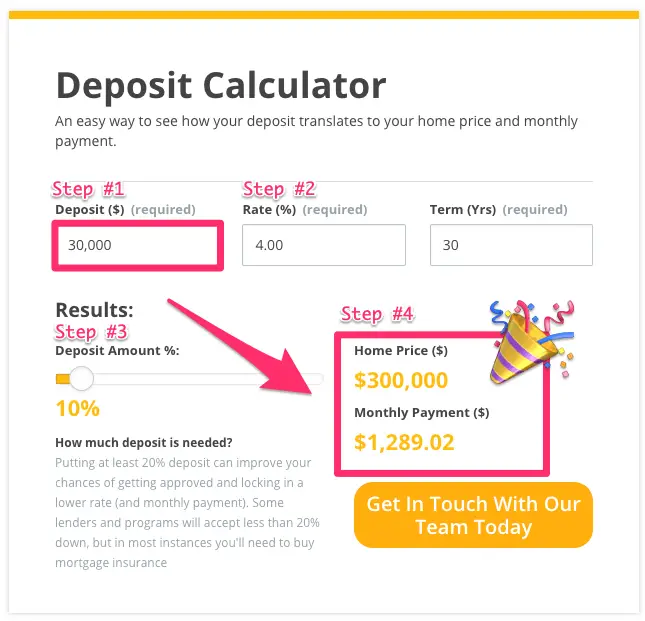

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Best Mortgage Lenders Of January 2022

- Best for Customized Mortgages: American Pacific Mortgage

- Best for Cash-Strapped Borrowers: loanDepot

- Best for Jumbo Loan Borrowers: PNC Bank

- Best for Military Borrowers: Navy Federal

- Best for Transparency: AimLoan

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau and/or with the U.S. Department of Housing and Urban Development .

Application score: 4/4

Customer satisfaction: 99.99%

Loan types offered: Conventional fixed 30-year, 15-year, or any term from 8 to 29 years ARM 7/6, 10/6 FHA fixed 30-year, 25-year, 15-year VA fixed 30-year, 25-year, 15-year Jumbo

Minimum down payment: 3%

-

Consistent winner of J.D. Power awards

-

Electronic closings in all 50 states

-

Will probably be your loan servicer, too

-

Serves Spanish-speaking borrowers

-

No option to meet a loan officer in person

-

Doesnt offer construction loans

-

May not be an option for borrowers with credit scores below 580

Rocket Mortgage is especially popular among borrowers who need to refinance or get an FHA loan. The company can automatically roll closing costs into your FHA loan, which will save money for borrowers who only keep their loan for a few years and be more expensive for borrowers who keep the loan for its full term.

Don’t Miss: Reverse Mortgage Manufactured Home

How To Use The Pre

Our pre-qualification calculator can provide an idea of what to expect before you talk to a lender. All we need are a few pieces of information about you and your finances:

Enter your annual income before taxes.

Enter the term of the mortgage youre considering.

Select your credit score range.

Tell us about your employment status.

Tell us if you have a down payment.

Tell us about past foreclosures or bankruptcy.

Enter your monthly recurring debt payments.

After completing each required field, youll see the loan amount we recommend, as well as a higher loan amount. We show two pre-qualification amounts because:

Different loans have different debt-to-income requirements. For example, conventional loans usually have stricter DTI requirements than FHA loans, insured by the Federal Housing Administration.

Its not always smart to borrow 100% of what a lender offers. The maximum loan amount is the most the lender is willing to loan you, not what makes sense for your budget. A higher loan amount will mean a higher monthly mortgage payment. Borrowing too much could make it difficult to ride unexpected financial bumps, such as a job loss or a big medical bill.

Why Should I Follow The 28/36% Rule

The 28%/36% rule states that you shouldn’t spend more than 28% of your gross monthly income on housing. It also says you shouldn’t spend more than 36% of your gross monthly income on all of the debt payments you have, including credit card payments and other loans. It’s a good rule to follow when figuring out how much house you can afford.

Read Also: Chase Recast

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

- your assets

- your income

Youll need to provide the following:

- identification

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate (for example, a recent pay stub

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

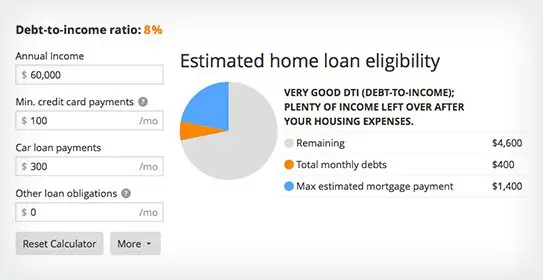

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

How Long Does It Take To Get Pre

Mortgage pre-qualification is an informal process that requires basic details, therefore, lenders can provide a non-binding estimate within a day or two. It can happen in-person, online, or even over the phone.

Pre-approvalon the other hand requires a deep dive into your finances and is binding, hence, it can take up to several business days depending on the lender.

See How Much Home You Can Afford To Help Narrow Your Search

Buying a home is an exciting time, but it can also be overwhelming as you look for the perfect home to fit your needs. One step that can be beneficial is to prequalify for your loan, so you know how much house you can afford.

Its always a good idea to get prequalified with a mortgage lender before you start shopping for the home you want. But if you want to start house-hunting and arent quite ready to contact a lender, you can prequalify yourself.

You May Like: How Does Rocket Mortgage Work

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Bmo Bank Of Montreal Mortgage Affordability

Before you get a mortgage from BMO, it is important to know how BMO calculates your mortgage affordability. BMO takes into account the following factors:

- Your household income

- Your heating costs

- Any applicable condo fees or maintenance costs

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

BMO includes the cost of mortgage insurance in your mortgage affordability calculation. This allows you to borrow more with a smaller down payment.

BMO calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to BMO, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Why Apply For A Mortgage Pre

A mortgage pre-approval is an important part of the home buying process. If you are pre-approved, it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided, and subject to certain conditions. A mortgage pre-approval often specifies a term, interest rate and principal amount. Although not a required step, it is helpful as it can give you a clearer picture of how much house you may be able to afford.

Read Also: Does Rocket Mortgage Service Their Own Loans

What Is Mortgage Pre

Pre-qualification is how lenders determine if you fit the basic financial criteria for a home loan.

To get pre-qualified, you tell a lender some basic information about your credit, debt, income, and assets, and it tells you how much you may be able to borrow. Tell is the key word here. The information used for pre-qualification is self-reported, which means the lender typically doesnt verify it or look at your credit report.

How A Jumbo Loan Works

If you have your sights set on a home that costs close to half a million dollars or moreand you don’t have that much sitting in a bank accountyou’re probably going to need a jumbo mortgage. And if youre trying to land one, youll face much more rigorous credit requirements than homeowners applying for a conventional loan. Thats because jumbo loans carry more credit risk for the lender since there is no guarantee by Fannie Mae or Freddie Mac. There’s also more risk because more money is involved.

Just like traditional mortgages, minimum requirements for a jumbo have become increasingly stringent since 2008. To get approved, youll need a stellar credit score700 or aboveand a very low debt-to-income ratio. The DTI should be under 43% and preferably closer to 36%. Although they are nonconforming mortgages, jumbos still must fall within the guidelines of what the Consumer Financial Protection Bureau considers a qualified mortgagea lending system with standardized terms and rules, such as the 43% DTI.

Also Check: Does Rocket Mortgage Sell Their Loans

What Down Payment Should I Input In The Mortgage Pre

If you aren’t sure about how much mortgage you qualify for, then just choose 5%. Once you see the result, then you can change the amount and the resulting purchase price will change.

The calculator will first calculate how much mortgage you qualify for. Then based on this number and your down payment chosen, you will see how much purchase price you can make that won’t exceed the mortgage approved.

As you review the results on the right side, you can see that the Default Insurance Premium is also included. When your down payment increases from 5% to 10%, the default insurance premium goes down. Therefore with a bigger down payment and lower mortgage insurance premium, your purchase price goes up.

How To Calculate Affordability

Keeping your mortgage payment manageable will help ensure that you’re able to continue paying it. You can use our “How much house can I afford” calculator above to look at mortgage rates to determine what your monthly payment will look like when accounting for things like:

- The amount of your home loan

- The mortgage interest rate you lock in

- The term of your loan

If you use the above formula for buying a house, you’ll be able to see if a home you’re looking to buy is considered affordable. Say you want to make sure your housing costs do not exceed 28% of your income. Using the example above, you’re looking at a monthly payment of $1,218. Divide $1,218 by 0.28, and you’ll get $4,350. If your monthly paycheck is $4,350 or higher, that’s likely an affordable home for you.

You May Like: Who Is Rocket Mortgage Owned By

How Does The Mortgage Process Work

The mortgage process begins when you apply. Youll give the lender information about your income and assets, along with supporting documentation such as W-2s, 1099s, tax returns, and bank statements. The lender will check your credit to learn about your debts and determine your debt-to-income ratio.

If you pass the initial approvals, the lenders mortgage underwriter then takes a deep dive into your finances to make sure you can afford the loan youre applying for and decide how much to let you borrow. Once youre approved, the lender produces a bunch of documents for you to sign and have witnessed by a notary. Then, it wires the funds for your new loan, which is called closing.

Understanding How Much Mortgage You Can Afford

Buying a houseis a huge undertaking, and its easy to get wrapped up in the excitement of it all. Its crucial to be realistic about what you can afford.

You want to hunt for homes that are in your price range so you dont fall in love with a house thats simply out of reach. Knowing your budget and sticking to it will make the entire home buying process run smoothly.

Don’t Miss: Rocket Mortgage Loan Types

How Much House Can I Afford With A Va Loan

If you’re an active member of the U.S. military or a veteran, you may qualify for a VA loan. A VA loan is a mortgage that’s backed by the U.S. Department of Veterans Affairs. With a VA loan, you don’t need to put any money toward a down payment, and you may be eligible to get a mortgage even with a lower credit score.

As is the case with an FHA loan, you’ll need to be careful with a VA loan to make sure you don’t take on too high a mortgage, especially if you’re not putting any money toward a down payment. Use a mortgage calculator to play with the numbers based on your loan amount and interest rate.